Trust EA

- Experten

- Konstantin Kulikov

- Version: 1.7

- Aktualisiert: 19 Dezember 2025

- Aktivierungen: 10

Diskutieren Sie die Komplexität des Forex-Handels hier: Chat "Age of Expert Advisors".

Logik

Diskutieren Sie die Komplexität des Forex-Handels hier: Chat "Age of Expert Advisors".

Logik

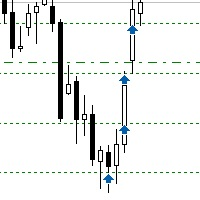

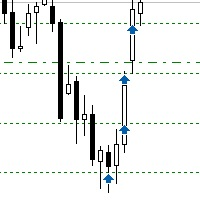

The live trading signals demonstrate impressive performance, particularly due to the EA's ability to operate effectively during the roll-over period, a time range where most expert advisors (EAs) have historically failed to remain profitable since a few years ago. This is especially noteworthy, as many EAs that once exploited inefficiencies during roll-over have stopped working, even on ECN accounts provided by reputable brokers. Roll-over EA's usually consistently performs well regardless of which reversal indicator or indicator value change is applied. This suggests a high probability that it would pass walk-forward optimization and Monte Carlo stress tests, and why the back-test results aren't over-optimized as reflected in the live signals. While there are numerous examples of roll-over-based EAs generating over 100,000% profit on demo accounts, they fail in live trading conditions due to broker-imposed restrictions. In contrast, this EA appears to overcome those limitations - you don't have to have zero spread for the EA to work. Additionally, the seller added a randomization feature to bypass prop firm account correlation so all in all good customer support.

Erlauben Sie die Verwendung von Cookies, um sich auf der Website MQL5.com anzumelden.

Bitte aktivieren Sie die notwendige Einstellung in Ihrem Browser, da Sie sich sonst nicht einloggen können.

The live trading signals demonstrate impressive performance, particularly due to the EA's ability to operate effectively during the roll-over period, a time range where most expert advisors (EAs) have historically failed to remain profitable since a few years ago. This is especially noteworthy, as many EAs that once exploited inefficiencies during roll-over have stopped working, even on ECN accounts provided by reputable brokers. Roll-over EA's usually consistently performs well regardless of which reversal indicator or indicator value change is applied. This suggests a high probability that it would pass walk-forward optimization and Monte Carlo stress tests, and why the back-test results aren't over-optimized as reflected in the live signals. While there are numerous examples of roll-over-based EAs generating over 100,000% profit on demo accounts, they fail in live trading conditions due to broker-imposed restrictions. In contrast, this EA appears to overcome those limitations - you don't have to have zero spread for the EA to work. Additionally, the seller added a randomization feature to bypass prop firm account correlation so all in all good customer support.