Advanced Volume Indicator

- Indicators

- Hozeifa M Haji

- Version: 1.1

- Activations: 5

What is this Indicator?

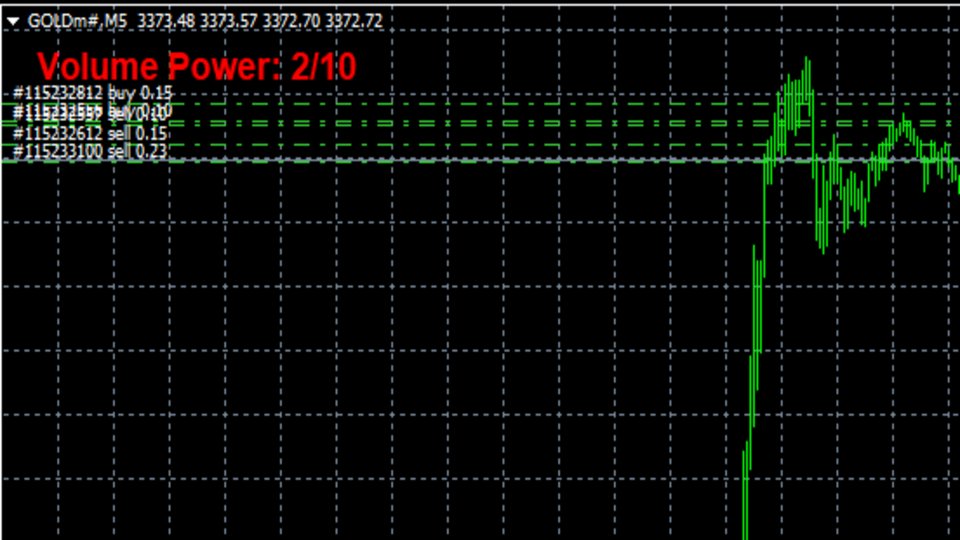

The Volume Power Meter is a lightweight MT4 indicator that measures the strength of trading volume and converts it into an easy-to-read rating between 1/10 and 10/10.

Instead of showing complex histograms or volume bars, it gives traders a simple numeric score in one corner of the chart:

The Volume Power Meter is a lightweight MT4 indicator that measures the strength of trading volume and converts it into an easy-to-read rating between 1/10 and 10/10.

Instead of showing complex histograms or volume bars, it gives traders a simple numeric score in one corner of the chart:

- 1/10 = Very weak volume

- 5/10 = Average volume

- 10/10 = Extremely high volume

This helps traders quickly judge market participation and momentum without cluttering their charts.

Features

- Simple Volume Rating: Displays volume power as a number out of 10.

- Color-Coded Levels:

- Red for weak volume (1–3)

- Yellow for moderate volume (4–6)

- Lime for strong volume (7–10)

- Corner Display: Clean and minimal text in the chart corner (you can choose position).

- Lightweight & Fast: No heavy calculations, only one text label.

- Customizable: Change font size, position, and averaging period.

Inputs / Settings

- LookbackBars → Number of candles used to calculate average volume (default: 50).

- Corner → Where to display the text (0 = Top-Left, 1 = Top-Right, 2 = Bottom-Left, 3 = Bottom-Right).

- X_Distance → Horizontal distance from the corner.

- Y_Distance → Vertical distance from the corner.

- FontSize → Size of the displayed text.

How it Works

- The indicator calculates the average tick volume of the last LookbackBars.

- It compares the current candle’s volume to that average.

- The result is scaled to 1–10:

- Average volume ≈ 5/10

- Half of average volume ≈ 2–3/10

- Twice the average volume ≈ 9–10/10

- The rating is displayed with automatic color coding.

Example Use Cases

- Scalpers can quickly see if the current market move has enough volume support.

- Breakout traders can confirm whether a breakout is happening with strong volume (8–10/10).

- Range traders can avoid weak, low-volume markets (1–3/10).

- General traders can filter trades based on market participation.