LSCB Scalping

- Experts

- Mathieu Ouellet

- Version: 7.3

- Updated: 31 August 2025

- Activations: 10

LSCB Expert Advisor v7.0

Liquidity Sweep Counter Breakout Strategy

The LSCB Expert Advisor implements a strategy based on liquidity sweep detection and counter-trend entries. The system identifies when price temporarily breaks key levels before reversing direction, a pattern commonly observed in institutional trading activity.

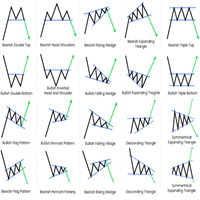

Strategy Overview

The LSCB strategy operates by detecting consolidation periods followed by liquidity sweeps. When price breaks beyond established range levels but closes back within the range, the system considers this a potential reversal signal. The algorithm uses ATR calculations to adapt to different market volatility conditions.

Core Features

Market Analysis Functions:

- ATR-based consolidation detection

- Dynamic range level identification

- Liquidity sweep pattern recognition

- Multi-timeframe compatibility

Risk Management System:

- Multiple stop loss and take profit calculation methods

- Position sizing based on account risk percentage

- Break-even management functionality

- Trailing stop implementation

- Maximum concurrent trade limits

Filtering Options:

- RSI momentum filter

- Moving average trend filter

- Volume confirmation filter

- Trading session time filter

- Simplified mode for testing purposes

Technical Specifications

Compatible Instruments:

- All major and minor forex pairs

- Gold and precious metals

- Stock indices and CFD instruments

- Automatic symbol suffix handling

Platform Requirements:

- MetaTrader 5 platform

- Minimum account balance recommendations apply

- Compatible with all broker account types

Configuration Parameters

Primary Settings:

- High/Low detection period (default: 7 bars)

- ATR consolidation threshold (default: 1.2)

- Range proximity threshold (default: 0.5 ATR multiplier)

- Consolidation bars for range calculation (default: 5 bars)

Risk Management:

- Stop loss ATR multiplier (default: 1.5)

- Take profit ATR multiplier (default: 2.5)

- Maximum lot size limits

- Risk percentage per trade

- Maximum concurrent positions (default: 2)

Trade Management Features

The system includes automatic trade management capabilities. Break-even functionality moves stop losses to protect initial capital when trades become profitable. Trailing stop implementation helps secure gains on favorable price movements. Position limits prevent overexposure to market risk.

Display and Monitoring

Visual Elements:

- Real-time range level display on charts

- Consolidation zone highlighting

- Trade entry arrows

- Performance dashboard with key metrics

Dashboard Information:

- Account balance and equity tracking

- Trade statistics and win rate

- Active position monitoring

- Market condition analysis

- Current ATR and spread readings

Operation Modes

The EA supports three operational modes:

Counter-trend mode focuses on reversal entries when price sweeps liquidity beyond range boundaries. Breakout mode enters trades in the direction of range breaks. Combined mode utilizes both approaches based on market conditions.

Installation Process

Standard installation requires copying the EA file to the MetaTrader 5 Experts folder. After platform restart, attach the EA to the desired chart and configure parameters according to trading preferences. Enable algorithmic trading in platform settings for automated operation.

Parameter Guidelines

For forex pairs on hourly timeframes, default parameters typically provide suitable starting points. Gold trading may benefit from adjusted volatility thresholds due to higher price fluctuations. Lower timeframes might require reduced range detection periods, while higher timeframes may need extended periods for proper range identification.

Risk Management Considerations

The EA includes multiple safeguards to manage trading risk. Position sizing calculations consider account balance and predefined risk percentages. Margin validation prevents excessive leverage usage. Stop loss implementation provides downside protection on all trades.

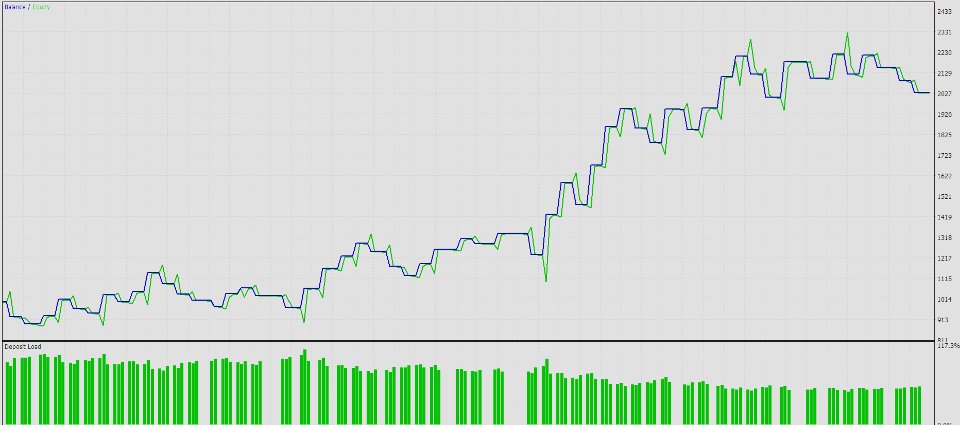

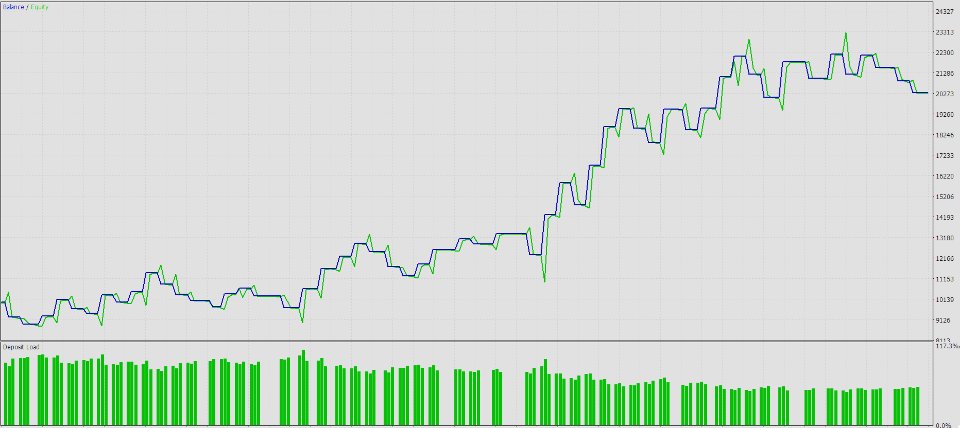

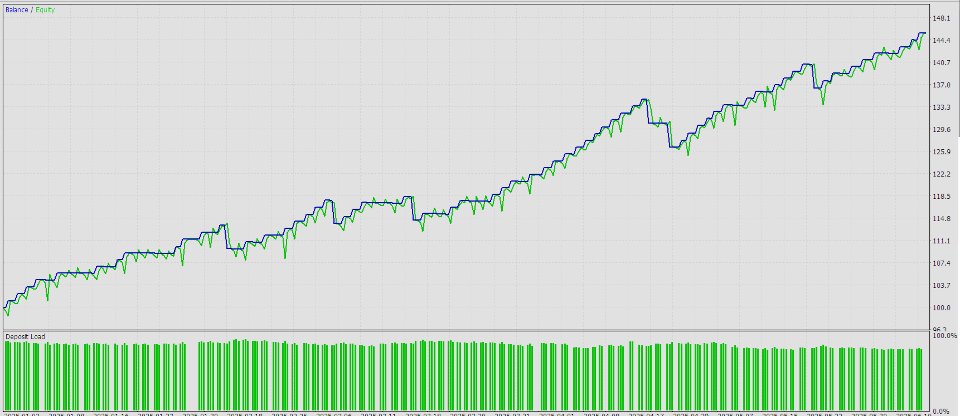

Backtest Compatibility

The system supports MetaTrader 5 strategy tester functionality. Historical testing across multiple market conditions helps evaluate performance characteristics. The EA maintains consistent behavior between backtesting and live trading environments.

Documentation

Complete setup instructions and parameter explanations are provided. The documentation covers strategy logic, risk management features, and troubleshooting guidance. Parameter optimization suggestions help adapt the EA to different trading styles.

Technical Implementation

The EA utilizes standard MQL5 functions without external dependencies. Code structure follows MetaTrader 5 development standards. The system handles symbol specifications automatically and adapts to different broker implementations.

Performance Monitoring

Built-in statistics tracking provides performance analysis. Win rate calculations, profit tracking, and drawdown monitoring help evaluate EA effectiveness. The dashboard displays real-time trading metrics for ongoing performance assessment.

Market Compliance

The EA meets MQL5 Market technical requirements and passes validation testing. All input parameters use English naming conventions. The system operates within MetaTrader 5 platform constraints and broker specifications.

This Expert Advisor is designed for traders familiar with automated trading systems and market risk management. Proper testing and parameter optimization are recommended before live trading implementation.

Important Notice

Trading involves substantial financial risk. Automated trading systems cannot guarantee profitable results. Users should understand the strategy logic and associated risks before implementation. Demo testing is recommended for system evaluation and parameter optimization.