Neural Networks in Trading: State Space Models

A large number of the models we have reviewed so far are based on the Transformer architecture. However, they may be inefficient when dealing with long sequences. And in this article, we will get acquainted with an alternative direction of time series forecasting based on state space models.

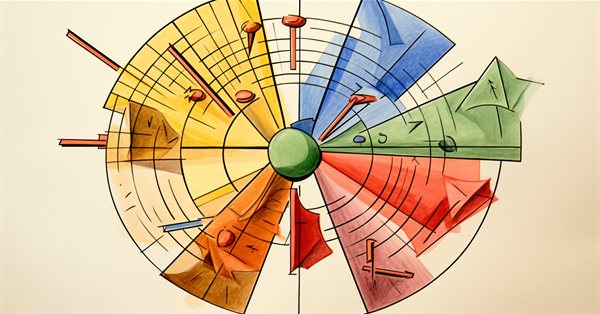

Angle-based operations for traders

This article will cover angle-based operations. We will look at methods for constructing angles and using them in trading.

Neural networks made easy (Part 60): Online Decision Transformer (ODT)

The last two articles were devoted to the Decision Transformer method, which models action sequences in the context of an autoregressive model of desired rewards. In this article, we will look at another optimization algorithm for this method.

A New Approach to Custom Criteria in Optimizations (Part 1): Examples of Activation Functions

The first of a series of articles looking at the mathematics of Custom Criteria with a specific focus on non-linear functions used in Neural Networks, MQL5 code for implementation and the use of targeted and correctional offsets.

Neural networks made easy (Part 68): Offline Preference-guided Policy Optimization

Since the first articles devoted to reinforcement learning, we have in one way or another touched upon 2 problems: exploring the environment and determining the reward function. Recent articles have been devoted to the problem of exploration in offline learning. In this article, I would like to introduce you to an algorithm whose authors completely eliminated the reward function.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model

A multi-task learning framework based on ResNeXt optimizes the analysis of financial data, taking into account its high dimensionality, nonlinearity, and time dependencies. The use of group convolution and specialized heads allows the model to effectively extract key features from the input data.

Reimagining Classic Strategies (Part VI): Multiple Time-Frame Analysis

In this series of articles, we revisit classic strategies to see if we can improve them using AI. In today's article, we will examine the popular strategy of multiple time-frame analysis to judge if the strategy would be enhanced with AI.

Interview with Andrey Bobryashov (ATC 2011)

Since the first Automated Trading Championship we have seen plenty of trading robots in our TOP-10 created with the use of various methods. Excellent results were shown both by the Exper Advisors based on standard indicators, and complicated analytical complexes with weekly automatic optimization of their own parameters.

DoEasy. Controls (Part 22): SplitContainer. Changing the properties of the created object

In the current article, I will implement the ability to change the properties and appearance of the newly created SplitContainer control.

Developing a Replay System (Part 32): Order System (I)

Of all the things that we have developed so far, this system, as you will probably notice and eventually agree, is the most complex. Now we need to do something very simple: make our system simulate the operation of a trading server. This need to accurately implement the way the trading server operates seems like a no-brainer. At least in words. But we need to do this so that the everything is seamless and transparent for the user of the replay/simulation system.

Neural Networks Made Easy (Part 84): Reversible Normalization (RevIN)

We already know that pre-processing of the input data plays a major role in the stability of model training. To process "raw" input data online, we often use a batch normalization layer. But sometimes we need a reverse procedure. In this article, we discuss one of the possible approaches to solving this problem.

Interview with Vitaly Antonov (ATC 2011)

It was only this summer that Vitaly Antonov (beast) has learned about the upcoming Automated Trading Championship and got to know MetaTrader 5 terminal. Time was running out, besides, Vitaly was a newcomer. So, he randomly chose GBPUSD currency pair to develop his trading system. And the choice turned out to be successful. It would have been impossible to use other symbols with the strategy.

MQL5 Wizard Techniques you should know (Part 64): Using Patterns of DeMarker and Envelope Channels with the White-Noise Kernel

The DeMarker Oscillator and the Envelopes' indicator are momentum and support/ resistance tools that can be paired when developing an Expert Advisor. We continue from our last article that introduced these pair of indicators by adding machine learning to the mix. We are using a recurrent neural network that uses the white-noise kernel to process vectorized signals from these two indicators. This is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Grouped File Operations

It is sometimes necessary to perform identical operations with a group of files. If you have a list of files included into a group, then it is no problem. However, if you need to make this list yourself, then a question arises: "How can I do this?" The article proposes doing this using functions FindFirstFile() and FindNextFile() included in kernel32.dll.

MQL5 Wizard Techniques you should know (Part 64): Using Patterns of DeMarker and Envelope Channels with the White-Noise Kernel

The DeMarker Oscillator and the Envelopes' indicator are momentum and support/ resistance tools that can be paired when developing an Expert Advisor. We continue from our last article that introduced these pair of indicators by adding machine learning to the mix. We are using a recurrent neural network that uses the white-noise kernel to process vectorized signals from these two indicators. This is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Creating a Trading Administrator Panel in MQL5 (Part V): Two-Factor Authentication (2FA)

Today, we will discuss enhancing security for the Trading Administrator Panel currently under development. We will explore how to implement MQL5 in a new security strategy, integrating the Telegram API for two-factor authentication (2FA). This discussion will provide valuable insights into the application of MQL5 in reinforcing security measures. Additionally, we will examine the MathRand function, focusing on its functionality and how it can be effectively utilized within our security framework. Continue reading to discover more!

Employing Game Theory Approaches in Trading Algorithms

We are creating an adaptive self-learning trading expert advisor based on DQN machine learning, with multidimensional causal inference. The EA will successfully trade simultaneously on 7 currency pairs. And agents of different pairs will exchange information with each other.

Neural networks made easy (Part 39): Go-Explore, a different approach to exploration

We continue studying the environment in reinforcement learning models. And in this article we will look at another algorithm – Go-Explore, which allows you to effectively explore the environment at the model training stage.

Interview with Antonio Morillas (ATC 2011)

Antonio Morillas from Spain (sallirom, by the way - it is reversed surname!) was first who doubled his starting balance from the beginning of the Championship and thus attracted our attention. His trading strategy is extremely risky. We decided to talk to Antonio about risk and luck as these are part and parcel of Automated Trading Championship.

Developing a multi-currency Expert Advisor (Part 3): Architecture revision

We have already made some progress in developing a multi-currency EA with several strategies working in parallel. Considering the accumulated experience, let's review the architecture of our solution and try to improve it before we go too far ahead.

Interview with Boris Odintsov (ATC 2010)

Boris Odintsov is one of the most impressive participants of the Championship who managed to go beyond $100,000 on the third week of the competition. Boris explains the rapid rise of his expert Advisor as a favorable combination of circumstances. In this interview he tells about what is important in trading, and what market would be unfavorable for his EA.

Statistical Arbitrage Through Cointegrated Stocks (Part 1): Engle-Granger and Johansen Cointegration Tests

This article aims to provide a trader-friendly, gentle introduction to the most common cointegration tests, along with a simple guide to understanding their results. The Engle-Granger and Johansen cointegration tests can reveal statistically significant pairs or groups of assets that share long-term dynamics. The Johansen test is especially useful for portfolios with three or more assets, as it calculates the strength of cointegrating vectors all at once.

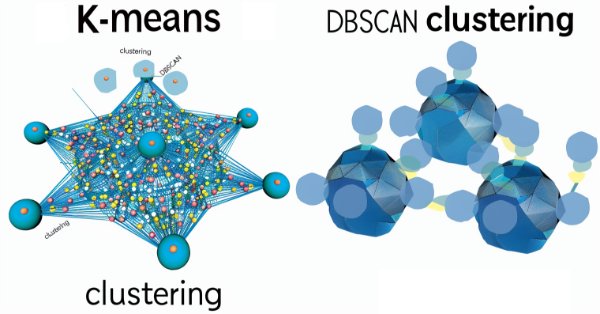

MQL5 Wizard Techniques you should know (Part 13): DBSCAN for Expert Signal Class

Density Based Spatial Clustering for Applications with Noise is an unsupervised form of grouping data that hardly requires any input parameters, save for just 2, which when compared to other approaches like k-means, is a boon. We delve into how this could be constructive for testing and eventually trading with Wizard assembled Expert Advisers

Category Theory in MQL5 (Part 7): Multi, Relative and Indexed Domains

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Neural Networks in Trading: Dual-Attention-Based Trend Prediction Model

We continue the discussion about the use of piecewise linear representation of time series, which was started in the previous article. Today we will see how to combine this method with other approaches to time series analysis to improve the price trend prediction quality.

Implementation of the Augmented Dickey Fuller test in MQL5

In this article we demonstrate the implementation of the Augmented Dickey-Fuller test, and apply it to conduct cointegration tests using the Engle-Granger method.

Trading with the MQL5 Economic Calendar (Part 4): Implementing Real-Time News Updates in the Dashboard

This article enhances our Economic Calendar dashboard by implementing real-time news updates to keep market information current and actionable. We integrate live data fetching techniques in MQL5 to update events on the dashboard continuously, improving the responsiveness of the interface. This update ensures that we can access the latest economic news directly from the dashboard, optimizing trading decisions based on the freshest data.

Self Optimizing Expert Advisor With MQL5 And Python (Part IV): Stacking Models

Today, we will demonstrate how you can build AI-powered trading applications capable of learning from their own mistakes. We will demonstrate a technique known as stacking, whereby we use 2 models to make 1 prediction. The first model is typically a weaker learner, and the second model is typically a more powerful model that learns the residuals of our weaker learner. Our goal is to create an ensemble of models, to hopefully attain higher accuracy.

From Novice to Expert: Animated News Headline Using MQL5 (IX) — Multiple Symbol Management on a single chart for News Trading

News trading often requires managing multiple positions and symbols within a very short time due to heightened volatility. In today’s discussion, we address the challenges of multi-symbol trading by integrating this feature into our News Headline EA. Join us as we explore how algorithmic trading with MQL5 makes multi-symbol trading more efficient and powerful.

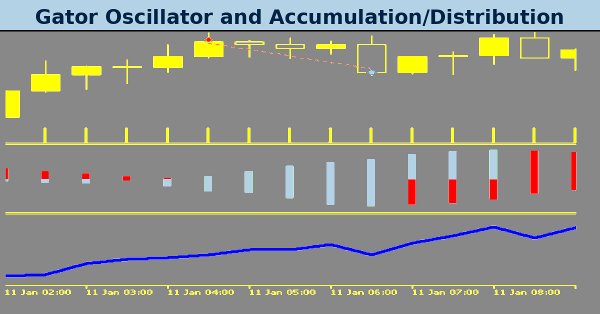

MQL5 Wizard Techniques you should know (Part 77): Using Gator Oscillator and the Accumulation/Distribution Oscillator

The Gator Oscillator by Bill Williams and the Accumulation/Distribution Oscillator are another indicator pairing that could be used harmoniously within an MQL5 Expert Advisor. We use the Gator Oscillator for its ability to affirm trends, while the A/D is used to provide confirmation of the trends via checks on volume. In exploring this indicator pairing, as always, we use the MQL5 wizard to build and test out their potential.

Visualizing deals on a chart (Part 2): Data graphical display

Here we are going to develop a script from scratch that simplifies unloading print screens of deals for analyzing trading entries. All the necessary information on a single deal is to be conveniently displayed on one chart with the ability to draw different timeframes.

ATC Champions League: Interview with Olexandr Topchylo (ATC 2011)

Interview with Olexandr Topchylo (Better) is the second publication within the "ATC Champions League" project. Having won the Automated Trading Championship 2007, this professional trader caught the attention of investors. Olexandr says that his first place in the ATC 2007 is one of the major events of his trading experience. However, later on this popularity helped him discover the biggest disappointment - it is so easy to lose investors after the first drawdown on an investor account.

Developing a Replay System (Part 48): Understanding the concept of a service

How about learning something new? In this article, you will learn how to convert scripts into services and why it is useful to do so.

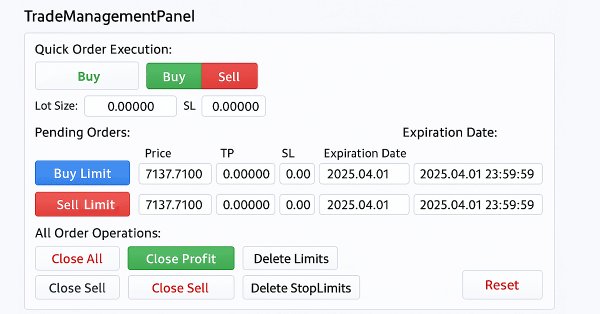

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (IV): Trade Management Panel class

This discussion covers the updated TradeManagementPanel in our New_Admin_Panel EA. The update enhances the panel by using built-in classes to offer a user-friendly trade management interface. It includes trading buttons for opening positions and controls for managing existing trades and pending orders. A key feature is the integrated risk management that allows setting stop loss and take profit values directly in the interface. This update improves code organization for large programs and simplifies access to order management tools, which are often complex in the terminal.

Trading with the MQL5 Economic Calendar (Part 5): Enhancing the Dashboard with Responsive Controls and Filter Buttons

In this article, we create buttons for currency pair filters, importance levels, time filters, and a cancel option to improve dashboard control. These buttons are programmed to respond dynamically to user actions, allowing seamless interaction. We also automate their behavior to reflect real-time changes on the dashboard. This enhances the overall functionality, mobility, and responsiveness of the panel.

ATC Champions League: Interview with Roman Zamozhniy (ATC 2011)

This is the first interview in the "ATC Champions League" project. Roman Zamozhniy (Rich) from Ukraine was the winner of the first Automated Trading Championship in 2006. In addition, he is a regular participant of our Championships - he has not missed a single contest. In this interview, we talked about Roman's first place and tried to figure out what is necessary for successful participation.

MQL5 Wizard Techniques you should know (Part 56): Bill Williams Fractals

The Fractals by Bill Williams is a potent indicator that is easy to overlook when one initially spots it on a price chart. It appears too busy and probably not incisive enough. We aim to draw away this curtain on this indicator by examining what its various patterns could accomplish when examined with forward walk tests on all, with wizard assembled Expert Advisor.

Elastic net regression using coordinate descent in MQL5

In this article we explore the practical implementation of elastic net regression to minimize overfitting and at the same time automatically separate useful predictors from those that have little prognostic power.

Neural Networks in Trading: Unified Trajectory Generation Model (UniTraj)

Understanding agent behavior is important in many different areas, but most methods focus on just one of the tasks (understanding, noise removal, or prediction), which reduces their effectiveness in real-world scenarios. In this article, we will get acquainted with a model that can adapt to solving various problems.

Developing a Replay System (Part 74): New Chart Trade (I)

In this article, we will modify the last code shown in this series about Chart Trade. These changes are necessary to adapt the code to the current replay/simulation system model. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.