Whale Tick Speed Reversal Trap

- Experts

- Mustafa Ozkurkcu

- Versione: 2.0

- Aggiornato: 18 settembre 2025

Overview

This Expert Advisor (EA) targets high-probability, short-term scalping opportunities by analyzing minute-based market activity (tick momentum), indecision boxes, and breakout/momentum behavior—optionally aligned with trend and session filters. Version 2.0 replaces second-based TPS with a minute (M1) window model that’s Open Prices Only compatible and more stable to optimize. Additional entry modes (Breakout Close and Retest Entry) help capture moves that classic momentum filters may miss, while exits include Partial Take-Profit, Break-Even, and Trailing Stop for disciplined risk management.

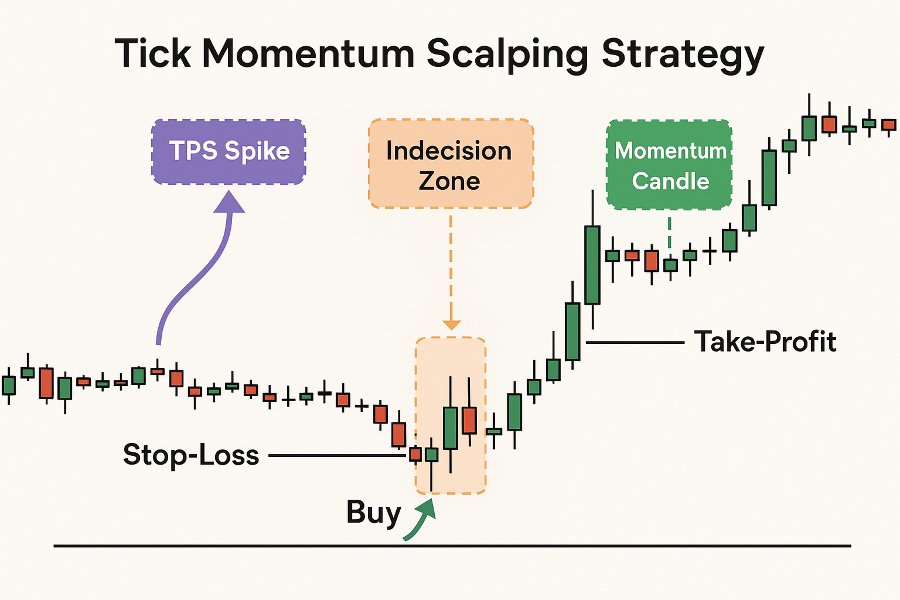

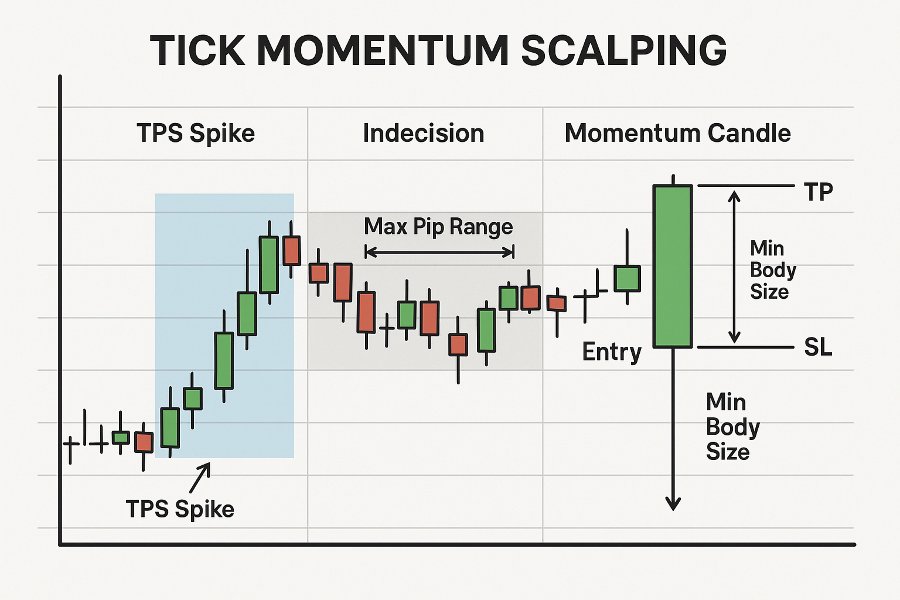

How the Strategy Works

1) Activity Detection (Z-Score & Percentile)

The EA measures activity using M1 tick-volume windows (e.g., 3 bars = 3 minutes). It compares the current window to a set of past windows with a Z-Score filter. If Z-Score is not met, two fallbacks can still qualify the bar:

-

Backup Multiplier: Current ≥ (Average × Multiplier).

-

Percentile Gate: Current ≥ the Xth percentile of past windows.

This layered design surfaces bursts of flow even in quiet regimes.

2) Indecision Box Confirmation (ATR or Pips)

After a valid activity reading, the EA confirms a tight price box across the last N M1 bars. You can define this either by a fixed pip range or by an ATR-based multiple, making the box adaptive to volatility.

3) Entry Triggers

The EA opens a trade when one of the following triggers appears after the box:

-

Momentum Candle: Strong body (≥ MinBodyPips) and restrained wick/body ratio.

-

Breakout Close: Last closed M1 candle finishes outside the box by at least X pips (no momentum wick/body check required).

-

Retest Entry: If a breakout occurred, the EA can enter on a retest of the broken box boundary within N bars (touch within Y pips).

4) Trend Alignment (Optional)

When enabled, entries must align with a higher-timeframe EMA trend (e.g., M5/EMA50), filtering trades to the dominant direction.

5) Session Filter (Optional)

Limit trading to specific server-time sessions (Asia, London, New York). This can increase quality or frequency depending on your setup.

6) Risk & Exits

Stop Loss (SL) is set beyond the indecision box edge with a configurable buffer; Take Profit (TP) is defined as an R-multiple of risk (e.g., 2.0R). Exits include Partial TP, Break-Even (with offset), and Trailing Stop (R-triggered), allowing you to lock in gains as the move develops.

Explanation of Input Parameters

Activity / Z-Score (minutes)

-

Activity_Window_Minutes: Number of M1 bars per activity window (e.g., 3 = 3 minutes). Smaller windows are more sensitive; larger are steadier.

-

Activity_ZScore_Enable: Enables statistical Z-Score filtering.

-

Activity_Past_Windows: Number of past windows for comparison (excludes the current).

-

Activity_ZScore_Threshold: Minimum Z-Score for a valid activity spike.

-

Activity_Backup_Multiplier: Fallback rule: Current ≥ Average × Multiplier.

-

Activity_Percentile_Enable: Enables percentile fallback when Z-Score/multiplier conditions fail.

-

Activity_Percentile_Min: Percentile threshold (0–100). Current must exceed this percentile of past windows.

Box / Indecision

-

Box_Mode (BOX_PIPS / BOX_ATR): Use a fixed pip range or ATR-based height.

-

Box_Max_Range_Pips: Max pip height of the box (PIPS mode only).

-

Box_Bars_M1: How many recent M1 bars define the box.

-

Box_ATR_Period_M1: ATR period used in ATR mode.

-

Box_ATR_Multiplier: Box height must be ≤ ATR × Multiplier (adaptive to volatility).

Momentum (M1)

-

Momentum_Min_Body_Pips: Minimum candle body size (pips) to qualify as momentum.

-

Momentum_Max_Wick_To_Body: Maximum wick/body ratio; keeps entries to clean, directional candles.

Entry Logic (More Signals)

-

Entry_Breakout_Close_Enable: Allows entry on a close X pips beyond the box (no momentum check).

-

Entry_Breakout_Pips: Required close distance beyond the box for Breakout Close.

-

Entry_Retest_Enable: Enables retest entries after a breakout.

-

Entry_Retest_Bars: Number of bars after the breakout during which a retest can trigger an entry.

-

Entry_Retest_Pips: Touch distance (tolerance) to the broken box boundary for valid retests.

Trend Filter (Higher TF)

-

Trend_Enable: Enforce trend alignment.

-

Trend_Timeframe: Higher timeframe for the EMA (e.g., M5).

-

Trend_EMA_Period: EMA period on the higher timeframe.

-

Trend_EMA_Shift: Index of the closed bar used for the check.

Session Filter (Server Time)

-

Session_Enable: Turn the session filter on/off.

-

Session_Asia_Enable / Start_Hour / End_Hour: Asia session controls (server time).

-

Session_London_Enable / Start_Hour / End_Hour: London session controls.

-

Session_NY_Enable / Start_Hour / End_Hour: New York session controls.

Risk / Targets

-

Risk_Fixed_Lot: Fixed position size (lots).

-

Risk_SL_Buffer_Pips: Extra buffer beyond the box edge for SL placement.

-

Risk_TP_R_Multiple: Take Profit as R-multiple of risk (e.g., 2.0 = 2R).

-

Risk_Max_Spread_Pips: Maximum allowed spread; entries are skipped when exceeded.

-

Risk_Max_Duration_Seconds: Hard time stop; closes trades after N seconds.

Exits: Partial / Break-Even / Trailing

-

Exit_Partial_Enable: Enables partial profit taking.

-

Exit_Partial_Trigger_R: R-level at which to take partial profits.

-

Exit_Partial_Close_Pct: Percentage of the position to close at the partial.

-

Exit_BE_Enable: Enables moving SL to break-even.

-

Exit_BE_Trigger_R: R-level to set break-even.

-

Exit_BE_Offset_Pips: Offset beyond entry to account for costs/slippage.

-

Exit_Trail_Enable: Enables trailing stop.

-

Exit_Trail_Trigger_R: R-level after which trailing becomes active.

-

Exit_Trail_Distance_Pips: Trailing distance (pips) once active.

General

-

General_Magic: Unique ID so the EA can distinguish its trades.

-

General_Use_Comments: Whether to add comments to orders/positions.

Important Risk Disclosure

This EA is an automated trading tool. Trading in financial markets involves substantial risk, including the potential loss of all invested capital.

No Guarantee of Future Performance: Results from past periods do not guarantee future outcomes. Market structure and volatility regimes evolve; what worked historically may degrade. Always forward-test and periodically re-evaluate.

Volatility & Slippage: Rapid moves, news events, liquidity gaps, or wider spreads can cause slippage, delayed fills, or missed stops. ATR-based boxes and activity filters may behave differently across symbols and brokers.

Position Sizing: Risk_Fixed_Lot directly scales both profits and losses. Choose sizing consistent with your risk tolerance and account size. Consider diversifying and capping daily/weekly loss.

Platform/Broker Conditions: Execution quality, minimum stop distances, and symbol specifications vary. Verify SL/TP distances, contract sizes, and tick value for your broker.

Best Practices: Thoroughly test on a demo account first. Use Open Prices Only for reproducible backtests with this EA, then validate on live ticks. Trade only with money you can afford to lose.