Meshor

- Experts

- Branislav Bridzik

- Version: 1.0

Meshor EA – Bollinger Breakout Strategy for Ranging Markets

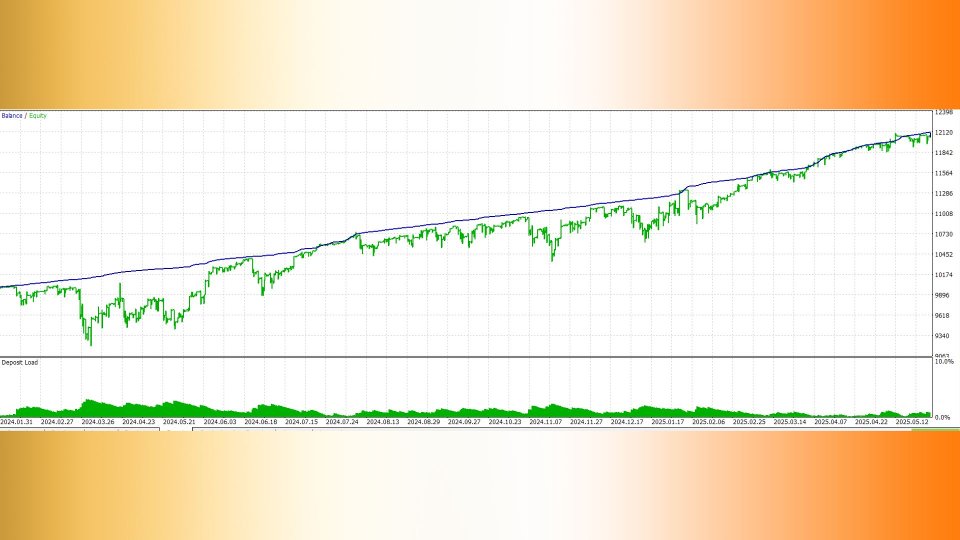

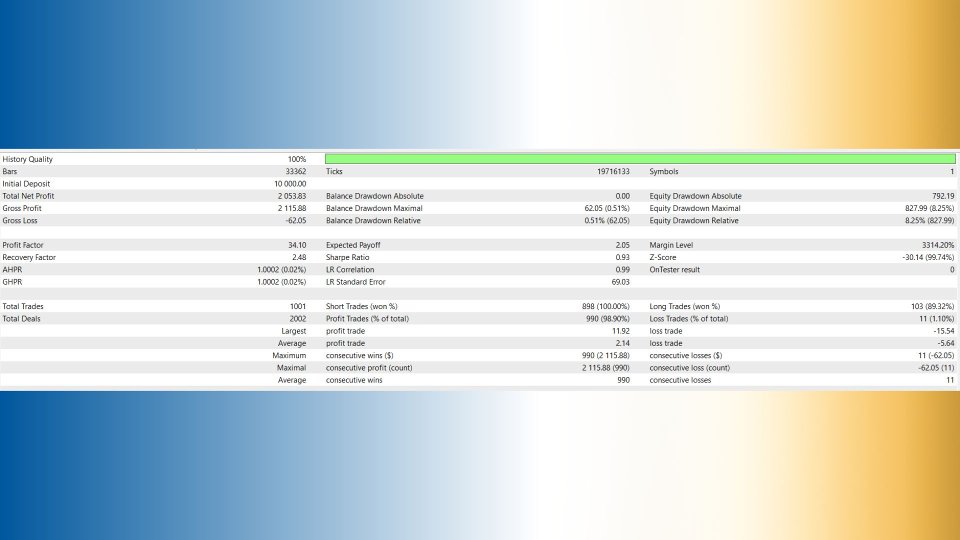

Meshor is a fully automated Expert Advisor designed for traders who want to take advantage of price reversals in ranging forex markets. Built around a Bollinger Band Breakout strategy, Meshor combines precision entry logic, dynamic position management, and adaptive profit-taking to deliver a disciplined trading experience. Whether you're trading major or minor currency pairs, Meshor offers a structured approach to mean reversion—but it’s important to understand both its strengths and limitations before going live.

Strategy Overview

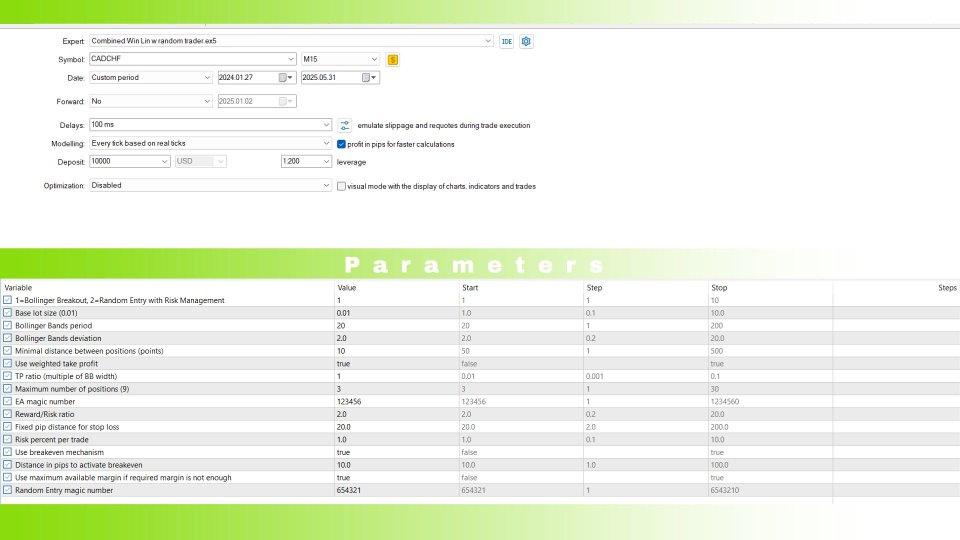

At its core, Meshor uses standard Bollinger Bands (20-period, 2.0 deviation) to detect potential breakout and reversal setups. The EA looks for moments when price closes outside the bands—either above the upper band or below the lower band—and then begins to reverse. These signals are interpreted as signs of exhaustion, where price is likely to revert back toward the mean.

-

Short Entry: Triggered when price closes above the upper Bollinger Band and then reverses downward.

-

Long Entry: Triggered when price closes below the lower Bollinger Band and then reverses upward.

This approach is particularly effective in sideways or consolidating markets, where price frequently oscillates between support and resistance levels.

Position Management & Pyramiding

Meshor trades in one direction at a time—either all long or all short positions. It uses a pyramiding system to manage exposure, allowing it to scale into trades as the market moves against the initial position. This can enhance profitability during strong reversals but also increases risk if the market continues trending in the opposite direction.

-

First and Second Positions: Use the base lot size.

-

Third to Fifth Positions: Each new position doubles the size of the previous one.

This dynamic sizing helps Meshor adapt to market conditions, but it also means that losses can grow quickly if the reversal doesn’t materialize.

Take Profit Mechanism

Meshor does not use stop losses or trailing exits. Instead, it relies on a fixed take profit system based on the width of the Bollinger Bands at the time of entry. This allows the EA to adjust its profit targets according to market volatility.

-

Weighted TP: 2x the Bollinger Band width (accounts for 75% of the TP logic).

-

Fixed TP: 1x the Bollinger Band width (accounts for 25% of the TP logic).

This dual-layer TP system ensures that trades have realistic profit expectations based on current market conditions.

Strengths

-

Mean Reversion Focus: Ideal for ranging markets with frequent reversals.

-

Clear Entry and Exit Rules: Based entirely on Bollinger Band behavior.

-

Dynamic Position Sizing: Pyramiding allows for flexible exposure.

-

Volatility-Based TP: Adapts profit targets to current market conditions.

-

Overtrading Filter: Helps reduce unnecessary entries.

Weaknesses

-

No Stop Loss: Trades rely solely on take profit, increasing risk.

-

Pyramiding Risk: Exposure grows exponentially with each added position.

-

Limited Confirmation: Strategy depends only on Bollinger Bands, without additional indicators.

-

Underperformance in Trending Markets: Meshor is not designed for strong directional moves.

Best Use Case

Meshor is best suited for traders who understand the risks of pyramiding and prefer trading in non-trending environments. It’s a powerful tool for capturing short-term reversals, but it requires careful backtesting and monitoring—especially when market conditions shift toward strong trends.

Before using Meshor in a live environment, it’s highly recommended to test it thoroughly on your chosen forex pairs. Market behavior can vary significantly between instruments, and performance will depend on volatility, liquidity, and price structure.

Meshor is not just another EA—it’s a specialized tool for traders who believe in the power of mean reversion and want a disciplined, rule-based system to execute that vision