Larry Williams Market Secrets (Part 5): Automating the Volatility Breakout Strategy in MQL5

This article demonstrates how to automate Larry Williams’ volatility breakout strategy in MQL5 using a practical, step-by-step approach. You will learn how to calculate daily range expansions, derive buy and sell levels, manage risk with range-based stops and reward-based targets, and structure a professional Expert Advisor for MetaTrader 5. Designed for traders and developers looking to transform Larry Williams’ market concepts into a fully testable and deployable automated trading system.

Data Science and ML (Part 41): Forex and Stock Markets Pattern Detection using YOLOv8

Detecting patterns in financial markets is challenging because it involves seeing what's on the chart, something that's difficult to undertake in MQL5 due to image limitations. In this article, we are going to discuss a decent model made in Python that helps us detect patterns present on the chart with minimal effort.

Graphics in DoEasy library (Part 98): Moving pivot points of extended standard graphical objects

In the article, I continue the development of extended standard graphical objects and create the functionality for moving pivot points of composite graphical objects using the control points for managing the coordinates of the graphical object pivot points.

Triangular arbitrage with predictions

This article simplifies triangular arbitrage, showing you how to use predictions and specialized software to trade currencies smarter, even if you're new to the market. Ready to trade with expertise?

Build Self Optimizing Expert Advisors in MQL5 (Part 2): USDJPY Scalping Strategy

Join us today as we challenge ourselves to build a trading strategy around the USDJPY pair. We will trade candlestick patterns that are formed on the daily time frame because they potentially have more strength behind them. Our initial strategy was profitable, which encouraged us to continue refining the strategy and adding extra layers of safety, to protect the capital gained.

Outline of MetaTrader Market (Infographics)

A few weeks ago we published the infographic on Freelance service. We also promised to reveal some statistics of the MetaTrader Market. Now, we invite you to examine the data we have gathered.

Building A Candlestick Trend Constraint Model(Part 3): Detecting changes in trends while using this system

This article explores how economic news releases, investor behavior, and various factors can influence market trend reversals. It includes a video explanation and proceeds by incorporating MQL5 code into our program to detect trend reversals, alert us, and take appropriate actions based on market conditions. This builds upon previous articles in the series.

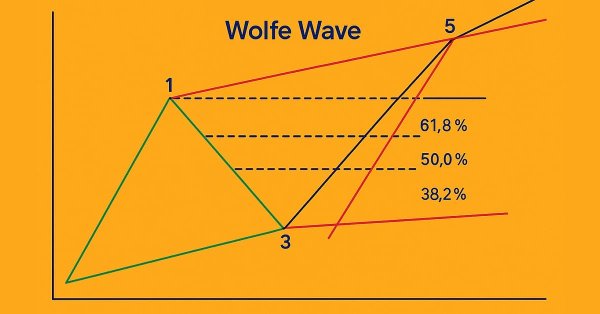

Introduction to MQL5 (Part 18): Introduction to Wolfe Wave Pattern

This article explains the Wolfe Wave pattern in detail, covering both the bearish and bullish variations. It also breaks down the step-by-step logic used to identify valid buy and sell setups based on this advanced chart pattern.

Creating a Trading Administrator Panel in MQL5 (Part III): Enhancing the GUI with Visual Styling (I)

In this article, we will focus on visually styling the graphical user interface (GUI) of our Trading Administrator Panel using MQL5. We’ll explore various techniques and features available in MQL5 that allow for customization and optimization of the interface, ensuring it meets the needs of traders while maintaining an attractive aesthetic.

SP500 Trading Strategy in MQL5 For Beginners

Discover how to leverage MQL5 to forecast the S&P 500 with precision, blending in classical technical analysis for added stability and combining algorithms with time-tested principles for robust market insights.

Integrating Hidden Markov Models in MetaTrader 5

In this article we demonstrate how Hidden Markov Models trained using Python can be integrated into MetaTrader 5 applications. Hidden Markov Models are a powerful statistical tool used for modeling time series data, where the system being modeled is characterized by unobservable (hidden) states. A fundamental premise of HMMs is that the probability of being in a given state at a particular time depends on the process's state at the previous time slot.

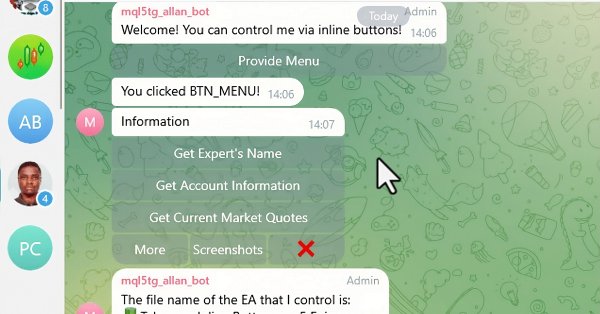

Creating an MQL5-Telegram Integrated Expert Advisor (Part 6): Adding Responsive Inline Buttons

In this article, we integrate interactive inline buttons into an MQL5 Expert Advisor, allowing real-time control via Telegram. Each button press triggers specific actions and sends responses back to the user. We also modularize functions for handling Telegram messages and callback queries efficiently.

Developing a Calendar-Based News Event Breakout Expert Advisor in MQL5

Volatility tends to peak around high-impact news events, creating significant breakout opportunities. In this article, we will outline the implementation process of a calendar-based breakout strategy. We'll cover everything from creating a class to interpret and store calendar data, developing realistic backtests using this data, and finally, implementing execution code for live trading.

Neural networks made easy (Part 58): Decision Transformer (DT)

We continue to explore reinforcement learning methods. In this article, I will focus on a slightly different algorithm that considers the Agent’s policy in the paradigm of constructing a sequence of actions.

How to Cut an EA Code for an Easier Life and Fewer Errors

A simple concept described in the article allows those developing automated trading systems in MQL4 to simplify existing trading systems, as well as reduce time needed for development of new systems due to shorter codes.

Neural networks made easy (Part 23): Building a tool for Transfer Learning

In this series of articles, we have already mentioned Transfer Learning more than once. However, this was only mentioning. in this article, I suggest filling this gap and taking a closer look at Transfer Learning.

Dynamic Swing Architecture: Market Structure Recognition from Swings to Automated Execution

This article introduces a fully automated MQL5 system designed to identify and trade market swings with precision. Unlike traditional fixed-bar swing indicators, this system adapts dynamically to evolving price structure—detecting swing highs and swing lows in real time to capture directional opportunities as they form.

DoEasy. Controls (Part 26): Finalizing the ToolTip WinForms object and moving on to ProgressBar development

In this article, I will complete the development of the ToolTip control and start the development of the ProgressBar WinForms object. While working on objects, I will develop universal functionality for animating controls and their components.

Developing a Replay System — Market simulation (Part 05): Adding Previews

We have managed to develop a way to implement the market replay system in a realistic and accessible way. Now let's continue our project and add data to improve the replay behavior.

Expert Advisor based on the universal MLP approximator

The article presents a simple and accessible way to use a neural network in a trading EA that does not require deep knowledge of machine learning. The method eliminates the target function normalization, as well as overcomes "weight explosion" and "network stall" issues offering intuitive training and visual control of the results.

Build Self Optimizing Expert Advisors in MQL5 (Part 8): Multiple Strategy Analysis

How best can we combine multiple strategies to create a powerful ensemble strategy? Join us in this discussion as we look to fit together three different strategies into our trading application. Traders often employ specialized strategies for opening and closing positions, and we want to know if our machines can perform this task better. For our opening discussion, we will get familiar with the faculties of the strategy tester and the principles of OOP we will need for this task.

Fast trading strategy tester in Python using Numba

The article implements a fast strategy tester for machine learning models using Numba. It is 50 times faster than the pure Python strategy tester. The author recommends using this library to speed up mathematical calculations, especially the ones involving loops.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs (III) – Adapter-Tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Neural networks made easy (Part 73): AutoBots for predicting price movements

We continue to discuss algorithms for training trajectory prediction models. In this article, we will get acquainted with a method called "AutoBots".

Price Action Analysis Toolkit Development (Part 23): Currency Strength Meter

Do you know what really drives a currency pair’s direction? It’s the strength of each individual currency. In this article, we’ll measure a currency’s strength by looping through every pair it appears in. That insight lets us predict how those pairs may move based on their relative strengths. Read on to learn more.

Data label for timeseries mining (Part 2):Make datasets with trend markers using Python

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

MQL5 Wizard Techniques you should know (Part 42): ADX Oscillator

The ADX is another relatively popular technical indicator used by some traders to gauge the strength of a prevalent trend. Acting as a combination of two other indicators, it presents as an oscillator whose patterns we explore in this article with the help of MQL5 wizard assembly and its support classes.

Price Action Analysis Toolkit Development (Part 30): Commodity Channel Index (CCI), Zero Line EA

Automating price action analysis is the way forward. In this article, we utilize the Dual CCI indicator, the Zero Line Crossover strategy, EMA, and price action to develop a tool that generates trade signals and sets stop-loss (SL) and take-profit (TP) levels using ATR. Please read this article to learn how we approach the development of the CCI Zero Line EA.

Interview with Nikolay Kositsin: multicurrency EA are less risky (ATC 2010)

Nikolay Kositsin has told us about his developments. He believes multicurrency Expert Advisors are a promising direction; and he is an experienced developer of such robots. At the championships, Nikolay participates only with multicurrency EAs. His Expert Advisor was the only multicurrency EA among the prize winners of all the ATC contests.

Building A Candlestick Trend Constraint Model (Part 1): For EAs And Technical Indicators

This article is aimed at beginners and pro-MQL5 developers. It provides a piece of code to define and constrain signal-generating indicators to trends in higher timeframes. In this way, traders can enhance their strategies by incorporating a broader market perspective, leading to potentially more robust and reliable trading signals.

Interview with Alexandr Artapov (ATC 2012)

It was during the second week of the Championship when the Expert Advisor of Alexandr Artapov (artall) found itself on the third position trading EURUSD and EURJPY. Then it briefly left TOP-10 to appear again after one month of struggle for survival. As it turned out, this trading robot is still having something up its sleeve.

Wrapping ONNX models in classes

Object-oriented programming enables creation of a more compact code that is easy to read and modify. Here we will have a look at the example for three ONNX models.

Price Action Analysis Toolkit Development (Part 12): External Flow (III) TrendMap

The flow of the market is determined by the forces between bulls and bears. There are specific levels that the market respects due to the forces acting on them. Fibonacci and VWAP levels are especially powerful in influencing market behavior. Join me in this article as we explore a strategy based on VWAP and Fibonacci levels for signal generation.

Developing a trading Expert Advisor from scratch (Part 27): Towards the future (II)

Let's move on to a more complete order system directly on the chart. In this article, I will show a way to fix the order system, or rather, to make it more intuitive.

Introduction to MQL5 (Part 13): A Beginner's Guide to Building Custom Indicators (II)

This article guides you through building a custom Heikin Ashi indicator from scratch and demonstrates how to integrate custom indicators into an EA. It covers indicator calculations, trade execution logic, and risk management techniques to enhance automated trading strategies.

Integrate Your Own LLM into EA (Part 2): Example of Environment Deployment

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

MQL5 Trading Toolkit (Part 3): Developing a Pending Orders Management EX5 Library

Learn how to develop and implement a comprehensive pending orders EX5 library in your MQL5 code or projects. This article will show you how to create an extensive pending orders management EX5 library and guide you through importing and implementing it by building a trading panel or graphical user interface (GUI). The expert advisor orders panel will allow users to open, monitor, and delete pending orders associated with a specified magic number directly from the graphical interface on the chart window.

Interview with Ruslan Ziyatdinov (ATC 2012)

The Championship keeps providing us with new discoveries, as well as new interesting Participants and unusual ideas implemented in the competition trading robots. While interviewing Ruslan Ziyatdinov (rusland1962), we learned about his simple approach to trading and found out why it is better to trade less frequently.

Chart Synchronization for Easier Technical Analysis

Chart Synchronization for Easier Technical Analysis is a tool that ensures all chart timeframes display consistent graphical objects like trendlines, rectangles, or indicators across different timeframes for a single symbol. Actions such as panning, zooming, or symbol changes are mirrored across all synced charts, allowing traders to seamlessly view and compare the same price action context in multiple timeframes.

Integrating MQL5 with data processing packages (Part 5): Adaptive Learning and Flexibility

This part focuses on building a flexible, adaptive trading model trained on historical XAUUSD data, preparing it for ONNX export and potential integration into live trading systems.