NH Breakout Trading

- Experts

- Nezir Hyka

- Version: 1.2

- Updated: 16 December 2025

- Activations: 5

NH Breakout Trading – Expert Advisor

Technical Description:

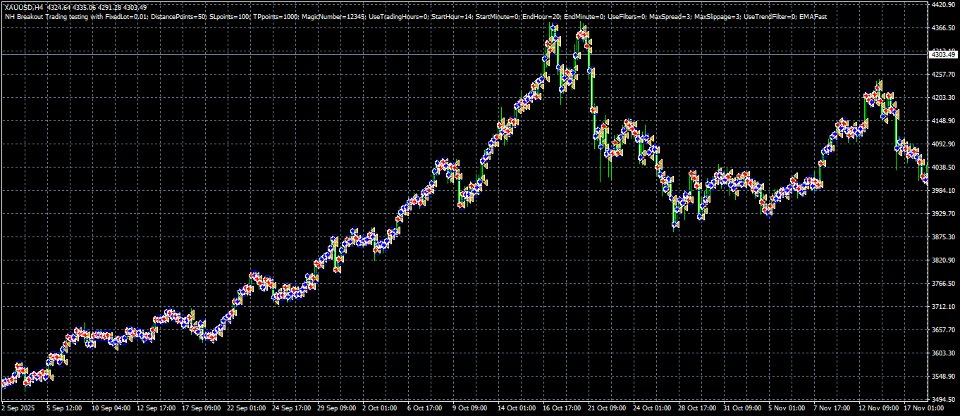

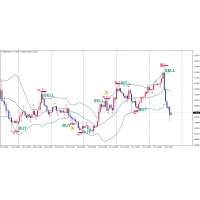

NH Breakout Trading is an automated Expert Advisor specifically designed for breakout strategies in high-volatility markets. The EA places Buy Stop and Sell Stop pending orders relative to the current candle’s open price, automatically calculates Stop Loss and Take Profit in points from the entry level, and applies operational filters including EMA-based trend detection, spread limits, and trading session restrictions to optimize order execution.

Recommended Markets:

-

Forex: EUR/USD, GBP/USD, USD/JPY, EUR/JPY – currencies with strong intraday volatility.

-

Commodities: XAU/USD (Gold), WTI Crude Oil – markets with frequent price swings.

-

Indices: NASDAQ 100, DAX 30 – highly volatile stock indices suited for breakout strategies.

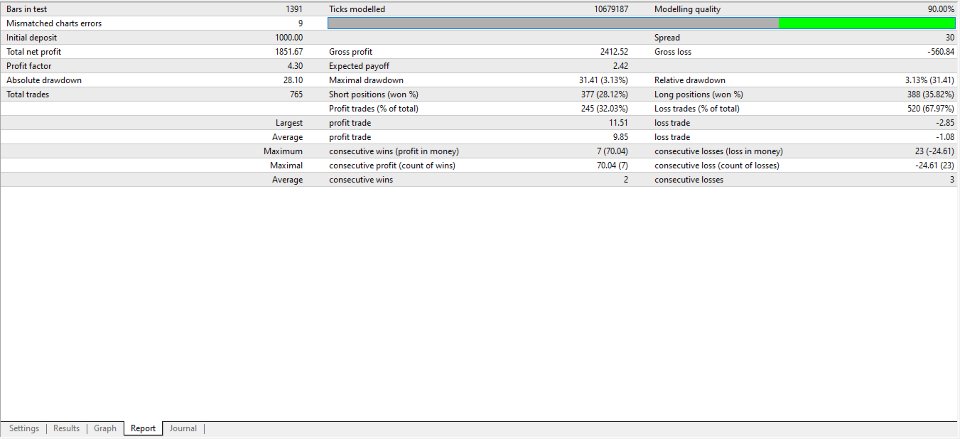

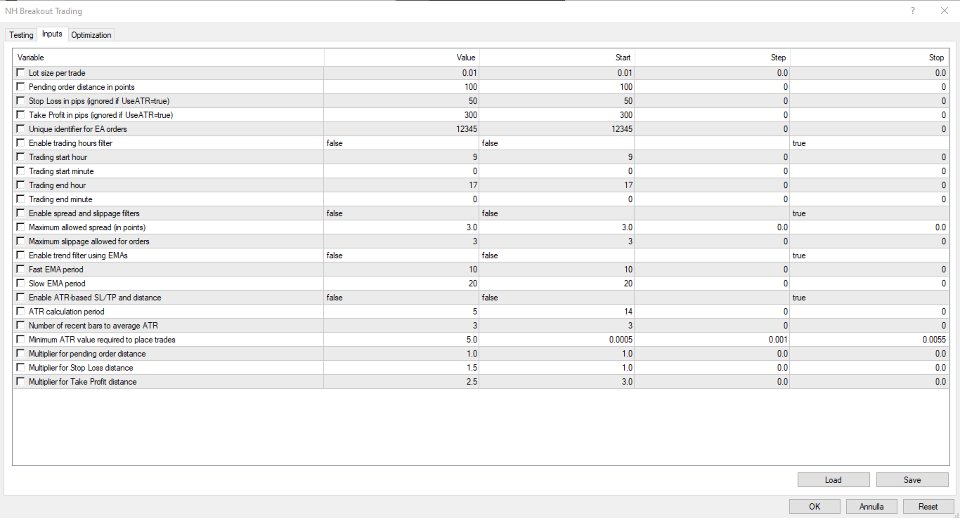

1. Lot and Order Settings:

-

FixedLot: the lot size for each trade.

-

DistancePoints: how far the pending orders (BuyStop/SellStop) are placed from the current price.

-

SLpoints / TPpoints: stop loss and take profit in pips, used only if ATR-based SL/TP is disabled.

-

MagicNumber: unique ID for orders placed by this EA (helps avoid conflicts if multiple EAs run on the same account).

2. Trading Hours Filter:

-

StartHour / StartMinute and EndHour / EndMinute: define the time range when the EA is allowed to place orders.

3. Spread and Slippage Filters:

-

MaxSpread: the maximum allowed spread (in points) to open a trade.

-

MaxSlippage: the maximum allowed slippage for order execution.

4. Trend (EMA) Filter:

-

EMAFastPeriod / EMASlowPeriod: periods for the fast and slow Exponential Moving Averages used to determine trend direction.

5. ATR (Average True Range) Filter:

-

ATRPeriod: period for the ATR calculation.

-

ATRBarsToCheck: number of recent bars used to average ATR values.

-

ATRThreshold: minimum ATR required to place trades.

-

ATRMultiplierDistance / SL / TP: multipliers to calculate distance for pending orders, stop loss, and take profit based on ATR.