The MQL5 Standard Library Explorer (Part 6): Optimizing a generated Expert Advisor

Contents

Introduction

After generating your Expert Advisor—whether through the MQL5 Wizard or from scratch—you might feel a surge of accomplishment as orders execute smoothly without errors. However, running it through the Strategy Tester often delivers a sobering reality: unimpressive results, marked by excessive drawdowns, overtrading, or inconsistent profitability. This is precisely where optimization steps in, allowing us to refine settings, logic, and constraints to unlock the EA's true potential and achieve more robust, sustainable performance.

In the context of MQL5 development, optimization typically refers to the process of fine-tuning an Expert Advisor's parameters using MetaTrader 5's Strategy Tester. This involves systematically testing various input combinations—such as signal thresholds, periods, or weights—across historical data to identify configurations that maximize key metrics like net profit, profit factor, or Sharpe ratio while minimizing risks like maximum drawdown. While this definition emphasizes quantitative parameter tuning, true optimization encompasses a broader spectrum, including structural and systematic enhancements like the time-based filtering we'll explore here. These methods address foundational issues (e.g., overreaction to noise) before or alongside param tuning, ensuring the EA isn't just curve-fitted to past data but adaptable to real markets.

Building directly on Part 5, where we constructed a multi-signal Expert Advisor using the MQL5 Wizard, this installment dives into optimization. For beginners, that Part 5 milestone proves that fully functional trading systems can be assembled with minimal coding by leveraging the MQL5 Standard Library. Yet, as we shift from assembly to real-world viability, we'll explore various optimization methods—ranging from traditional parameter tuning to structural enhancements. Our primary focus here will be on systematic, structural optimization, particularly using time-based filters to curb excessive trading and overreaction to market noise.

Even with these code-level refinements, the Strategy Tester remains indispensable: it allows us to rigorously test changes, observe quantitative improvements (e.g., reduced trade frequency or smoother equity curves), and compare new results against baseline backtests from before the modifications. For instance, varying time filters (e.g., restricting to high-volatility London/New York overlaps vs. quieter Asian sessions) can dramatically alter outcomes, highlighting how market dynamics shift across periods and underscoring the need for iterative testing to avoid over-optimization pitfalls like curve-fitting.

Other key considerations in optimization include the risk of overfitting (where the EA excels in historical tests but fails live due to data-specific tweaks), the importance of out-of-sample validation (testing on unseen data via walk-forward analysis), and sensitivity to external factors like slippage, spreads, or news events. By blending structural governance with Tester-driven param adjustments, we create resilient systems—always verifying progress through comparative metrics to ensure genuine enhancements.

We'll transition smoothly from diagnostics to hands-on implementation, ensuring you can apply these techniques without discarding the native framework.

It is important to state from the outset that the signal modules provided by MetaQuotes are not poorly designed. On the contrary, they are computationally efficient, internally consistent, and grounded in well-defined market models. Each module encapsulates a clear interpretation of price behavior and exposes a standardized interface for participation in a collective decision-making process. The challenge we encounter is therefore not one of implementation quality but of contextual deployment.

The moment our objective shifts from assembling an EA to improving its real-world performance, an in-depth level of understanding becomes essential. At this stage, working beyond the Wizard interface is no longer optional. While the Wizard excels at system construction, meaningful optimization requires direct interaction with the generated source code and an understanding of how signals behave across different market conditions.

In this section, our focus transitions from assembly to refinement. Rather than immediately modifying execution logic or money management, we concentrate on the signal evaluation and voting mechanism itself. As we inspect the generated architecture, a critical insight emerges: the primary source of poor performance is not the signal logic but the absence of higher-level constraints such as market regime awareness and trading frequency control.

The default voting system aggregates signal outputs efficiently and deterministically. Each signal module evaluates its internal market models, assigns a strength to its forecast, and contributes to a final decision through weighted averaging. This process is technically sound and computationally efficient. However, it operates under an implicit assumption: that signals should be allowed to vote continuously, regardless of market regime, volatility state, or recent trading activity.

This assumption becomes problematic in practice. Markets transition between trending, ranging, volatile, and low-activity regimes, yet most signal modules are designed to perform optimally only under specific conditions. Without regime filtering, signals that are statistically valid in one environment continue firing in unsuitable conditions. At the same time, the absence of frequency constraints allows repeated confirmations of similar information to trigger excessive trade entries, even when no meaningful new market information has emerged.

The equity curve produced by our initial multi-signal Expert Advisor makes this limitation clear. The losses observed are not the result of faulty indicators or inefficient code. Instead, they reflect a system that reacts too often and without sufficient contextual restraint. Market noise is repeatedly elevated to actionable information, leading to overtrading, amplified drawdowns, and gradual equity erosion.

The conclusion is therefore not to replace the native signal modules, but to govern and extend them intelligently. Meaningful optimization focuses on controlling when signals are permitted to participate in decision-making, how frequently they are allowed to trigger trade actions, and under which market regimes their interpretations remain valid.

Rather than modifying native source files directly, these improvements are best achieved by introducing custom signal layers—either by extending the behavior of existing signal logic externally or by developing new signal modules from first principles. This approach preserves the integrity and reliability of the native library while enabling precise control over signal behavior.

Such optimization strategies include:

- Regime classification (trend, range, volatility state)

- Trading frequency throttling and cooldown logic

- Time, session, and event-based filtering

- Adaptive weighting and conditional signal participation

- Custom signal modules designed to complement, rather than duplicate, native logic

When these contextual layers are applied, the existing signal modules often perform far better than their default behavior suggests.

In the sections that follow, we will examine the generated multi-signal Expert Advisor in detail and introduce systematic optimization techniques that operate at multiple levels: internal signal logic, EA inputs, regime filters, and decision-level constraints. By refining how signals are used rather than discarding them, we establish a disciplined path toward robust and sustainable performance improvements. From here, we'll transition into practical implementation, starting with time-based filtering to demonstrate how small, targeted code adjustments can dramatically reduce overtrading while paving the way for further parameter tuning in the Strategy Tester.

Inspecting the generated Multi-Signal Expert Advisor

As with any complex trading system, effective optimization begins by decomposing the problem into its observable components. Our Expert Advisor is no exception. The unfavorable equity curve, erratic backtest behavior, and dense journal logs are not random anomalies—they are direct, traceable consequences of how the EA’s internal logic interacts with market data. Every trade opened, every drawdown sustained, and every episode of overtrading stem from specific decision paths in the code. To achieve meaningful performance gains, we must first locate where decisions are formed, how frequently they occur, and under what conditions they are permitted to act.

Rather than attempting to optimize every aspect simultaneously, our inspection strategy deliberately focuses on the decision-making core: the signal evaluation and voting mechanism. The code snippet below highlights the key signal modules included in our Wizard-generated Expert Advisor:

#include <Expert\Signal\SignalFibonacci.mqh> #include <Expert\Signal\SignalAC.mqh> #include <Expert\Signal\SignalMA.mqh> #include <Expert\Signal\SignalRSI.mqh>

These four modules—SignalFibonacci, SignalAC, SignalMA, and SignalRSI—constitute the analytical engine of the EA. Each interprets market data through its own lens, generates a directional forecast with an associated strength, and contributes to the collective vote that determines whether a trade is triggered. Components such as trailing stops and money management modules (which we will address in later parts) influence trade outcomes after the entry decision has already been made. If the signals themselves fire excessively, trigger in mismatched market regimes, or redundantly reinforce the same information, no downstream execution or position-sizing adjustment can fully compensate. Therefore, genuine optimization must start here: with the signals, their combination logic, and the governance rules that control their participation.

This focused inspection serves a dual purpose. First, it reveals why the default configuration underperforms—often not because the indicators are flawed, but because they lack contextual restraint. Second, it identifies the exact levers available for improvement: signal weights, admission thresholds, voting thresholds, frequency controls, and conditional participation rules. By systematically examining these elements and testing the effects of targeted changes in the Strategy Tester, we can quantify improvements—comparing trade frequency, equity curve smoothness, drawdown statistics, and profit factor before and after each refinement. Varying parameters such as trading session windows or cooldown periods further demonstrate how sensitive results are to market context, reinforcing that structural governance and iterative tester validation are inseparable parts of a disciplined optimization process.

In the subsections that follow, we will break down the critical aspects of this decision core:

- Signal composition and their intended market roles

- Weight configuration and its impact on dominance

- Thresholds that gate signal admission and trade execution

- The voting and collection mechanism—where the real aggregation happens

- Observed trading frequency as a diagnostic indicator of over-reaction

1. Signal composition and their intended market roles

#include <Expert\Signal\SignalFibonacci.mqh> #include <Expert\Signal\SignalAC.mqh> #include <Expert\Signal\SignalMA.mqh> #include <Expert\Signal\SignalRSI.mqh>

Although these signal modules are provided as closed, ready-to-use components, they are not opaque. Each encapsulates a specific set of internal market models derived from the behavior of the indicator it represents. Understanding what those models are, how often they trigger, and how strongly they influence the final vote is essential. Without this knowledge, combining signals becomes an exercise in blind aggregation rather than informed system design. The first critical question is what role each signal plays in the system:

SignalFibonacci

Our customs are structurally oriented and context-dependent. Most relevant around pullbacks, retracements, and mean-reversion zones within established structure.

SignalMA

Trend-oriented. Best suited for regime identification or directional bias rather than frequent entry triggers.

SignalAC (Accelerator Oscillator)

Momentum-based. Sensitive to short-term changes and often produces frequent signals.

SignalRSI

Oscillator-based. Highly sensitive in ranging or low-timeframe environments and a common source of overtrading when unconstrained.

The Wizard does not assign roles to these signals—it merely aggregates them.

2. Weight configuration and its impact on dominance

input double Signal_Fib_Weight = 1.0; input double Signal_AC_Weight = 1.0; input double Signal_MA_Weight = 1.0; input double Signal_RSI_Weight = 1.0;

Weights define relative influence, not signal quality. Setting all weights to 1.0 implicitly assumes that:

- all signals are equally informative,

- all signals are valid across all market regimes,

- all signals should contribute equally and continuously, and

- this assumption is rarely valid in practice.

Our inspection strategy includes systematic experimentation with weight distributions, observing:

- Changes in trade frequency

- Shifts in equity curve smoothness

- Reduction or amplification of drawdowns

- Signal dominance in the journal logs

Weights become one of the primary tuning variables during optimization, especially when combined with regime or frequency constraints.

3. Thresholds that gate signal admission and trade execution

input int Signal_ThresholdOpen = 10; input int Signal_ThresholdClose = 10;

Thresholds determine how strong the aggregated vote must be before action is taken. Low thresholds increase sensitivity but often result in:

- Excessive trade frequency

- Reaction to noise rather than information

- Increased transaction costs and drawdowns

As highlighted in the documentation, thresholds are not cosmetic inputs—they are structural controls. Our inspection therefore includes varying threshold levels and observing:

- trade density over time;

- signal clustering in the journal;

- the relationship between vote strength and trade outcome.

4. The voting and collection mechanism—where the real aggregation happens

This block defines the signal collection, not just the signals themselves. At this level, the EA answers a critical question continuously:

Which analytical opinions are allowed to participate in the vote right now?

Our optimization work is therefore not limited to changing parameters. It also involves:- temporarily disabling individual signals,

- observing equity and frequency changes,

- evaluating redundancy between oscillators, and

- testing asymmetric combinations (e.g., trend + momentum only).

5. Observed trading frequency as a diagnostic indicator of overreaction

Within a window of approximately 5.5 hours (00:30–06:05), the EA generated well over 60 signal evaluations and opened 6 separate market positions, while modifying stops and targets dozens of times on the same positions. Signals were triggered almost every 5 minutes, frequently alternating between long and short interpretations without meaningful cooldown or regime validation. This density of signal activity indicates that the EA treats indicator fluctuations as actionable events rather than contextual information.

For the purpose of inspection, we extracted a short segment of the Strategy Tester journal covering a five-hour window of market activity; below, I presented just part of it to keep it simple.

2025.12.20 01:52:26.762 2024.11.07 00:05:00 Long Signal Detected: Pattern 0: Oscillator direction confirmation | RSI: 39.64, Diff: 3.12 | Weight: 70 2025.12.20 01:52:26.767 2024.11.07 00:10:00 Short Signal Detected: Pattern 2: Failed swing | Current RSI: 35.84 < Previous Extremum: 36.52 | Weight: 90 2025.12.20 01:52:26.769 2024.11.07 00:16:00 Short Signal Detected: Pattern 2: Failed swing | Current RSI: 34.29 < Previous Extremum: 36.52 | Weight: 90 2025.12.20 01:52:26.785 2024.11.07 00:20:00 Long Signal Detected: Pattern 0: Oscillator direction confirmation | RSI: 35.99, Diff: 1.70 | Weight: 70 2025.12.20 01:52:26.801 2024.11.07 00:25:00 Long Signal Detected: Pattern 0: Oscillator direction confirmation | RSI: 36.87, Diff: 0.88 | Weight: 70 2025.12.20 01:52:26.801 2024.11.07 00:25:00 position modified [#9152 sell 0.02 EURUSDr 1.07337 sl: 1.07326 tp: 1.06837] 2025.12.20 01:52:26.815 2024.11.07 00:25:00 CTrade::OrderSend: modify position #9152 EURUSDr (sl: 1.07326, tp: 1.06837) [done] 2025.12.20 01:52:26.912 2024.11.07 00:30:00 Long Signal Detected: Pattern 0: Oscillator direction confirmation | RSI: 37.80, Diff: 0.92 | Weight: 70 2025.12.20 01:52:26.912 2024.11.07 00:30:00 position modified [#9152 sell 0.02 EURUSDr 1.07337 sl: 1.07322 tp: 1.06837] 2025.12.20 01:52:26.926 2024.11.07 00:30:00 CTrade::OrderSend: modify position #9152 EURUSDr (sl: 1.07322, tp: 1.06837) [done] 2025.12.20 01:52:26.992 2024.11.07 00:35:00 Short Signal Detected: Pattern 0: Oscillator direction confirmation | RSI: 34.54, Diff: -3.26 | Weight: 70 2025.12.20 01:52:27.022 2024.11.07 00:40:00 Long Signal Detected: Pattern 0: Oscillator direction confirmation | RSI: 36.50, Diff: 1.96 | Weight: 70 2025.12.20 01:52:27.022 2024.11.07 00:40:00 position modified [#9152 sell 0.02 EURUSDr 1.07337 sl: 1.07316 tp: 1.06837] 2025.12.20 01:52:27.038 2024.11.07 00:40:00 CTrade::OrderSend: modify position #9152 EURUSDr (sl: 1.07316, tp: 1.06837) [done] 2025.12.20 01:52:27.070 2024.11.07 00:45:00 Long Signal Detected: Pattern 2: Failed swing | Current RSI: 38.01 > Previous Extremum: 37.80 | Weight: 90 2025.12.20 01:52:27.070 2024.11.07 00:45:00 position modified [#9152 sell 0.02 EURUSDr 1.07337 sl: 1.07310 tp: 1.06837] 2025.12.20 01:52:27.085 2024.11.07 00:45:00 CTrade::OrderSend: modify position #9152 EURUSDr (sl: 1.07310, tp: 1.06837) [done] 2025.12.20 01:52:27.133 2024.11.07 00:50:00 Long Signal Detected: Pattern 2: Failed swing | Current RSI: 38.53 > Previous Extremum: 37.80 | Weight: 90 2025.12.20 01:52:27.180 2024.11.07 00:55:00 Short Signal Detected: Pattern 0: Oscillator direction confirmation | RSI: 37.18, Diff: -1.35 | Weight: 70 2025.12.20 01:52:27.277 2024.11.07 01:00:00 Long Signal Detected: Pattern 3: Divergence | Bullish divergence detected | Weight: 80 2025.12.20 01:52:27.277 2024.11.07 01:00:00 position modified [#9152 sell 0.02 EURUSDr 1.07337 sl: 1.07288 tp: 1.06837] 2025.12.20 01:52:27.308 2024.11.07 01:00:00 CTrade::OrderSend: modify position #9152 EURUSDr (sl: 1.07288, tp: 1.06837) [done] 2025.12.20 01:52:27.324 2024.11.07 01:00:01 stop loss triggered #9152 sell 0.02 EURUSDr 1.07337 sl: 1.07288 tp: 1.06837 [#9153 buy 0.02 EURUSDr at 1.07288]

More critically, the journal shows that signal evaluation continues aggressively even while positions are already open, leading to repeated stop-loss tightening and premature exits. This behavior confirms that the losses are not caused by isolated bad trades, but by excessive decision frequency and uncontrolled signal participation. The EA is effectively overreacting to noise, reinforcing the conclusion that optimization must prioritize trade frequency limits, signal governance, and regime awareness, not merely parameter tuning.

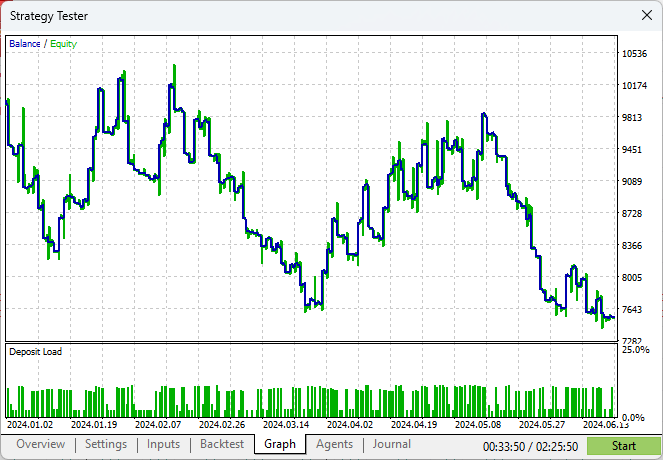

Equity Curve Produced by the Generated Multi-Signal EA.

The equity curve above was produced by our multi-signal Expert Advisor; it shows a steady and prolonged decline rather than isolated losses or random volatility. This behavior indicates a system that is continuously active but structurally misaligned with market conditions. Trades are being opened frequently, losses accumulate gradually, and short recovery phases fail to change the overall downward trajectory. This pattern is characteristic of excessive signal triggering, where routine market noise is repeatedly interpreted as valid trade opportunities.

The accompanying deposit load further confirms this diagnosis. Market exposure remains consistently elevated, with frequent spikes that suggest closely spaced or overlapping trades, even as equity deteriorates. Together, these observations provide clear evidence that the issue does not lie in execution or indicator malfunction, but in how signals are allowed to participate and combine. The results reinforce the need to move beyond default behavior and focus on optimization strategies that regulate signal frequency, contextual validity, and decision-making discipline.

Beyond the equity curve, the journal and trade log become essential inspection instruments. By analyzing:

- how many trades occur per session;

- whether multiple trades cluster in flat conditions;

- how often signals re-fire without new market information.

We can infer whether the voting system is reacting to information or merely movement. This insight directly informs later implementation steps such as:

- Cooldown logic

- Regime gating

- Conditional signal participation

- Custom signal refinement or replacement

This structured inspection—examining signal roles, weight distribution, thresholds, and observed trading frequency—forms the launchpad for implementation. Rather than guessing improvements, we identify concrete levers already exposed by the EA architecture and documentation. These observations guide us toward targeted optimization strategies aimed at improving a multi-signal Expert Advisor in a controlled, measurable, and repeatable manner.

In the next stage, we move from inspection to implementation by developing time-filtering logic to gain direct control over when the Expert Advisor is allowed to trade. Parameter tuning is incorporated as a supporting step, requiring minimal coding and focusing primarily on adjusting values through experimentation to identify configurations that yield improved results—all while preserving the integrity of the native framework.

Implementation

This stage is critical, as we shift our focus from analysis to execution through the direct implementation of time-filtering logic. By introducing controlled trading windows, we significantly reduce unnecessary trade frequency and gain precise authority over when the Expert Advisor is permitted to operate. These enhancements are implemented through minimal, targeted modifications to our custom code, allowing us to govern the EA’s behavior without disrupting its core signal architecture. Most optimization insights are reserved for the results section, as they largely involve fine-tuning input parameters rather than extensive coding—reinforcing the principle that disciplined control can often outperform complexity.

1. Core Time Filtering Implementation

The session management system operates directly on broker time, eliminating timezone complexities. The algorithm converts the current server time to a minute-based format for precise comparison with user-defined session boundaries. This approach handles both standard daytime sessions and overnight sessions through conditional logic that adjusts for midnight crossings. The system provides a robust temporal firewall that completely blocks trading activity outside specified hours while maintaining minimal computational overhead.

//--- Trading Session Parameters (using BROKER time) input bool EnableSessionFilter =true; // Enable Session Filter input string Session_StartTime ="09:00"; // Session Start (Broker time, HH:MM) input string Session_EndTime ="17:00"; // Session End (Broker time, HH:MM) input bool Close_Outside_Session =false; // Close trades outside session? bool IsTradingTime() { if(!SessionEnabled) return true; datetime current_time = TimeCurrent(); MqlDateTime time_struct; TimeToStruct(current_time, time_struct); // Get current hour and minute int current_hour = time_struct.hour; int current_minute = time_struct.min; int current_total_minutes = current_hour * 60 + current_minute; // Parse start time string start_parts[]; int start_hour = 9, start_minute = 0; if(StringSplit(Session_StartTime, ':', start_parts) >= 2) { start_hour = (int)StringToInteger(start_parts[0]); start_minute = (int)StringToInteger(start_parts[1]); } // Parse end time string end_parts[]; int end_hour = 17, end_minute = 0; if(StringSplit(Session_EndTime, ':', end_parts) >= 2) { end_hour = (int)StringToInteger(end_parts[0]); end_minute = (int)StringToInteger(end_parts[1]); } // Calculate session boundaries in minutes int session_start_minutes = start_hour * 60 + start_minute; int session_end_minutes = end_hour * 60 + end_minute; // Check if current time is within session if(session_end_minutes > session_start_minutes) { // Normal session within same day return (current_total_minutes >= session_start_minutes && current_total_minutes < session_end_minutes); } else { // Session crosses midnight return (current_total_minutes >= session_start_minutes || current_total_minutes < session_end_minutes); } }

2. Trade Limit Management System

A sophisticated quota-based system prevents overtrading by implementing two counting methodologies. The historical approach tracks all opening transactions within the current session using MQL5's history functions, while the alternative method monitors only open positions. This dual capability allows traders to choose between strict historical tracking or flexible position-based limits. The system automatically resets trade counts at the start of each new session using an optimized 60-second check frequency that balances accuracy with performance efficiency.

//--- Trade Limit Parameters input bool EnableTradeLimit =true; // Enable Maximum Trade Limit input int MaxTradesPerSession =2; // Maximum trades per session (1-2) input bool CountAllPositions =true; // Count all positions (true) or only open ones (false) int CurrentTradeCount = 0; datetime SessionStartTime = 0; datetime LastResetCheck = 0; bool CanOpenNewTrade() { if(!SessionEnabled) return true; // Check if we're in trading session if(!IsTradingTime()) return false; // Check trade limit if(EnableTradeLimit) { // Update trade count CurrentTradeCount = CountSessionTrades(); if(CurrentTradeCount >= MaxTradesPerSession) { Print("Trade limit reached: ", CurrentTradeCount, "/", MaxTradesPerSession, " trades this session"); return false; } } return true; }

3. Integration Layer Architecture

The modified OnTick() function implements a hierarchical decision-making process that prioritizes control logic before signal processing. This architecture creates a circuit breaker mechanism where trading permissions are validated before any signal analysis occurs. The integration maintains existing position management capabilities for trailing stops and exit signals while completely blocking new trade entries when conditions aren't met. This layered approach preserves the original signal generation logic while adding disciplined execution controls.

void OnTick() { // Display current status on chart ShowStatusInfo(); // Reset trade count if new session if(SessionEnabled) { ResetTradeCount(); } // Check if we can open new trades bool can_open_trades = true; if(SessionEnabled) { can_open_trades = CanOpenNewTrade(); } // Process trades based on conditions if(can_open_trades) { // Conditions met - allow normal trading ExtExpert.OnTick(); } else { // Conditions not met - check if we need to close positions if(Close_Outside_Session && !IsTradingTime()) { CheckSessionClose(); } // Do NOT process any new trades when conditions are not met // This blocks ALL new trading activity return; } }

4. Real-Time Monitoring and Feedback

A performance-optimized display system provides immediate visual feedback through chart comments updated once per second. This monitoring layer shows current session status, trade count progress, and system warnings in real time. The implementation uses static variables to minimize CPU usage while delivering critical information for both live trading and debugging purposes. This transparency helps us to understand exactly why trades are being executed or blocked at any given moment.

void ShowStatusInfo() { static datetime last_print = 0; if(TimeCurrent() - last_print >= 1) // Update every second { string current_time = TimeToString(TimeCurrent(), TIME_MINUTES); bool in_session = IsTradingTime(); bool can_trade = CanOpenNewTrade(); string status_text = ""; if(SessionEnabled) { if(in_session) { if(EnableTradeLimit) { status_text = StringFormat("TRADING: %s-%s | Trades: %d/%d | Time: %s", Session_StartTime, Session_EndTime, CurrentTradeCount, MaxTradesPerSession, current_time); } else { status_text = StringFormat("TRADING: %s-%s | Time: %s", Session_StartTime, Session_EndTime, current_time); } } else { status_text = StringFormat("BLOCKED: Outside session %s-%s | Time: %s", Session_StartTime, Session_EndTime, current_time); } // Add trade limit warning if applicable if(in_session && EnableTradeLimit && CurrentTradeCount >= MaxTradesPerSession) { status_text += "\nTRADE LIMIT REACHED!"; } } else { status_text = "TRADING 24/7: Session filter OFF | Time: " + current_time; } Comment(status_text); last_print = TimeCurrent(); } }

5. Technical Architecture Benefits

The implementation creates a modular filtering system where each layer operates independently yet integrates seamlessly. This design allows for future expansion with additional filters like day-of-week restrictions or volatility-based controls. The architecture demonstrates how algorithmic discipline can be added to existing trading systems without modifying core signal logic, providing a template for systematic trading improvements across various expert advisor designs.

CExpert ExtExpert; CTrade Trade; bool SessionEnabled = false; int CurrentTradeCount = 0; datetime SessionStartTime = 0; datetime LastResetCheck = 0; // ... Initialization in OnInit() ... int OnInit() { // ... existing initialization code ... // Initialize session parameters SessionEnabled = EnableSessionFilter; // Get initial trade count if(EnableTradeLimit) { CurrentTradeCount = CountSessionTrades(); SessionStartTime = GetSessionStartDatetime(); LastResetCheck = TimeCurrent(); } // Display session info if(SessionEnabled) { Print("=== TRADING SESSION FILTER ENABLED ==="); Print("Session Time: ", Session_StartTime, " to ", Session_EndTime, " (Broker Time)"); Print("Close Outside Session: ", Close_Outside_Session ? "Yes" : "No"); if(EnableTradeLimit) { Print("Maximum Trades Per Session: ", MaxTradesPerSession); Print("Count Method: ", CountAllPositions ? "All positions (including history)" : "Only open positions"); Print("Current Trade Count: ", CurrentTradeCount); } Print("Current Broker Time: ", TimeToString(TimeCurrent(), TIME_DATE|TIME_MINUTES)); Print("====================================="); } else { Print("Session Filter Disabled - Trading 24/7"); } return(INIT_SUCCEEDED); }

Testing

The implementation of time-based filters has fundamentally transformed our expert advisor into a disciplined trading system, significantly reducing trade frequency while improving quality. By restricting operations to specific sessions and enforcing a maximum trade limit, we've gained precise control over execution timing and exposure. This strategic filtering eliminates unfavorable market conditions, resulting in fewer but higher-probability trades that demonstrate improved risk-adjusted returns and a more controlled equity curve progression.

To achieve further optimization and a more uniform performance curve, we must now systematically refine signal weight combinations, explore optimal time windows, and integrate additional filtering layers. Through methodical testing of parameters using genetic algorithms and walk-forward analysis, we can calibrate the system for consistent performance across varying market conditions, ultimately developing a robust trading algorithm with smooth, upward-trending equity growth and controlled drawdown characteristics.

Time-filtered trading: Multi-Signal Expert.

Equity Curve

The equity curve produced under time-filtered trading conditions clearly contrasts with the earlier smooth, uninterrupted downward slope. Instead of continuous degradation, the system now exhibits cyclical equity behavior, with alternating phases of recovery and decline. This confirms that the prior losses were not purely signal failures, but a consequence of unrestricted execution across unsuitable market hours, where noise, low liquidity, or regime mismatch dominated outcomes.

By introducing time-based controls, the EA no longer reacts indiscriminately to every valid signal. Trade activity is concentrated into defined sessions, reducing exposure during statistically inefficient periods. The result is a lower trade density, improved trade distribution, and moderated drawdown structure, even though the underlying signal logic remains unchanged. This directly validates our initial hypothesis: that governing when signals are allowed to act is as important as the signals themselves.

From an inspection standpoint, this outcome reinforces the need to treat the generated EA as evidence of a structural issue—namely, excessive participation frequency rather than flawed signal interpretation. The system’s behavior now reflects deliberate execution instead of mechanical overreaction, marking a decisive step toward disciplined algorithmic control.

Moving forward, this framework enables further refinement through controlled optimization of session windows, maximum trades per interval, and regime-aware participation rules. Crucially, these improvements preserve the integrity of the native signal architecture while advancing our goal: a predictable, risk-adjusted trading system governed by execution discipline rather than raw signal abundance.

Conclusion

In this part, we successfully took a Wizard-generated multi-signal Expert Advisor and made it noticeably better—not by overhauling the entire system, but by adding one thoughtful control: time-based trading filters. This simple yet powerful change gave us direct authority over when the EA is allowed to open trades, shifting it from a reactive, noise-chasing machine to a more disciplined and restrained strategy. We saw clear improvements: fewer unnecessary trades, an improved equity curve, and drawdowns that felt far more controlled than before. These results prove that even modest structural tweaks can deliver real progress without complicating the codebase.

Along the way, several important lessons stood out. First, the most damaging performance issues often stem from trading too frequently and in the wrong market conditions, rather than from flawed indicators or weak logic. Second, introducing even a single well-chosen constraint—such as limiting activity to specific trading sessions—can dramatically cut overtrading and improve overall behavior. Third, timeframe choice plays a huge role: lower timeframes tend to generate more noise and more trades (which usually hurts results), while higher timeframes produce fewer but often more reliable signals. Finally, these kinds of structural improvements create a much stronger foundation. Once the EA is no longer overreacting, any subsequent parameter tuning in the Strategy Tester becomes far more meaningful and less prone to producing misleading “optimized” results.

What we’ve covered here is just one piece of the optimization puzzle. There are many more powerful techniques we haven’t touched on yet—regime classification, adaptive signal weighting, cooldown periods after trades, volatility-based filters, event-driven exclusions, walk-forward analysis, Monte Carlo simulations, and much more. Each of these methods can take the EA to the next level, but they also increase complexity. That’s why we’re saving them for future parts of the series. As we gradually build toward more advanced topics, we’ll introduce these concepts one at a time, always testing them on the foundation we’re establishing now.

I attached the full updated source code below so you can experiment with different trading windows, combine them with your own ideas, or see exactly how the filters were implemented. Optimization is an ongoing journey, and there’s still a lot more to discover together.

Thank you for following along. Your comments, questions, test results, and suggestions are always welcome—they help guide where the series goes next. Until the next part—happy coding and safe trading.

| Source File | Version | Description: |

|---|---|---|

| SignalFibonacci.mqh | 1.0 | Unmodified standard signal module reused from Part 5. This file must be included to avoid compilation errors, as it provides the Fibonacci signal logic required by the EA. |

| Multi-Signal_Expert.mq5 | 1.1 | Updated Wizard-generated Expert Advisor enhanced with execution controls, optimized signal thresholds, and session-based trading restrictions. This version focuses on reducing trade frequency and improving trade quality without altering core signal logic. |

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Introduction to MQL5 (Part 37): Mastering API and WebRequest Function in MQL5 (XI)

Introduction to MQL5 (Part 37): Mastering API and WebRequest Function in MQL5 (XI)

Data Science and ML (Part 48): Are Transformers a Big Deal for Trading?

Data Science and ML (Part 48): Are Transformers a Big Deal for Trading?

Creating Custom Indicators in MQL5 (Part 6): Evolving RSI Calculations with Smoothing, Hue Shifts, and Multi-Timeframe Support

Creating Custom Indicators in MQL5 (Part 6): Evolving RSI Calculations with Smoothing, Hue Shifts, and Multi-Timeframe Support

MQL5 Trading Tools (Part 13): Creating a Canvas-Based Price Dashboard with Graph and Stats Panels

MQL5 Trading Tools (Part 13): Creating a Canvas-Based Price Dashboard with Graph and Stats Panels

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use