Iron Side EA

- Experts

- Branislav Bridzik

- Version: 1.1

- Updated: 19 August 2025

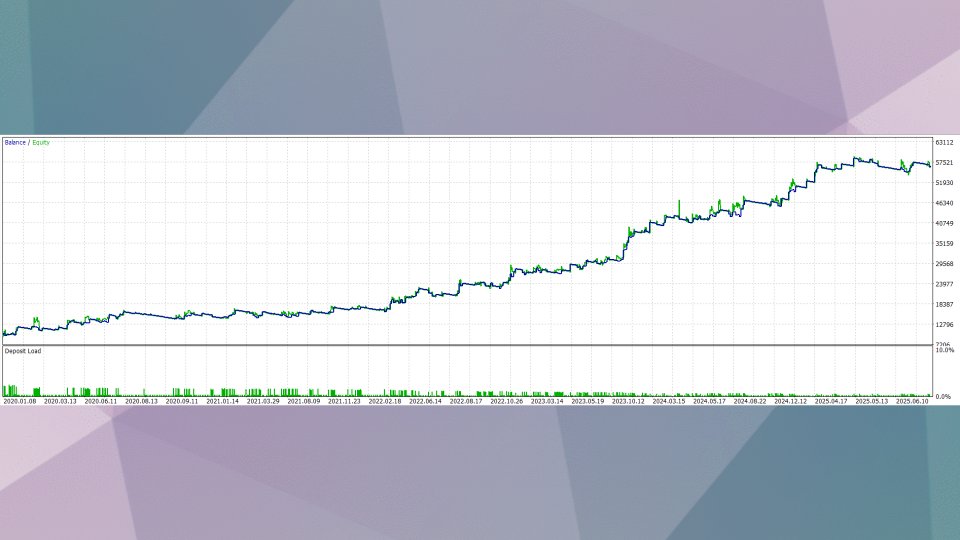

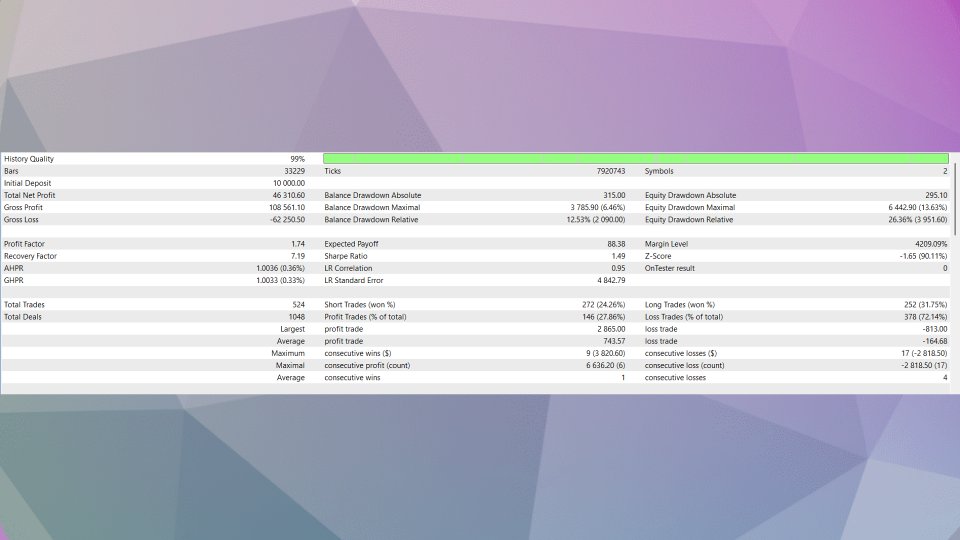

The Iron Side Expert Advisor (EA) is an automated trading system designed for the MetaTrader platform, featuring two independent systems: System 1, optimized for XAUUSD (Gold), and System 2, configured for USDJPY. The EA emphasizes price action and market conditions for precise entry and exit signals, with minimal reliance on specific indicators. Below is a detailed description of both systems, focusing on entry and exit signals as requested

Use on XAUUSD symbol on any timeframe. Iron Side trades both systems simulatneously from one chart. No need for separate setup. In inputs type the exact symbol name your broker uses for XAUUSD and USDJPY (e.g. XAUUSD.m, GOLD., USDJPY.pro etc.)

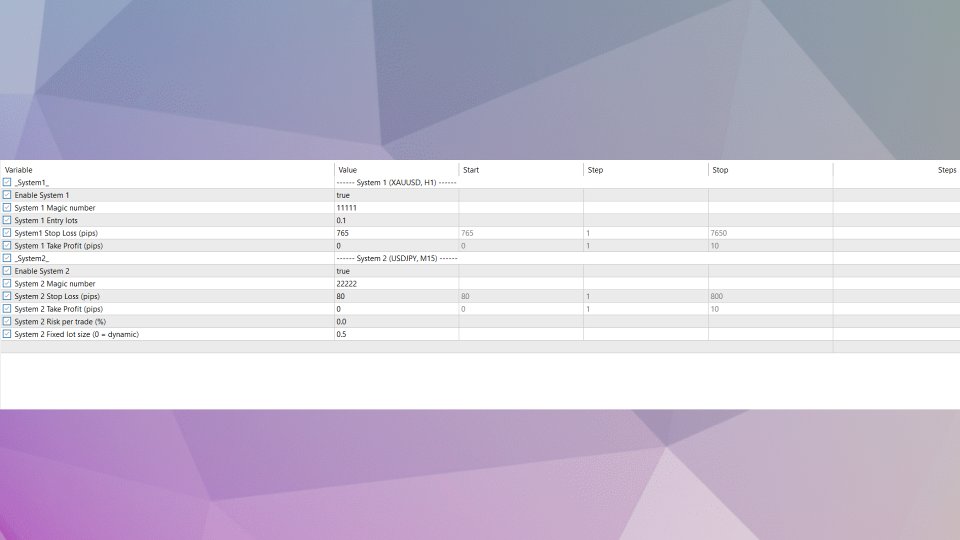

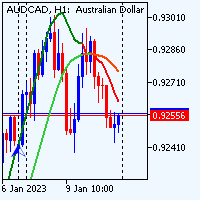

System 1: XAUUSD Trading Strategy Overview System 1 is tailored for trading XAUUSD, using a structured approach to identify entry and exit points based on price action and breakout patterns. It employs a fixed lot size of 0.10, a stop loss of 765 pips, and no predefined take profit, relying on specific exit signals to close trades.

Entry Signals: Buy Signal: Triggered when the price crosses above a key upper level after being below it previously, combined with a bullish confirmation from a short-term trend-following indicator, signaling a potential upward breakout or trend continuation. Sell Signal: Initiated when the price crosses below a key lower level after being above it previously, paired with a bearish confirmation from a short-term trend-following indicator, indicating a potential downward move.

Risk Management Stop Loss: Fixed at 765 pips to limit potential losses. Lot Size: Fixed at 0.10 for consistent risk exposure. No Take Profit: Relies on exit signals for flexibility in capturing larger market moves. Usage Instructions

Platform: Apply the EA to the XAUUSD chart in MetaTrader. Settings: Ensure Enable_System1 is true and verify default parameters (e.g., Magic_Number1 = 11111, Stop_Loss1 = 765, Entry_Amount1 = 0.10). Monitoring: The EA automatically manages trades based on defined signals. Ensure sufficient account balance to handle the fixed lot size and stop loss.

System 2: USDJPY Trading Strategy

Overview System 2 is designed for trading USDJPY, using a dynamic lot sizing option (or fixed at 0.5 lots) and a stop loss of 80 pips. It incorporates a trailing stop and account protection features, with no predefined take profit, relying on exit signals to close trades.

Entry Signals Buy Signal: Triggered when the price shows a sharp upward momentum shift, confirmed by a crossover in short-term market strength indicators, suggesting a potential bullish move. Sell Signal: Initiated when the price exhibits a sharp downward momentum shift, confirmed by a crossover in short-term market strength indicators, indicating a potential bearish move. Exit Signals

For Long Positions: Exit when a bearish crossover occurs in key trend-following indicators, signaling a potential reversal. Exit when a momentum indicator shows a bearish divergence, suggesting weakening bullish momentum. For Short Positions: Exit when a bullish crossover occurs in key trend-following indicators, indicating a potential reversal. Exit when a momentum indicator shows a bullish divergence, suggesting weakening bearish momentum. Trailing Stop: Adjusts the stop loss dynamically based on the highest high (for buys) or lowest low (for sells) of the previous bar, locking in profits as the trade moves favorably. Risk Management Stop Loss: Fixed at 80 pips to cap potential losses. Lot Size: Fixed at 0.5 or dynamic sizing based on risk percentage (configurable via Risk_Percent2). Account Protection: Includes limits on maximum open positions, daily loss, daily drawdown, and equity drawdown to safeguard the account. News Filter: Avoids trading during high or medium-impact news events for USD, JPY, or EUR, configurable via News_Priority2..

Notes Both systems prioritize price action and market conditions, using technical indicators for signal generation without heavy reliance on them. Ensure a stable internet connection and low-spread conditions for optimal performance on XAUUSD (System 1) and USDJPY (System 2). Systems can be enabled/disabled independently (Enable_System1 or Enable_System2) to focus on one pair. System 2’s news filter avoids trading during volatile news events, adjustable for priority or disableable.