Mean Machine

- Experts

- William Brandon Autry

- Version: 11.5

- Updated: 6 November 2025

- Activations: 12

Mean Machine GPT Version 11.0 - Where Institutional Intelligence Meets Specialized Trading

Since pioneering genuine AI integration in algorithmic trading, we have refined this approach through multiple market cycles, economic regimes, and technological evolutions. What began as our conviction that adaptive machine learning represents the natural progression of quantitative trading has become an industry direction. Version 11.0 marks our most sophisticated implementation yet.

This is not AI as marketing terminology. This is computational intelligence applied with institutional rigor to specialized trading strategies, refined through years of production deployment across varying market conditions. The infrastructure supporting Version 11.0 represents the culmination of continuous research and development in adaptive position management, multi-model consensus systems, and neural network weight optimization.

Version 11.0 features access to over 300+ AI models including 55+ FREE integrated models, specialized mean reversion and trend-following strategies, the proprietary Sacred Phi position management system, enhanced neural network weight training, and architectural capabilities that experienced practitioners continue to discover. The system performs enhanced web search at 10x speed for real-time market intelligence, monitoring breaking news, economic events, and sentiment while executing sophisticated multi-strategy approaches optimized for low-volatility sessions.

Key Evolutionary Enhancements:

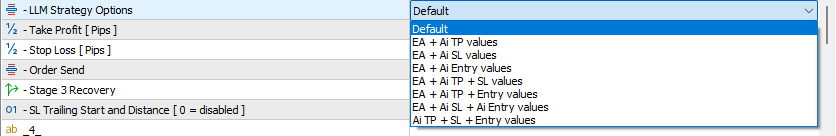

- 300+ AI Model Ecosystem with 55+ FREE Options: Direct API integration with institutional-grade providers including OpenAI, Anthropic Claude, DeepSeek, Google Gemini, Meta Llama, Mistral, and X.AI Grok 4. Each model contributes specialized analytical capabilities through our selective activation system. This multi-model architecture emerged from years of production testing across market regimes where single-model approaches showed limitations.

- Sacred Phi Position Management: Our proprietary secondary strategy system developed through extensive research into market microstructure and position scaling mathematics. Handles market noise through sophisticated mathematical principles, creating staggered exits and maintaining profit targets in currency terms while compensating for swap and commission dynamics. This approach evolved from observing institutional desk practices rather than retail EA conventions.

- Multi-Strategy Adaptation: Real-time regime detection switches between mean reversion, trend-following, and breakout strategies based on market conditions. Specifically optimized for AUDCAD, AUDNZD, and NZDCAD pairs during low-volatility sessions where these strategies demonstrate statistical edge. This specialization reflects our philosophy that focused optimization outperforms generalized approaches.

- Neural Network Weight Training: Continuous learning system that trains weights based on trade outcomes, strategy performance, and market conditions. Each successful pattern strengthens corresponding neural pathways while unsuccessful trades adjust weights for improvement. This represents practical machine learning implementation focused on incremental advantage accumulation.

- Advanced Ecosystem Architecture: The infrastructure supporting Version 11.0 includes capabilities that extend beyond standard EA operation. Experienced practitioners exploring the system deeply have discovered features enabling sophisticated coordination between instances. This architecture anticipates the evolution toward distributed intelligence systems while maintaining full functionality in standard deployment.

- Test API Connection Validation: Pre-flight verification system that validates API keys, credits, and model availability before live trading. This operational reliability feature emerged from production deployment experience where configuration errors could impact performance.

- Advanced Position Management (APM): Configurable management profiles (Relaxed, Balanced, Strict) with independent API selection and customizable modification approaches for take profit, stop loss, or both. Default Relaxed setting provides maximum flexibility for ranging markets based on empirical testing across conditions.

- API Cost Reduction (ACR): Intelligent optimization reduces API costs by 60-80 percent through batching, caching, and strategic call management while maintaining full analytical capabilities. This efficiency layer makes multi-model operation economically viable for retail traders.

- Diverse Analytical Perspectives: When multiple models are enabled, each focuses on different market aspects, preventing analytical tunnel vision. This multi-perspective approach mirrors institutional research desk practices where diverse viewpoints strengthen decision confidence.

- Combined Decision Weight Options: Choose between Unanimous decision for maximum confidence, Majority Vote for balanced approach, or Performance-Weighted for merit-based influence when using 3 or more AI models. Each consensus mechanism serves different risk tolerance and confidence requirements.

- Selective Web Grounding: Strategic application of real-time web search where market events impact positions while technical pattern recognition relies on price action analysis. This optimization balances information advantage against operational efficiency.

Version 11.0 represents years of refinement in specialized trading strategy implementation combined with institutional-grade AI integration. By focusing on proven strategies enhanced by sophisticated multi-model analysis and proprietary position management, this system delivers professional capabilities that continuously evolve through neural network training and operational learning.

The Evolution of Adaptive Trading Systems

Quantitative trading has progressed through distinct phases: technical indicators dominated the 1970s-80s, multifactor models emerged in the 1990s, and computational intelligence integration began gaining institutional adoption in the 2010s. Each advancement took approximately a decade to move from institutional pioneers to broader market acceptance.

Our approach began during the early institutional adoption phase, when the computational resources and expertise required for adaptive machine learning systems existed primarily at quantitative hedge funds and proprietary trading desks. The insight driving our development was that cloud computing infrastructure and purpose-built architectures could make these capabilities accessible beyond institutional barriers.

Today, with AI integration mentioned across the trading technology landscape, the market has validated what we recognized years ago: adaptive systems represent the natural evolution of algorithmic trading. The question for sophisticated practitioners is no longer whether to integrate machine learning, but rather how deeply, with what methodology, and with what operational rigor.

Professional Trading Through Specialized AI Integration

Mean Machine GPT represents specialized trading strategies enhanced by enterprise-level AI integration. The system connects directly to official API endpoints of elite AI providers including OpenAI, Anthropic, Google, Meta, X.AI, and Mistral AI, each offering their complete model suites. This direct API integration enables real-time processing optimized for mean reversion and trend-following strategies, providing institutional-quality analysis specifically tuned for low-volatility forex sessions.

This is a professional-grade system that leverages multiple AI models working in specialized roles. It is not a consumer application with AI features added; it is a trading system built from the ground up around computational intelligence integration, informed by years of production deployment experience.

Distinguishing Characteristics:

1 on 1 complimentary initial setup and walkthrough via AnyDesk. Just message me after your purchase.

- Specialized Strategy Focus: Optimized for mean reversion and trend-following on specific pairs (AUDCAD, AUDNZD, NZDCAD) rather than attempting universal application. This specialization creates statistical edge through focused optimization. The philosophy: depth in specific domains outperforms breadth across all conditions.

- Commonwealth Currency Expertise: Deliberately selected pairs exhibiting favorable volatility and volume characteristics without excessive noise. Natural correlations provide portfolio effects while maintaining tradeable divergences. This pair selection reflects extensive empirical testing rather than arbitrary coverage.

- Sacred Phi System: Proprietary position management approach using mathematical principles to navigate market noise. Not a conventional grid or martingale system, but an intelligent method for maintaining profit targets while adapting to conditions. This system emerged from research into institutional position scaling practices.

- Flexible AI Configuration: Selective API activation allows enabling only required providers. Operate with single API for efficiency or multiple APIs for consensus validation with sophisticated decision weighting. This flexibility accommodates different operational philosophies and cost considerations.

- Neural Network Evolution: Continuous weight training based on trade outcomes, gradually learning optimal conditions for each strategy while adapting to individual trading approaches. This represents practical machine learning focused on incremental improvement rather than revolutionary claims.

- Test API Connection: Validation feature that verifies all API connections before live trading, ensuring operational reliability from deployment. This feature emerged from production experience where configuration verification prevents avoidable issues.

- Max Net Currency Control: Sophisticated exposure management tracking net positions across all currencies, preventing overexposure and hidden correlation risks. This risk management approach reflects institutional portfolio construction principles.

- Low-Volatility Optimization: Specifically tuned for quieter market sessions where mean reversion demonstrates statistical advantage and spread costs remain favorable. This specialization acknowledges that different strategies excel under different regimes.

- Prop Firm Ready: Comprehensive risk controls including daily drawdown limits, balance-based stops, and end-of-day calculations for prop firm compliance. These features serve professional traders operating under institutional risk constraints.

- Advanced Architecture: Built with integration capabilities that experienced practitioners continue to explore. The infrastructure supports distributed intelligence features that extend beyond standard EA operation, anticipating evolution in algorithmic trading systems.

- Auto GMT Detection: Automatic time zone adjustment for accurate global trading without manual configuration.

- Dedicated Support: Direct assistance available when needed, reflecting our commitment to partnership rather than transactional software sales.

Mean Machine GPT represents a specialized approach to algorithmic trading that extends beyond conventional EA capabilities. While backtesting provides insights into strategy logic, approximately 50 percent of the system's capabilities emerge only during live trading. This includes real-time AI model selection, neural network weight training, adaptive strategy switching, and the sophisticated Sacred Phi position management system.

The system is designed for professional traders seeking institutional-grade AI integration without backtest overfitting. Real-world performance emerges from combining proven trading strategies with modern computational enhancement, not from curve-fitted historical optimization. We maintain a strong stance against backtest manipulation: while we could easily produce flawless historical results, such representation would be disingenuous to the system's adaptive nature.

This approach reflects our conviction that transparency about capabilities and limitations serves sophisticated practitioners better than marketing-optimized backtests. The system is built for live market deployment where adaptation matters more than historical curve-fitting.

Operational Philosophy

Mean Machine GPT embodies a specific philosophy about algorithmic trading: specialization in proven strategies, enhanced by computational intelligence, deployed with institutional risk management. This philosophy emerged from observing what works consistently across market cycles rather than chasing revolutionary claims.

The system does not promise to have solved markets. It provides sophisticated tools for traders who understand that sustained advantage comes from consistent application of sound strategies with incremental improvements through machine learning. The AI integration serves to enhance pattern recognition and position management, not to eliminate the fundamental nature of trading risk.

This honest representation distinguishes systems built for long-term professional deployment from those optimized for sales conversion through exaggerated claims. Sophisticated practitioners recognize this distinction and value transparency about both capabilities and limitations.

Join the Community:

- Explore the Blog: Deep insights into strategy development and AI integration, including technical discussions of methodologies and architectural decisions.

- Community Channel: Connect with professional traders using the system. Some practitioners are already experimenting with advanced ecosystem features. (Now private - message after purchase for invitation)

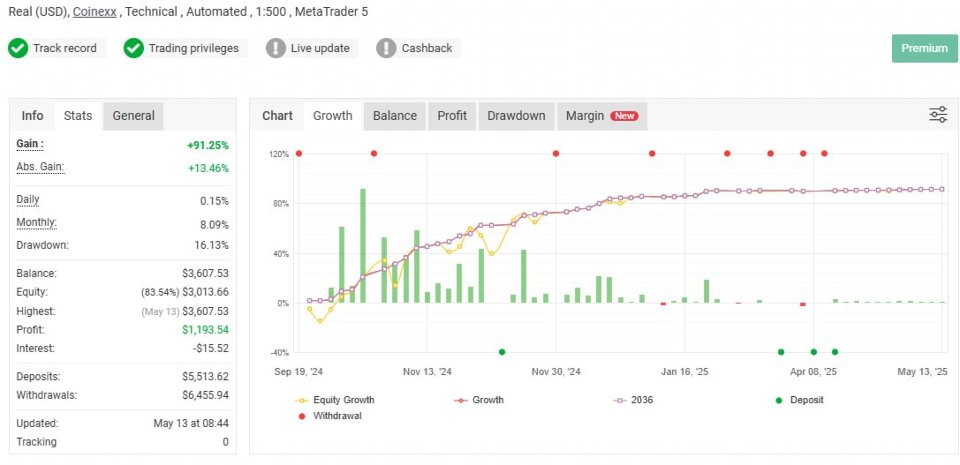

- Live Signals: Real performance tracking across market conditions, providing transparency about actual results.

Getting Started:

- Test API Connection: Use the built-in validation feature to verify all API connections before live deployment. Enable test mode, confirm connectivity, then disable for trading. This verification step prevents common configuration issues.

- Strategic Deployment: Attach to a single AUDCAD or EURUSD chart. The EA manages all configured symbols from this single instance, simplifying operational complexity.

- Configure Your Approach: Start with standard independent operation, though some advanced practitioners have discovered additional operational modes. Select your AI providers and decision weight mechanism based on your trading philosophy and risk tolerance.

Multi-Symbol Trading Excellence:

The deliberate focus on AUDCAD, AUDNZD, and NZDCAD provides several advantages:

- Correlation Benefits: Commonwealth currencies share economic factors while maintaining tradeable divergences, creating natural portfolio effects that institutional traders exploit systematically.

- Volatility Sweet Spot: These pairs offer sufficient movement for profit without excessive whipsaws that plague more volatile instruments. This balance emerged from empirical testing across pair universes.

- Reduced News Impact: Less affected by USD-centric news events, allowing more stable mean reversion patterns to develop and persist.

- Optimal Spread Conditions: Generally tighter spreads during low-volatility sessions when the system performs optimally, improving cost efficiency.

Configuration Recommendations:

- Starting Configuration: Begin with default symbols (AUDCAD, AUDNZD, NZDCAD) and conservative settings. Enable Neural Network and ACR systems. Start with single API provider before adding consensus models, allowing you to understand baseline operation before introducing additional complexity.

- Portfolio Approach: Deploy multiple instances with varied configurations across different accounts. This diversification creates more consistent returns than single-account concentration. Advanced practitioners have discovered interesting synergies when running multiple coordinated instances, though standard independent operation remains fully effective.

- Complementary Pairs: If expanding beyond defaults, consider pairs with similar characteristics like USDCAD or EURCHF that exhibit ranging behavior suitable for mean reversion. Avoid pairs with different volatility profiles that would require separate optimization.

- Risk Management: Use the comprehensive prop firm features even on personal accounts. Set daily and weekly targets to ensure consistent, sustainable growth rather than pursuing aggressive returns that increase drawdown risk.

Who This System Serves:

Mean Machine GPT is built for traders who understand that specialization outperforms generalization in forex trading. By focusing on specific strategies (mean reversion and trend-following) for specific pairs (Commonwealth currencies) during specific conditions (low-volatility sessions), the system creates statistical edge enhanced by AI rather than dependent on it.

This is for practitioners who value:

- Transparent methodology over marketing claims

- Continuous refinement over revolutionary promises

- Operational reliability over backtest perfection

- Professional-grade implementation over consumer simplicity

- Long-term consistency over short-term excitement

The combination of proven trading strategies with modern computational capabilities, continuous neural network training, and sophisticated position management delivers consistent performance through varying conditions. Some traders have already discovered hidden capabilities within the system that enable unprecedented coordination and shared intelligence. The infrastructure is built for more than standard operation, with features that continue to reveal themselves to experienced practitioners.

Mean Machine GPT transforms specialized trading strategies into a professional-grade system enhanced by the most advanced AI integration available today, refined through years of production deployment and continuous evolution.

Risk Disclosure

While Mean Machine GPT employs sophisticated strategies and AI enhancement for long-term performance, forex trading involves substantial risk. The Sacred Phi system and other advanced features are designed to manage risk intelligently, but cannot eliminate it entirely. No trading system, regardless of technological sophistication, can guarantee profits or prevent losses. Trade responsibly within your risk tolerance and never invest more than you can afford to lose. Past performance does not guarantee future results, and all trading involves the risk of loss.

I am a loyal user since the beginning. Everything's good, nice performace. Keep it up, Brandon! ⭐⭐⭐⭐⭐