Developing a multi-currency Expert Advisor (Part 10): Creating objects from a string

The EA development plan includes several stages with intermediate results being saved in the database. They can only be retrieved from there again as strings or numbers, not objects. So we need a way to recreate the desired objects in the EA from the strings read from the database.

From Novice to Expert: Animated News Headline Using MQL5 (IV) — Locally hosted AI model market insights

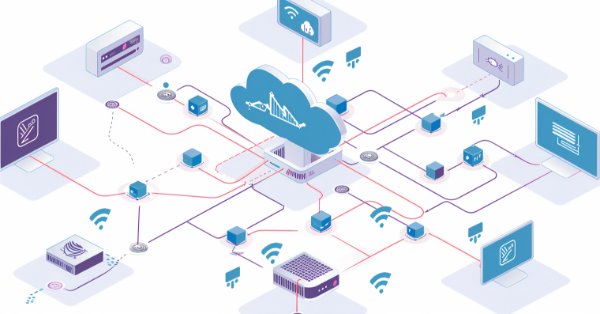

In today's discussion, we explore how to self-host open-source AI models and use them to generate market insights. This forms part of our ongoing effort to expand the News Headline EA, introducing an AI Insights Lane that transforms it into a multi-integration assistive tool. The upgraded EA aims to keep traders informed through calendar events, financial breaking news, technical indicators, and now AI-generated market perspectives—offering timely, diverse, and intelligent support to trading decisions. Join the conversation as we explore practical integration strategies and how MQL5 can collaborate with external resources to build a powerful and intelligent trading work terminal.

Developing a Replay System — Market simulation (Part 25): Preparing for the next phase

In this article, we complete the first phase of developing our replay and simulation system. Dear reader, with this achievement I confirm that the system has reached an advanced level, paving the way for the introduction of new functionality. The goal is to enrich the system even further, turning it into a powerful tool for research and development of market analysis.

Risk Management (Part 3): Building the Main Class for Risk Management

In this article, we will begin creating a core risk management class that will be key to controlling risks in the system. We will focus on building the foundations, defining the basic structures, variables and functions. In addition, we will implement the necessary methods for setting maximum profit and loss values, thereby laying the foundation for risk management.

Price Driven CGI Model: Theoretical Foundation

Let's discuss the data manipulation algorithm, as we dive deeper into conceptualizing the idea of using price data to drive CGI objects. Think about transferring the effects of events, human emotions and actions on financial asset prices to a real-life model. This study delves into leveraging price data to influence the scale of a CGI object, controlling growth and emotions. These visible effects can establish a fresh analytical foundation for traders. Further insights are shared in the article.

Developing a quality factor for Expert Advisors

In this article, we will see how to develop a quality score that your Expert Advisor can display in the strategy tester. We will look at two well-known calculation methods – Van Tharp and Sunny Harris.

Neural Networks Made Easy (Part 91): Frequency Domain Forecasting (FreDF)

We continue to explore the analysis and forecasting of time series in the frequency domain. In this article, we will get acquainted with a new method to forecast data in the frequency domain, which can be added to many of the algorithms we have studied previously.

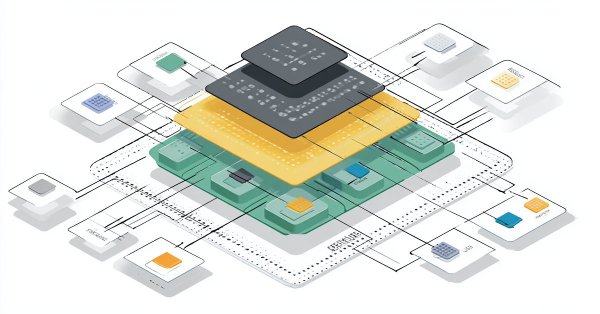

Neural networks made easy (Part 41): Hierarchical models

The article describes hierarchical training models that offer an effective approach to solving complex machine learning problems. Hierarchical models consist of several levels, each of which is responsible for different aspects of the task.

Comet Tail Algorithm (CTA)

In this article, we will look at the Comet Tail Optimization Algorithm (CTA), which draws inspiration from unique space objects - comets and their impressive tails that form when approaching the Sun. The algorithm is based on the concept of the motion of comets and their tails, and is designed to find optimal solutions in optimization problems.

Generative Adversarial Networks (GANs) for Synthetic Data in Financial Modeling (Part 1): Introduction to GANs and Synthetic Data in Financial Modeling

This article introduces traders to Generative Adversarial Networks (GANs) for generating Synthetic Financial data, addressing data limitations in model training. It covers GAN basics, python and MQL5 code implementations, and practical applications in finance, empowering traders to enhance model accuracy and robustness through synthetic data.

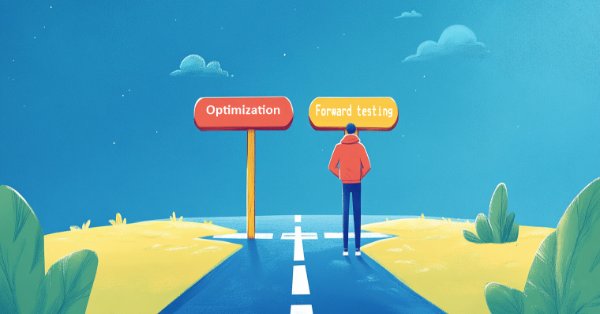

Developing a multi-currency Expert Advisor (Part 18): Automating group selection considering forward period

Let's continue to automate the steps we previously performed manually. This time we will return to the automation of the second stage, that is, the selection of the optimal group of single instances of trading strategies, supplementing it with the ability to take into account the results of instances in the forward period.

Developing A Swing Entries Monitoring (EA)

As the year approaches its end, long-term traders often reflect on market history to analyze its behavior and trends, aiming to project potential future movements. In this article, we will explore the development of a long-term entry monitoring Expert Advisor (EA) using MQL5. The objective is to address the challenge of missed long-term trading opportunities caused by manual trading and the absence of automated monitoring systems. We'll use one of the most prominently traded pairs as an example to strategize and develop our solution effectively.

Risk-Based Trade Placement EA with On-Chart UI (Part 2): Adding Interactivity and Logic

Learn how to build an interactive MQL5 Expert Advisor with an on-chart control panel. Know how to compute risk-based lot sizes and place trades directly from the chart.

Trading with the MQL5 Economic Calendar (Part 8): Optimizing News-Driven Backtesting with Smart Event Filtering and Targeted Logs

In this article, we optimize our economic calendar with smart event filtering and targeted logging for faster, clearer backtesting in live and offline modes. We streamline event processing and focus logs on critical trade and dashboard events, enhancing strategy visualization. These improvements enable seamless testing and refinement of news-driven trading strategies.

Neural Networks in Trading: Superpoint Transformer (SPFormer)

In this article, we introduce a method for segmenting 3D objects based on Superpoint Transformer (SPFormer), which eliminates the need for intermediate data aggregation. This speeds up the segmentation process and improves the performance of the model.

Codex Pipelines, from Python to MQL5, for Indicator Selection: A Multi-Quarter Analysis of the XLF ETF with Machine Learning

We continue our look at how the selection of indicators can be pipelined when facing a ‘none-typical’ MetaTrader asset. MetaTrader 5 is primarily used to trade forex, and that is good given the liquidity on offer, however the case for trading outside of this ‘comfort-zone’, is growing bolder with not just the overnight rise of platforms like Robinhood, but also the relentless pursuit of an edge for most traders. We consider the XLF ETF for this article and also cap our revamped pipeline with a simple MLP.

From Novice to Expert: Animated News Headline Using MQL5 (X)—Multiple Symbol Chart View for News Trading

Today we will develop a multi-chart view system using chart objects. The goal is to enhance news trading by applying MQL5 algorithms that help reduce trader reaction time during periods of high volatility, such as major news releases. In this case, we provide traders with an integrated way to monitor multiple major symbols within a single all-in-one news trading tool. Our work is continuously advancing with the News Headline EA, which now features a growing set of functions that add real value both for traders using fully automated systems and for those who prefer manual trading assisted by algorithms. Explore more knowledge, insights, and practical ideas by clicking through and joining this discussion.

MQL5 Wizard Techniques you should know (Part 43): Reinforcement Learning with SARSA

SARSA, which is an abbreviation for State-Action-Reward-State-Action is another algorithm that can be used when implementing reinforcement learning. So, as we saw with Q-Learning and DQN, we look into how this could be explored and implemented as an independent model rather than just a training mechanism, in wizard assembled Expert Advisors.

Price Action Analysis Toolkit Development (Part 54): Filtering Trends with EMA and Smoothed Price Action

This article explores a method that combines Heikin‑Ashi smoothing with EMA20 High and Low boundaries and an EMA50 trend filter to improve trade clarity and timing. It demonstrates how these tools can help traders identify genuine momentum, filter out noise, and better navigate volatile or trending markets.

Developing a multi-currency Expert Advisor (Part 11): Automating the optimization (first steps)

To get a good EA, we need to select multiple good sets of parameters of trading strategy instances for it. This can be done manually by running optimization on different symbols and then selecting the best results. But it is better to delegate this work to the program and engage in more productive activities.

Neural Networks Made Easy (Part 97): Training Models With MSFformer

When exploring various model architecture designs, we often devote insufficient attention to the process of model training. In this article, I aim to address this gap.

MQL5 Wizard Techniques you should know (Part 31): Selecting the Loss Function

Loss Function is the key metric of machine learning algorithms that provides feedback to the training process by quantifying how well a given set of parameters are performing when compared to their intended target. We explore the various formats of this function in an MQL5 custom wizard class.

Neural Networks in Trading: Market Analysis Using a Pattern Transformer

When we use models to analyze the market situation, we mainly focus on the candlestick. However, it has long been known that candlestick patterns can help in predicting future price movements. In this article, we will get acquainted with a method that allows us to integrate both of these approaches.

Neural Networks in Trading: Hierarchical Feature Learning for Point Clouds

We continue to study algorithms for extracting features from a point cloud. In this article, we will get acquainted with the mechanisms for increasing the efficiency of the PointNet method.

Reusing Invalidated Orderblocks As Mitigation Blocks (SMC)

In this article, we explore how previously invalidated orderblocks can be reused as mitigation blocks within Smart Money Concepts (SMC). These zones reveal where institutional traders re-enter the market after a failed orderblock, providing high-probability areas for trade continuation in the dominant trend.

Blood inheritance optimization (BIO)

I present to you my new population optimization algorithm - Blood Inheritance Optimization (BIO), inspired by the human blood group inheritance system. In this algorithm, each solution has its own "blood type" that determines the way it evolves. Just as in nature where a child's blood type is inherited according to specific rules, in BIO new solutions acquire their characteristics through a system of inheritance and mutations.

MQL5 Wizard Techniques you should know (Part 50): Awesome Oscillator

The Awesome Oscillator is another Bill Williams Indicator that is used to measure momentum. It can generate multiple signals, and therefore we review these on a pattern basis, as in prior articles, by capitalizing on the MQL5 wizard classes and assembly.

Building A Candlestick Trend Constraint Model (Part 6): All in one integration

One major challenge is managing multiple chart windows of the same pair running the same program with different features. Let's discuss how to consolidate several integrations into one main program. Additionally, we will share insights on configuring the program to print to a journal and commenting on the successful signal broadcast on the chart interface. Find more information in this article as we progress the article series.

Build a Remote Forex Risk Management System in Python

We are making a remote professional risk manager for Forex in Python, deploying it on the server step by step. In the course of the article, we will understand how to programmatically manage Forex risks, and how not to waste a Forex deposit any more.

Creating a Trading Administrator Panel in MQL5 (Part VI): Multiple Functions Interface (I)

The Trading Administrator's role goes beyond just Telegram communications; they can also engage in various control activities, including order management, position tracking, and interface customization. In this article, we’ll share practical insights on expanding our program to support multiple functionalities in MQL5. This update aims to overcome the current Admin Panel's limitation of focusing primarily on communication, enabling it to handle a broader range of tasks.

Developing a Replay System (Part 77): New Chart Trade (IV)

In this article, we will cover some of the measures and precautions to consider when creating a communication protocol. These are pretty simple and straightforward things, so we won't go into too much detail in this article. But to understand what will happen, you need to understand the content of the article.

Neural networks made easy (Part 89): Frequency Enhanced Decomposition Transformer (FEDformer)

All the models we have considered so far analyze the state of the environment as a time sequence. However, the time series can also be represented in the form of frequency features. In this article, I introduce you to an algorithm that uses frequency components of a time sequence to predict future states.

Developing an MQTT client for MetaTrader 5: a TDD approach — Final

This article is the last part of a series describing our development steps of a native MQL5 client for the MQTT 5.0 protocol. Although the library is not production-ready yet, in this part, we will use our client to update a custom symbol with ticks (or rates) sourced from another broker. Please, see the bottom of this article for more information about the library's current status, what is missing for it to be fully compliant with the MQTT 5.0 protocol, a possible roadmap, and how to follow and contribute to its development.

Across Neighbourhood Search (ANS)

The article reveals the potential of the ANS algorithm as an important step in the development of flexible and intelligent optimization methods that can take into account the specifics of the problem and the dynamics of the environment in the search space.

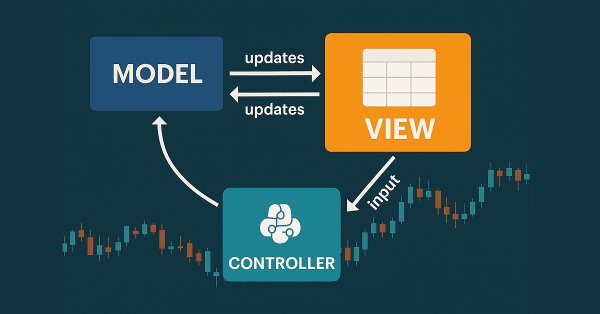

Tables in the MVC Paradigm in MQL5: Integrating the Model Component into the View Component

In the article, we will create the first version of the TableControl (TableView) control. This will be a simple static table being created based on the input data defined by two arrays — a data array and an array of column headers.

From Basic to Intermediate: BREAK and CONTINUE Statements

In this article, we will look at how to use the RETURN, BREAK, and CONTINUE statements in a loop. Understanding what each of these statements does in the loop execution flow is very important for working with more complex applications. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Population optimization algorithms: Intelligent Water Drops (IWD) algorithm

The article considers an interesting algorithm derived from inanimate nature - intelligent water drops (IWD) simulating the process of river bed formation. The ideas of this algorithm made it possible to significantly improve the previous leader of the rating - SDS. As usual, the new leader (modified SDSm) can be found in the attachment.

Neural Networks in Trading: Hierarchical Vector Transformer (Final Part)

We continue studying the Hierarchical Vector Transformer method. In this article, we will complete the construction of the model. We will also train and test it on real historical data.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (II): Modularization

In this discussion, we take a step further in breaking down our MQL5 program into smaller, more manageable modules. These modular components will then be integrated into the main program, enhancing its organization and maintainability. This approach simplifies the structure of our main program and makes the individual components reusable in other Expert Advisors (EAs) and indicator developments. By adopting this modular design, we create a solid foundation for future enhancements, benefiting both our project and the broader developer community.

Dialectic Search (DA)

The article introduces the dialectical algorithm (DA), a new global optimization method inspired by the philosophical concept of dialectics. The algorithm exploits a unique division of the population into speculative and practical thinkers. Testing shows impressive performance of up to 98% on low-dimensional problems and overall efficiency of 57.95%. The article explains these metrics and presents a detailed description of the algorithm and the results of experiments on different types of functions.