Neural Networks in Trading: Transformer with Relative Encoding

Self-supervised learning can be an effective way to analyze large amounts of unlabeled data. The efficiency is provided by the adaptation of models to the specific features of financial markets, which helps improve the effectiveness of traditional methods. This article introduces an alternative attention mechanism that takes into account the relative dependencies and relationships between inputs.

Neural Networks Made Easy (Part 92): Adaptive Forecasting in Frequency and Time Domains

The authors of the FreDF method experimentally confirmed the advantage of combined forecasting in the frequency and time domains. However, the use of the weight hyperparameter is not optimal for non-stationary time series. In this article, we will get acquainted with the method of adaptive combination of forecasts in frequency and time domains.

Andrey Bolkonsky (abolk): "Any programmer knows that there is no software without bugs"

Andrey Bolkonsky (abolk) has been participating in the Jobs service since its opening. He has developed dozens of indicators and Expert Advisors for the MetaTrader 4 and MetaTrader 5 platforms. We will talk with Andrey about what a server is from the perspective of a programmer.

Neural networks made easy (Part 34): Fully Parameterized Quantile Function

We continue studying distributed Q-learning algorithms. In previous articles, we have considered distributed and quantile Q-learning algorithms. In the first algorithm, we trained the probabilities of given ranges of values. In the second algorithm, we trained ranges with a given probability. In both of them, we used a priori knowledge of one distribution and trained another one. In this article, we will consider an algorithm which allows the model to train for both distributions.

Quantization in machine learning (Part 1): Theory, sample code, analysis of implementation in CatBoost

The article considers the theoretical application of quantization in the construction of tree models and showcases the implemented quantization methods in CatBoost. No complex mathematical equations are used.

Developing a Replay System (Part 27): Expert Advisor project — C_Mouse class (I)

In this article we will implement the C_Mouse class. It provides the ability to program at the highest level. However, talking about high-level or low-level programming languages is not about including obscene words or jargon in the code. It's the other way around. When we talk about high-level or low-level programming, we mean how easy or difficult the code is for other programmers to understand.

Neural networks made easy (Part 80): Graph Transformer Generative Adversarial Model (GTGAN)

In this article, I will get acquainted with the GTGAN algorithm, which was introduced in January 2024 to solve complex problems of generation architectural layouts with graph constraints.

Using association rules in Forex data analysis

How to apply predictive rules of supermarket retail analytics to the real Forex market? How are purchases of cookies, milk and bread related to stock exchange transactions? The article discusses an innovative approach to algorithmic trading based on the use of association rules.

Mastering Quick Trades: Overcoming Execution Paralysis

The UT BOT ATR Trailing Indicator is a personal and customizable indicator that is very effective for traders who like to make quick decisions and make money from differences in price referred to as short-term trading (scalpers) and also proves to be vital and very effective for long-term traders (positional traders).

Reimagining Classic Strategies (Part III): Forecasting Higher Highs And Lower Lows

In this series article, we will empirically analyze classic trading strategies to see if we can improve them using AI. In today's discussion, we tried to predict higher highs and lower lows using the Linear Discriminant Analysis model.

Dimitar Manov: "I fear only extraordinary situations in the Championship" (ATC 2010)

In the recent review by Boris Odintsov the Expert Advisor of the Bulgarian Participant Dimitar Manov appeared among the most stable and reliable EAs. We decided to interview this developer and try to find the secret of his success. In this interview Dimitar has told us what situation would be unfavorable for his robot, why he's not using indicators and whether he is expecting to win the competition.

Overcoming ONNX Integration Challenges

ONNX is a great tool for integrating complex AI code between different platforms, it is a great tool that comes with some challenges that one must address to get the most out of it, In this article we discuss the common issues you might face and how to mitigate them.

Developing a multi-currency Expert Advisor (Part 5): Variable position sizes

In the previous parts, the Expert Advisor (EA) under development was able to use only a fixed position size for trading. This is acceptable for testing, but is not advisable when trading on a real account. Let's make it possible to trade using variable position sizes.

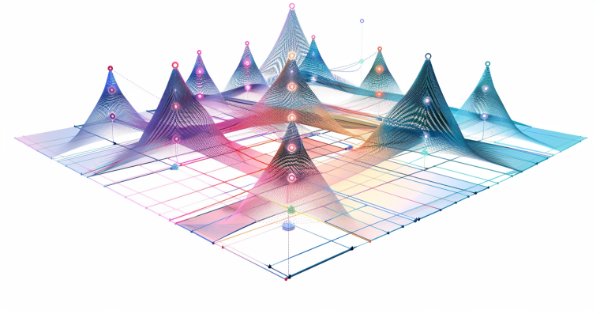

Brain Storm Optimization algorithm (Part II): Multimodality

In the second part of the article, we will move on to the practical implementation of the BSO algorithm, conduct tests on test functions and compare the efficiency of BSO with other optimization methods.

Trading Insights Through Volume: Moving Beyond OHLC Charts

Algorithmic trading system that combines volume analysis with machine learning techniques, specifically LSTM neural networks. Unlike traditional trading approaches that primarily focus on price movements, this system emphasizes volume patterns and their derivatives to predict market movements. The methodology incorporates three main components: volume derivatives analysis (first and second derivatives), LSTM predictions for volume patterns, and traditional technical indicators.

From Novice to Expert: Automating Trade Discipline with an MQL5 Risk Enforcement EA

For many traders, the gap between knowing a risk rule and following it consistently is where accounts go to die. Emotional overrides, revenge trading, and simple oversight can dismantle even the best strategy. Today, we will transform the MetaTrader 5 platform into an unwavering enforcer of your trading rules by developing a Risk Enforcement Expert Advisor. Join this discussion to find out more.

From Novice to Expert: Forex Market Periods

Every market period has a beginning and an end, each closing with a price that defines its sentiment—much like any candlestick session. Understanding these reference points allows us to gauge the prevailing market mood, revealing whether bullish or bearish forces are in control. In this discussion, we take an important step forward by developing a new feature within the Market Periods Synchronizer—one that visualizes Forex market sessions to support more informed trading decisions. This tool can be especially powerful for identifying, in real time, which side—bulls or bears—dominates the session. Let’s explore this concept and uncover the insights it offers.

Creating a Trading Administrator Panel in MQL5 (Part VIII): Analytics Panel

Today, we delve into incorporating useful trading metrics within a specialized window integrated into the Admin Panel EA. This discussion focuses on the implementation of MQL5 to develop an Analytics Panel and highlights the value of the data it provides to trading administrators. The impact is largely educational, as valuable lessons are drawn from the development process, benefiting both upcoming and experienced developers. This feature demonstrates the limitless opportunities this development series offers in equipping trade managers with advanced software tools. Additionally, we'll explore the implementation of the PieChart and ChartCanvas classes as part of the continued expansion of the Trading Administrator panel’s capabilities.

Building a Keltner Channel Indicator with Custom Canvas Graphics in MQL5

In this article, we build a Keltner Channel indicator with custom canvas graphics in MQL5. We detail the integration of moving averages, ATR calculations, and enhanced chart visualization. We also cover backtesting to evaluate the indicator’s performance for practical trading insights.

Developing a multi-currency Expert Advisor (Part 14): Adaptive volume change in risk manager

The previously developed risk manager contained only basic functionality. Let's try to consider possible ways of its development, allowing us to improve trading results without interfering with the logic of trading strategies.

Population optimization algorithms: Bat algorithm (BA)

In this article, I will consider the Bat Algorithm (BA), which shows good convergence on smooth functions.

Application of Nash's Game Theory with HMM Filtering in Trading

This article delves into the application of John Nash's game theory, specifically the Nash Equilibrium, in trading. It discusses how traders can utilize Python scripts and MetaTrader 5 to identify and exploit market inefficiencies using Nash's principles. The article provides a step-by-step guide on implementing these strategies, including the use of Hidden Markov Models (HMM) and statistical analysis, to enhance trading performance.

Developing a Replay System (Part 59): A New Future

Having a proper understanding of different ideas allows us to do more with less effort. In this article, we'll look at why it's necessary to configure a template before the service can interact with the chart. Also, what if we improve the mouse pointer so we can do more things with it?

Portfolio optimization in Forex: Synthesis of VaR and Markowitz theory

How does portfolio trading work on Forex? How can Markowitz portfolio theory for portfolio proportion optimization and VaR model for portfolio risk optimization be synthesized? We create a code based on portfolio theory, where, on the one hand, we will get low risk, and on the other, acceptable long-term profitability.

Interview with Valery Mazurenko (ATC 2011)

The task of writing an Expert Advisor trading on multiple currency pairs is complex both in terms of finding suitable strategies and from the technological side. But if the goal is set clear, nothing is impossible then. It was four times already that Vitaly Mazurenko (notused) submitted his multi-currency Expert Advisor. It seems, he has managed to find the right way this time.

DoEasy. Controls (Part 27): Working on ProgressBar WinForms object

In this article, I will continue the development of the ProgressBar control. In particular, I will create the functionality for managing the progress bar and visual effects.

MQL5 Trading Tools (Part 7): Informational Dashboard for Multi-Symbol Position and Account Monitoring

In this article, we develop an informational dashboard in MQL5 for monitoring multi-symbol positions and account metrics like balance, equity, and free margin. We implement a sortable grid with real-time updates, CSV export, and a glowing header effect to enhance usability and visual appeal.

From Basic to Intermediate: Array (I)

This article is a transition between what has been discussed so far and a new stage of research. To understand this article, you need to read the previous ones. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

MQL5 Wizard Techniques you should know (Part 46): Ichimoku

The Ichimuko Kinko Hyo is a renown Japanese indicator that serves as a trend identification system. We examine this, on a pattern by pattern basis, as has been the case in previous similar articles, and also assess its strategies & test reports with the help of the MQL5 wizard library classes and assembly.

Utilizing CatBoost Machine Learning model as a Filter for Trend-Following Strategies

CatBoost is a powerful tree-based machine learning model that specializes in decision-making based on stationary features. Other tree-based models like XGBoost and Random Forest share similar traits in terms of their robustness, ability to handle complex patterns, and interpretability. These models have a wide range of uses, from feature analysis to risk management. In this article, we're going to walk through the procedure of utilizing a trained CatBoost model as a filter for a classic moving average cross trend-following strategy.

Pure implementation of RSA encryption in MQL5

MQL5 lacks built-in asymmetric cryptography, making secure data exchange over insecure channels like HTTP difficult. This article presents a pure MQL5 implementation of RSA using PKCS#1 v1.5 padding, enabling safe transmission of AES session keys and small data blocks without external libraries. This approach provides HTTPS-like security over standard HTTP and even more, it fills an important gap in secure communication for MQL5 applications.

Idleness is the Stimulus to Progress. Semiautomatic Marking a Template

Among the dozens of examples of how to work with charts, there is a method of manual marking a template. Trend lines, channels, support/resistance levels, etc. are imposed in a chart. Surely, there are some special programs for this kind of work. Everyone decides on his/her own which method to use. In this article, I offer you for your consideration the methods of manual marking with subsequent automating some elements of the repeated routine actions.

Price Action Analysis Toolkit Development (Part 14): Parabolic Stop and Reverse Tool

Embracing technical indicators in price action analysis is a powerful approach. These indicators often highlight key levels of reversals and retracements, offering valuable insights into market dynamics. In this article, we demonstrate how we developed an automated tool that generates signals using the Parabolic SAR indicator.

Interview with Berron Parker (ATC 2010)

During the first week of the Championship Berron's Expert Advisor has been on the top position. He now tells us about his experience of EA development and difficulties of moving to MQL5. Berron says his EA is set up to work in a trend market, but can be weak in other market conditions. However, he is hopeful that his robot will show good results in this competition.

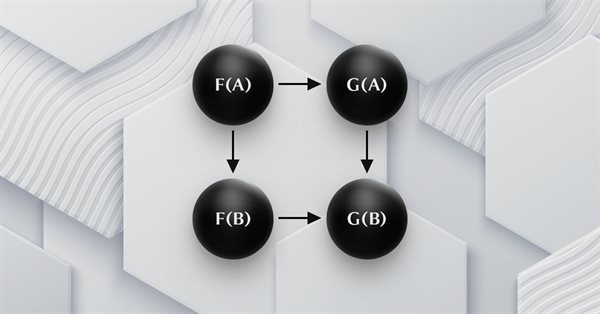

Category Theory in MQL5 (Part 18): Naturality Square

This article continues our series into category theory by introducing natural transformations, a key pillar within the subject. We look at the seemingly complex definition, then delve into examples and applications with this series’ ‘bread and butter’; volatility forecasting.

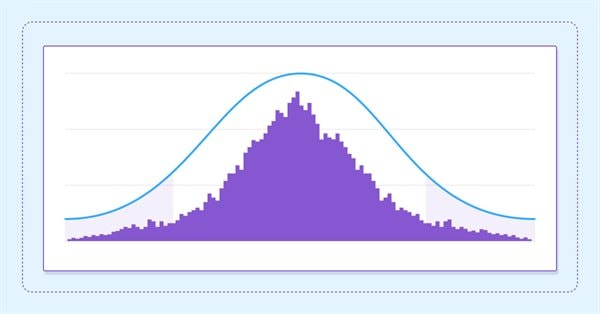

Estimate future performance with confidence intervals

In this article we delve into the application of boostrapping techniques as a means to estimate the future performance of an automated strategy.

Atomic Orbital Search (AOS) algorithm: Modification

In the second part of the article, we will continue developing a modified version of the AOS (Atomic Orbital Search) algorithm focusing on specific operators to improve its efficiency and adaptability. After analyzing the fundamentals and mechanics of the algorithm, we will discuss ideas for improving its performance and the ability to analyze complex solution spaces, proposing new approaches to extend its functionality as an optimization tool.

Interview with Igor Korepin (ATC 2011)

Appearance of the Expert Advisor cs2011 by Igor Korepin (Xupypr) at the very top of the Automated Trading Championship 2011 was really impressive - its balance was almost twice that of the EA featured on the second place. However, despite such a sound breakaway, the Expert Advisor could not stay long on the first line. Igor frankly said that he relied much on a lucky start of his trading robot in the competition. We'll see if luck helps this simple EA to take the lead in the ATC 2011 race again.

Reimagining Classic Strategies (Part 21): Bollinger Bands And RSI Ensemble Strategy Discovery

This article explores the development of an ensemble algorithmic trading strategy for the EURUSD market that combines the Bollinger Bands and the Relative Strength Indicator (RSI). Initial rule-based strategies produced high-quality signals but suffered from low trade frequency and limited profitability. Multiple iterations of the strategy were evaluated, revealing flaws in our understanding of the market, increased noise, and degraded performance. By appropriately employing statistical learning algorithms, shifting the modeling target to technical indicators, applying proper scaling, and combining machine learning forecasts with classical trading rules, the final strategy achieved significantly improved profitability and trade frequency while maintaining acceptable signal quality.

SQLite capabilities in MQL5: Example of a dashboard with trading statistics by symbols and magic numbers

In this article, we will consider creating an indicator that displays trading statistics on a dashboard by account and by symbols and trading strategies. We will implement the code based on examples from the Documentation and the article on working with databases.