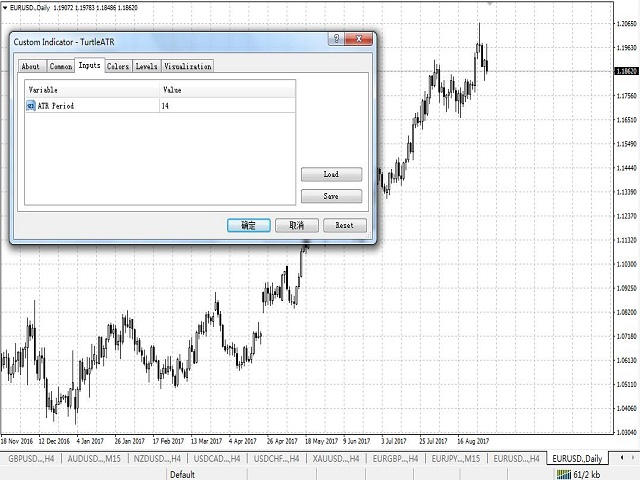

Turtle ATR

- Indicators

- Yupeng Xiao

- Version: 1.10

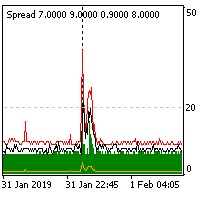

This indicator was modified according to the 'Way Of The Turtle'. The ATR indicator can be used as a reference to set stop-loss or take-profit, and also can be used to confirm the daily price range (also applicable to other cycles).

Calculation

The true range value is calculated as follows:

- TR = MAX(H-L, H-PDC, PDC-L)

Among them:

- H = Highest price of the current bar

- L = Lowest price of the current bar

- PDC = Close price of the previous bar

The average true range in 'Way Of The Turtle' is calculated as follows:

- ATR = ((period-1)*PDN+TR)/period

Among them:

- PDN = ATR value of the previous bar

- TR = True range value of the current bar

NOTE: We use the simple average value as the first ATR value.

Parameters

- ATR Period - set the period of the ATR indicator, default value is 14.

Thanks for sharing