Permuting price bars in MQL5

In this article we present an algorithm for permuting price bars and detail how permutation tests can be used to recognize instances where strategy performance has been fabricated to deceive potential buyers of Expert Advisors.

From Basic to Intermediate: The Include Directive

In today's article, we will discuss a compilation directive that is widely used in various codes that can be found in MQL5. Although this directive will be explained rather superficially here, it is important that you begin to understand how to use it, as it will soon become indispensable as you move to higher levels of programming. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Basic to Intermediate: Structs (II)

In this article, we will try to understand why programming languages like MQL5 have structures, and why in some cases structures are the ideal way to pass values between functions and procedures, while in other cases they may not be the best way to do it.

Integrating MQL5 with data processing packages (Part 1): Advanced Data analysis and Statistical Processing

Integration enables seamless workflow where raw financial data from MQL5 can be imported into data processing packages like Jupyter Lab for advanced analysis including statistical testing.

Integrating MQL5 with data processing packages (Part 4): Big Data Handling

Exploring advanced techniques to integrate MQL5 with powerful data processing tools, this part focuses on efficient handling of big data to enhance trading analysis and decision-making.

Data Science and ML (Part 47): Forecasting the Market Using the DeepAR model in Python

In this article, we will attempt to predict the market with a decent model for time series forecasting named DeepAR. A model that is a combination of deep neural networks and autoregressive properties found in models like ARIMA and Vector Autoregressive (VAR).

Artificial Bee Hive Algorithm (ABHA): Theory and methods

In this article, we will consider the Artificial Bee Hive Algorithm (ABHA) developed in 2009. The algorithm is aimed at solving continuous optimization problems. We will look at how ABHA draws inspiration from the behavior of a bee colony, where each bee has a unique role that helps them find resources more efficiently.

Neural Networks in Trading: Exploring the Local Structure of Data

Effective identification and preservation of the local structure of market data in noisy conditions is a critical task in trading. The use of the Self-Attention mechanism has shown promising results in processing such data; however, the classical approach does not account for the local characteristics of the underlying structure. In this article, I introduce an algorithm capable of incorporating these structural dependencies.

Resampling techniques for prediction and classification assessment in MQL5

In this article, we will explore and implement, methods for assessing model quality that utilize a single dataset as both training and validation sets.

MQL5 Wizard Techniques you should know (Part 32): Regularization

Regularization is a form of penalizing the loss function in proportion to the discrete weighting applied throughout the various layers of a neural network. We look at the significance, for some of the various regularization forms, this can have in test runs with a wizard assembled Expert Advisor.

Developing an MQL5 RL agent with RestAPI integration (Part 3): Creating automatic moves and test scripts in MQL5

This article discusses the implementation of automatic moves in the tic-tac-toe game in Python, integrated with MQL5 functions and unit tests. The goal is to improve the interactivity of the game and ensure the reliability of the system through testing in MQL5. The presentation covers game logic development, integration, and hands-on testing, and concludes with the creation of a dynamic game environment and a robust integrated system.

Redefining MQL5 and MetaTrader 5 Indicators

An innovative approach to collecting indicator information in MQL5 enables more flexible and streamlined data analysis by allowing developers to pass custom inputs to indicators for immediate calculations. This approach is particularly useful for algorithmic trading, as it provides enhanced control over the information processed by indicators, moving beyond traditional constraints.

Visualizing deals on a chart (Part 1): Selecting a period for analysis

Here we are going to develop a script from scratch that simplifies unloading print screens of deals for analyzing trading entries. All the necessary information on a single deal is to be conveniently displayed on one chart with the ability to draw different timeframes.

Simplifying Databases in MQL5 (Part 2): Using metaprogramming to create entities

We explored the advanced use of #define for metaprogramming in MQL5, creating entities that represent tables and column metadata (type, primary key, auto-increment, nullability, etc.). We centralized these definitions in TickORM.mqh, automating the generation of metadata classes and paving the way for efficient data manipulation by the ORM, without having to write SQL manually.

Reimagining Classic Strategies (Part IV): SP500 and US Treasury Notes

In this series of articles, we analyze classical trading strategies using modern algorithms to determine whether we can improve the strategy using AI. In today's article, we revisit a classical approach for trading the SP500 using the relationship it has with US Treasury Notes.

Python-MetaTrader 5 Strategy Tester (Part 04): Tester 101

In this fascinating article, we build our very first trading robot in the simulator and run a strategy testing action that resembles how the MetaTrader 5 strategy tester works, then compare the outcome produced in a custom simulation against our favorite terminal.

Neural Networks in Trading: Injection of Global Information into Independent Channels (InjectTST)

Most modern multimodal time series forecasting methods use the independent channels approach. This ignores the natural dependence of different channels of the same time series. Smart use of two approaches (independent and mixed channels) is the key to improving the performance of the models.

Developing a Replay System (Part 46): Chart Trade Project (V)

Tired of wasting time searching for that very file that you application needs in order to work? How about including everything in the executable? This way you won't have to search for the things. I know that many people use this form of distribution and storage, but there is a much more suitable way. At least as far as the distribution of executable files and their storage is concerned. The method that will be presented here can be very useful, since you can use MetaTrader 5 itself as an excellent assistant, as well as MQL5. Furthermore, it is not that difficult to understand.

Developing a Replay System (Part 29): Expert Advisor project — C_Mouse class (III)

After improving the C_Mouse class, we can focus on creating a class designed to create a completely new framework fr our analysis. We will not use inheritance or polymorphism to create this new class. Instead, we will change, or better said, add new objects to the price line. That's what we will do in this article. In the next one, we will look at how to change the analysis. All this will be done without changing the code of the C_Mouse class. Well, actually, it would be easier to achieve this using inheritance or polymorphism. However, there are other methods to achieve the same result.

Neural Network in Practice: Pseudoinverse (II)

Since these articles are educational in nature and are not intended to show the implementation of specific functionality, we will do things a little differently in this article. Instead of showing how to apply factorization to obtain the inverse of a matrix, we will focus on factorization of the pseudoinverse. The reason is that there is no point in showing how to get the general coefficient if we can do it in a special way. Even better, the reader can gain a deeper understanding of why things happen the way they do. So, let's now figure out why hardware is replacing software over time.

ALGLIB library optimization methods (Part I)

In this article, we will get acquainted with the ALGLIB library optimization methods for MQL5. The article includes simple and clear examples of using ALGLIB to solve optimization problems, which will make mastering the methods as accessible as possible. We will take a detailed look at the connection of such algorithms as BLEIC, L-BFGS and NS, and use them to solve a simple test problem.

Exploring Cryptography in MQL5: A Step-by-Step Approach

This article explores the integration of cryptography within MQL5, enhancing the security and functionality of trading algorithms. We’ll cover key cryptographic methods and their practical implementation in automated trading.

Self Optimizing Expert Advisors in MQL5 (Part 12): Building Linear Classifiers Using Matrix Factorization

This article explores the powerful role of matrix factorization in algorithmic trading, specifically within MQL5 applications. From regression models to multi-target classifiers, we walk through practical examples that demonstrate how easily these techniques can be integrated using built-in MQL5 functions. Whether you're predicting price direction or modeling indicator behavior, this guide lays a strong foundation for building intelligent trading systems using matrix methods.

Self Optimizing Expert Advisors in MQL5 (Part 8): Multiple Strategy Analysis (3) — Weighted Voting Policy

This article explores how determining the optimal number of strategies in an ensemble can be a complex task that is easier to solve through the use of the MetaTrader 5 genetic optimizer. The MQL5 Cloud is also employed as a key resource for accelerating backtesting and optimization. All in all, our discussion here sets the stage for developing statistical models to evaluate and improve trading strategies based on our initial ensemble results.

Creating a Trading Administrator Panel in MQL5 (Part IV): Login Security Layer

Imagine a malicious actor infiltrating the Trading Administrator room, gaining access to the computers and the Admin Panel used to communicate valuable insights to millions of traders worldwide. Such an intrusion could lead to disastrous consequences, such as the unauthorized sending of misleading messages or random clicks on buttons that trigger unintended actions. In this discussion, we will explore the security measures in MQL5 and the new security features we have implemented in our Admin Panel to safeguard against these threats. By enhancing our security protocols, we aim to protect our communication channels and maintain the trust of our global trading community. Find more insights in this article discussion.

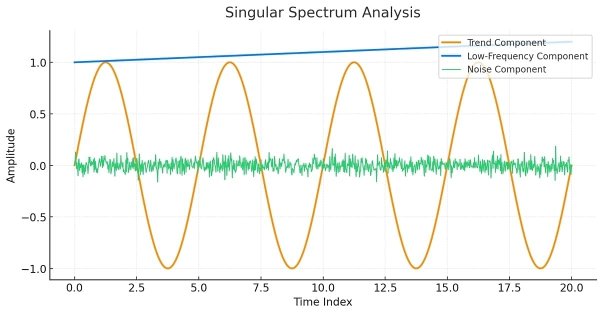

Singular Spectrum Analysis in MQL5

This article is meant as a guide for those unfamiliar with the concept of Singular Spectrum Analysis and who wish to gain enough understanding to be able to apply the built-in tools available in MQL5.

Bivariate Copulae in MQL5 (Part 2): Implementing Archimedean copulae in MQL5

In the second installment of the series, we discuss the properties of bivariate Archimedean copulae and their implementation in MQL5. We also explore applying copulae to the development of a simple pairs trading strategy.

Neural Networks in Trading: Point Cloud Analysis (PointNet)

Direct point cloud analysis avoids unnecessary data growth and improves the performance of models in classification and segmentation tasks. Such approaches demonstrate high performance and robustness to perturbations in the original data.

Developing a Replay System (Part 43): Chart Trade Project (II)

Most people who want or dream of learning to program don't actually have a clue what they're doing. Their activity consists of trying to create things in a certain way. However, programming is not about tailoring suitable solutions. Doing it this way can create more problems than solutions. Here we will be doing something more advanced and therefore different.

Developing a Replay System (Part 40): Starting the second phase (I)

Today we'll talk about the new phase of the replay/simulator system. At this stage, the conversation will become truly interesting and quite rich in content. I strongly recommend that you read the article carefully and use the links provided in it. This will help you understand the content better.

Sending Messages from MQL5 to Discord, Creating a Discord-MetaTrader 5 Bot

Similar to Telegram, Discord is capable of receiving information and messages in JSON format using it's communication API's, In this article, we are going to explore how you can use discord API's to send trading signals and updates from MetaTrader 5 to your Discord trading community.

Creating Dynamic MQL5 Graphical Interfaces through Resource-Driven Image Scaling with Bicubic Interpolation on Trading Charts

In this article, we explore dynamic MQL5 graphical interfaces, using bicubic interpolation for high-quality image scaling on trading charts. We detail flexible positioning options, enabling dynamic centering or corner anchoring with custom offsets.

The View and Controller components for tables in the MQL5 MVC paradigm: Simple controls

The article covers simple controls as components of more complex graphical elements of the View component within the framework of table implementation in the MVC (Model-View-Controller) paradigm. The basic functionality of the Controller is implemented for interaction of elements with the user and with each other. This is the second article on the View component and the fourth one in a series of articles on creating tables for the MetaTrader 5 client terminal.

MQL5 Wizard Techniques you should know (Part 76): Using Patterns of Awesome Oscillator and the Envelope Channels with Supervised Learning

We follow up on our last article, where we introduced the indicator couple of the Awesome-Oscillator and the Envelope Channel, by looking at how this pairing could be enhanced with Supervised Learning. The Awesome-Oscillator and Envelope-Channel are a trend-spotting and support/resistance complimentary mix. Our supervised learning approach is a CNN that engages the Dot Product Kernel with Cross-Time-Attention to size its kernels and channels. As per usual, this is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Neural Networks in Trading: Transformer for the Point Cloud (Pointformer)

In this article, we will talk about algorithms for using attention methods in solving problems of detecting objects in a point cloud. Object detection in point clouds is important for many real-world applications.

Statistical Arbitrage Through Cointegrated Stocks (Part 5): Screening

This article proposes an asset screening process for a statistical arbitrage trading strategy through cointegrated stocks. The system starts with the regular filtering by economic factors, like asset sector and industry, and finishes with a list of criteria for a scoring system. For each statistical test used in the screening, a respective Python class was developed: Pearson correlation, Engle-Granger cointegration, Johansen cointegration, and ADF/KPSS stationarity. These Python classes are provided along with a personal note from the author about the use of AI assistants for software development.

From Basic to Intermediate: Array (III)

In this article, we will look at how to work with arrays in MQL5, including how to pass information between functions and procedures using arrays. The purpose is to prepare you for what will be demonstrated and explained in future materials in the series. Therefore, I strongly recommend that you carefully study what will be shown in this article.

Analyzing binary code of prices on the exchange (Part II): Converting to BIP39 and writing GPT model

Continuing tries to decipher price movements... What about linguistic analysis of the "market dictionary" that we get by converting the binary price code to BIP39? In this article, we will delve into an innovative approach to exchange data analysis and consider how modern natural language processing techniques can be applied to the market language.

From Basic to Intermediate: Array (II)

In this article, we will look at what a dynamic array and a static array are. Is there a difference between using one or the other? Or are they always the same? When should you use one and when the other type? And what about constant arrays? We will try to understand what they are designed for and consider the risks of not initializing all the values in the array.

Category Theory in MQL5 (Part 17): Functors and Monoids

This article, the final in our series to tackle functors as a subject, revisits monoids as a category. Monoids which we have already introduced in these series are used here to aid in position sizing, together with multi-layer perceptrons.