ATR Channel Indicator MT4

- Indicators

- Eda Kaya

- Version: 2.1

ATR Channel Indicator (Average True Range Channel) MetaTrader 4

The ATR Channel Indicator is a powerful technical analysis tool in MetaTrader 4 designed to measure market volatility and identify price trends. By utilizing adaptive algorithms and dynamic price channels, this indicator enhances trading precision.

A key advantage of the ATR Channel Indicator is its ability to pinpoint optimal Buy and Sell signals while minimizing trend-following errors.

«Indicator Installation & User Guide»

MT4 Indicator Installation | ATR Channel Indicator MT5 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Prop Firm Protector: Trade Assist Prop Firm Plus TF Expert MT4 | Money Management + DrawDown Protector: Trade Panel Prop Firm Drawdawn Limiter Pro MT4

Indicator Specifications

| Category | Price Action - Volatile |

| Platform | MetaTrader 4 |

| Skill Level | Intermediate |

| Indicator Type | Trend-Following - Range - Reversal |

| Time Frame | Multi Time Frame |

| Trading Style | Scalp - Fast Scalp |

| Market | All Markets |

Indicator Overview

The ATR Channel Indicator generates three upper and three lower channels around a moving average, creating adaptive dynamic bands that adjust to market volatility. These channels continuously recalibrate based on shifting market conditions, allowing traders to refine Stop Loss (SL) and Take Profit (TP) levels with greater accuracy—especially during rapid price movements.

Uptrend Conditions

On a 4-hour Bitcoin (BTC) chart during an uptrend, the ATR Channel Indicator confirms bullish momentum by forming price channels above the moving average. When the price consistently tests the upper channel boundaries, it signals strong buying pressure and a sustained uptrend. The widening gap between the channels indicates increasing bullish strength, helping traders identify high-probability Buy entry points.

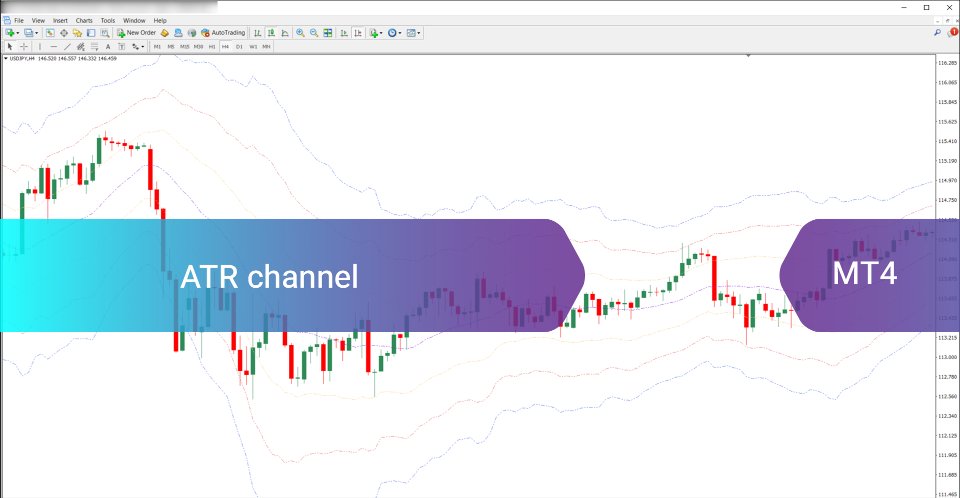

Downtrend Conditions

On a 1-hour EUR/USD chart during a downtrend, the ATR Channel Indicator plots price channels below the moving average, reflecting selling dominance. If the price repeatedly touches the lower channel bands, it suggests persistent bearish momentum.

A narrowing channel distance highlights weakening buying interest, providing traders with optimal Sell entry points or exit signals for long positions.

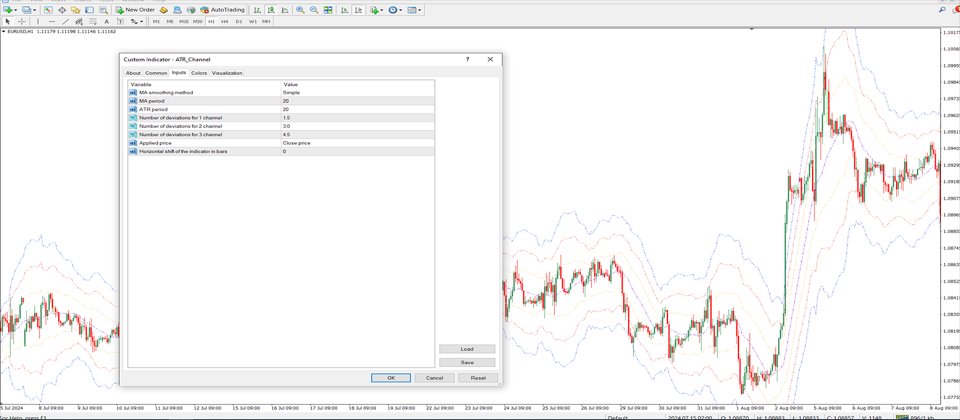

Settings

· MA Smoothing Method: Adjusts the type of moving average (e.g., SMA, EMA).

· MA Period: Number of candles for MA calculation (Default: 20).

· ATR Period: Number of candles for ATR calculation (Default: 20).

· Channel 1 Deviation: Width of the first channel (Default: 1.5).

· Channel 2 Deviation: Width of the second channel (Default: 3.0).

· Channel 3 Deviation: Width of the third channel (Default: 4.5).

· Applied Price: Calculation based on candle closing prices.

· Horizontal Shift: Disabled by default.

Conclusion

The ATR Channel Indicator is a highly adaptive tool that improves trading decisions across different market conditions. By accurately identifying entry and exit points, traders can enhance their strategies in forex, crypto, and other financial markets. Its dynamic channel structure makes it particularly useful for scalping, swing trading, and trend analysis.