All about Automated Trading Championship: Interviews with the Participants'07

The published interviews of Championship 2007 bear the stamp of the results obtained during the preceding contest. The first Championship evoked a wide response on the internet and in printings. The leading developer of the MetaQuotes Software Corp. tells about changes made to the forthcoming Automated Trading Championship 2007. We put our questions to the developer of a well-known indicating complex ZUP, Eugeni Neumoin (nen) and spoke to an equity trader, Alexander Pozdnishev (AlexSilver).

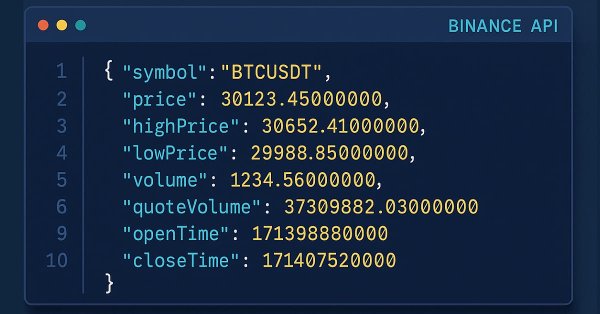

HTTP and Connexus (Part 2): Understanding HTTP Architecture and Library Design

This article explores the fundamentals of the HTTP protocol, covering the main methods (GET, POST, PUT, DELETE), status codes and the structure of URLs. In addition, it presents the beginning of the construction of the Conexus library with the CQueryParam and CURL classes, which facilitate the manipulation of URLs and query parameters in HTTP requests.

Neural networks are easy (Part 59): Dichotomy of Control (DoC)

In the previous article, we got acquainted with the Decision Transformer. But the complex stochastic environment of the foreign exchange market did not allow us to fully implement the potential of the presented method. In this article, I will introduce an algorithm that is aimed at improving the performance of algorithms in stochastic environments.

Triangular and Sawtooth Waves: Analytical Tools for Traders

Wave analysis is one of the methods used in technical analysis. This article focuses on two less conventional wave patterns: triangular and sawtooth waves. These formations underpin a number of technical indicators designed for market price analysis.

Overcoming The Limitation of Machine Learning (Part 3): A Fresh Perspective on Irreducible Error

This article takes a fresh perspective on a hidden, geometric source of error that quietly shapes every prediction your models make. By rethinking how we measure and apply machine learning forecasts in trading, we reveal how this overlooked perspective can unlock sharper decisions, stronger returns, and a more intelligent way to work with models we thought we already understood.

MQL5 Wizard Techniques you should know (Part 55): SAC with Prioritized Experience Replay

Replay buffers in Reinforcement Learning are particularly important with off-policy algorithms like DQN or SAC. This then puts the spotlight on the sampling process of this memory-buffer. While default options with SAC, for instance, use random selection from this buffer, Prioritized Experience Replay buffers fine tune this by sampling from the buffer based on a TD-score. We review the importance of Reinforcement Learning, and, as always, examine just this hypothesis (not the cross-validation) in a wizard assembled Expert Advisor.

The MQL5 Standard Library Explorer (Part 4): Custom Signal Library

Today, we use the MQL5 Standard Library to build custom signal classes and let the MQL5 Wizard assemble a professional Expert Advisor for us. This approach simplifies development so that even beginner programmers can create robust EAs without in-depth coding knowledge, focusing instead on tuning inputs and optimizing performance. Join this discussion as we explore the process step by step.

Population optimization algorithms: Boids Algorithm

The article considers Boids algorithm based on unique examples of animal flocking behavior. In turn, the Boids algorithm serves as the basis for the creation of the whole class of algorithms united under the name "Swarm Intelligence".

Most notable Artificial Cooperative Search algorithm modifications (ACSm)

Here we will consider the evolution of the ACS algorithm: three modifications aimed at improving the convergence characteristics and the algorithm efficiency. Transformation of one of the leading optimization algorithms. From matrix modifications to revolutionary approaches regarding population formation.

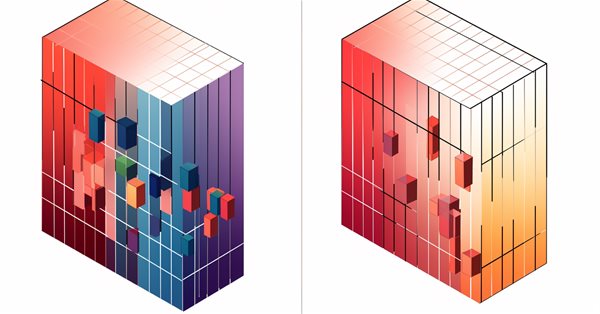

MQL5 Trading Tools (Part 11): Correlation Matrix Dashboard (Pearson, Spearman, Kendall) with Heatmap and Standard Modes

In this article, we build a correlation matrix dashboard in MQL5 to compute asset relationships using Pearson, Spearman, and Kendall methods over a set timeframe and bars. The system offers standard mode with color thresholds and p-value stars, plus heatmap mode with gradient visuals for correlation strengths. It includes an interactive UI with timeframe selectors, mode toggles, and a dynamic legend for efficient analysis of symbol interdependencies.

Population optimization algorithms: Spiral Dynamics Optimization (SDO) algorithm

The article presents an optimization algorithm based on the patterns of constructing spiral trajectories in nature, such as mollusk shells - the spiral dynamics optimization (SDO) algorithm. I have thoroughly revised and modified the algorithm proposed by the authors. The article will consider the necessity of these changes.

Tabu Search (TS)

The article discusses the Tabu Search algorithm, one of the first and most well-known metaheuristic methods. We will go through the algorithm operation in detail, starting with choosing an initial solution and exploring neighboring options, with an emphasis on using a tabu list. The article covers the key aspects of the algorithm and its features.

From Basic to Intermediate: IF ELSE

In this article we will discuss how to work with the IF operator and its companion ELSE. This statement is the most important and significant of those existing in any programming language. However, despite its ease of use, it can sometimes be confusing if we have no experience with its use and the concepts associated with it. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Python-MetaTrader 5 Strategy Tester (Part 03): MT5-Like Trading Operations — Handling and Managing

In this article we introduce Python-MetaTrader5-like ways of handling trading operations such as opening, closing, and modifying orders in the simulator. To ensure the simulation behaves like MT5, a strict validation layer for trade requests is implemented, taking into account symbol trading parameters and typical brokerage restrictions.

Animal Migration Optimization (AMO) algorithm

The article is devoted to the AMO algorithm, which models the seasonal migration of animals in search of optimal conditions for life and reproduction. The main features of AMO include the use of topological neighborhood and a probabilistic update mechanism, which makes it easy to implement and flexible for various optimization tasks.

Data Science and ML (Part 45): Forex Time series forecasting using PROPHET by Facebook Model

The Prophet model, developed by Facebook, is a robust time series forecasting tool designed to capture trends, seasonality, and holiday effects with minimal manual tuning. It has been widely adopted for demand forecasting and business planning. In this article, we explore the effectiveness of Prophet in forecasting volatility in forex instruments, showcasing how it can be applied beyond traditional business use cases.

Developing a Replay System (Part 33): Order System (II)

Today we will continue to develop the order system. As you will see, we will be massively reusing what has already been shown in other articles. Nevertheless, you will receive a small reward in this article. First, we will develop a system that can be used with a real trading server, both from a demo account or from a real one. We will make extensive use of the MetaTrader 5 platform, which will provide us with all the necessary support from the beginning.

Developing a Replay System (Part 69): Getting the Time Right (II)

Today we will look at why we need the iSpread feature. At the same time, we will understand how the system informs us about the remaining time of the bar when there is not a single tick available for it. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Market Simulation (Part 04): Creating the C_Orders Class (I)

In this article, we will start creating the C_Orders class to be able to send orders to the trading server. We'll do this little by little, as our goal is to explain in detail how this will happen through the messaging system.

All about Automated Trading Championship: Additional Materials of Championships 2006-2007

We present to you a selection of these materials that are divided into several parts. The present one contains additional materials about automated trading, Expert Advisors development, etc.

Introduction to MQL5 (Part 31): Mastering API and WebRequest Function in MQL5 (V)

Learn how to use WebRequest and external API calls to retrieve recent candle data, convert each value into a usable type, and save the information neatly in a table format. This step lays the groundwork for building an indicator that visualizes the data in candle format.

Neural Networks in Trading: Piecewise Linear Representation of Time Series

This article is somewhat different from my earlier publications. In this article, we will talk about an alternative representation of time series. Piecewise linear representation of time series is a method of approximating a time series using linear functions over small intervals.

Requesting in Connexus (Part 6): Creating an HTTP Request and Response

In this sixth article of the Connexus library series, we will focus on a complete HTTP request, covering each component that makes up a request. We will create a class that represents the request as a whole, which will help us bring together the previously created classes.

Feature Engineering With Python And MQL5 (Part III): Angle Of Price (2) Polar Coordinates

In this article, we take our second attempt to convert the changes in price levels on any market, into a corresponding change in angle. This time around, we selected a more mathematically sophisticated approach than we selected in our first attempt, and the results we obtained suggest that our change in approach may have been the right decision. Join us today, as we discuss how we can use Polar coordinates to calculate the angle formed by changes in price levels, in a meaningful way, regardless of which market you are analyzing.

Neural networks made easy (Part 82): Ordinary Differential Equation models (NeuralODE)

In this article, we will discuss another type of models that are aimed at studying the dynamics of the environmental state.

Larry Williams Market Secrets (Part 3): Proving Non-Random Market Behavior with MQL5

Explore whether financial markets are truly random by recreating Larry Williams’ market behavior experiments using MQL5. This article demonstrates how simple price-action tests can reveal statistical market biases using a custom Expert Advisor.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention

We invite you to explore a framework that combines wavelet transforms and a multi-task self-attention model, aimed at improving the responsiveness and accuracy of forecasting in volatile market conditions. The wavelet transform allows asset returns to be decomposed into high and low frequencies, carefully capturing long-term market trends and short-term fluctuations.

Statistical Arbitrage Through Cointegrated Stocks (Part 3): Database Setup

This article presents a sample MQL5 Service implementation for updating a newly created database used as source for data analysis and for trading a basket of cointegrated stocks. The rationale behind the database design is explained in detail and the data dictionary is documented for reference. MQL5 and Python scripts are provided for the database creation, schema initialization, and market data insertion.

MQL5 Wizard Techniques you should know (Part 82): Using Patterns of TRIX and the WPR with DQN Reinforcement Learning

In the last article, we examined the pairing of Ichimoku and the ADX under an Inference Learning framework. For this piece we revisit, Reinforcement Learning when used with an indicator pairing we considered last in ‘Part 68’. The TRIX and Williams Percent Range. Our algorithm for this review will be the Quantile Regression DQN. As usual, we present this as a custom signal class designed for implementation with the MQL5 Wizard.

MQL5 Wizard Techniques you should know (Part 45): Reinforcement Learning with Monte-Carlo

Monte-Carlo is the fourth different algorithm in reinforcement learning that we are considering with the aim of exploring its implementation in wizard assembled Expert Advisors. Though anchored in random sampling, it does present vast ways of simulation which we can look to exploit.

From Basic to Intermediate: Array (IV)

In this article, we'll look at how you can do something very similar to what's implemented in languages like C, C++, and Java. I am talking about passing a virtually infinite number of parameters inside a function or procedure. While this may seem like a fairly advanced topic, in my opinion, what will be shown here can be easily implemented by anyone who has understood the previous concepts. Provided that they were really properly understood.

Chemical reaction optimization (CRO) algorithm (Part I): Process chemistry in optimization

In the first part of this article, we will dive into the world of chemical reactions and discover a new approach to optimization! Chemical reaction optimization (CRO) uses principles derived from the laws of thermodynamics to achieve efficient results. We will reveal the secrets of decomposition, synthesis and other chemical processes that became the basis of this innovative method.

Ensemble methods to enhance numerical predictions in MQL5

In this article, we present the implementation of several ensemble learning methods in MQL5 and examine their effectiveness across different scenarios.

From Novice to Expert: Creating a Liquidity Zone Indicator

The extent of liquidity zones and the magnitude of the breakout range are key variables that substantially affect the probability of a retest occurring. In this discussion, we outline the complete process for developing an indicator that incorporates these ratios.

Anarchic Society Optimization (ASO) algorithm

In this article, we will get acquainted with the Anarchic Society Optimization (ASO) algorithm and discuss how an algorithm based on the irrational and adventurous behavior of participants in an anarchic society (an anomalous system of social interaction free from centralized power and various kinds of hierarchies) is able to explore the solution space and avoid the traps of local optimum. The article presents a unified ASO structure applicable to both continuous and discrete problems.

Mastering Model Interpretation: Gaining Deeper Insight From Your Machine Learning Models

Machine Learning is a complex and rewarding field for anyone of any experience. In this article we dive deep into the inner mechanisms powering the models you build, we explore the intricate world of features,predictions and impactful decisions unravelling the complexities and gaining a firm grasp of model interpretation. Learn the art of navigating tradeoffs , enhancing predictions, ranking feature importance all while ensuring robust decision making. This essential read helps you clock more performance from your machine learning models and extract more value for employing machine learning methodologies.

MQL5 Wizard Techniques you should know (Part 39): Relative Strength Index

The RSI is a popular momentum oscillator that measures pace and size of a security’s recent price change to evaluate over-and-under valued situations in the security’s price. These insights in speed and magnitude are key in defining reversal points. We put this oscillator to work in another custom signal class and examine the traits of some of its signals. We start, though, by wrapping up what we started previously on Bollinger Bands.

MQL5 Wizard Techniques you should know (Part 63): Using Patterns of DeMarker and Envelope Channels

The DeMarker Oscillator and the Envelope indicator are momentum and support/resistance tools that can be paired when developing an Expert Advisor. We therefore examine on a pattern by pattern basis what could be of use and what potentially avoid. We are using, as always, a wizard assembled Expert Advisor together with the Patterns-Usage functions that are built into the Expert Signal Class.

Spurious Regressions in Python

Spurious regressions occur when two time series exhibit a high degree of correlation purely by chance, leading to misleading results in regression analysis. In such cases, even though variables may appear to be related, the correlation is coincidental and the model may be unreliable.

Economic forecasts: Exploring the Python potential

How to use World Bank economic data for forecasts? What happens when you combine AI models and economics?