Arvi Pullback And Pin Bar

- Experts

- Arvind Verma

- Version: 1.3

- Activations: 5

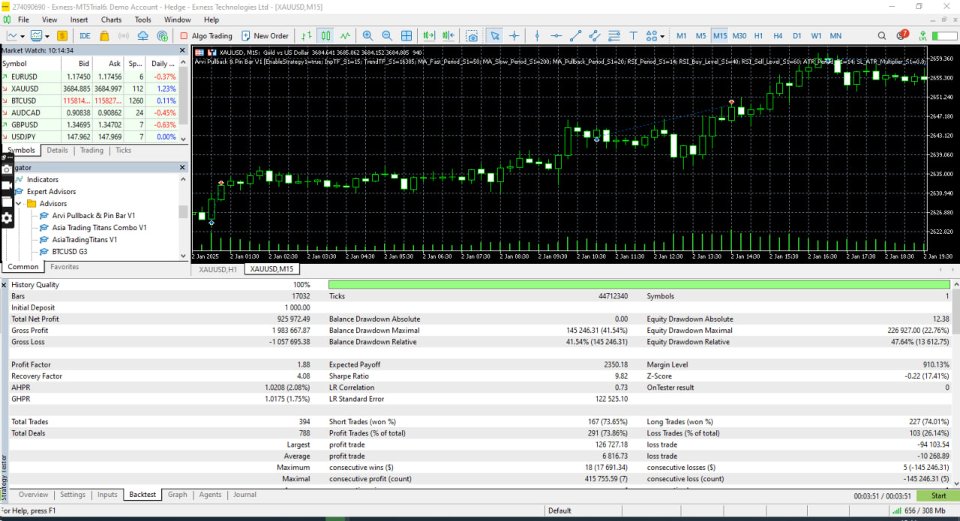

Asia Trading Titans bundles two independent execution engines into one MT5 Expert Advisor: an adaptive trend-pullback engine and a controlled reversal engine. Each engine runs and sizes trades independently (separate execution IDs, position controls and money-management) so you can use either engine alone or both together without cross-interference.

Live signal & set files

-

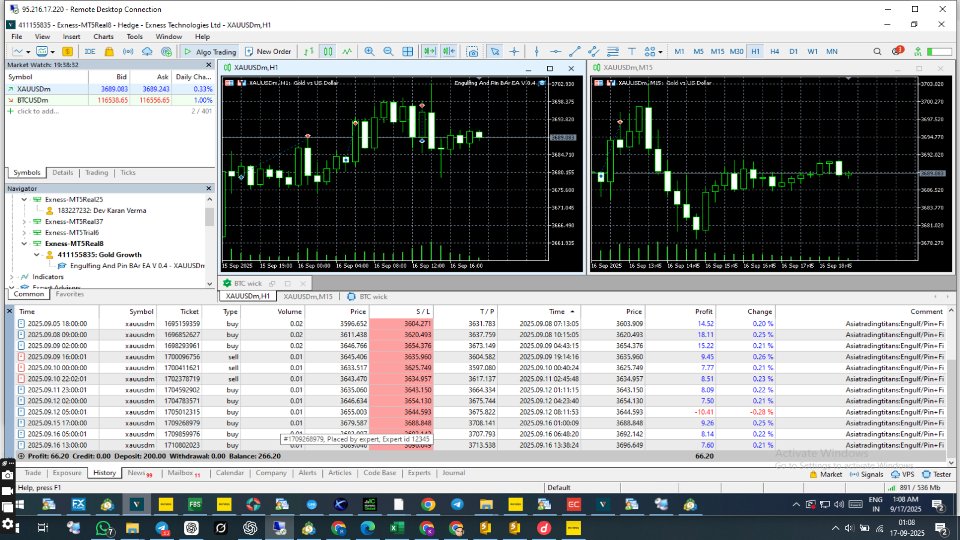

Live Signals: https://www.mql5.com/en/signals/2331149?source=Site+Signals+My

-

Set files / custom tuning: contact via Private Message — Arvind Verma (arvindverma786)

Minimum requirements & recommendations

-

Minimum deposit: small-account friendly (use demo for initial validation).

-

Primary instruments: optimized for precious metals/CFD markets (best behavior observed on gold instruments during development).

-

Runs internally on multiple timeframes (engine-specific), so a single EA instance is sufficient.

-

Broker recommendation: I personally suggest Exness (with 3-digit quotes on XAUUSD) as this was used during development/testing. Other standard MT5 brokers also work — but always confirm symbol specs (digits, tick size, contract size, margin).

-

Test on your broker’s symbol tick data and adjust the provided tuning files before going live.

What it does (high level)

Engine A — Adaptive Pullback Engine

-

Determines larger trend context using a robust dual-band smoothing layer.

-

Seeks weighted pullbacks to a fast adaptive band on the entry timeframe.

-

Confirms entries via a momentum oscillator crossing and an on-chart price-structure check.

-

Stops and targets are scaled to current intramarket volatility using an adaptive volatility scaler; optional dynamic trailing to protect unrealised gains.

Engine B — Structured Reversal Engine

-

Detects structured reversal clusters (defined wick/body relationships and run-up/down conditions) after directional stretches.

-

Optional confirmation layers: momentum threshold, higher-timeframe alignment, and volatility-based stop/target sizing.

-

Includes dynamic sizing mode for scaling exposure in line with account equity and a conservative fallback lot.

Both engines include shared runtime utilities:

-

Spread/slippage/time filters, per-day profit and loss guards, margin safety checks, efficient indicator handles and a single persistent log file for low I/O overhead.

-

Optional prevention of simultaneous entries from conflicting timeframe activity.

-

A compact on-chart runtime panel displays active engines, trades today, daily PnL% and current market quotes.

Key features (concise)

-

Two independent engines in one EA — enable/disable per engine.

-

Isolated execution IDs to avoid cross-management.

-

Volatility-aware SL/TP plus fixed-value options.

-

Multiple lot-modes: fixed, percent-of-equity, or engine-driven dynamic sizing.

-

Daily P&L pause, max trades per day, spread and slippage checks, time-of-day filters.

-

Lightweight news-filter stub (extendable).

-

Back testing friendly (no external DLLs required).

Inputs & tuning (non-exhaustive)

-

Global: enable/disable engines, trade hours, spread & slippage guards, daily PnL targets/limits.

-

Engine A: trend band parameters, pullback band, momentum confirmation toggle, volatility scaler multipliers, trailing on/off.

-

Engine B: reversal pattern sensitivity, pattern-size floor, wick/body tolerance, confirmation toggles (momentum / higher-TF alignment), dynamic sizing toggle, trailing on/off.

(Full list of inputs available in the EA — defaults are tuned for common CFD/metal symbols but must be validated per broker.)

Recommended workflow

-

Start on demo: enable one engine at a time and run forward demo for several weeks.

-

Use the provided tuned set files for rapid, conservative validation (request via PM).

-

Keep risk conservative initially and cap maximum lot sizes.

-

For low-liquidity venues, increase volatility thresholds and pattern-size floors.

-

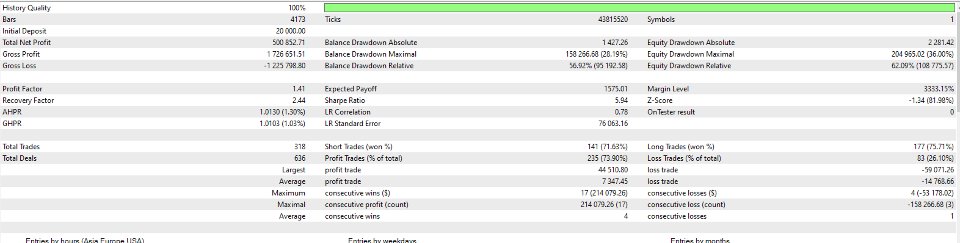

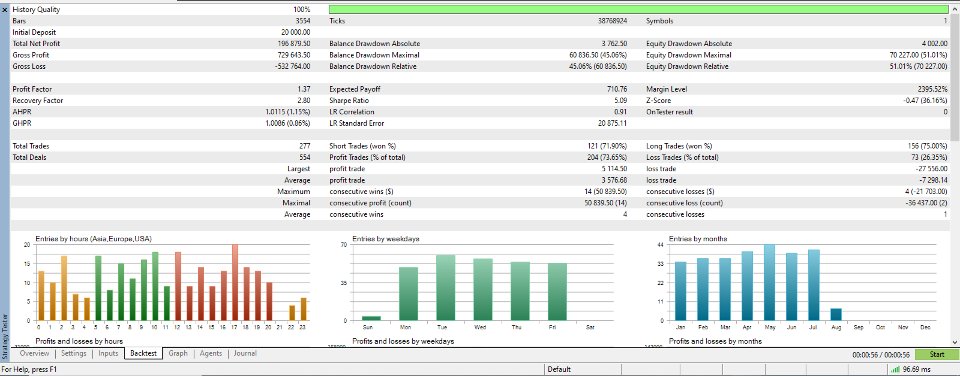

Backtest with your broker’s tick data and realistic spread/slippage.

Support & contact

For set files, custom tuning or support send a Private Message on MQL5: Arvind Verma (arvindverma786). Include symbol, timeframe, broker name and preferred risk for a recommended set.

Disclaimer

Past results are not a guarantee of future performance. Always test on a demo account and verify behavior with your broker’s symbol specifications (tick size, contract size, margin).