Neural networks made easy (Part 18): Association rules

As a continuation of this series of articles, let's consider another type of problems within unsupervised learning methods: mining association rules. This problem type was first used in retail, namely supermarkets, to analyze market baskets. In this article, we will talk about the applicability of such algorithms in trading.

Building a Custom Market Regime Detection System in MQL5 (Part 1): Indicator

This article details creating an MQL5 Market Regime Detection System using statistical methods like autocorrelation and volatility. It provides code for classes to classify trending, ranging, and volatile conditions and a custom indicator.

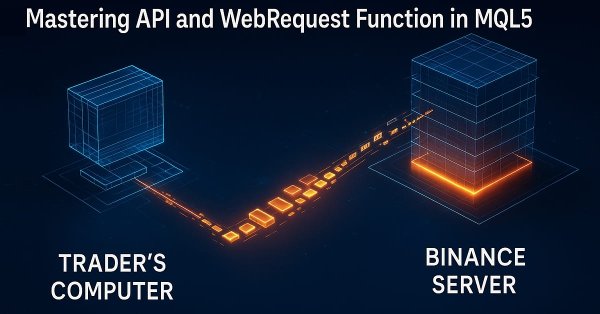

Introduction to MQL5 (Part 29): Mastering API and WebRequest Function in MQL5 (III)

In this article, we continue mastering API and WebRequest in MQL5 by retrieving candlestick data from an external source. We focus on splitting the server response, cleaning the data, and extracting essential elements such as opening time and OHLC values for multiple daily candles, preparing the data for further analysis.

Cyclic Parthenogenesis Algorithm (CPA)

The article considers a new population optimization algorithm - Cyclic Parthenogenesis Algorithm (CPA), inspired by the unique reproductive strategy of aphids. The algorithm combines two reproduction mechanisms — parthenogenesis and sexual reproduction — and also utilizes the colonial structure of the population with the possibility of migration between colonies. The key features of the algorithm are adaptive switching between different reproductive strategies and a system of information exchange between colonies through the flight mechanism.

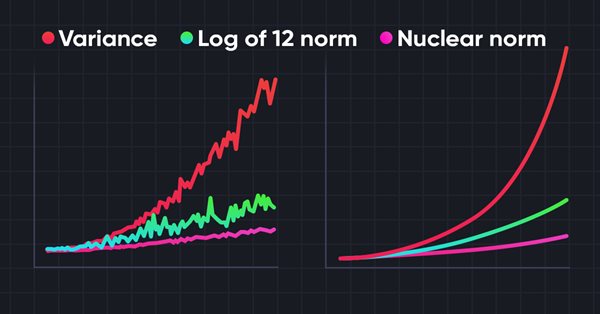

Neural networks made easy (Part 56): Using nuclear norm to drive research

The study of the environment in reinforcement learning is a pressing problem. We have already looked at some approaches previously. In this article, we will have a look at yet another method based on maximizing the nuclear norm. It allows agents to identify environmental states with a high degree of novelty and diversity.

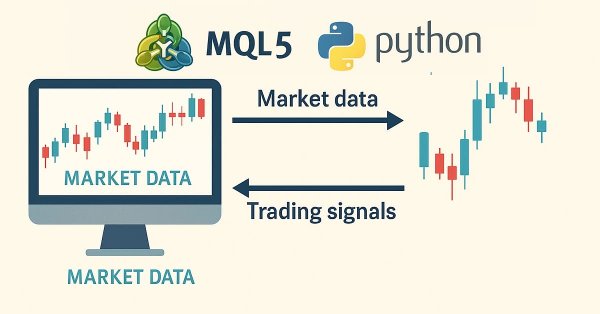

From Python to MQL5: A Journey into Quantum-Inspired Trading Systems

The article explores the development of a quantum-inspired trading system, transitioning from a Python prototype to an MQL5 implementation for real-world trading. The system uses quantum computing principles like superposition and entanglement to analyze market states, though it runs on classical computers using quantum simulators. Key features include a three-qubit system for analyzing eight market states simultaneously, 24-hour lookback periods, and seven technical indicators for market analysis. While the accuracy rates might seem modest, they provide a significant edge when combined with proper risk management strategies.

The Statistic Analysis of Market Movements and Their Prognoses

The present article contemplates the wide opportunities of the statistic approach to marketing. Unfortunately, beginner traders deliberately fail to apply the really mighty science of statistics. Meanwhile, it is the only thing they use subconsciously while analyzing the market. Besides, statistics can give answers to many questions.

Neural Networks in Trading: A Parameter-Efficient Transformer with Segmented Attention (PSformer)

This article introduces the new PSformer framework, which adapts the architecture of the vanilla Transformer to solving problems related to multivariate time series forecasting. The framework is based on two key innovations: the Parameter Sharing (PS) mechanism and the Segment Attention (SegAtt).

Color buffers in multi-symbol multi-period indicators

In this article, we will review the structure of the indicator buffer in multi-symbol, multi-period indicators and organize the display of colored buffers of these indicators on the chart.

ALGLIB library optimization methods (Part II)

In this article, we will continue to study the remaining optimization methods from the ALGLIB library, paying special attention to their testing on complex multidimensional functions. This will allow us not only to evaluate the efficiency of each algorithm, but also to identify their strengths and weaknesses in different conditions.

Neural networks made easy (Part 54): Using random encoder for efficient research (RE3)

Whenever we consider reinforcement learning methods, we are faced with the issue of efficiently exploring the environment. Solving this issue often leads to complication of the algorithm and training of additional models. In this article, we will look at an alternative approach to solving this problem.

Statistical Arbitrage Through Mean Reversion in Pairs Trading: Beating the Market by Math

This article describes the fundamentals of portfolio-level statistical arbitrage. Its goal is to facilitate the understanding of the principles of statistical arbitrage to readers without deep math knowledge and propose a starting point conceptual framework. The article includes a working Expert Advisor, some notes about its one-year backtest, and the respective backtest configuration settings (.ini file) for the reproduction of the experiment.

Data Science and ML (Part 40): Using Fibonacci Retracements in Machine Learning data

Fibonacci retracements are a popular tool in technical analysis, helping traders identify potential reversal zones. In this article, we’ll explore how these retracement levels can be transformed into target variables for machine learning models to help them understand the market better using this powerful tool.

Data label for time series mining (Part 3):Example for using label data

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

Building A Candlestick Trend Constraint Model (Part 9): Multiple Strategies Expert Advisor (I)

Today, we will explore the possibilities of incorporating multiple strategies into an Expert Advisor (EA) using MQL5. Expert Advisors provide broader capabilities than just indicators and scripts, allowing for more sophisticated trading approaches that can adapt to changing market conditions. Find, more in this article discussion.

Price Action Analysis Toolkit Development (Part 35): Training and Deploying Predictive Models

Historical data is far from “trash”—it’s the foundation of any robust market analysis. In this article, we’ll take you step‑by‑step from collecting that history to using it to train a predictive model, and finally deploying that model for live price forecasts. Read on to learn how!

Tricolor Indicators and Some Opportunities for Maximal Simplification of Writing Indicators

In this article the author dwells on some means of increasing indicators' informational value for visual trading. The author analyzes the realization of tricolor indicators, indicators, for building which data from other timeframes is used, and continues to dwell on the library of indicators, described in the article "Effective Averaging Algorithms with Minimal Lag: Use in Indicators"

Three-Dimensional Graphs - a Professional Tool of Market Analyzing

In this article we will write a simple library for the construction of 3D graphs and their further viewing in Microsoft Excel. We will use standard MQL4 options to prepare and export data into *.csv file.

Price Action Analysis Toolkit Development (Part 21): Market Structure Flip Detector Tool

The Market Structure Flip Detector Expert Advisor (EA) acts as your vigilant partner, constantly observing shifts in market sentiment. By utilizing Average True Range (ATR)-based thresholds, it effectively detects structure flips and labels each Higher Low and Lower High with clear indicators. Thanks to MQL5’s swift execution and flexible API, this tool offers real-time analysis that adjusts the display for optimal readability and provides a live dashboard to monitor flip counts and timings. Furthermore, customizable sound and push notifications guarantee that you stay informed of critical signals, allowing you to see how straightforward inputs and helper routines can transform price movements into actionable strategies.

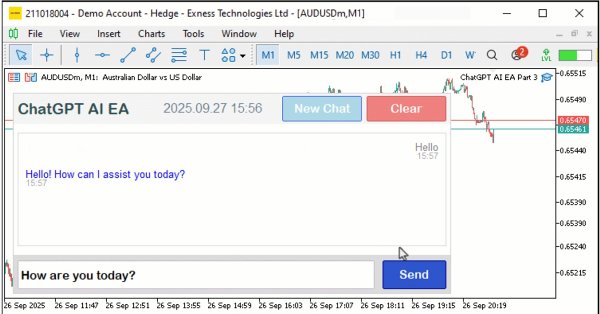

Building AI-Powered Trading Systems in MQL5 (Part 3): Upgrading to a Scrollable Single Chat-Oriented UI

In this article, we upgrade the ChatGPT-integrated program in MQL5 to a scrollable single chat-oriented UI, enhancing conversation history display with timestamps and dynamic scrolling. The system builds on JSON parsing to manage multi-turn messages, supporting customizable scrollbar modes and hover effects for improved user interaction.

Currency pair strength indicator in pure MQL5

We are going to develop a professional indicator for currency strength analysis in MQL5. This step-by-step guide will show you how to develop a powerful trading tool with a visual dashboard for MetaTrader 5. You will learn how to calculate the strength of currency pairs across multiple timeframes (H1, H4, D1), implement dynamic data updates, and create a user-friendly interface.

Secrets of MetaTrader 4 Client Terminal: File Library in MetaEditor

When creating custom programs, code editor is of great importance. The more functions are available in the editor, the faster and more convenient is creation of the program. Many programs are created on basis of an already existing code. Do you use an indicator or a script that does not fully suit your purposes? Download the code of this program from our website and customize it for yourselves.

Developing a trading Expert Advisor from scratch (Part 24): Providing system robustness (I)

In this article, we will make the system more reliable to ensure a robust and secure use. One of the ways to achieve the desired robustness is to try to re-use the code as much as possible so that it is constantly tested in different cases. But this is only one of the ways. Another one is to use OOP.

Developing a Replay System — Market simulation (Part 15): Birth of the SIMULATOR (V) - RANDOM WALK

In this article we will complete the development of a simulator for our system. The main goal here will be to configure the algorithm discussed in the previous article. This algorithm aims to create a RANDOM WALK movement. Therefore, to understand today's material, it is necessary to understand the content of previous articles. If you have not followed the development of the simulator, I advise you to read this sequence from the very beginning. Otherwise, you may get confused about what will be explained here.

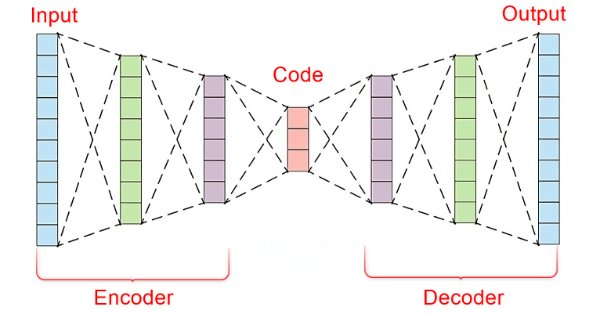

Data Science and Machine Learning (Part 22): Leveraging Autoencoders Neural Networks for Smarter Trades by Moving from Noise to Signal

In the fast-paced world of financial markets, separating meaningful signals from the noise is crucial for successful trading. By employing sophisticated neural network architectures, autoencoders excel at uncovering hidden patterns within market data, transforming noisy input into actionable insights. In this article, we explore how autoencoders are revolutionizing trading practices, offering traders a powerful tool to enhance decision-making and gain a competitive edge in today's dynamic markets.

Neural networks made easy (Part 75): Improving the performance of trajectory prediction models

The models we create are becoming larger and more complex. This increases the costs of not only their training as well as operation. However, the time required to make a decision is often critical. In this regard, let us consider methods for optimizing model performance without loss of quality.

DoEasy. Controls (Part 32): Horizontal ScrollBar, mouse wheel scrolling

In the article, we will complete the development of the horizontal scrollbar object functionality. We will also make it possible to scroll the contents of the container by moving the scrollbar slider and rotating the mouse wheel, as well as make additions to the library, taking into account the new order execution policy and new runtime error codes in MQL5.

MQL5 Wizard techniques you should know (Part 04): Linear Discriminant Analysis

Todays trader is a philomath who is almost always looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders in this effort.

Reimagining Classic Strategies (Part 16): Double Bollinger Band Breakouts

This article walks the reader through a reimagined version of the classical Bollinger Band breakout strategy. It identifies key weaknesses in the original approach, such as its well-known susceptibility to false breakouts. The article aims to introduce a possible solution: the Double Bollinger Band trading strategy. This relatively lesser known approach supplements the weaknesses of the classical version and offers a more dynamic perspective on financial markets. It helps us overcome the old limitations defined by the original rules, providing traders with a stronger and more adaptive framework.

Neural networks made easy (Part 22): Unsupervised learning of recurrent models

We continue to study unsupervised learning algorithms. This time I suggest that we discuss the features of autoencoders when applied to recurrent model training.

Bill Williams Strategy with and without other indicators and predictions

In this article, we will take a look to one the famous strategies of Bill Williams, and discuss it, and try to improve the strategy with other indicators and with predictions.

Building a Custom Market Regime Detection System in MQL5 (Part 2): Expert Advisor

This article details building an adaptive Expert Advisor (MarketRegimeEA) using the regime detector from Part 1. It automatically switches trading strategies and risk parameters for trending, ranging, or volatile markets. Practical optimization, transition handling, and a multi-timeframe indicator are included.

Building AI-Powered Trading Systems in MQL5 (Part 4): Overcoming Multiline Input, Ensuring Chat Persistence, and Generating Signals

In this article, we enhance the ChatGPT-integrated program in MQL5 overcoming multiline input limitations with improved text rendering, introducing a sidebar for navigating persistent chat storage using AES256 encryption and ZIP compression, and generating initial trade signals through chart data integration.

Population optimization algorithms: Monkey algorithm (MA)

In this article, I will consider the Monkey Algorithm (MA) optimization algorithm. The ability of these animals to overcome difficult obstacles and get to the most inaccessible tree tops formed the basis of the idea of the MA algorithm.

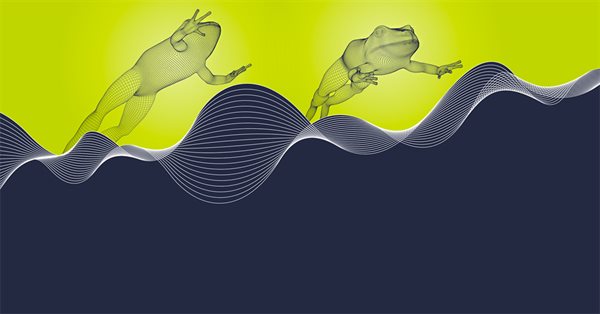

Population optimization algorithms: Shuffled Frog-Leaping algorithm (SFL)

The article presents a detailed description of the shuffled frog-leaping (SFL) algorithm and its capabilities in solving optimization problems. The SFL algorithm is inspired by the behavior of frogs in their natural environment and offers a new approach to function optimization. The SFL algorithm is an efficient and flexible tool capable of processing a variety of data types and achieving optimal solutions.

Developing an MQL5 RL agent with RestAPI integration (Part 2): MQL5 functions for HTTP interaction with the tic-tac-toe game REST API

In this article we will talk about how MQL5 can interact with Python and FastAPI, using HTTP calls in MQL5 to interact with the tic-tac-toe game in Python. The article discusses the creation of an API using FastAPI for this integration and provides a test script in MQL5, highlighting the versatility of MQL5, the simplicity of Python, and the effectiveness of FastAPI in connecting different technologies to create innovative solutions.

Measuring Indicator Information

Machine learning has become a popular method for strategy development. Whilst there has been more emphasis on maximizing profitability and prediction accuracy , the importance of processing the data used to build predictive models has not received a lot of attention. In this article we consider using the concept of entropy to evaluate the appropriateness of indicators to be used in predictive model building as documented in the book Testing and Tuning Market Trading Systems by Timothy Masters.

Introduction to MQL5 (Part 2): Navigating Predefined Variables, Common Functions, and Control Flow Statements

Embark on an illuminating journey with Part Two of our MQL5 series. These articles are not just tutorials, they're doorways to an enchanted realm where programming novices and wizards alike unite. What makes this journey truly magical? Part Two of our MQL5 series stands out with its refreshing simplicity, making complex concepts accessible to all. Engage with us interactively as we answer your questions, ensuring an enriching and personalized learning experience. Let's build a community where understanding MQL5 is an adventure for everyone. Welcome to the enchantment!

The Parafrac V2 Oscillator: Integrating Parabolic SAR with Average True Range

The Parafrac V2 Oscillator is an advanced technical analysis tool that integrates the Parabolic SAR with the Average True Range (ATR) to overcome limitations of its predecessor, which relied on fractals and was prone to signal spikes overshadowing previous and current signals. By leveraging ATR’s volatility measure, the version 2 offers a smoother, more reliable method for detecting trends, reversals, and divergences, helping traders reduce chart congestion and analysis paralysis.

Forex spread trading using seasonality

The article examines the possibilities of generating and providing reporting data on the use of the seasonality factor when trading spreads on Forex.