Anti Gartley Harmonic Pattern Indicator MT4

- Indicators

- Eda Kaya

- Version: 2.1

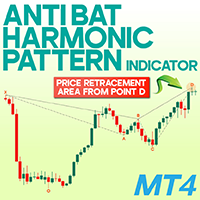

Anti-Gartley Harmonic Pattern Indicator in MT4

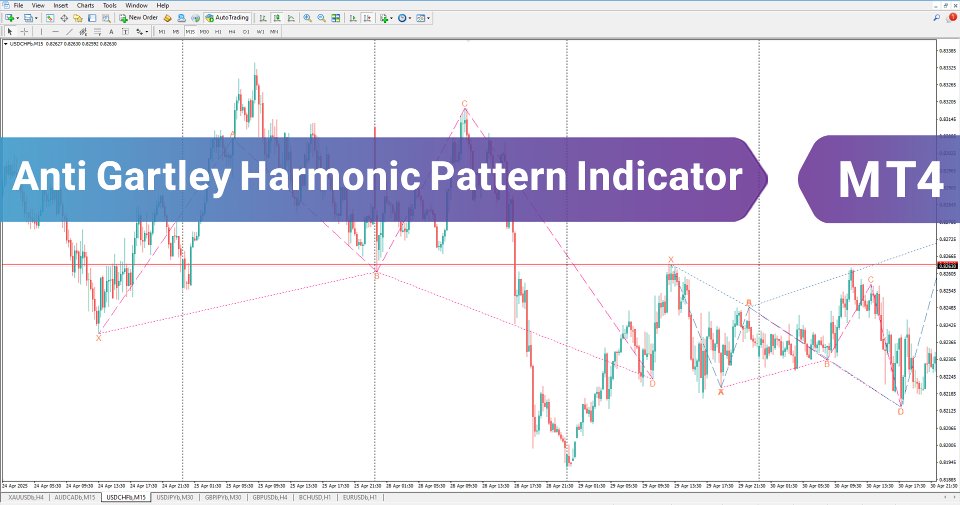

The Anti-Gartley Harmonic Pattern Indicator is a practical analytical tool within the MetaTrader 4 environment, designed to identify the structure of harmonic patterns. This indicator detects the Anti-Gartley harmonic pattern by locating five key points (pivots) on the chart and visualizes the pattern by drawing specific lines.

By combining this indicator with other technical analysis tools, users can identify both bullish and bearish patterns, enabling more specialized and professional chart analysis.

«Indicator Installation & User Guide»

MT4 Indicator Installation | Anti Gartley Harmonic Pattern Indicator MT5 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Prop Firm Protector: Trade Assist Prop Firm Plus TF Expert MT4 | Money Management + DrawDown Protector: Trade Panel Prop Firm Drawdawn Limiter Pro MT4

Anti-Gartley Harmonic Pattern Indicator Table

The general specifications of the Anti-Gartley Harmonic Pattern Indicator are listed below:

| Category | Harmonic Pattern - Classic and Chart Patterns - Price Action |

| Platform | MetaTrader 4 |

| Skill Level | Advanced |

| Indicator Type | Reversal - Leading - Non-Repainting |

| Time Frame | Multi Time Frame |

| Trading Style | Scalping - Day Trading - Intraday Trading |

| Trading Markets | Forex - Stocks - Indices |

Indicator at a Glance

The Anti-Gartley Harmonic Pattern Indicator accurately identifies and draws the Anti-Gartley harmonic pattern on the chart by pinpointing points X, A, B, C, and D, and connecting them with lines. This professional-grade tool helps traders detect potential entry points, recognize price reversal zones (PRZ), and make more informed decisions in the market.

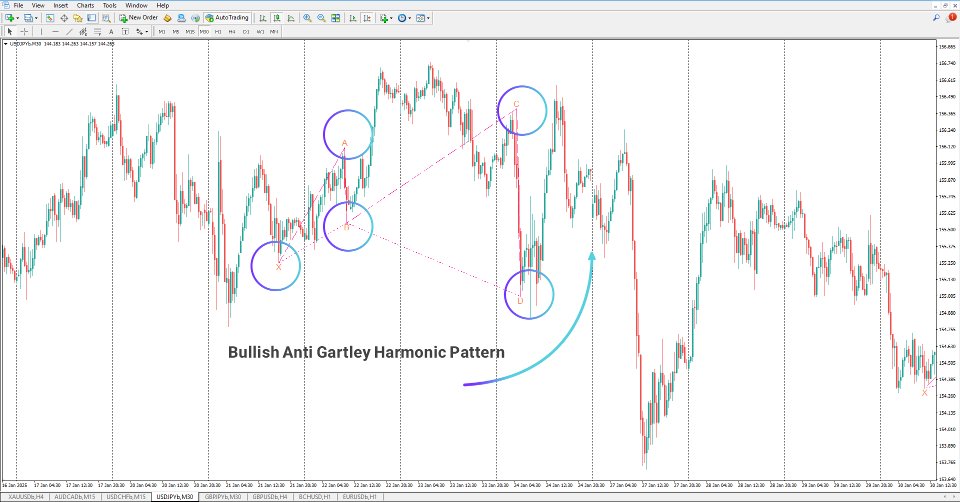

Bullish Pattern

On the 30-minute USDJPY chart, a bullish Anti-Gartley harmonic pattern has appeared. Traders aiming to identify this formation can rely on the Anti-Gartley Harmonic Pattern Indicator to detect the pattern and consider point D as the potential price reversal zone (PRZ) for entering buy positions.

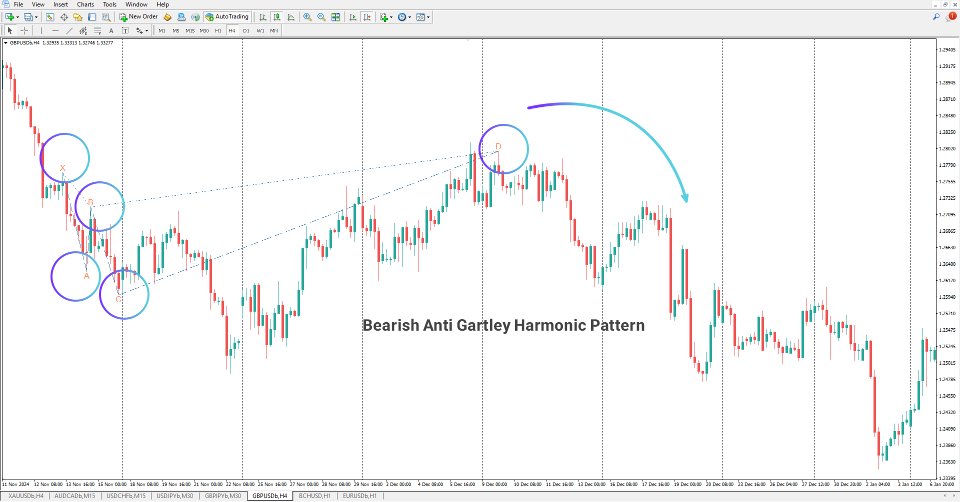

Bearish Pattern

On the 4-hour GBPUSD chart, the Anti-Gartley Harmonic Pattern Indicator has identified and drawn a bearish Anti-Gartley pattern, suggesting a sell setup. Traders can use this tool to find a suitable entry point for short positions by recognizing the completed pattern and targeting point D within the PRZ.

Anti-Gartley Harmonic Pattern Indicator Settings

The settings for the Anti-Gartley Harmonic Pattern Indicator are detailed below:

· Minimum Length Of Wave (candle): Choose the minimum length of a wave (based on candle count)

· Num Of Previous Candle: Select how many previous candles to analyze

· Show Lines: Enable or disable the display of pattern lines

· Break Pivot: Enable pivot breakout detection

· Original Pivot to Broken Pivot (Pipet): Set the distance (in pipettes) between the original and broken pivot

· Shift: Define the horizontal shift value for pattern lines

· Bullish Pattern: Enable detection of bullish patterns

· Bearish Pattern: Enable detection of bearish patterns

· Style Of Line: Choose the style of the pattern lines

· Width Of Line: Set the line width

· Custom Color Lines (Bearish Harmonic): Choose custom color for bearish pattern lines

· Custom Color Lines (Bullish Harmonic): Choose custom color for bullish pattern lines

· Custom Color Of Text: Set the color for on-chart explanatory text

Conclusion

The Anti-Gartley Harmonic Pattern Indicator is recognized as an advanced trading tool in the Forex market, helping traders better interpret market structure by drawing the Anti-Gartley harmonic pattern. This tool highlights optimal zones for entering buy or sell trades by identifying patterns and marking potential reversal areas (PRZ).

Utilizing this indicator can enhance trading performance and provide traders with deeper insight into price reversal opportunities.