PZ Pivot Points

- Indicators

- PZ TRADING SLU

- Version: 4.0

- Updated: 10 August 2019

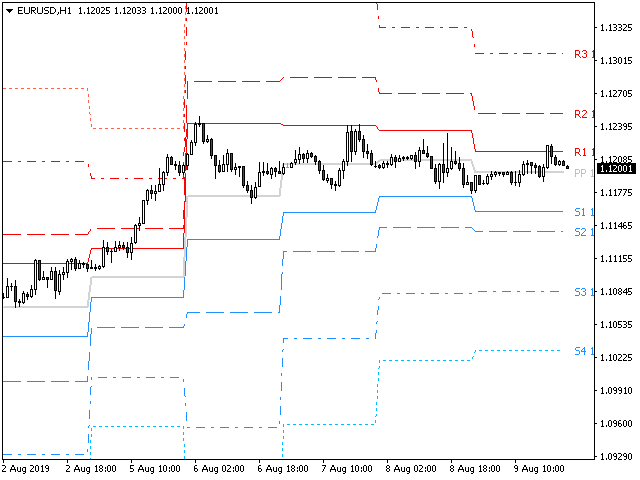

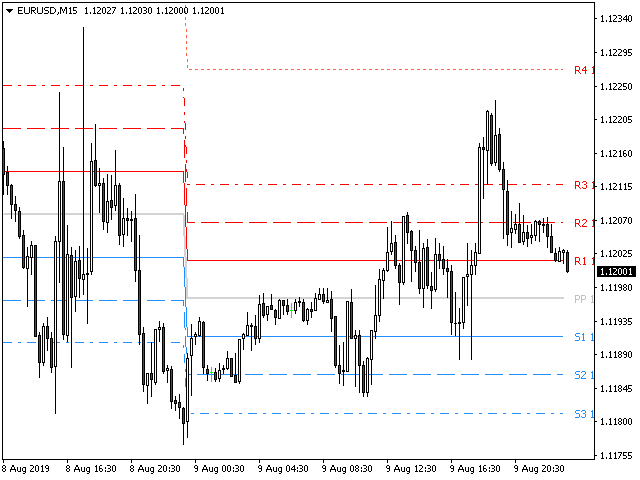

This indicator displays pivot points in the chart, including historical vales, and supports many calculation modes for Pivot Points and S/R levels. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

- It plots historical levels for backtesting purposes

- It allows you to select the reference timeframe

- It implements different Pivot Point calculation modes

- It implements different SR calculation modes

- It implements customizable colors and sizes

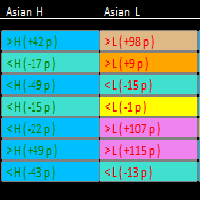

Calculation Modes

The indicator implements different calculation modes for the pivot point.- (H+L+C)/3

- (H+L+O)/3

- (H+L+C+O)/4

- (H+L+C+C)/4

- (H+L+O+O)/4

- (H+L)/2

- (H+C)/2

- (L+C)/2

It also implements many different calculation modes for SR Levels:

- Classic Formula

- R4 = R3 + (High – Low)

- R3 = R2 + (High – Low)

- R2 = PP + (High – Low)

- R1 = (2 * PP) – Low

- S1 = (2 * PP) – High

- S2 = PP – (High – Low)

- S3 = S2 – (High – Low)

- S4 = S3 – (High – Low)

- Woodie Pivot Points

- R4 = R3 + (High – Low)

- R3 = High + 2 * (PP – Low)

- R2 = PP + (High – Low)

- R1 = (2 * PP) – Low

- S1 = (2 * PP) – HIGH

- S2 = PP – (High – Low)

- S3 = Low – 2 * (High – PP)

- S4 = S3 – (High – Low)

- Camarilla Pivot Points

- R4 = PP + (High – Low) * 1.1/2

- R3 = PP + (High – Low) * 1.1/4

- R2 = PP + (High – Low) * 1.1/6

- R1 = PP + (High – Low) * 1.1/12

- S1 = PP – (High – Low) * 1.1/12

- S2 = PP – (High – Low) * 1.1/6

- S3 = PP – (High – Low) * 1.1/4

- S4 = PP – (High – Low) * 1.1/2

Input Parameters

- PP Calculation Mode: Select the Pivot Points calculation mode desired

- S/R Calculation Mode: Select the SR calculation mode desired

- Timeframe: Choose the timeframe to calculate pivot points from

- Mid Points: Display or hide mid points between SR levels

- Display Labels: Display or hide name and price labels

- Color of S levels: Color of support levels

- Color of R levels: Color of resistance levels

- Color of P level: Color of pivot point levels

- Font size: Font size for name and price labels

Support

I am happy to provide free products but given my limited time, they come without support of any kind. My apologies.Author

Arturo López Pérez, private investor and speculator, software engineer and founder of Point Zero Trading Solutions.

5 Stars! Great Work! Thank You!