Implementation of a Breakeven Mechanism in MQL5 (Part 1): Base Class and Fixed-Points Breakeven Mode

This article discusses the application of a breakeven mechanism in automated strategies using the MQL5 language. We will start with a simple explanation of what the breakeven mode is, how it is implemented, and its possible variations. Next, this functionality will be integrated into the Order Blocks expert advisor, which we created in our last article on risk management. To evaluate its effectiveness, we will run two backtests under specific conditions: one using the breakeven mechanism and the other without it.

MetaTrader 5 Machine Learning Blueprint (Part 7): From Scattered Experiments to Reproducible Results

In the latest installment of this series, we move beyond individual machine learning techniques to address the "Research Chaos" that plagues many quantitative traders. This article focuses on the transition from ad-hoc notebook experiments to a principled, production-grade pipeline that ensures reproducibility, traceability, and efficiency.

Market Simulation (Part 16): Sockets (X)

We are close to completing this challenge. However, before we begin, I want you to try to understand these two articles—this one and the previous one. That way, you will truly understand the next article, in which I will cover exclusively the part related to MQL5 programming. But I will also try to make it understandable. If you do not understand these last two articles, it will be difficult for you to understand the next one, because the material accumulates. The more things there are to do, the more you need to create and understand in order to achieve the goal.

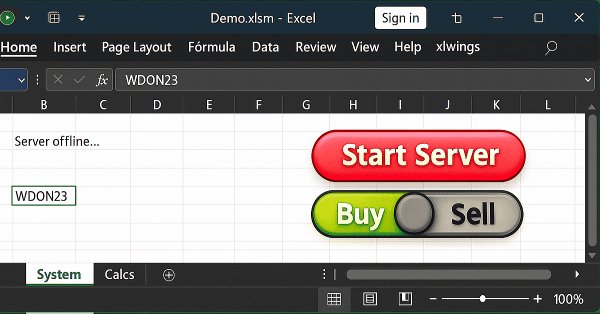

Market Simulation (Part 15): Sockets (IX)

In this article, we will discuss one of the possible solutions to what we have been trying to demonstrate—namely, how to allow an Excel user to perform an action in MetaTrader 5 without sending orders or opening or closing positions. The idea is that the user employs Excel to conduct fundamental analysis of a particular symbol. And by using only Excel, they can instruct an expert advisor running in MetaTrader 5 to open or close a specific position.

Market Simulation (Part 13): Sockets (VII)

When we develop something in xlwings or any other package that allows reading and writing directly to Excel, we must note that all programs, functions, or procedures execute and then complete their task. They do not remain in a loop, no matter how hard we try to do things differently.

Using the MQL5 Economic Calendar for News Filtering (Part 1): Implementing Pre- and Post-News Windows in MQL5

We build a calendar‑driven news filter entirely in MQL5, avoiding web requests and external DLLs. Part 1 covers loading and caching events, mapping them to symbols by currency, filtering by impact level, defining pre/post windows, and blocking new trades during active news, with optional pre‑news position closure. The result is a configurable, prop‑firm‑friendly control that reduces false pauses and protects entries during volatility.

Market Simulation (Part 12): Sockets (VI)

In this article, we will look at how to solve certain problems and issues that arise when using Python code within other programs. More specifically, we will demonstrate a common issue encountered when using Excel in conjunction with MetaTrader 5, although we will be using Python to facilitate this interaction. However, this implementation has a minor drawback. It does not occur in all cases, but only in certain specific situations. When it does happen, it is necessary to understand the cause. In today’s article, we will begin explaining how to resolve this issue.

Market Simulation: (Part 11): Sockets (V)

We are beginning to implement the connection between Excel and MetaTrader 5, but first we need to understand some key points. This way, you won't have to rack your brains trying to figure out why something works or doesn't. And before you frown at the prospect of integrating Python and Excel, let's see how we can (to some extent) control MetaTrader 5 through Excel using xlwings. What we demonstrate here will primarily focus on educational objectives. However, don't think that we can only do what will be covered here.

Integrating MQL5 with Data Processing Packages (Part 7): Building Multi-Agent Environments for Cross-Symbol Collaboration

The article presents a complete Python–MQL5 integration for multi‑agent trading: MT5 data ingestion, indicator computation, per‑agent decisions, and a weighted consensus that outputs a single action. Signals are stored to JSON, served by Flask, and consumed by an MQL5 Expert Advisor for execution with position sizing and ATR‑derived SL/TP. Flask routes provide safe lifecycle control and status monitoring.

Algorithmic Trading Strategies: AI and Its Road to Golden Pinnacles

This article demonstrates an approach to creating trading strategies for gold using machine learning. Considering the proposed approach to the analysis and forecasting of time series from different angles, it is possible to determine its advantages and disadvantages in comparison with other ways of creating trading systems which are based solely on the analysis and forecasting of financial time series.

Angular Analysis of Price Movements: A Hybrid Model for Predicting Financial Markets

What is angular analysis of financial markets? How to use price action angles and machine learning to make accurate forecasts with 67% accuracy? How to combine a regression and classification model with angular features and obtain a working algorithm? What does Gann have to do with it? Why are price movement angles a good indicator for machine learning?

Python-MetaTrader 5 Strategy Tester (Part 05): Multi-Symbols and Timeframes Strategy Tester

This article presents a MetaTrader 5–compatible backtesting workflow that scales across symbols and timeframes. We use HistoryManager to parallelize data collection, synchronize bars and ticks from all timeframes, and run symbol‑isolated OnTick handlers in threads. You will learn how modelling modes affect speed/accuracy, when to rely on terminal data, how to reduce I/O with event‑driven updates, and how to assemble a complete multicurrency trading robot.

Integrating Computer Vision into Trading in MQL5 (Part 1): Creating Basic Functions

The EURUSD forecasting system with the use of computer vision and deep learning. Learn how convolutional neural networks can recognize complex price patterns in the foreign exchange market and predict exchange rate movements with up to 54% accuracy. The article shares the methodology for creating an algorithm that uses artificial intelligence technologies for visual analysis of charts instead of traditional technical indicators. The author demonstrates the process of transforming price data into "images", their processing by a neural network, and a unique opportunity to peer into the "consciousness" of AI through activation maps and attention heatmaps. Practical Python code using the MetaTrader 5 library allows readers to reproduce the system and apply it in their own trading.

Exploring Machine Learning in Unidirectional Trend Trading Using Gold as a Case Study

This article discusses an approach to trading only in the chosen direction (buy or sell). For this purpose, the technique of causal inference and machine learning are used.

Integrating External Applications with MQL5 Community OAuth

Learn how to add “Sign in with MQL5” to your Android app using the OAuth 2.0 authorization code flow. The guide covers app registration, endpoints, redirect URI, Custom Tabs, deep-link handling, and a PHP backend that exchanges the code for an access token over HTTPS. You will authenticate real MQL5 users and access profile data such as rank and reputation.

Introduction to MQL5 (Part 38): Mastering API and WebRequest Function in MQL5 (XII)

Create a practical bridge between MetaTrader 5 and Binance: fetch 30‑minute klines with WebRequest, extract OHLC/time values from JSON, and confirm a bullish engulfing pattern using only completed candles. Then assemble the query string, compute the HMAC‑SHA256 signature, add X‑MBX‑APIKEY, and submit authenticated orders. You get a clear, end‑to‑end EA workflow from data acquisition to order execution.

From Novice to Expert: Statistical Validation of Supply and Demand Zones

Today, we uncover the often overlooked statistical foundation behind supply and demand trading strategies. By combining MQL5 with Python through a Jupyter Notebook workflow, we conduct a structured, data-driven investigation aimed at transforming visual market assumptions into measurable insights. This article covers the complete research process, including data collection, Python-based statistical analysis, algorithm design, testing, and final conclusions. To explore the methodology and findings in detail, read the full article.

Market Simulation (Part 10): Sockets (IV)

In this article, we'll look at what you need to do to start using Excel to manage MetaTrader 5, but in a very interesting way. To do this, we will use an Excel add-in to avoid using built-in VBA. If you don't know what add-in is meant, read this article and learn how to program in Python directly in Excel.

Graph Theory: Traversal Breadth-First Search (BFS) Applied in Trading

Breadth First Search (BFS) uses level-order traversal to model market structure as a directed graph of price swings evolving through time. By analyzing historical bars or sessions layer by layer, BFS prioritizes recent price behavior while still respecting deeper market memory.

Introduction to MQL5 (Part 37): Mastering API and WebRequest Function in MQL5 (XI)

In this article, we show how to send authenticated requests to the Binance API using MQL5 to retrieve your account balance for all assets. Learn how to use your API key, server time, and signature to securely access account data, and how to save the response to a file for future use.

Risk Management (Part 3): Building the Main Class for Risk Management

In this article, we will begin creating a core risk management class that will be key to controlling risks in the system. We will focus on building the foundations, defining the basic structures, variables and functions. In addition, we will implement the necessary methods for setting maximum profit and loss values, thereby laying the foundation for risk management.

Developing Trend Trading Strategies Using Machine Learning

This study introduces a novel methodology for the development of trend-following trading strategies. This section describes the process of annotating training data and using it to train classifiers. This process yields fully operational trading systems designed to run on MetaTrader 5.

Python-MetaTrader 5 Strategy Tester (Part 04): Tester 101

In this fascinating article, we build our very first trading robot in the simulator and run a strategy testing action that resembles how the MetaTrader 5 strategy tester works, then compare the outcome produced in a custom simulation against our favorite terminal.

Central Force Optimization (CFO) algorithm

The article presents the Central Force Optimization (CFO) algorithm inspired by the laws of gravity. It explores how principles of physical attraction can solve optimization problems where "heavier" solutions attract less successful counterparts.

Introduction to MQL5 (Part 36): Mastering API and WebRequest Function in MQL5 (X)

This article introduces the basic concepts behind HMAC-SHA256 and API signatures in MQL5, explaining how messages and secret keys are combined to securely authenticate requests. It lays the foundation for signing API calls without exposing sensitive data.

Developing a multi-currency Expert Advisor (Part 24): Adding a new strategy (II)

In this article, we will continue to connect the new strategy to the created auto optimization system. Let's look at what changes need to be made to the optimization project creation EA, as well as the second and third stage EAs.

Python-MetaTrader 5 Strategy Tester (Part 03): MT5-Like Trading Operations — Handling and Managing

In this article we introduce Python-MetaTrader5-like ways of handling trading operations such as opening, closing, and modifying orders in the simulator. To ensure the simulation behaves like MT5, a strict validation layer for trade requests is implemented, taking into account symbol trading parameters and typical brokerage restrictions.

Introduction to MQL5 (Part 35): Mastering API and WebRequest Function in MQL5 (IX)

Discover how to detect user actions in MetaTrader 5, send requests to an AI API, extract responses, and implement scrolling text in your panel.

Forex arbitrage trading: Analyzing synthetic currencies movements and their mean reversion

In this article, we will examine the movements of synthetic currencies using Python and MQL5 and explore how feasible Forex arbitrage is today. We will also consider ready-made Python code for analyzing synthetic currencies and share more details on what synthetic currencies are in Forex.

Optimizing Trend Strength: Trading in Trend Direction and Strength

This is a specialized trend-following EA that makes both short and long-term analyses, trading decisions, and executions based on the overall trend and its strength. This article will explore in detail an EA that is specifically designed for traders who are patient, disciplined, and focused enough to only execute trades and hold their positions only when trading with strength and in the trend direction without changing their bias frequently, especially against the trend, until take-profit targets are hit.

Python-MetaTrader 5 Strategy Tester (Part 02): Dealing with Bars, Ticks, and Overloading Built-in Functions in a Simulator

In this article, we introduce functions similar to those provided by the Python-MetaTrader 5 module, providing a simulator with a familiar interface and a custom way of handling bars and ticks internally.

Introduction to MQL5 (Part 34): Mastering API and WebRequest Function in MQL5 (VIII)

In this article, you will learn how to create an interactive control panel in MetaTrader 5. We cover the basics of adding input fields, action buttons, and labels to display text. Using a project-based approach, you will see how to set up a panel where users can type messages and eventually display server responses from an API.

Fibonacci in Forex (Part I): Examining the Price-Time Relationship

How does the market observe Fibonacci-based relationships? This sequence, where each subsequent number is equal to the sum of the two previous ones (1, 1, 2, 3, 5, 8, 13, 21...), not only describes the growth of the rabbit population. We will consider the Pythagorean hypothesis that everything in the world is subject to certain relationships of numbers...

Introduction to MQL5 (Part 33): Mastering API and WebRequest Function in MQL5 (VII)

This article demonstrates how to integrate the Google Generative AI API with MetaTrader 5 using MQL5. You will learn how to structure API requests, handle server responses, extract AI-generated content, manage rate limits, and save the results to a text file for easy access.

Building AI-Powered Trading Systems in MQL5 (Part 8): UI Polish with Animations, Timing Metrics, and Response Management Tools

In this article, we enhance the AI-powered trading system in MQL5 with user interface improvements, including loading animations for request preparation and thinking phases, as well as timing metrics displayed in responses for better feedback. We add response management tools like regenerate buttons to re-query the AI and export options to save the last response to a file, streamlining interaction.

Successful Restaurateur Algorithm (SRA)

Successful Restaurateur Algorithm (SRA) is an innovative optimization method inspired by restaurant business management principles. Unlike traditional approaches, SRA does not discard weak solutions, but improves them by combining with elements of successful ones. The algorithm shows competitive results and offers a fresh perspective on balancing exploration and exploitation in optimization problems.

Implementing Practical Modules from Other Languages in MQL5 (Part 06): Python-Like File IO operations in MQL5

This article shows how to simplify complex MQL5 file operations by building a Python-style interface for effortless reading and writing. It explains how to recreate Python’s intuitive file-handling patterns through custom functions and classes. The result is a cleaner, more reliable approach to MQL5 file I/O.

Pure implementation of RSA encryption in MQL5

MQL5 lacks built-in asymmetric cryptography, making secure data exchange over insecure channels like HTTP difficult. This article presents a pure MQL5 implementation of RSA using PKCS#1 v1.5 padding, enabling safe transmission of AES session keys and small data blocks without external libraries. This approach provides HTTPS-like security over standard HTTP and even more, it fills an important gap in secure communication for MQL5 applications.

Introduction to MQL5 (Part 32): Mastering API and WebRequest Function in MQL5 (VI)

This article will show you how to visualize candle data obtained via the WebRequest function and API in candle format. We'll use MQL5 to read the candle data from a CSV file and display it as custom candles on the chart, since indicators cannot directly use the WebRequest function.

Building AI-Powered Trading Systems in MQL5 (Part 7): Further Modularization and Automated Trading

In this article, we enhance the AI-powered trading system's modularity by separating UI components into a dedicated include file. The system now automates trade execution based on AI-generated signals, parsing JSON responses for BUY/SELL/NONE with entry/SL/TP, visualizing patterns like engulfing or divergences on charts with arrows, lines, and labels, and optional auto-signal checks on new bars.