Nexus EA Forex MT5

- Experts

- Enrique Enguix

- Version: 9.99

- Updated: 12 September 2025

- Activations: 20

NEXUS — an Expert Advisor that evolves with the market

New: A new set for XAUUSD is also available.

Many EAs work… until the market changes. The reason is usually simple: they use fixed rules such as “buy when RSI < 30.” They work for a while and then go blind when the regime changes.

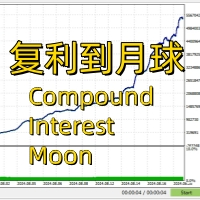

NEXUS combines quantitative rules with out-of-sample validation: it builds combinations in real time from the data. It analyzes a configurable history (e.g., 500 periods on H1 or D1) and generates thousands of combinations between indicators and context.

If a combination shows statistical edge, NEXUS validates it out of sample (OOS): it learns on one segment and tests on another it has not seen. What holds up is stored as a strategy; what fails is discarded. This process repeats automatically in each cycle.

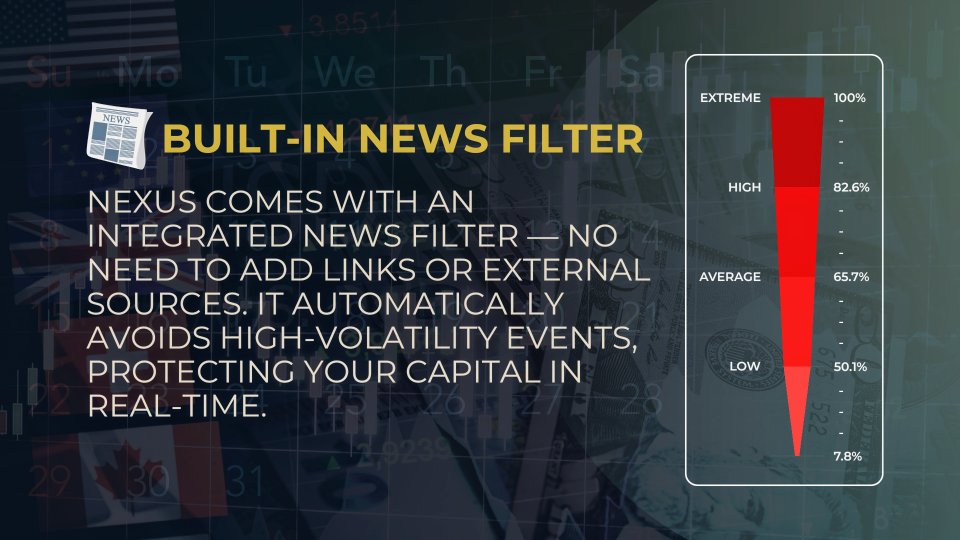

Before opening a trade, it applies environment filters: high-impact news, abnormal volatility, session/day, and optionally volume value areas (Point of Control, POC). It only trades when there is an edge and the context does not invalidate it.

Controlled Grid

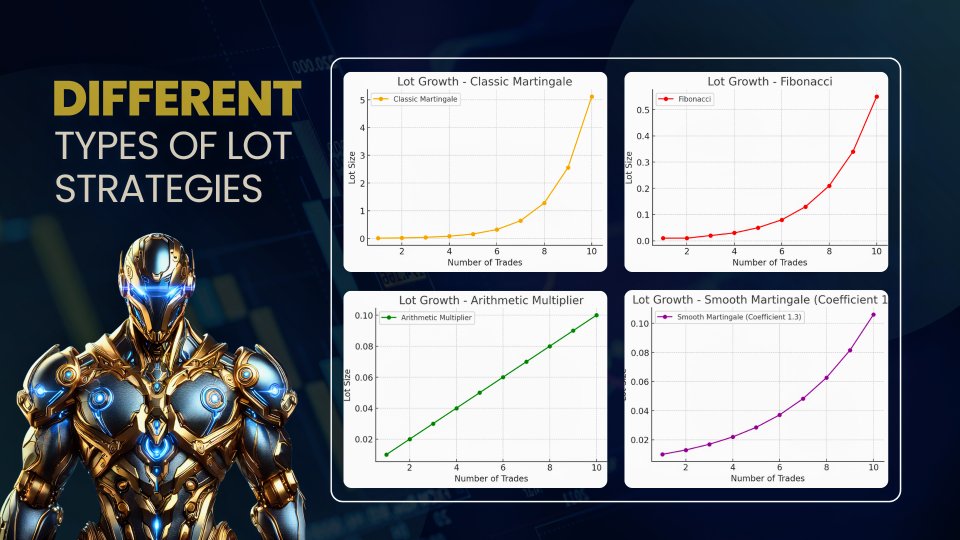

NEXUS uses a grid with clear brakes: entry spacing adjusts to volatility; an internal clock enforces a minimum time between entries to prevent stacking; and a volatility risk filter cuts the cycle if price moves too far from its mean based on the configured threshold (stricter in the Conservative set).

For exits, it uses a moving basket target with trailing stop. If price pulls back beyond the margin, it closes the basket securing profits. It also includes a Global Stop (loss limit) and a recovery system with block closures by time, number of trades, or loss percentage.

Summary: adaptive grid, entry timing, clear risk filter, and ready-to-use sets. You start with a cautious setup and can fine-tune later.

Included Sets

-

Conservative Sets: Designed to trade less frequently with stricter risk parameters. The goal is to prioritize capital management. Includes configurations for EUR/USD, GBP/USD, EUR/JPY, AUD/CHF, GBP/CAD, and AUD/USD.

-

Classic Sets: Intermediate risk profile. Allows higher trading frequency than conservative sets, seeking a balance between activity and control. Includes configurations for EUR/USD, GBP/USD, USD/CAD, and USD/CHF.

-

Aggressive Set: High-frequency setup with elevated risk. Recommended only for experienced users with active account monitoring. Includes sets for EUR/USD and XAUUSD.

Note: all sets were validated out of sample (2018–2025). Use a demo account before going live and adjust to your broker (spread, slippage, minimum lot size).

Short example of operation

Validated entry: New York session, stable market. It detects a breakout with confirmation and opens the first trade. After a pullback it places the second entry further away. Momentum resumes and the basket closes in profit with trailing.

Environment lock: ten minutes before USD news, it blocks new entries and manages only open positions.

What you get when you buy

1. Main package: 10 ready-to-use sets (Conservative, Classic, and Aggressive),2. Full user guide,

3. License with 20 activations for accounts and VPS,

4. Free updates,

5. Support through MQL5 comments and messages,

6. Optional review by appointment (procedure detailed in the guide).

Direct download of the sets: Download sets. For the guide, FAQ, previews, and support, visit the NEXUS HUB from my MQL5 profile BIO.

Requirements

MetaTrader 5 and 24/7 VPS with ideal latency below 50 ms. Broker with fast execution (ECN) and minimum leverage 1:30. Recommended spreads ≤ 1.5 pips and slippage ≤ 20 points (adjust MaxSlippage).

Indicative deposit

100 USD per pair for the Conservative set. 500 USD per pair for the Classic set. The Aggressive profile requires experience and sufficient capital.

Startup checklist (5 minutes)

Installation: install NEXUS from Market in MT5, open the chart of the symbol (e.g., EUR/USD) and drag the EA from the Navigator (Ctrl+N).

Configuration: enable algorithmic trading in the “Common” tab, load the corresponding set in “Inputs,” decide whether to use Global Stop, and confirm with OK.

Verification: the chart timeframe does not matter because NEXUS uses its internal framework; check the “Experts” tab (Ctrl+T → Experts) for messages.

Deployment: repeat the procedure for each symbol and, if using VPS, synchronize the account.

Disclaimer: NEXUS does not guarantee results or eliminate risk; it provides configurable controls and operational criteria.

I have been using Nexus since September 18, 2025. Obviously, this is still too short a time to make a long-term assessment. But so far, it has delivered good results. In total, there have been 49 trades, 47 of which closed with a profit. The losses from the two losing trades were small. What I like about Nexus is that it can be configured to your own preferences. It offers a wide range of parameters. On the other hand, Enrique provides set files with detailed descriptions, so if someone doesn’t want to experiment with the settings, it’s possible to simply use one of the predefined sets and be good to go. One thing that is important to me is that an EA continues to be developed. Enrique keeps improving the EA and always strives to make it better. For example, he provided an experimental set file for XAUUSD, which I tested, and it already delivered very good results (16 out of 17 trades closed in profit). Another important aspect is the support. Whether it’s questions about parameters or general inquiries, Enrique always provides quick and detailed answers. He also publishes interesting blog posts about how the EA works, insights into optimizing setups, what is important for an EA, and more. I’m looking forward to continuing this journey with Nexus, and I’m sure this is just the beginning of a long adventure.