Daily Drop Analyzer

- Indicators

- Rafael Gazzinelli

- Version: 1.0

Daily Drop Analyzer is a technical indicator for MetaTrader 5 that performs historical tests based on daily price drops. It analyzes up to 200 Market Watch symbols, identifying the most frequent entry levels within a configurable range.

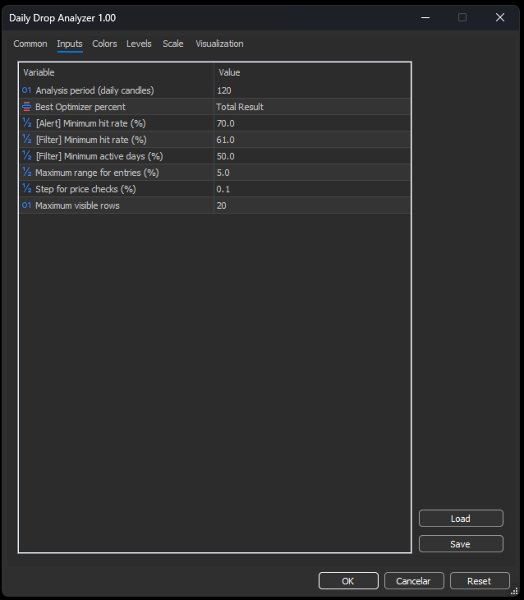

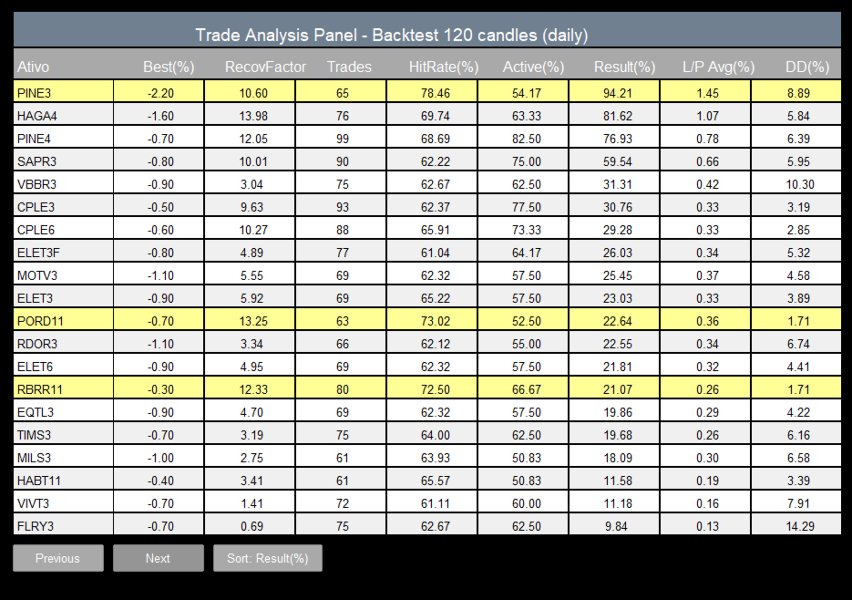

The calculation uses daily candle data (adjustable period, default 120 days), testing drop variations from 0% to -5% in 0.1% steps. The entry level with the best result is determined based on a selected criterion: Total Result or Recovery Factor.

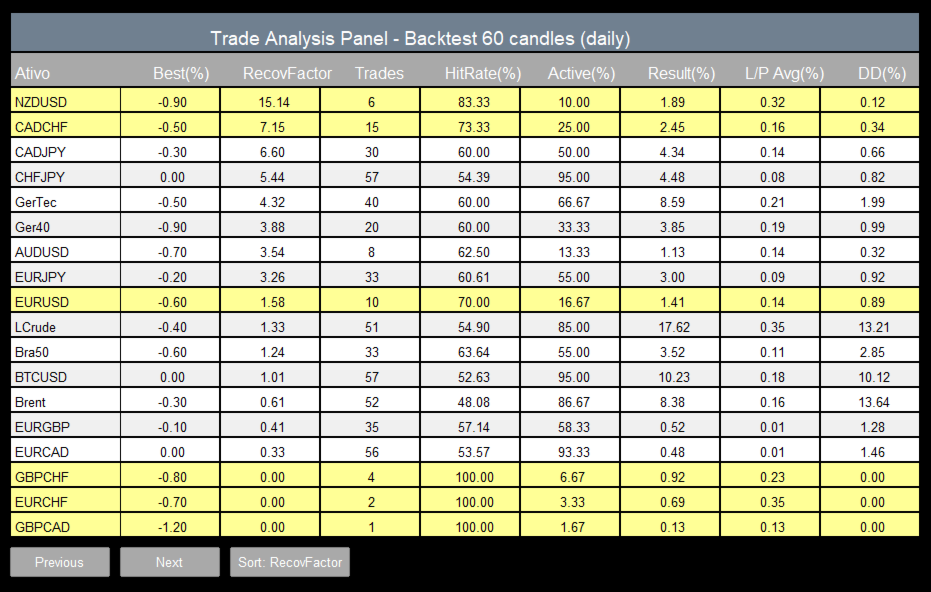

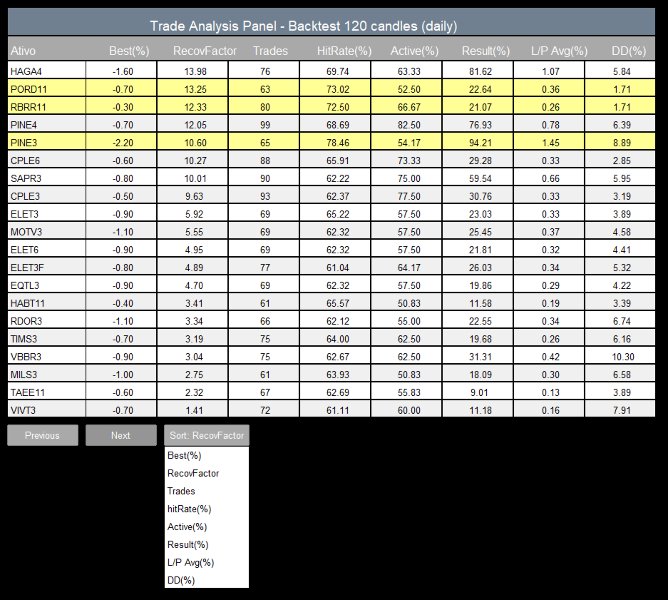

Results are displayed in an interactive on-chart table showing key metrics such as Hit Rate, number of trades, Active Days %, Gross Result, Average per Trade, and Drawdown. The panel supports sorting by any metric and displays up to 20 rows per page.

Filters can be applied based on Hit Rate, Active Days %, and other criteria. Symbols with a hit rate above the defined threshold (e.g., ≥70%) are visually highlighted for easy identification.

Configurable Parameters

- Period: Number of daily candles used in the analysis (default: 120).

- OptimizerType: Optimization criterion for selecting the best entry level (Total Result or Recovery Factor).

- HitRateThresholdAlert: Visual highlight for high hit rate (e.g., ≥70%).

- HitRateThreshold: Minimum hit rate filter to include symbols (default: 60%).

- MinimunActive: Minimum percentage of active days with trades during the analysis period (default: 20%).

- RangeMax: Maximum drop tested for entry, from 0% to -5% (default: 5%).

- Step: Increment between tested drop levels (e.g., 0.1%).

- MaxVisibleRows: Maximum number of visible rows in the results panel (default: 20).

Additional Features

- Simultaneous analysis of multiple Market Watch symbols based on historical daily data.

- Interactive panel with sorting by various technical metrics and visual highlight options.

- Automatic updates on new daily candles or chart resizing.

Daily Drop Analyzer is designed for use on daily charts and is compatible with any asset available in the Market Watch.