Building A Candlestick Trend Constraint Model (Part 4): Customizing Display Style For Each Trend Wave

In this article, we will explore the capabilities of the powerful MQL5 language in drawing various indicator styles on Meta Trader 5. We will also look at scripts and how they can be used in our model.

Data Science and ML (Part 38): AI Transfer Learning in Forex Markets

The AI breakthroughs dominating headlines, from ChatGPT to self-driving cars, aren’t built from isolated models but through cumulative knowledge transferred from various models or common fields. Now, this same "learn once, apply everywhere" approach can be applied to help us transform our AI models in algorithmic trading. In this article, we are going to learn how we can leverage the information gained across various instruments to help in improving predictions on others using transfer learning.

Data Science and ML (Part 32): Keeping your AI models updated, Online Learning

In the ever-changing world of trading, adapting to market shifts is not just a choice—it's a necessity. New patterns and trends emerge everyday, making it harder even the most advanced machine learning models to stay effective in the face of evolving conditions. In this article, we’ll explore how to keep your models relevant and responsive to new market data by automatically retraining.

Elements of correlation analysis in MQL5: Pearson chi-square test of independence and correlation ratio

The article observes classical tools of correlation analysis. An emphasis is made on brief theoretical background, as well as on the practical implementation of the Pearson chi-square test of independence and the correlation ratio.

Modelling Requotes in Tester and Expert Advisor Stability Analysis

Requote is a scourge for many Expert Advisors, especially for those that have rather sensitive conditions of entering/exiting a trade. In the article, a way to check up the EA for the requotes stability is offered.

Indicator of historical positions on the chart as their profit/loss diagram

In this article, I will consider the option of obtaining information about closed positions based on their trading history. Besides, I will create a simple indicator that displays the approximate profit/loss of positions on each bar as a diagram.

MQL5 Wizard Techniques you should know (Part 27): Moving Averages and the Angle of Attack

The Angle of Attack is an often-quoted metric whose steepness is understood to strongly correlate with the strength of a prevailing trend. We look at how it is commonly used and understood and examine if there are changes that could be introduced in how it's measured for the benefit of a trade system that puts it in use.

Custom Indicator: Plotting Partial Entry, Exit and Reversal Deals for Netting Accounts

In this article, we will look at a non-standard way of creating an indicator in MQL5. Instead of focusing on a trend or chart pattern, our goal will be to manage our own positions, including partial entries and exits. We will make extensive use of dynamic matrices and some trading functions related to trade history and open positions to indicate on the chart where these trades were made.

Developing a multi-currency Expert Advisor (Part 15): Preparing EA for real trading

As we gradually approach to obtaining a ready-made EA, we need to pay attention to issues that seem secondary at the stage of testing a trading strategy, but become important when moving on to real trading.

Population ADAM (Adaptive Moment Estimation)

The article presents the transformation of the well-known and popular ADAM gradient optimization method into a population algorithm and its modification with the introduction of hybrid individuals. The new approach allows creating agents that combine elements of successful decisions using probability distribution. The key innovation is the formation of hybrid population individuals that adaptively accumulate information from the most promising solutions, increasing the efficiency of search in complex multidimensional spaces.

Ten "Errors" of a Newcomer in Trading?

The article substantiates approach to building a trading system as a sequence of opening and closing the interrelated orders regarding the existing conditions - prices and the current values of each order's profit/loss, not only and not so much the conventional "alerts". We are giving an exemplary realization of such an elementary trading system.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part III)

This part of the article series is dedicated to integrating WhatsApp with MetaTrader 5 for notifications. We have included a flow chart to simplify understanding and will discuss the importance of security measures in integration. The primary purpose of indicators is to simplify analysis through automation, and they should include notification methods for alerting users when specific conditions are met. Discover more in this article.

Trading Using Linux

The article describes how to use indicators to watch the situation on financial markets online.

Developing a Replay System — Market simulation (Part 08): Locking the indicator

In this article, we will look at how to lock the indicator while simply using the MQL5 language, and we will do it in a very interesting and amazing way.

Terminal Service Client. How to Make Pocket PC a Big Brother's Friend

The article describes the way of connecting to the remote PC with installed MT4 Client Terminal via a PDA.

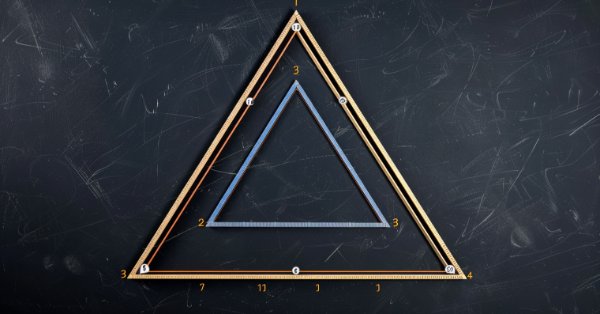

Statistical Arbitrage Through Cointegrated Stocks (Part 6): Scoring System

In this article, we propose a scoring system for mean-reversion strategies based on statistical arbitrage of cointegrated stocks. The article suggests criteria that go from liquidity and transaction costs to the number of cointegration ranks and time to mean-reversion, while taking into account the strategic criteria of data frequency (timeframe) and the lookback period for cointegration tests, which are evaluated before the score ranking properly. The files required for the reproduction of the backtest are provided, and their results are commented on as well.

Interview with Valery Mazurenko (ATC 2010)

By the end of the first trading week, Valery Mazurenrk (notused) with his multicurrency Expert Advisor ch2010 appeared on the top position. Having treated trading as a hobby, Valery is now trying to monetize this hobby and write a stable-operating Expert Advisor for real trading. In this interview he shares his opinion about the role of mathematics in trading and explains why object-oriented approach suits best to writing multicurrency EAs.

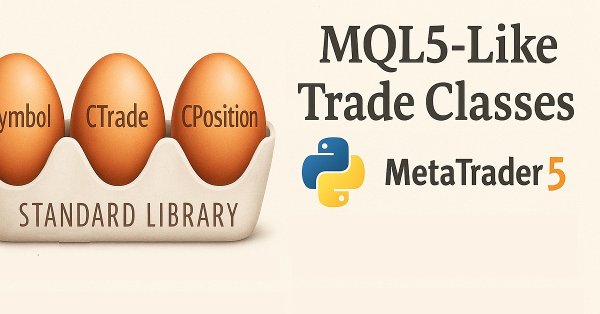

Building MQL5-Like Trade Classes in Python for MetaTrader 5

MetaTrader 5 python package provides an easy way to build trading applications for the MetaTrader 5 platform in the Python language, while being a powerful and useful tool, this module isn't as easy as MQL5 programming language when it comes to making an algorithmic trading solution. In this article, we are going to build trade classes similar to the one offered in MQL5 to create a similar syntax and make it easier to make trading robots in Python as in MQL5.

Matrix Factorization: A more practical modeling

You might not have noticed that the matrix modeling was a little strange, since only columns were specified, not rows and columns. This looks very strange when reading the code that performs matrix factorizations. If you were expecting to see the rows and columns listed, you might get confused when trying to factorize. Moreover, this matrix modeling method is not the best. This is because when we model matrices in this way, we encounter some limitations that force us to use other methods or functions that would not be necessary if the modeling were done in a more appropriate way.

Price Action Analysis Toolkit Development (Part 22): Correlation Dashboard

This tool is a Correlation Dashboard that calculates and displays real-time correlation coefficients across multiple currency pairs. By visualizing how pairs move in relation to one another, it adds valuable context to your price-action analysis and helps you anticipate inter-market dynamics. Read on to explore its features and applications.

Chaos theory in trading (Part 2): Diving deeper

We continue our dive into chaos theory in financial markets. This time I will consider its applicability to the analysis of currencies and other assets.

Developing a Replay System (Part 76): New Chart Trade (III)

In this article, we'll look at how the code of DispatchMessage, missing from the previous article, works. We will laso introduce the topic of the next article. For this reason, it is important to understand how this code works before moving on to the next topic. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Market Profile indicator (Part 2): Optimization and rendering on canvas

The article considers an optimized version of the Market Profile indicator, where rendering with multiple graphical objects is replaced with rendering on a canvas - an object of the CCanvas class.

Risk Management (Part 3): Building the Main Class for Risk Management

In this article, we will begin creating a core risk management class that will be key to controlling risks in the system. We will focus on building the foundations, defining the basic structures, variables and functions. In addition, we will implement the necessary methods for setting maximum profit and loss values, thereby laying the foundation for risk management.

Neural Networks Made Easy (Part 86): U-Shaped Transformer

We continue to study timeseries forecasting algorithms. In this article, we will discuss another method: the U-shaped Transformer.

From Novice to Expert: The Essential Journey Through MQL5 Trading

Unlock your potential! You're surrounded by opportunities. Discover 3 top secrets to kickstart your MQL5 journey or take it to the next level. Let's dive into discussion of tips and tricks for beginners and pros alike.

From Novice to Expert: Animated News Headline Using MQL5 (VI) — Pending Order Strategy for News Trading

In this article, we shift focus toward integrating news-driven order execution logic—enabling the EA to act, not just inform. Join us as we explore how to implement automated trade execution in MQL5 and extend the News Headline EA into a fully responsive trading system. Expert Advisors offer significant advantages for algorithmic developers thanks to the wide range of features they support. So far, we’ve focused on building a news and calendar events presentation tool, complete with integrated AI insights lanes and technical indicator insights.

Neural Networks Made Easy (Part 85): Multivariate Time Series Forecasting

In this article, I would like to introduce you to a new complex timeseries forecasting method, which harmoniously combines the advantages of linear models and transformers.

Polynomial models in trading

This article is about orthogonal polynomials. Their use can become the basis for a more accurate and effective analysis of market information allowing traders to make more informed decisions.

Creating a Trading Administrator Panel in MQL5 (Part VI):Trade Management Panel (II)

In this article, we enhance the Trade Management Panel of our multi-functional Admin Panel. We introduce a powerful helper function that simplifies the code, improving readability, maintainability, and efficiency. We will also demonstrate how to seamlessly integrate additional buttons and enhance the interface to handle a wider range of trading tasks. Whether managing positions, adjusting orders, or simplifying user interactions, this guide will help you develop a robust, user-friendly Trade Management Panel.

Time series clustering in causal inference

Clustering algorithms in machine learning are important unsupervised learning algorithms that can divide the original data into groups with similar observations. By using these groups, you can analyze the market for a specific cluster, search for the most stable clusters using new data, and make causal inferences. The article proposes an original method for time series clustering in Python.

Neural networks made easy (Part 74): Trajectory prediction with adaptation

This article introduces a fairly effective method of multi-agent trajectory forecasting, which is able to adapt to various environmental conditions.

Developing a multi-currency Expert Advisor (Part 16): Impact of different quote histories on test results

The EA under development is expected to show good results when trading with different brokers. But for now we have been using quotes from a MetaQuotes demo account to perform tests. Let's see if our EA is ready to work on a trading account with different quotes compared to those used during testing and optimization.

Market Simulation (Part 06): Transferring Information from MetaTrader 5 to Excel

Many people, especially non=programmers, find it very difficult to transfer information between MetaTrader 5 and other programs. One such program is Excel. Many use Excel as a way to manage and maintain their risk control. It is an excellent program and easy to learn, even for those who are not VBA programmers. Here we will look at how to establish a connection between MetaTrader 5 and Excel (a very simple method).

From Novice to Expert: Animated News Headline Using MQL5 (III) — Indicator Insights

In this article, we’ll advance the News Headline EA by introducing a dedicated indicator insights lane—a compact, on-chart display of key technical signals generated from popular indicators such as RSI, MACD, Stochastic, and CCI. This approach eliminates the need for multiple indicator subwindows on the MetaTrader 5 terminal, keeping your workspace clean and efficient. By leveraging the MQL5 API to access indicator data in the background, we can process and visualize market insights in real-time using custom logic. Join us as we explore how to manipulate indicator data in MQL5 to create an intelligent and space-saving scrolling insights system, all within a single horizontal lane on your trading chart.

Developing a multi-currency Expert Advisor (Part 8): Load testing and handling a new bar

As we progressed, we used more and more simultaneously running instances of trading strategies in one EA. Let's try to figure out how many instances we can get to before we hit resource limitations.

Easy Way to Publish a Video at MQL4.Community

It is usually easier to show, than to explain. We offer a simple and free way to create a video clip using CamStudio for publishing it in MQL.community forums.

Implementing Practical Modules from Other Languages in MQL5 (Part 02): Building the REQUESTS Library, Inspired by Python

In this article, we implement a module similar to requests offered in Python to make it easier to send and receive web requests in MetaTrader 5 using MQL5.

The MQL5 Standard Library Explorer (Part 5): Multiple Signal Expert

In this session, we will build a sophisticated, multi-signal Expert Advisor using the MQL5 Standard Library. This approach allows us to seamlessly blend built-in signals with our own custom logic, demonstrating how to construct a powerful and flexible trading algorithm. For more, click to read further.

Neural Networks in Trading: Node-Adaptive Graph Representation with NAFS

We invite you to get acquainted with the NAFS (Node-Adaptive Feature Smoothing) method, which is a non-parametric approach to creating node representations that does not require parameter training. NAFS extracts features of each node given its neighbors and then adaptively combines these features to form a final representation.