Whale Tick Speed Reversal Trap

- Experts

- Mustafa Ozkurkcu

- Version: 1.0

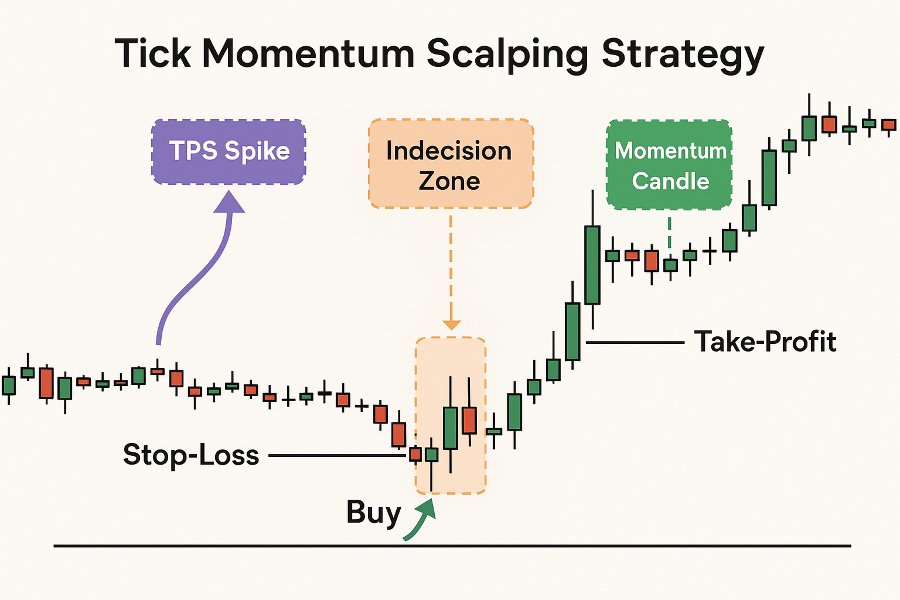

This Expert Advisor (EA) is designed to capture high-probability, short-term scalping opportunities by analyzing market speed (tick momentum). The strategy combines three core elements: tick rate analysis, periods of indecision, and momentum candles. The logic behind this combination is to enter a position right before a potential market breakout.

How the Strategy Works

-

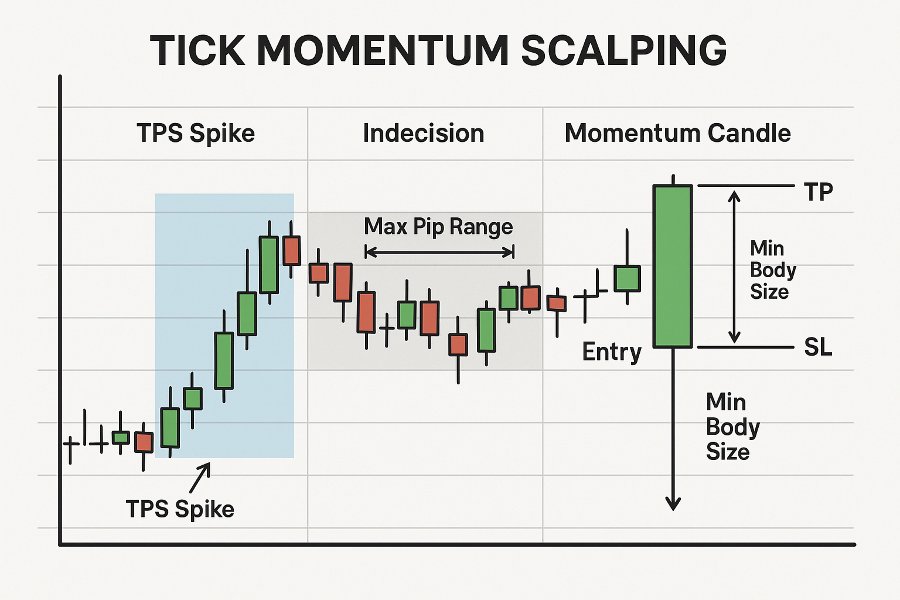

Tick Rate Detection (TPS - Ticks Per Second): The EA analyzes the number of ticks (price changes) within a specific timeframe (TPS Period). A detected tick flow that is much faster than normal (a TPS Spike) is considered a sign of high buying or selling pressure entering the market. This often indicates that large market participants ("Whales") are becoming active.

-

Indecision Period Confirmation: Immediately following a high tick rate, the strategy checks if the last few candles (Indecision Bars) have remained within a very small price range (Indecision Pips). This suggests a period of consolidation or indecision in the market before the next big move. The strategy interprets this as the "calm before the storm."

-

Entry with a Momentum Candle: After the period of indecision, the strategy looks for a strong momentum candle (Min Body Pips, Max Wick Ratio). This candle signals a clear breakout from the indecision zone, either to the upside or the downside. The direction of this candle determines the direction of the trade the EA will open.

When all these conditions are met simultaneously, the EA opens a trade in the direction of the momentum. The Take Profit (TP) and Stop Loss (SL) levels for the trade are dynamically set based on the high and low of the indecision candles. This ensures that risk management is adjusted according to the market's current volatility.

Explanation of Input Parameters

-

TPS Period: The time period in seconds used to calculate the average tick rate. Smaller values can generate more sensitive signals, while larger values may produce more stable signals.

-

TPS Multiplier: The multiplier used for detecting a high tick rate (spike) signal. This determines how much higher the current tick rate must be compared to the average. For example, a value of 3.0 looks for a rate 3 times the normal.

-

Tick Buffer Size: The size of the memory buffer where tick data is stored.

-

Indecision Pips: The maximum range in pips for indecision candles. This defines how "small" the candles must be.

-

Indecision Bars: The number of past candles to analyze for the indecision condition.

-

Min Body Pips: The minimum candle body size in pips for a momentum candle. This is used to filter out weak signals.

-

Max Wick Ratio: The maximum wick-to-body ratio for a momentum candle. This ensures the candle represents a strong, clean move.

-

Lot Size: The fixed trade volume (lot) to be used for each transaction.

-

SL Multiplier: A multiplier that determines the distance of the Stop Loss (SL) level relative to the indecision zone.

-

TP Multiplier: A ratio that determines how many times larger the Take Profit (TP) level will be compared to the Stop Loss level (TP/SL ratio).

-

Max Spread Pips: The maximum allowed spread in pips for a trade to be opened. If the spread is higher than this value, no trade will be placed.

-

Max Trade Duration: The maximum time in seconds that an open trade can remain active before being automatically closed.

-

Magic Number: A unique ID used by the EA to distinguish its own trades from those of other EAs or manual trades.

-

Use Comments: Determines whether comments will be added to the trades.

Important Risk Disclosure

This Expert Advisor is an automated tool that makes trading decisions for you. All trading in financial markets involves significant risks, and there is always a possibility of losing some or all of your capital.

-

Past Performance is Not a Guarantee of Future Results: The fact that this EA has generated profits in the past does not mean it will perform the same way in the future. Market conditions are constantly changing, and the effectiveness of the strategy may decrease over time.

-

Market Volatility: Rapid market movements, unexpected news events, or increased spreads from your broker can cause your Stop Loss level to be missed or result in slippage.

-

Lot Size: The lot size you use directly determines your risk. Using a higher lot size increases potential profits but also multiplies potential losses. It is crucial to create a risk management plan that is appropriate for your account.

Before using this EA, you must ensure you have thoroughly tested the strategy on a demo account and fully understand all the associated risks. When you decide to trade with real capital, only use money you can afford to lose.