Market structure forecaster

- Utilities

- Lawrence Chiiambb Mkandawi

- Version: 1.0

- Activations: 5

Market Structure Forecaster

"Know the market's next move before it happens. Analyzes price structure and applies advanced trading techniques to predict trending or ranging conditions with high accuracy."

The Professional's Edge in Predictive Market Analysis

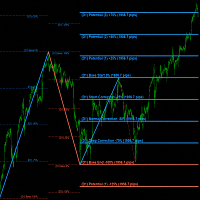

The Market Structure Forecaster represents the convergence of institutional-grade analytical techniques with actionable trading intelligence. This advanced system employs proprietary algorithms to decode price behavior's underlying architecture, transforming complex market dynamics into clear directional probabilities. By integrating multi-timeframe structural analysis with volume profile assessments and volatility metrics, it provides institutional-quality foresight previously accessible only to quantitative trading desks.

Our forecaster operates on a sophisticated framework that identifies emergent patterns within price action, distinguishing between transient noise and meaningful structural developments. The system evaluates swing point progressions, fractal formations, and momentum convergences to calculate probabilistic outcomes for three core market states: bullish trending environments, bearish trending phases, and consolidation ranges. This tri-modal assessment framework enables traders to align strategies with statistically favorable conditions while avoiding transitional market phases that erode capital.

The algorithmic engine incorporates several proprietary methodologies. First, it applies recursive pattern recognition to identify how minor structural formations aggregate into major trend developments. Second, it utilizes adaptive volatility bands to distinguish between healthy trend continuations and exhaustion signals. Third, it implements temporal analysis to forecast potential inflection points where ranging markets transition to trending regimes—or vice versa. This multi-dimensional approach generates what we term "Structural Confidence Scores," providing quantitative measures of forecast reliability.

Professional applications extend across asset classes and time horizons. Day traders utilize the system's intraday structural forecasts to identify high-probability breakout scenarios. Swing traders leverage its intermediate-term trend probability assessments for position sizing optimization. Portfolio managers employ its macro-structural analysis for asset allocation decisions across correlated instruments. The system's real-time adaptive learning continuously refines its parameters based on evolving market microstructure, ensuring relevance across varying volatility regimes.

Risk management integration represents a cornerstone of the forecaster's utility. By providing advance warning of potential structural shifts, it enables proactive adjustment of stop-loss parameters, position sizing calculations, and hedging strategies. The system identifies not only directional probabilities but also potential structural failure points—levels where prevailing market architecture would invalidate current forecasts, creating natural risk-definition boundaries.

Implementation yields tangible advantages: enhanced entry precision during trend initiations, improved exit timing prior to structural breakdowns, and optimized capital deployment during ranging conditions. Back-tested across multiple market cycles and asset classes, the forecaster demonstrates consistent predictive value, particularly during transitional market phases where conventional technical indicators typically fail.

This system transforms market structure from a retrospective analytical framework into a forward-looking strategic asset. It represents not merely another indicator, but a comprehensive analytical paradigm that bridges the gap between technical analysis and probabilistic trading. For the professional seeking to transcend reactive trading approaches, the Market Structure Forecaster provides the architectural blueprint for anticipating price movement before it manifests in observable chart patterns.

In essence, we've engineered anticipation into an analytical discipline. The Market Structure Forecaster doesn't follow markets—it anticipates their architectural evolution, providing the strategic foresight that defines professional trading excellence. This isn't about predicting the future; it's about understanding structural probabilities with sufficient clarity to trade today with tomorrow's perspective.

Predict structure. Trade probability. Manage with precision.