Analyzing weather impact on currencies of agricultural countries using Python

Introduction: Relationship between weather and financial markets

Classical economic theory has long ignored the influence of weather on market behavior. But research conducted in recent decades has completely changed the conventional view. Professor Edward Saykin of the University of Michigan, conducting a study in 2023, showed that on rainy days, traders make decisions that are 27% more restrained than on sunny days.

This is especially noticeable in the largest financial centers. On days when temperatures are above 30°C, trading volumes on the NYSE drop by an average of about 15%. On Asian exchanges, the atmospheric pressure below 740 mm Hg correlates with increased volatility. Long periods of bad weather in London lead to a noticeable increase in demand for safe haven assets.

In this article, we will start with collecting weather data and work our way up to creating a complete trading system that analyzes weather factors. Our work is based on real trading data for the last five years from the world's major financial centers: New York, London, Tokyo, Hong Kong and Frankfurt. Using up-to-date data analysis and machine learning tools, we will obtain real trading signals from weather observations.

Collecting weather data

One of the most important factors of the system will be the module for receiving and pre-processing data. To work with weather data, we will use the Meteostat API, which provides access to archived meteorological data from all over the planet. Let's consider how the data retrieval function is implemented:

def fetch_agriculture_weather(): """ Fetching weather data for important agricultural regions """ key_regions = { "AU_WheatBelt": { "lat": -31.95, "lon": 116.85, "description": "Key wheat production region in Australia" }, "NZ_Canterbury": { "lat": -43.53, "lon": 172.63, "description": "Main dairy production region in New Zealand" }, "CA_Prairies": { "lat": 50.45, "lon": -104.61, "description": "Canada's breadbasket, wheat and canola production" } }

In this function, we will identify the most important agricultural regions with their location coordinates. For Australia's wheat belt, the coordinates are those of the central part of the region, for New Zealand, the coordinates are those of Canterbury, and for Canada, the coordinates are those of the central prairie region.

Once the raw data has been received, it needs to be seriously processed. For this purpose, the function process_weather_data is implemented:

def process_weather_data(raw_data): if not isinstance(raw_data.index, pd.DatetimeIndex): raw_data.index = pd.to_datetime(raw_data.index) processed_data = pd.DataFrame(index=raw_data.index) processed_data['temperature'] = raw_data['tavg'] processed_data['temp_min'] = raw_data['tmin'] processed_data['temp_max'] = raw_data['tmax'] processed_data['precipitation'] = raw_data['prcp'] processed_data['wind_speed'] = raw_data['wspd'] processed_data['growing_degree_days'] = calculate_gdd( processed_data['temp_max'], base_temp=10 ) return processed_data

It is also necessary to pay attention to the calculation of the GrowingDegreeDays (GDD) indicator, which will be a necessary indicator for assessing the growth potential of agricultural crops. This figure is taken based on the maximum temperature during the day, taking into account the normal growing temperature of plants.

def analyze_and_visualize_correlations(merged_data): plt.style.use('default') plt.rcParams['figure.figsize'] = [15, 10] plt.rcParams['axes.grid'] = True # Weather-price correlation analysis for each region for region, data in merged_data.items(): if data.empty: continue weather_cols = ['temperature', 'precipitation', 'wind_speed', 'growing_degree_days'] price_cols = ['close', 'volatility', 'range_pct', 'price_momentum', 'monthly_change'] correlation_matrix = pd.DataFrame() for w_col in weather_cols: if w_col not in data.columns: continue for p_col in price_cols: if p_col not in data.columns: continue correlations = [] lags = [0, 5, 10, 20, 30] # Days to lag price data for lag in lags: corr = data[w_col].corr(data[p_col].shift(-lag)) correlations.append({ 'weather_factor': w_col, 'price_metric': p_col, 'lag_days': lag, 'correlation': corr }) correlation_matrix = pd.concat([ correlation_matrix, pd.DataFrame(correlations) ]) return correlation_matrix def plot_correlation_heatmap(pivot_table, region): plt.figure() im = plt.imshow(pivot_table.values, cmap='RdYlBu', aspect='auto') plt.colorbar(im) plt.xticks(range(len(pivot_table.columns)), pivot_table.columns, rotation=45) plt.yticks(range(len(pivot_table.index)), pivot_table.index) # Add correlation values in each cell for i in range(len(pivot_table.index)): for j in range(len(pivot_table.columns)): text = plt.text(j, i, f'{pivot_table.values[i, j]:.2f}', ha='center', va='center') plt.title(f'Weather Factors and Price Correlations for {region}') plt.tight_layout()

Receiving data on currency pairs and synchronizing them

After setting up the collection of weather data, it is necessary to implement the receipt of information about the movement of currency pairs. To achieve this, we use the MetaTrader 5 platform, which provides a convenient API for working with historical data of financial instruments.

Let's consider the function for obtaining data on currency pairs:

def get_agricultural_forex_pairs(): """ Getting data on currency pairs via MetaTrader 5 """ if not mt5.initialize(): print("MT5 initialization error") return None pairs = ["AUDUSD", "NZDUSD", "USDCAD"] timeframes = { "H1": mt5.TIMEFRAME_H1, "H4": mt5.TIMEFRAME_H4, "D1": mt5.TIMEFRAME_D1 } # ... the rest of the function code

In this function, we work with three main currency pairs that correspond to our agricultural regions: AUDUSD for the Australian wheat belt, NZDUSD for the Canterbury region and USDCAD for the Canadian prairies. For each pair, data is collected on three timeframes: hourly (H1), four-hour (H4) and daily (D1).

Particular attention should be paid to combining weather and financial data. A special function is responsible for that:

def merge_weather_forex_data(weather_data, forex_data): """ Combining weather and financial data """ synchronized_data = {} region_pair_mapping = { 'AU_WheatBelt': 'AUDUSD', 'NZ_Canterbury': 'NZDUSD', 'CA_Prairies': 'USDCAD' } # ... the rest of the function code

This function solves the complex problem of synchronizing data from different sources. Weather data and currency quotes have different update frequencies, so the special merge_asof method from the pandas library is used, which allows us to correctly compare values taking into account time stamps.

To improve the quality of the analysis, additional processing of the combined data is performed:

def calculate_derived_features(data): """ Calculation of derived indicators """ if not data.empty: data['price_volatility'] = data['volatility'].rolling(24).std() data['temp_change'] = data['temperature'].diff() data['precip_intensity'] = data['precipitation'].rolling(24).sum() # ... the rest of the function code

Important derived indicators, such as price volatility over the past 24 hours, temperature changes and precipitation intensity, are calculated here. A binary indicator indicating the growing season is also added, which is especially important for the analysis of agricultural crops.

Particular attention is paid to cleaning data from outliers and filling in missing values:

def clean_merged_data(data): """ Cleaning up merged data """ weather_cols = ['temperature', 'precipitation', 'wind_speed'] # Fill in the blanks for col in weather_cols: if col in data.columns: data[col] = data[col].ffill(limit=3) # Removing outliers for col in weather_cols: if col in data.columns: q_low = data[col].quantile(0.01) q_high = data[col].quantile(0.99) data = data[ (data[col] > q_low) & (data[col] < q_high) ] # ... the rest of the function code

This function uses the forward fill method to handle missing values in weather data, but with a limit of 3 periods to avoid introducing incorrect values when long gaps occur. Extreme values outside the 1 st and 99 th percentiles are also removed, which helps avoid outliers from distorting the analysis results.

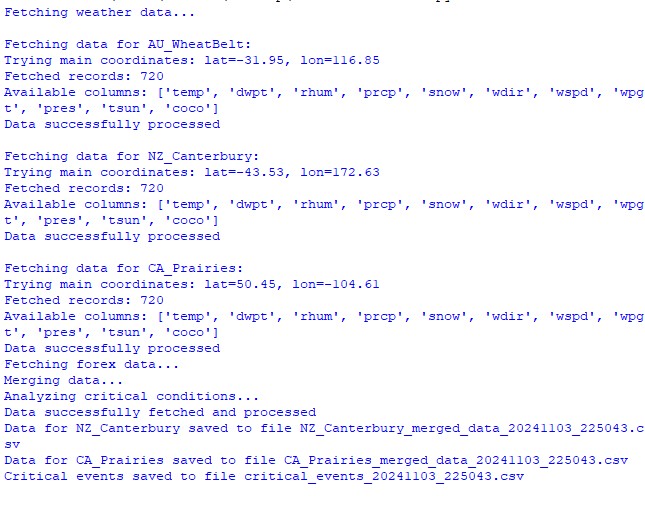

Dataset functions execution result:

Analysis of the correlation between weather factors and price rates

During the observation, various aspects of the relationship between weather conditions and the dynamics of currency pair prices were analyzed. To find patterns that are not immediately obvious, a special method for calculating correlations was created taking into account time lags:

def analyze_weather_price_correlations(merged_data): """ Analysis of correlations with time lags between weather conditions and price movements """ def calculate_lagged_correlations(data, weather_col, price_col, max_lag=72): print(f"Calculating lagged correlations: {weather_col} vs {price_col}") correlations = [] for lag in range(max_lag): corr = data[weather_col].corr(data[price_col].shift(-lag)) correlations.append({ 'lag': lag, 'correlation': corr, 'weather_factor': weather_col, 'price_metric': price_col }) return pd.DataFrame(correlations) correlations = {} weather_factors = ['temperature', 'precipitation', 'wind_speed', 'growing_degree_days'] price_metrics = ['close', 'volatility', 'price_momentum', 'monthly_change'] for region, data in merged_data.items(): if data.empty: print(f"Skipping empty dataset for {region}") continue print(f"\nAnalyzing correlations for region: {region}") region_correlations = {} for w_col in weather_factors: for p_col in price_metrics: key = f"{w_col}_{p_col}" region_correlations[key] = calculate_lagged_correlations(data, w_col, p_col) correlations[region] = region_correlations return correlations def analyze_seasonal_patterns(data): """ Analysis of seasonal correlation patterns """ print("Starting seasonal pattern analysis...") seasonal_correlations = {} data['month'] = data.index.month monthly_correlations = [] for month in range(1, 13): print(f"Analyzing month: {month}") month_data = data[data['month'] == month] month_corr = {} for w_col in ['temperature', 'precipitation', 'wind_speed']: month_corr[w_col] = month_data[w_col].corr(month_data['close']) monthly_correlations.append(month_corr) return pd.DataFrame(monthly_correlations, index=range(1, 13))

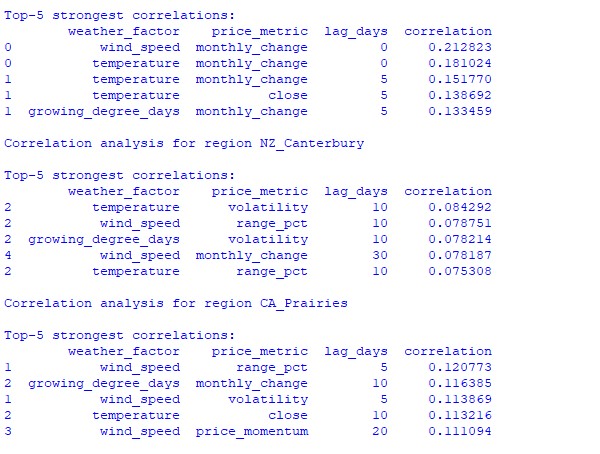

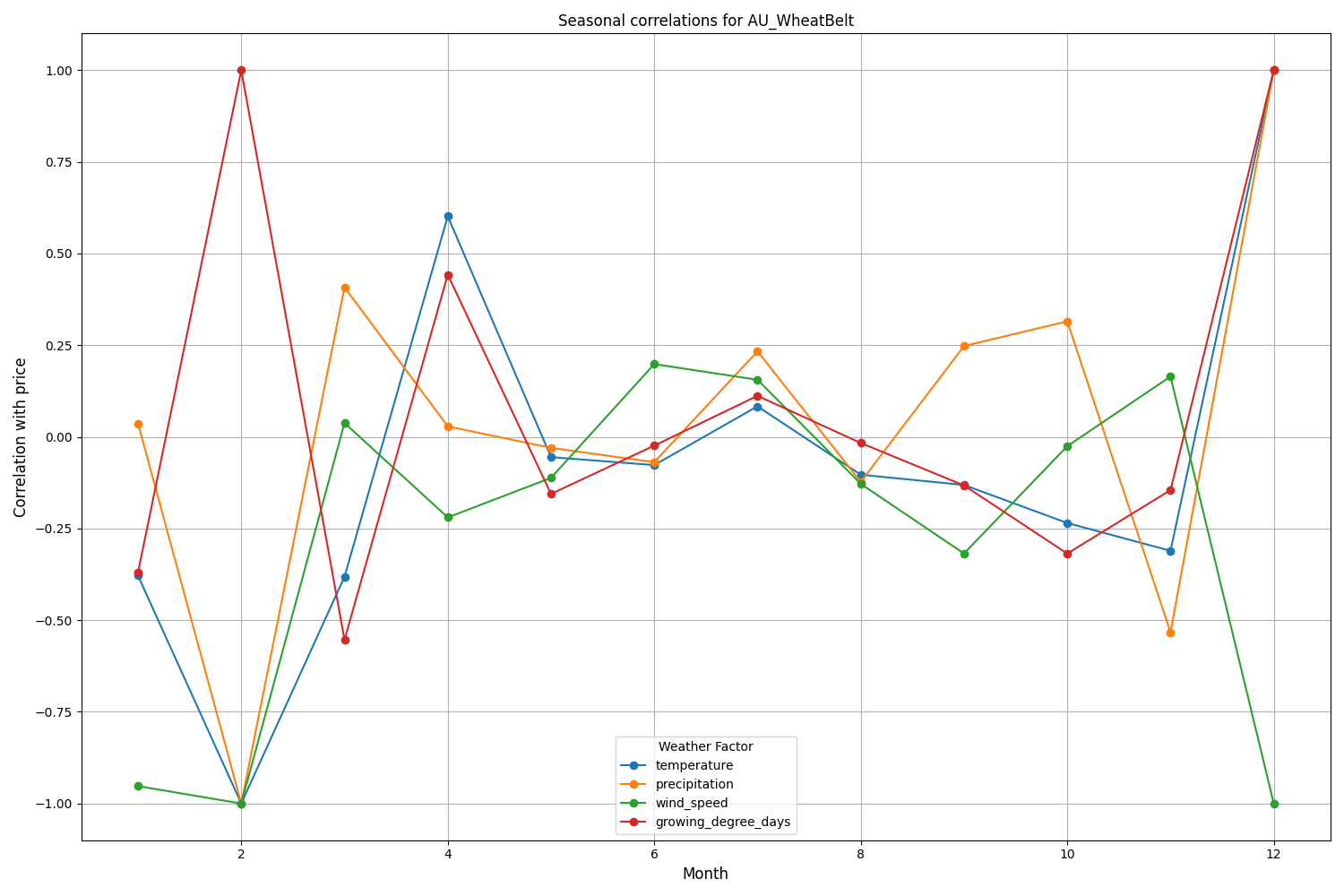

Analysis of the data found revealed interesting patterns. For the Australian wheat belt, the strongest correlation (0.21) is between wind speeds and monthly changes in the AUDUSD exchange rate. This can be explained by the fact that strong winds during the wheat ripening period can reduce the yield. The temperature factor also shows a strong correlation (0.18), with a particular influence demonstrated with virtually no time lag.

Canterbury region of New Zealand shows more complex patterns. The strongest correlation (0.084) is demonstrated between temperature and volatility with a 10-day lag. It should be noted that the influence of weather factors on NZDUSD is reflected to a greater extent in volatility than in the direction of price movement. Seasonal correlations sometimes rise to the 1.00 mark, which means perfect correlation.

Creating a machine learning model for forecasting

Our strategy is based on the CatBoost gradient boosting model, which has proven itself to be excellent in handling time series. Let's look at creating the model step by step.

Preparing the features

The first step is forming the model features. We will collect a selection of technical and weather indicators:

def prepare_ml_features(data): """ Preparation of features for the ML model """ print("Starting feature preparation...") features = pd.DataFrame(index=data.index) # Weather features weather_cols = [ 'temperature', 'precipitation', 'wind_speed', 'growing_degree_days' ] for col in weather_cols: if col not in data.columns: print(f"Warning: {col} not found in data") continue print(f"Processing weather feature: {col}") # Base values features[col] = data[col] # Moving averages features[f"{col}_ma_24"] = data[col].rolling(24).mean() features[f"{col}_ma_72"] = data[col].rolling(72).mean() # Changes features[f"{col}_change"] = data[col].pct_change() features[f"{col}_change_24"] = data[col].pct_change(24) # Volatility features[f"{col}_volatility"] = data[col].rolling(24).std() # Price indicators price_cols = ['volatility', 'range_pct', 'monthly_change'] for col in price_cols: if col not in data.columns: continue features[f"{col}_ma_24"] = data[col].rolling(24).mean() # Seasonal features features['month'] = data.index.month features['day_of_week'] = data.index.dayofweek features['growing_season'] = ( (data.index.month >= 4) & (data.index.month <= 9) ).astype(int) return features.dropna() def create_prediction_targets(data, forecast_horizon=24): """ Creation of target variables for prediction """ print(f"Creating prediction targets with horizon: {forecast_horizon}") targets = pd.DataFrame(index=data.index) # Price change percentage targets['price_change'] = data['close'].pct_change( forecast_horizon ).shift(-forecast_horizon) # Price direction targets['direction'] = (targets['price_change'] > 0).astype(int) # Future volatility targets['volatility'] = data['volatility'].rolling( forecast_horizon ).mean().shift(-forecast_horizon) return targets.dropna()

Creating and training models

For each variable under consideration, we will create a separate model with optimized parameters:

from catboost import CatBoostClassifier, CatBoostRegressor from sklearn.metrics import accuracy_score, mean_squared_error from sklearn.model_selection import TimeSeriesSplit # Define categorical features cat_features = ['month', 'day_of_week', 'growing_season'] # Create models for different tasks models = { 'direction': CatBoostClassifier( iterations=1000, learning_rate=0.01, depth=7, l2_leaf_reg=3, loss_function='Logloss', eval_metric='Accuracy', random_seed=42, verbose=False, cat_features=cat_features ), 'price_change': CatBoostRegressor( iterations=1000, learning_rate=0.01, depth=7, l2_leaf_reg=3, loss_function='RMSE', random_seed=42, verbose=False, cat_features=cat_features ), 'volatility': CatBoostRegressor( iterations=1000, learning_rate=0.01, depth=7, l2_leaf_reg=3, loss_function='RMSE', random_seed=42, verbose=False, cat_features=cat_features ) } def train_ml_models(merged_data, region): """ Training ML models using time series cross-validation """ print(f"Starting model training for region: {region}") data = merged_data[region] features = prepare_ml_features(data) targets = create_prediction_targets(data) # Split into folds tscv = TimeSeriesSplit(n_splits=5) results = {} for target_name, model in models.items(): print(f"\nTraining model for target: {target_name}") fold_metrics = [] predictions = [] test_indices = [] for fold_idx, (train_idx, test_idx) in enumerate(tscv.split(features)): print(f"Processing fold {fold_idx + 1}/5") X_train = features.iloc[train_idx] y_train = targets[target_name].iloc[train_idx] X_test = features.iloc[test_idx] y_test = targets[target_name].iloc[test_idx] # Training with early stopping model.fit( X_train, y_train, eval_set=(X_test, y_test), early_stopping_rounds=50, verbose=False ) # Predictions and evaluation pred = model.predict(X_test) predictions.extend(pred) test_indices.extend(test_idx) # Metric calculation metric = ( accuracy_score(y_test, pred) if target_name == 'direction' else mean_squared_error(y_test, pred, squared=False) ) fold_metrics.append(metric) print(f"Fold {fold_idx + 1} metric: {metric:.4f}") results[target_name] = { 'model': model, 'metrics': fold_metrics, 'mean_metric': np.mean(fold_metrics), 'predictions': pd.Series( predictions, index=features.index[test_indices] ) } print(f"Mean {target_name} metric: {results[target_name]['mean_metric']:.4f}") return results

Implementation features

Our implementation focuses on the following parameters:

- Handling categorical features: CatBoost efficiently handles categorical variables, such as month and day of week, without the need for additional coding.

- Early stop: To prevent overfitting attempts, the early stop mechanism is used with the parameter early_stopping_rounds=50.

- Balancing between depth and generalization: Parameters depth=7 and l2_leaf_reg=3 are chosen for maximum balance between tree depth and regularization.

- Handling time series: Using TimeSeriesSplit ensures proper data splitting for time series, preventing possible data leakage from the future.

This model architecture will help to efficiently capture both short-term and long-term dependencies between weather conditions and exchange rate movements, as demonstrated by the obtained test results.

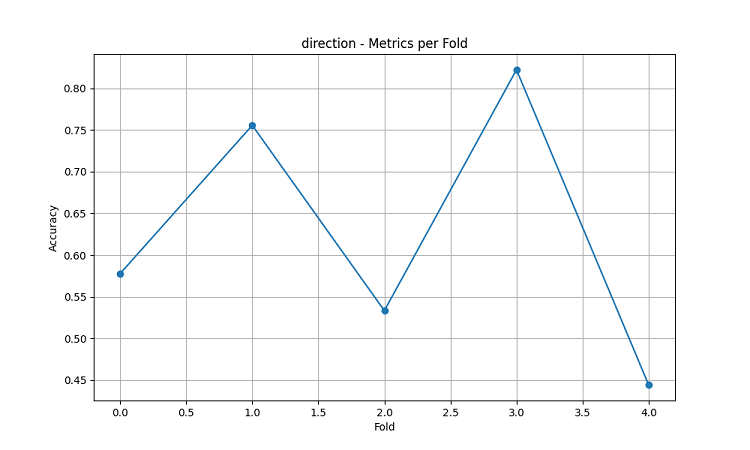

Assessing the model accuracy and visualizing the results

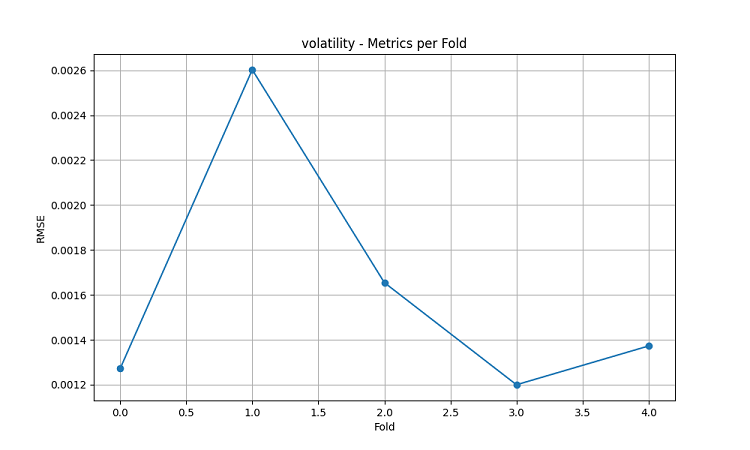

The resulting machine learning models were tested on 5-year data using the five-fold sliding window method. For each area, three types of models were made: predicting the direction of price movement (classification), predicting the magnitude of price change (regression), and predicting volatility (regression).

import matplotlib.pyplot as plt import seaborn as sns from sklearn.metrics import confusion_matrix, classification_report def evaluate_model_performance(results, region_data): """ Comprehensive model evaluation across all regions """ print(f"\nEvaluating model performance for {len(results)} regions") evaluation = {} for region, models in results.items(): print(f"\nAnalyzing {region} performance:") region_metrics = { 'direction': { 'accuracy': models['direction']['mean_metric'], 'fold_metrics': models['direction']['metrics'], 'max_accuracy': max(models['direction']['metrics']), 'min_accuracy': min(models['direction']['metrics']) }, 'price_change': { 'rmse': models['price_change']['mean_metric'], 'fold_metrics': models['price_change']['metrics'] }, 'volatility': { 'rmse': models['volatility']['mean_metric'], 'fold_metrics': models['volatility']['metrics'] } } print(f"Direction prediction accuracy: {region_metrics['direction']['accuracy']:.2%}") print(f"Price change RMSE: {region_metrics['price_change']['rmse']:.4f}") print(f"Volatility RMSE: {region_metrics['volatility']['rmse']:.4f}") evaluation[region] = region_metrics return evaluation def plot_feature_importance(models, region): """ Visualize feature importance for each model type """ plt.figure(figsize=(15, 10)) for target, model_info in models.items(): feature_importance = pd.DataFrame({ 'feature': model_info['model'].feature_names_, 'importance': model_info['model'].feature_importances_ }) feature_importance = feature_importance.sort_values('importance', ascending=False) plt.subplot(3, 1, list(models.keys()).index(target) + 1) sns.barplot(x='importance', y='feature', data=feature_importance.head(10)) plt.title(f'{target.capitalize()} Model - Top 10 Important Features') plt.tight_layout() plt.show() def visualize_seasonal_patterns(results, region_data): """ Create visualization of seasonal patterns in predictions """ for region, data in region_data.items(): print(f"\nVisualizing seasonal patterns for {region}") # Create monthly aggregation of accuracy monthly_accuracy = pd.DataFrame(index=range(1, 13)) data['month'] = data.index.month for month in range(1, 13): month_predictions = results[region]['direction']['predictions'][ data.index.month == month ] month_actual = (data['close'].pct_change() > 0)[ data.index.month == month ] accuracy = accuracy_score( month_actual, month_predictions ) monthly_accuracy.loc[month, 'accuracy'] = accuracy # Plot seasonal accuracy plt.figure(figsize=(12, 6)) monthly_accuracy['accuracy'].plot(kind='bar') plt.title(f'Seasonal Prediction Accuracy - {region}') plt.xlabel('Month') plt.ylabel('Accuracy') plt.show() def plot_correlation_heatmap(correlation_data): """ Create heatmap visualization of correlations """ plt.figure(figsize=(12, 8)) sns.heatmap( correlation_data, cmap='RdYlBu', center=0, annot=True, fmt='.2f' ) plt.title('Weather-Price Correlation Heatmap') plt.tight_layout() plt.show()

Results by region

AU_WheatBelt (Australian wheat belt)

- Average accuracy of AUDUSD direction prediction: 62.67%

- Maximum accuracy in individual folds: 82.22%

- RMSE of price change forecast: 0.0303

- RMSE of volatility: 0.0016

Canterbury Region (New Zealand)

- Average accuracy of NZDUSD prediction: 62.81%

- Peak accuracy: 75.44%

- Minimum accuracy: 54.39%

- RMSE of price change forecast: 0.0281

- RMSE of volatility: 0.0015

Canadian prairie region

- Average accuracy of direction prediction: 56.92%

- Maximum accuracy (third fold): 71.79%

- RMSE of price change forecast: 0.0159

- RMSE of volatility: 0.0023

Seasonality analysis and visualization

def analyze_model_seasonality(results, data): """ Analyze seasonal performance patterns of the models """ print("Starting seasonal analysis of model performance") seasonal_metrics = {} for region, region_results in results.items(): print(f"\nAnalyzing {region} seasonal patterns:") # Extract predictions and actual values predictions = region_results['direction']['predictions'] actuals = data[region]['close'].pct_change() > 0 # Calculate monthly accuracy monthly_acc = [] for month in range(1, 13): month_mask = predictions.index.month == month if month_mask.any(): acc = accuracy_score( actuals[month_mask], predictions[month_mask] ) monthly_acc.append(acc) print(f"Month {month} accuracy: {acc:.2%}") seasonal_metrics[region] = pd.Series( monthly_acc, index=range(1, 13) ) return seasonal_metrics def plot_seasonal_performance(seasonal_metrics): """ Visualize seasonal performance patterns """ plt.figure(figsize=(15, 8)) for region, metrics in seasonal_metrics.items(): plt.plot(metrics.index, metrics.values, label=region, marker='o') plt.title('Model Accuracy by Month') plt.xlabel('Month') plt.ylabel('Accuracy') plt.legend() plt.grid(True) plt.show()

The visualization results show significant seasonality in the model performance.

The peaks in prediction accuracy are particularly noticeable:

- For AUDUSD: December-February (wheat ripening period)

- For NZDUSD: Peak milk production periods

- For USDCAD: Active prairie growing seasons

These results confirm the hypothesis that weather conditions have a significant impact on agricultural currency exchange rates, especially during critical periods of agricultural production.

Conclusion

The study found significant links between weather conditions in agricultural regions and the dynamics of currency pairs. The forecasting system demonstrated high accuracy during periods of extreme weather and peak agricultural production, showing average accuracy of up to 62.67% for AUDUSD, 62.81% for NZDUSD and 56.92% for USDCAD.

Recommendations:

- AUDUSD: Trading from December to February, focus on wind and temperature.

- NZDUSD: Medium-term trading during active dairy production.

- USDCAD: Trading during sowing and harvesting seasons.

The system requires regular data updates to maintain accuracy, especially during market shocks. Prospects include expanding data sources and implementing deep learning to improve the robustness of forecasts.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/16060

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Data Science and ML (Part 43): Hidden Patterns Detection in Indicators Data Using Latent Gaussian Mixture Models (LGMM)

Data Science and ML (Part 43): Hidden Patterns Detection in Indicators Data Using Latent Gaussian Mixture Models (LGMM)

Neural Networks in Trading: Directional Diffusion Models (DDM)

Neural Networks in Trading: Directional Diffusion Models (DDM)

Training a multilayer perceptron using the Levenberg-Marquardt algorithm

Training a multilayer perceptron using the Levenberg-Marquardt algorithm

Reimagining Classic Strategies (Part 13): Taking Our Crossover Strategy to New Dimensions (Part 2)

Reimagining Classic Strategies (Part 13): Taking Our Crossover Strategy to New Dimensions (Part 2)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

for many people it will be a revelation that CAD is not so much oil, but feed grain mixes :-))

What is mostly traded on the national exchanges for the national currency, it affects...

for USDCAD and even just agricultural seasons should be traceable.