Pipelines in MQL5

In this piece, we look at a key data preparation step for machine learning that is gaining rapid significance. Data Preprocessing Pipelines. These in essence are a streamlined sequence of data transformation steps that prepare raw data before it is fed to a model. As uninteresting as this may initially seem to the uninducted, this ‘data standardization’ not only saves on training time and execution costs, but it goes a long way in ensuring better generalization. In this article we are focusing on some SCIKIT-LEARN preprocessing functions, and while we are not exploiting the MQL5 Wizard, we will return to it in coming articles.

Using PSAR, Heiken Ashi, and Deep Learning Together for Trading

This project explores the fusion of deep learning and technical analysis to test trading strategies in forex. A Python script is used for rapid experimentation, employing an ONNX model alongside traditional indicators like PSAR, SMA, and RSI to predict EUR/USD movements. A MetaTrader 5 script then brings this strategy into a live environment, using historical data and technical analysis to make informed trading decisions. The backtesting results indicate a cautious yet consistent approach, with a focus on risk management and steady growth rather than aggressive profit-seeking.

Creating a market making algorithm in MQL5

How do market makers work? Let's consider this issue and create a primitive market-making algorithm.

Data Science and ML (Part 33): Pandas Dataframe in MQL5, Data Collection for ML Usage made easier

When working with machine learning models, it’s essential to ensure consistency in the data used for training, validation, and testing. In this article, we will create our own version of the Pandas library in MQL5 to ensure a unified approach for handling machine learning data, for ensuring the same data is applied inside and outside MQL5, where most of the training occurs.

Neural networks made easy (Part 38): Self-Supervised Exploration via Disagreement

One of the key problems within reinforcement learning is environmental exploration. Previously, we have already seen the research method based on Intrinsic Curiosity. Today I propose to look at another algorithm: Exploration via Disagreement.

Neural networks made easy (Part 50): Soft Actor-Critic (model optimization)

In the previous article, we implemented the Soft Actor-Critic algorithm, but were unable to train a profitable model. Here we will optimize the previously created model to obtain the desired results.

Interview with Alexander Arashkevich (ATC 2011)

The Championship fervour has finally subsided and we can take a breath and start rethinking its results again. And we have another winner Alexander Arashkevich (AAA777) from Belarus, who has won a special prize from the major sponsor of Automated Trading Championship 2011 - a 3 day trip to one of the Formula One races of the 2012 season. We could not miss the opportunity to talk with him.

Building A Candlestick Trend Constraint Model (Part 7): Refining our model for EA development

In this article, we will delve into the detailed preparation of our indicator for Expert Advisor (EA) development. Our discussion will encompass further refinements to the current version of the indicator to enhance its accuracy and functionality. Additionally, we will introduce new features that mark exit points, addressing a limitation of the previous version, which only identified entry points.

ATC Champions League: Interview with Boris Odintsov (ATC 2011)

Interview with Boris Odintsov (bobsley) is the last one within the ATC Champions League project. Boris won the Automated Trading Championship 2010 - the first Championship held for the Expert Advisors in the new MQL5 language. Having appeared in the top ten already in the first week of the ATC 2010, his EA brought it to the finish and earned $77,000. This year, Boris participates in the competition with the same Expert Advisor with modified settings. Perhaps the robot would still be able to repeat its success.

Developing a Replay System (Part 78): New Chart Trade (V)

In this article, we will look at how to implement part of the receiver code. Here we will implement an Expert Advisor to test and learn how the protocol interaction works. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Creating 3D bars based on time, price and volume

The article dwells on multivariate 3D price charts and their creation. We will also consider how 3D bars predict price reversals, and how Python and MetaTrader 5 allow us to plot these volume bars in real time.

Finding custom currency pair patterns in Python using MetaTrader 5

Are there any repeating patterns and regularities in the Forex market? I decided to create my own pattern analysis system using Python and MetaTrader 5. A kind of symbiosis of math and programming for conquering Forex.

Neural Networks in Trading: Hierarchical Vector Transformer (HiVT)

We invite you to get acquainted with the Hierarchical Vector Transformer (HiVT) method, which was developed for fast and accurate forecasting of multimodal time series.

Neural networks made easy (Part 43): Mastering skills without the reward function

The problem of reinforcement learning lies in the need to define a reward function. It can be complex or difficult to formalize. To address this problem, activity-based and environment-based approaches are being explored to learn skills without an explicit reward function.

Price Action Analysis Toolkit Development (Part 29): Boom and Crash Interceptor EA

Discover how the Boom & Crash Interceptor EA transforms your charts into a proactive alert system-spotting explosive moves with lightning-fast velocity scans, volatility surge checks, trend confirmation, and pivot-zone filters. With crisp green “Boom” and red “Crash” arrows guiding your every decision, this tool cuts through the noise and lets you capitalize on market spikes like never before. Dive in to see how it works and why it can become your next essential edge.

Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization (Part III)

In this article the author continues to analyze implementation algorithms of simplest trading systems and introduces backtesting automation. The article will be useful for beginning traders and EA writers.

Neural networks made easy (Part 48): Methods for reducing overestimation of Q-function values

In the previous article, we introduced the DDPG method, which allows training models in a continuous action space. However, like other Q-learning methods, DDPG is prone to overestimating Q-function values. This problem often results in training an agent with a suboptimal strategy. In this article, we will look at some approaches to overcome the mentioned issue.

Do Traders Need Services From Developers?

Algorithmic trading becomes more popular and needed, which naturally led to a demand for exotic algorithms and unusual tasks. To some extent, such complex applications are available in the Code Base or in the Market. Although traders have simple access to those apps in a couple of clicks, these apps may not satisfy all needs in full. In this case, traders look for developers who can write a desired application in the MQL5 Freelance section and assign an order.

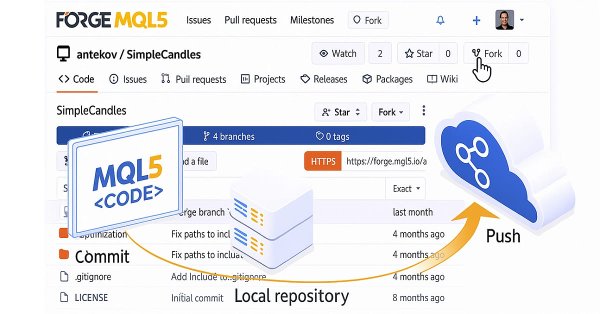

Moving to MQL5 Algo Forge (Part 2): Working with Multiple Repositories

In this article, we are considering one of the possible approaches to organizing the storage of the project's source code in a public repository. We will distribute the code across different branches to establish clear and convenient rules for the project development.

Master MQL5 from beginner to pro (Part V): Fundamental control flow operators

This article explores the key operators used to modify the program's execution flow: conditional statements, loops, and switch statements. Utilizing these operators will allow the functions we create to behave more "intelligently".

Interview with Ge Senlin (ATC 2011)

The Expert Advisor by Ge Senlin (yyy999) from China got featured in the top ten of the Automated Trading Championship 2011 in late October and hasn't left it since then. Not often participants from the PRC show good results in the Championship - Forex trading is not allowed in this country. After the poor results in the previous year ATC, Senlin has prepared a new multicurrency Expert Advisor that never closes loss positions and uses position increase instead. Let's see whether this EA will be able to rise even higher with such a risky strategy.

Self Optimizing Expert Advisor With MQL5 And Python (Part V): Deep Markov Models

In this discussion, we will apply a simple Markov Chain on an RSI Indicator, to observe how price behaves after the indicator passes through key levels. We concluded that the strongest buy and sell signals on the NZDJPY pair are generated when the RSI is in the 11-20 range and 71-80 range, respectively. We will demonstrate how you can manipulate your data, to create optimal trading strategies that are learned directly from the data you have. Furthermore, we will demonstrate how to train a deep neural network to learn to use the transition matrix optimally.

Robustness Testing on Expert Advisors

In strategy development, there are many intricate details to consider, many of which are not highlighted for beginner traders. As a result, many traders, myself included, have had to learn these lessons the hard way. This article is based on my observations of common pitfalls that most beginner traders encounter when developing strategies on MQL5. It will offer a range of tips, tricks, and examples to help identify the disqualification of an EA and test the robustness of our own EAs in an easy-to-implement way. The goal is to educate readers, helping them avoid future scams when purchasing EAs as well as preventing mistakes in their own strategy development.

MQL5 Wizard Techniques you should know (Part 78): Gator and AD Oscillator Strategies for Market Resilience

The article presents the second half of a structured approach to trading with the Gator Oscillator and Accumulation/Distribution. By introducing five new patterns, the author shows how to filter false moves, detect early reversals, and align signals across timeframes. With clear coding examples and performance tests, the material bridges theory and practice for MQL5 developers.

News Trading Made Easy (Part 6): Performing Trades (III)

In this article news filtration for individual news events based on their IDs will be implemented. In addition, previous SQL queries will be improved to provide additional information or reduce the query's runtime. Furthermore, the code built in the previous articles will be made functional.

MQL5 Wizard Techniques you should know (Part 08): Perceptrons

Perceptrons, single hidden layer networks, can be a good segue for anyone familiar with basic automated trading and is looking to dip into neural networks. We take a step by step look at how this could be realized in a signal class assembly that is part of the MQL5 Wizard classes for expert advisors.

Price Action Analysis Toolkit Development (Part 15): Introducing Quarters Theory (I) — Quarters Drawer Script

Points of support and resistance are critical levels that signal potential trend reversals and continuations. Although identifying these levels can be challenging, once you pinpoint them, you’re well-prepared to navigate the market. For further assistance, check out the Quarters Drawer tool featured in this article, it will help you identify both primary and minor support and resistance levels.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs(IV) — Test Trading Strategy

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Timeseries in DoEasy library (part 57): Indicator buffer data object

In the article, develop an object which will contain all data of one buffer for one indicator. Such objects will be necessary for storing serial data of indicator buffers. With their help, it will be possible to sort and compare buffer data of any indicators, as well as other similar data with each other.

DoEasy. Controls (Part 16): TabControl WinForms object — several rows of tab headers, stretching headers to fit the container

In this article, I will continue the development of TabControl and implement the arrangement of tab headers on all four sides of the control for all modes of setting the size of headers: Normal, Fixed and Fill To Right.

Building A Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (II)

Think about an independent Expert Advisor. Previously, we discussed an indicator-based Expert Advisor that also partnered with an independent script for drawing risk and reward geometry. Today, we will discuss the architecture of an MQL5 Expert Advisor, that integrates, all the features in one program.

Self Optimizing Expert Advisors in MQL5 (Part 17): Ensemble Intelligence

All algorithmic trading strategies are difficult to set up and maintain, regardless of complexity—a challenge shared by beginners and experts alike. This article introduces an ensemble framework where supervised models and human intuition work together to overcome their shared limitations. By aligning a moving average channel strategy with a Ridge Regression model on the same indicators, we achieve centralized control, faster self-correction, and profitability from otherwise unprofitable systems.

Multiple Symbol Analysis With Python And MQL5 (Part 3): Triangular Exchange Rates

Traders often face drawdowns from false signals, while waiting for confirmation can lead to missed opportunities. This article introduces a triangular trading strategy using Silver’s pricing in Dollars (XAGUSD) and Euros (XAGEUR), along with the EURUSD exchange rate, to filter out noise. By leveraging cross-market relationships, traders can uncover hidden sentiment and refine their entries in real time.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (Final Part)

The use of anisotropic diffusion processes for encoding the initial data in a hyperbolic latent space, as proposed in the HypDIff framework, assists in preserving the topological features of the current market situation and improves the quality of its analysis. In the previous article, we started implementing the proposed approaches using MQL5. Today we will continue the work we started and will bring it to its logical conclusion.

MQL5 Trading Toolkit (Part 8): How to Implement and Use the History Manager EX5 Library in Your Codebase

Discover how to effortlessly import and utilize the History Manager EX5 library in your MQL5 source code to process trade histories in your MetaTrader 5 account in this series' final article. With simple one-line function calls in MQL5, you can efficiently manage and analyze your trading data. Additionally, you will learn how to create different trade history analytics scripts and develop a price-based Expert Advisor as practical use-case examples. The example EA leverages price data and the History Manager EX5 library to make informed trading decisions, adjust trade volumes, and implement recovery strategies based on previously closed trades.

Reimagining Classic Strategies (Part II): Bollinger Bands Breakouts

This article explores a trading strategy that integrates Linear Discriminant Analysis (LDA) with Bollinger Bands, leveraging categorical zone predictions for strategic market entry signals.

Vladimir Tsyrulnik: The Essense of my program is improvisation! (ATC 2010)

Vladimir Tsyrulnik is the holder of one of the brightest highs of the current Championship. By the end of the third trading week Vladimir's Expert Advisor was on the sixth position. The IMEX algorithm the Expert Advisor is based on was developed by Vladimir. To learn more about this algorithm, we had an interview with Vladimir.

Mastering File Operations in MQL5: From Basic I/O to Building a Custom CSV Reader

This article focuses on essential MQL5 file-handling techniques, spanning trade logs, CSV processing, and external data integration. It offers both conceptual understanding and hands-on coding guidance. Readers will learn to build a custom CSV importer class step-by-step, gaining practical skills for real-world applications.

MQL5 Wizard Techniques you should know (Part 71): Using Patterns of MACD and the OBV

The Moving-Average-Convergence-Divergence (MACD) oscillator and the On-Balance-Volume (OBV) oscillator are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This pairing, as is practice in these article series, is complementary with the MACD affirming trends while OBV checks volume. As usual, we use the MQL5 wizard to build and test any potential these two may possess.

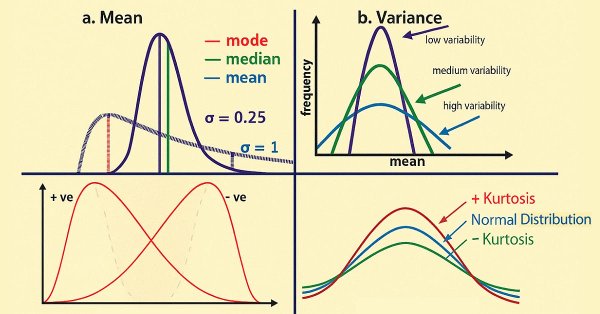

Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds