Turtle ATR Channel

- Indicators

- Yupeng Xiao

- Version: 1.10

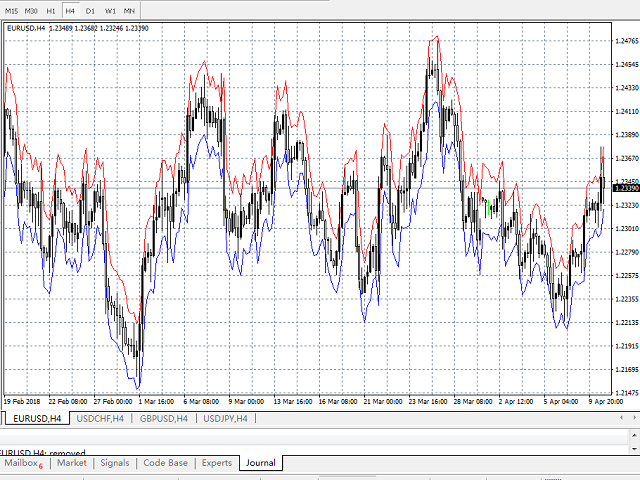

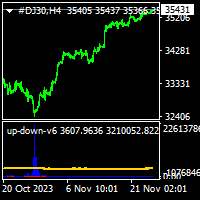

This indicator was modified according to the 'Way Of The Turtle'. It generates a channel based on the opening price and ATR values of the current bar. Turtle ATR Channel can be used to help identify overbought and oversold conditions in a market.

Calculation

upper channel = Open + r1*ATR

lower channel = Open - r2*ATR

Among them:

- Open is the opening price of the current bar.

- ATR is the ATR value of the current bar.

- r1, r2 are the ATR ratios.

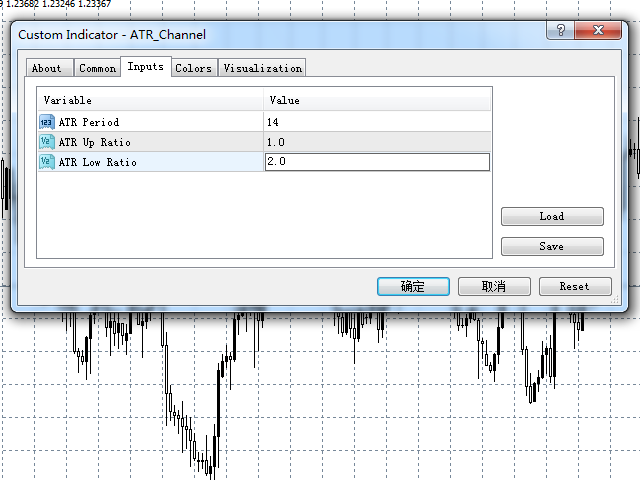

Input Parameters

- ATR Period - set the period of the ATR indicator, default value is 14.

- ATR Up Ratio - set the value of r1, default value is 1.0.

- ATR Low Ratio - set the value of r2, default value is 1.0.

How to trade

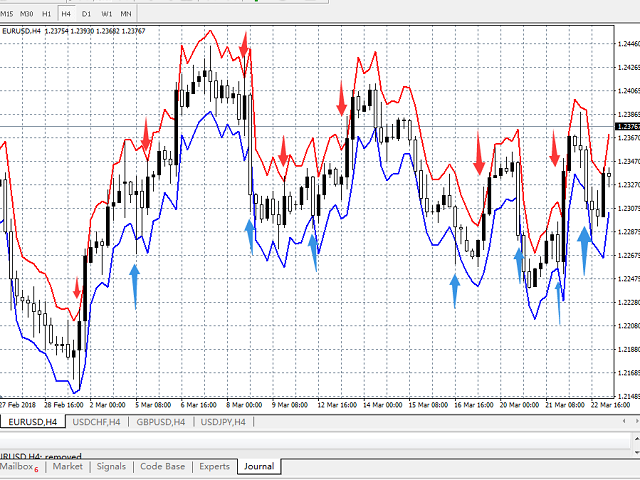

Basically Turtle ATR Channel can be used to help identify overbought and oversold conditions in a market. When a market’s price break through the upper channel, the market is considered overbought (selling area). Conversely, when a market’s price break through the lower channel, the market is considered oversold (buying area).

Note: When your opening position is lost out, stop trading at the same direction next time. For example, you opened a sell position when price broke through the upper channel and it was lost out. After that price broke through the upper channel again. At that moment you should not open a sell position and wait for the price to break through the lower channel.

It is applicable to all currencies and all timeframes.

Очень неплохой индикатор