PZ Wolfe Waves MT5

- Indicators

- PZ TRADING SLU

- Version: 6.2

- Updated: 31 January 2022

- Activations: 20

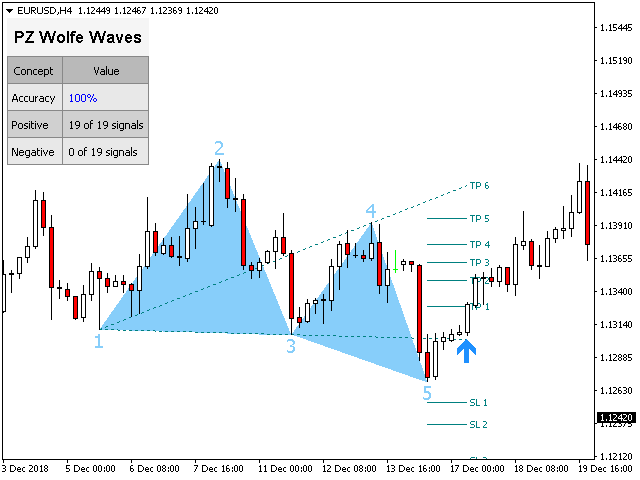

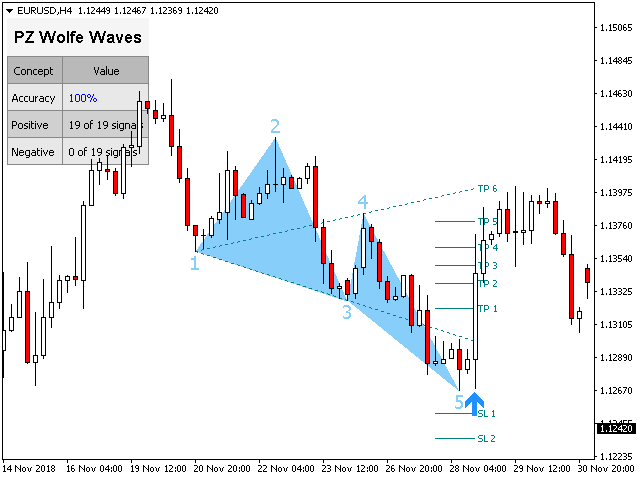

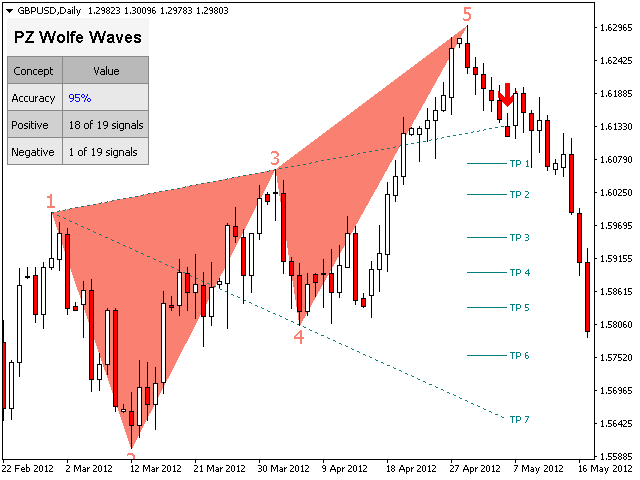

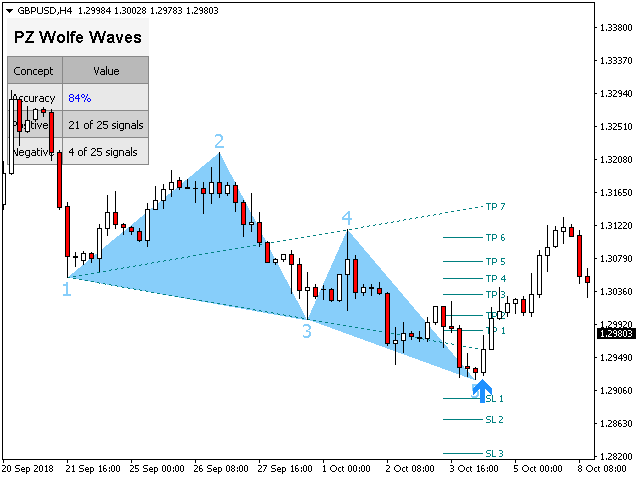

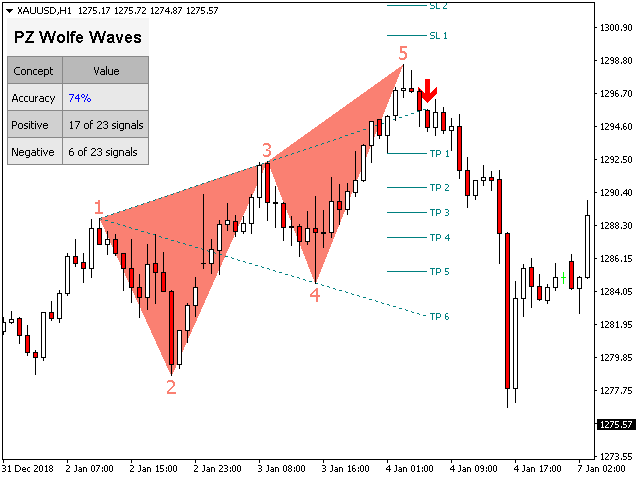

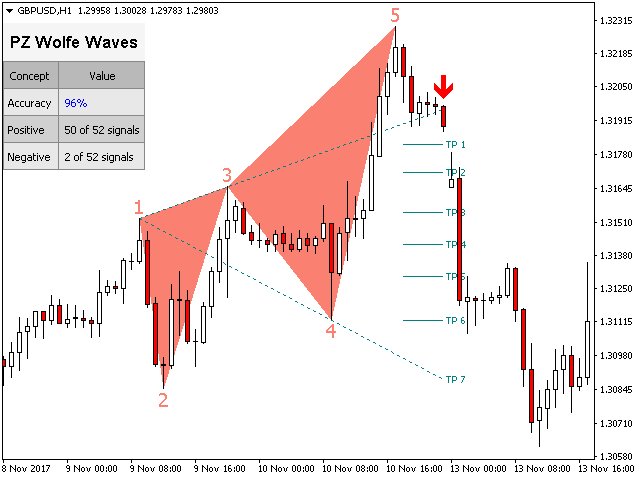

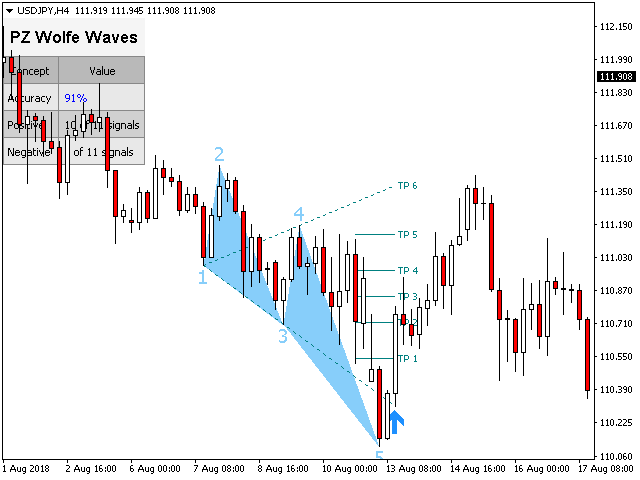

Wolfe Waves are naturally occurring trading patterns present in all financial markets and represent a fight towards an equilibrium price. These patterns can develop over short and long-term time frames and are one of the most reliable predictive reversal patterns in existence, normally preceding strong and long price movements.

[ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

- Clear trading signals

- Amazingly easy to trade

- Customizable colors and sizes

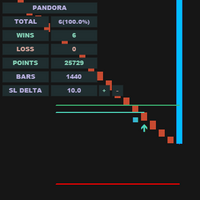

- Implements performance statistics

- Displays suitable stop-loss and take-profit levels

- It implements email/sound/visual alerts

Definition of Wolve Wave

A wolfe wave must have the following characteristics. (Click here to see an example)- Waves 3-4 must stay within the channel created by 1-2

- Wave 4 is within the channel created by waves 1-2

- Wave 5 exceeds trendline created by waves 1 and 3

Input Parameters

- Amplitude - The amplitude represents the minimum amount of bars between alternative price points. To find big patterns, increase the amplitude parameter. To find smaller patterns, decrease the amplitude parameter. You can load the indicator many times in the chart to find overlapping patterns of different sizes.

- Breakout Period - Optional donchian breakout period for wolfe wave confirmation. Zero means not used.

- Max History Bars - Amount of past bars to evaluate when the indicator loads in the chart.

- Display Stats - Show or hide the statistics dashboard and performance data.

- Display SL/TP Levels - Show or hide suitable SL and TP levels for each signal.

- Display Price Labels - Show or hide the pattern price labels.

- Drawing Options - Colors and sizes for bullish or bearish lines and labels, as well as font sizes.

- Breakouts - Colors and sizes for breakout arrows.

- Alerts - Enable or disable alerts at will.

Author

Arturo López Pérez, private investor and speculator, software engineer and founder of Point Zero Trading Solutions.

I bought the software Wolfe Waves installed into MT5 and everything but the software will not work on MT5 did the trouble shooting and contracted customer support and no help to fix the software i have purchased a software for 149.00 that dose not work that is not right to charge someone money for software and not even help them with it. The on the video nothing comes up like it shows on the video. This product sucks and i would say stay way it not worth it. The Company should be ashamed to take someone money and not help them or anything 149.00 may not seem like a lot but to get nothing for something that you paid for is not right