Developing a Replay System — Market simulation (Part 22): FOREX (III)

Although this is the third article on this topic, I must explain for those who have not yet understood the difference between the stock market and the foreign exchange market: the big difference is that in the Forex there is no, or rather, we are not given information about some points that actually occurred during the course of trading.

Population optimization algorithms: Mind Evolutionary Computation (MEC) algorithm

The article considers the algorithm of the MEC family called the simple mind evolutionary computation algorithm (Simple MEC, SMEC). The algorithm is distinguished by the beauty of its idea and ease of implementation.

Neural networks made easy (Part 57): Stochastic Marginal Actor-Critic (SMAC)

Here I will consider the fairly new Stochastic Marginal Actor-Critic (SMAC) algorithm, which allows building latent variable policies within the framework of entropy maximization.

Developing a Replay System (Part 70): Getting the Time Right (III)

In this article, we will look at how to use the CustomBookAdd function correctly and effectively. Despite its apparent simplicity, it has many nuances. For example, it allows you to tell the mouse indicator whether a custom symbol is on auction, being traded, or the market is closed. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Reimagining Classic Strategies (Part X): Can AI Power The MACD?

Join us as we empirically analyzed the MACD indicator, to test if applying AI to a strategy, including the indicator, would yield any improvements in our accuracy on forecasting the EURUSD. We simultaneously assessed if the indicator itself is easier to predict than price, as well as if the indicator's value is predictive of future price levels. We will furnish you with the information you need to decide whether you should consider investing your time into integrating the MACD in your AI trading strategies.

Multiple Symbol Analysis With Python And MQL5 (Part I): NASDAQ Integrated Circuit Makers

Join us as we discuss how you can use AI to optimize your position sizing and order quantities to maximize the returns of your portfolio. We will showcase how to algorithmically identify an optimal portfolio and tailor your portfolio to your returns expectations or risk tolerance levels. In this discussion, we will use the SciPy library and the MQL5 language to create an optimal and diversified portfolio using all the data we have.

From Basic to Intermediate: Variables (III)

Today we will look at how to use predefined MQL5 language variables and constants. In addition, we will analyze another special type of variables: functions. Knowing how to properly work with these variables can mean the difference between an application that works and one that doesn't. In order to understand what is presented here, it is necessary to understand the material that was discussed in previous articles.

Mastering Log Records (Part 1): Fundamental Concepts and First Steps in MQL5

Welcome to the beginning of another journey! This article opens a special series where we will create, step by step, a library for log manipulation, tailored for those who develop in the MQL5 language.

Data label for time series mining (Part 6):Apply and Test in EA Using ONNX

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

A Generic Optimization Formulation (GOF) to Implement Custom Max with Constraints

In this article we will present a way to implement optimization problems with multiple objectives and constraints when selecting "Custom Max" in the Setting tab of the MetaTrader 5 terminal. As an example, the optimization problem could be: Maximize Profit Factor, Net Profit, and Recovery Factor, such that the Draw Down is less than 10%, the number of consecutive losses is less than 5, and the number of trades per week is more than 5.

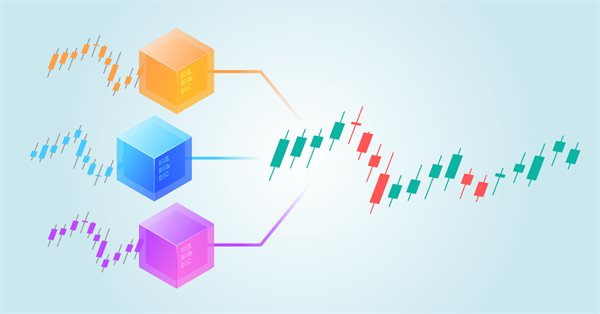

Build Self Optimizing Expert Advisors in MQL5 (Part 7): Trading With Multiple Periods At Once

In this series of articles, we have considered multiple different ways of identifying the best period to use our technical indicators with. Today, we shall demonstrate to the reader how they can instead perform the opposite logic, that is to say, instead of picking the single best period to use, we will demonstrate to the reader how to employ all available periods effectively. This approach reduces the amount of data discarded, and offers alternative use cases for machine learning algorithms beyond ordinary price prediction.

Data Science and ML (Part 46): Stock Markets Forecasting Using N-BEATS in Python

N-BEATS is a revolutionary deep learning model designed for time series forecasting. It was released to surpass classical models for time series forecasting such as ARIMA, PROPHET, VAR, etc. In this article, we are going to discuss this model and use it in predicting the stock market.

Developing a Replay System (Part 37): Paving the Path (I)

In this article, we will finally begin to do what we wanted to do much earlier. However, due to the lack of "solid ground", I did not feel confident to present this part publicly. Now I have the basis to do this. I suggest that you focus as much as possible on understanding the content of this article. I mean not simply reading it. I want to emphasize that if you do not understand this article, you can completely give up hope of understanding the content of the following ones.

From Novice to Expert: Revealing the Candlestick Shadows (Wicks)

In this discussion, we take a step forward to uncover the underlying price action hidden within candlestick wicks. By integrating a wick visualization feature into the Market Periods Synchronizer, we enhance the tool with greater analytical depth and interactivity. This upgraded system allows traders to visualize higher-timeframe price rejections directly on lower-timeframe charts, revealing detailed structures that were once concealed within the shadows.

Developing a Replay System (Part 73): An Unusual Communication (II)

In this article, we will look at how to transmit information in real time between the indicator and the service, and also understand why problems may arise when changing the timeframe and how to solve them. As a bonus, you will get access to the latest version of the replay /simulation app.

Neural Networks in Trading: A Complex Trajectory Prediction Method (Traj-LLM)

In this article, I would like to introduce you to an interesting trajectory prediction method developed to solve problems in the field of autonomous vehicle movements. The authors of the method combined the best elements of various architectural solutions.

Quantitative approach to risk management: Applying VaR model to optimize multi-currency portfolio using Python and MetaTrader 5

This article explores the potential of the Value at Risk (VaR) model for multi-currency portfolio optimization. Using the power of Python and the functionality of MetaTrader 5, we demonstrate how to implement VaR analysis for efficient capital allocation and position management. From theoretical foundations to practical implementation, the article covers all aspects of applying one of the most robust risk calculation systems – VaR – in algorithmic trading.

Trading with the MQL5 Economic Calendar (Part 10): Draggable Dashboard and Interactive Hover Effects for Seamless News Navigation

In this article, we enhance the MQL5 Economic Calendar by introducing a draggable dashboard that allows us to reposition the interface for better chart visibility. We implement hover effects for buttons to improve interactivity and ensure seamless navigation with a dynamically positioned scrollbar.

Superposition and Interference of Financial Securities

The more factors influence the behavior of a currency pair, the more difficult it is to evaluate its behavior and make up future forecasts. Therefore, if we managed to extract components of a currency pair, values of a national currency that change with the time, we could considerably delimit the freedom of national currency movement as compared to the currency pair with this currency, as well as the number of factors influencing its behavior. As a result we would increase the accuracy of its behavior estimation and future forecasting. How can we do that?

From Novice to Expert: Mastering Detailed Trading Reports with Reporting EA

In this article, we delve into enhancing the details of trading reports and delivering the final document via email in PDF format. This marks a progression from our previous work, as we continue exploring how to harness the power of MQL5 and Python to generate and schedule trading reports in the most convenient and professional formats. Join us in this discussion to learn more about optimizing trading report generation within the MQL5 ecosystem.

Developing a Replay System — Market simulation (Part 19): Necessary adjustments

Here we will prepare the ground so that if we need to add new functions to the code, this will happen smoothly and easily. The current code cannot yet cover or handle some of the things that will be necessary to make meaningful progress. We need everything to be structured in order to enable the implementation of certain things with the minimal effort. If we do everything correctly, we can get a truly universal system that can very easily adapt to any situation that needs to be handled.

Gain An Edge Over Any Market (Part IV): CBOE Euro And Gold Volatility Indexes

We will analyze alternative data curated by the Chicago Board Of Options Exchange (CBOE) to improve the accuracy of our deep neural networks when forecasting the XAUEUR symbol.

Developing a Replay System (Part 51): Things Get Complicated (III)

In this article, we will look into one of the most difficult issues in the field of MQL5 programming: how to correctly obtain a chart ID, and why objects are sometimes not plotted on the chart. The materials presented here are for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Example of CNA (Causality Network Analysis), SMOC (Stochastic Model Optimal Control) and Nash Game Theory with Deep Learning

We will add Deep Learning to those three examples that were published in previous articles and compare results with previous. The aim is to learn how to add DL to other EA.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs (II)-LoRA-Tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

DoEasy. Controls (Part 11): WinForms objects — groups, CheckedListBox WinForms object

The article considers grouping WinForms objects and creation of the CheckBox objects list object.

MQL5 Wizard Techniques you should know (Part 26): Moving Averages and the Hurst Exponent

The Hurst Exponent is a measure of how much a time series auto-correlates over the long term. It is understood to be capturing the long-term properties of a time series and therefore carries some weight in time series analysis even outside of economic/ financial time series. We however, focus on its potential benefit to traders by examining how this metric could be paired with moving averages to build a potentially robust signal.

From Basic to Intermediate: Variables (I)

Many beginning programmers have a hard time understanding why their code doesn't work as they expect. There are many things that make code truly functional. It's not just a bunch of different functions and operations that make the code work. Today I invite you to learn how to properly create real code, rather than copy and paste fragments of it. The materials presented here are for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

MQL5 Wizard Techniques you should know (Part 28): GANs Revisited with a Primer on Learning Rates

The Learning Rate, is a step size towards a training target in many machine learning algorithms’ training processes. We examine the impact its many schedules and formats can have on the performance of a Generative Adversarial Network, a type of neural network that we had examined in an earlier article.

Category Theory in MQL5 (Part 10): Monoid Groups

This article continues the series on category theory implementation in MQL5. Here we look at monoid-groups as a means normalising monoid sets making them more comparable across a wider span of monoid sets and data types..

Example of Stochastic Optimization and Optimal Control

This Expert Advisor, named SMOC (likely standing for Stochastic Model Optimal Control), is a simple example of an advanced algorithmic trading system for MetaTrader 5. It uses a combination of technical indicators, model predictive control, and dynamic risk management to make trading decisions. The EA incorporates adaptive parameters, volatility-based position sizing, and trend analysis to optimize its performance across varying market conditions.

Developing a Replay System (Part 54): The Birth of the First Module

In this article, we will look at how to put together the first of a number of truly functional modules for use in the replay/simulator system that will also be of general purpose to serve other purposes. We are talking about the mouse module.

MetaTrader tick info access from MQL5 services to Python application using sockets

Sometimes everything is not programmable in the MQL5 language. And even if it is possible to convert existing advanced libraries in MQL5, it would be time-consuming. This article tries to show that we can bypass Windows OS dependency by transporting tick information such as bid, ask and time with MetaTrader services to a Python application using sockets.

MQL5 Wizard Techniques you should know (Part 69): Using Patterns of SAR and the RVI

The Parabolic-SAR (SAR) and the Relative Vigour Index (RVI) are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered in the past, is also complementary since SAR defines the trend while RVI checks momentum. As usual, we use the MQL5 wizard to build and test any potential this indicator pairing may have.

Reimagining Classic Strategies in MQL5 (Part III): FTSE 100 Forecasting

In this series of articles, we will revisit well-known trading strategies to inquire, whether we can improve the strategies using AI. In today's article, we will explore the FTSE 100 and attempt to forecast the index using a portion of the individual stocks that make up the index.

Neural Networks in Trading: Controlled Segmentation

In this article. we will discuss a method of complex multimodal interaction analysis and feature understanding.

Neural networks made easy (Part 72): Trajectory prediction in noisy environments

The quality of future state predictions plays an important role in the Goal-Conditioned Predictive Coding method, which we discussed in the previous article. In this article I want to introduce you to an algorithm that can significantly improve the prediction quality in stochastic environments, such as financial markets.

Neural Networks in Trading: Directional Diffusion Models (DDM)

In this article, we discuss Directional Diffusion Models that exploit data-dependent anisotropic and directed noise in a forward diffusion process to capture meaningful graph representations.

Price Action Analysis Toolkit Development (Part 56): Reading Session Acceptance and Rejection with CPI

This article presents a session-based analytical framework that combines time-defined market sessions with the Candle Pressure Index (CPI) to classify acceptance and rejection behavior at session boundaries using closed-candle data and clearly defined rules.

Introduction to MQL5 (Part 22): Building an Expert Advisor for the 5-0 Harmonic Pattern

This article explains how to detect and trade the 5-0 harmonic pattern in MQL5, validate it using Fibonacci levels, and display it on the chart.