Telgo Trader EA

- Experts

- Timothy Chuma Ifiora

- Versão: 1.0

- Ativações: 5

TELGO TRADER (OBT) Expert Advisor

Overview

The TELGO TRADER (OBT) is an advanced automated trading system that implements sophisticated Order Block detection based on Inner Circle Trader (ICT) concepts. This EA combines institutional trading theory with smart market structure analysis to identify high-probability trading opportunities in the H1 timeframe.

Key Features

Advanced Order Block Detection

- Multi-Timeframe Analysis: Analyzes higher timeframes for stronger Order Block signals

- ATR-Based Validation: Uses Average True Range for dynamic size filtering and impulse move detection

- Volume Confirmation: Incorporates volume analysis for enhanced signal validation

- Market Structure Awareness: Considers overall market structure for better trade timing

- Mitigation Tracking: Monitors whether Order Blocks have been previously tested

Intelligent Market Context Analysis

- Range Detection: Automatically identifies ranging vs trending market conditions

- Dynamic Entry Zones: Calculates optimal entry zones within Order Blocks

- Price Action Patterns: Recognizes inverted hammer, doji, and other reversal patterns

- Real-time Market Assessment: Continuously evaluates market conditions

Comprehensive Risk Management

- Position Sizing: Automatic position sizing based on account risk percentage

- Advanced Stop Management:

- Initial stop loss placement

- Break-even adjustment

- Advanced trailing stop system with customizable start point

- Trade Synchronization: Prevents over-trading with maximum open trades limit

- ATR-Based Stops: Dynamic stop loss calculation using market volatility

Flexible Trading Controls

- Selective Validation Override: Choose which validation criteria to enforce or ignore

- Customizable Body Size Filter: Set minimum candle body size requirements

- Trading Window Control: Option to ignore time-based trading restrictions

- Market Condition Override: Bypass market condition checks when needed

Input Parameters

Risk Management Settings

- MaxRiskPercent: Percentage of account balance to risk per trade (default: 1.0%)

- calcTp: Take profit calculation multiplier (default: 2.0)

- minBodySize: Minimum candle body size in points (default: 12)

- trailingStart: Profit in pips before trailing stop activates (default: 70)

Trading Control Overrides(DON'T TOUCH)

- ignoreTradingWindow: Bypass time-based trading restrictions (default: false)

- ignoreMarketCondition: Skip market condition validation (default: false)

- ignorePricePosition: Override price position checks (default: false)

- ignoreCandlePattern: Bypass candle pattern requirements (default: false)

- ignoreTrendMomentum: Skip trend momentum validation (default: false)

Order Block Settings

- g_maxOrderBlocks: Maximum number of Order Blocks to track simultaneously (default: 30)

- g_maxOpenTrades: Maximum number of concurrent trades allowed (default: 2)

- g_onlyUntestedOBs: Trade only previously unmitigated Order Blocks (default: true)

- g_showTradingStats: Display trading statistics on chart (default: true)

Technical Specifications

Order Block Identification

- Scans for significant price moves and preceding consolidation areas

- Validates Order Blocks using multiple criteria including size, volume, and structure

- Tracks mitigation status to identify fresh institutional levels

- Maintains database of active Order Blocks for systematic monitoring

Validation System

- Market Condition Analysis: Evaluates trending vs ranging environments

- Price Position Verification: Confirms optimal entry positioning

- Candle Pattern Recognition: Identifies supportive price action patterns

- Trend Momentum Assessment: Validates directional bias alignment

- Trading Window Management: Respects optimal trading hours

Risk Control Framework

- Automatic position sizing based on account equity and risk tolerance

- Dynamic stop loss placement relative to Order Block structure

- Trailing stop system with customizable activation point

- Maximum concurrent trades limitation for portfolio protection

Advantages

Institutional Trading Approach

- Based on proven ICT Order Block concepts

- Mimics institutional trading behavior and smart money positioning

- Targets areas where large market participants are likely positioned

Adaptive Control System

- Flexible validation overrides for different market conditions

- Customizable parameters for various trading styles

- Real-time market condition assessment and adaptation

Robust Risk Management

- Conservative default risk settings (1% per trade)

- Multiple layers of trade protection

- Account balance preservation through systematic position sizing

Professional Implementation

- Clean code architecture with modular design

- Comprehensive logging and statistics tracking

- Visual debugging tools for performance monitoring

Recommended Usage

Optimal Settings

- Timeframe: H1 (exclusively optimized for 1-hour charts)

- Currency Pairs: EURUSD, GBPUSD, USDJPY, AUDUSD

- Account Size: Minimum $500 for proper risk management

- Risk Level: 1-2% for conservative approach

Market Conditions

- Works best in trending markets with clear institutional participation

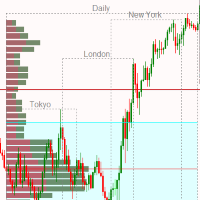

- Effective during major trading sessions (London, New York overlap)

- Suitable for both trending and ranging market environments

Setup Requirements

- VPS recommended for continuous operation

- Stable internet connection for real-time analysis

- Sufficient margin for multiple concurrent positions

Important Notes

- Designed specifically for H1 timeframe operation

- Requires basic understanding of Order Block concepts

- Regular monitoring recommended for optimal performance

- Backtesting advised before live implementation

The TELGO TRADER (OBT) transforms institutional Order Block concepts into a systematic, automated trading approach designed for consistent performance in the H1 timeframe across major currency pairs.