Do Traders Need Services From Developers?

Algorithmic trading becomes more popular and needed, which naturally led to a demand for exotic algorithms and unusual tasks. To some extent, such complex applications are available in the Code Base or in the Market. Although traders have simple access to those apps in a couple of clicks, these apps may not satisfy all needs in full. In this case, traders look for developers who can write a desired application in the MQL5 Freelance section and assign an order.

Neural Networks Made Easy (Part 87): Time Series Patching

Forecasting plays an important role in time series analysis. In the new article, we will talk about the benefits of time series patching.

Developing a Replay System (Part 78): New Chart Trade (V)

In this article, we will look at how to implement part of the receiver code. Here we will implement an Expert Advisor to test and learn how the protocol interaction works. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Price Action Analysis Toolkit Development (Part 24): Price Action Quantification Analysis Tool

Candlestick patterns offer valuable insights into potential market moves. Some single candles signal continuation of the current trend, while others foreshadow reversals, depending on their position within the price action. This article introduces an EA that automatically identifies four key candlestick formations. Explore the following sections to learn how this tool can enhance your price-action analysis.

Neural Networks in Trading: Hierarchical Vector Transformer (HiVT)

We invite you to get acquainted with the Hierarchical Vector Transformer (HiVT) method, which was developed for fast and accurate forecasting of multimodal time series.

Data Science and ML (Part 42): Forex Time series Forecasting using ARIMA in Python, Everything you need to Know

ARIMA, short for Auto Regressive Integrated Moving Average, is a powerful traditional time series forecasting model. With the ability to detect spikes and fluctuations in a time series data, this model can make accurate predictions on the next values. In this article, we are going to understand what is it, how it operates, what you can do with it when it comes to predicting the next prices in the market with high accuracy and much more.

Machine Learning Blueprint (Part 4): The Hidden Flaw in Your Financial ML Pipeline — Label Concurrency

Discover how to fix a critical flaw in financial machine learning that causes overfit models and poor live performance—label concurrency. When using the triple-barrier method, your training labels overlap in time, violating the core IID assumption of most ML algorithms. This article provides a hands-on solution through sample weighting. You will learn how to quantify temporal overlap between trading signals, calculate sample weights that reflect each observation's unique information, and implement these weights in scikit-learn to build more robust classifiers. Learning these essential techniques will make your trading models more robust, reliable and profitable.

Self Optimizing Expert Advisors in MQL5 (Part 15): Linear System Identification

Trading strategies may be challenging to improve because we often don’t fully understand what the strategy is doing wrong. In this discussion, we introduce linear system identification, a branch of control theory. Linear feedback systems can learn from data to identify a system’s errors and guide its behavior toward intended outcomes. While these methods may not provide fully interpretable explanations, they are far more valuable than having no control system at all. Let’s explore linear system identification and observe how it may help us as algorithmic traders to maintain control over our trading applications.

MQL5 Trading Tools (Part 2): Enhancing the Interactive Trade Assistant with Dynamic Visual Feedback

In this article, we upgrade our Trade Assistant Tool by adding drag-and-drop panel functionality and hover effects to make the interface more intuitive and responsive. We refine the tool to validate real-time order setups, ensuring accurate trade configurations relative to market prices. We also backtest these enhancements to confirm their reliability.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (Final Part)

The use of anisotropic diffusion processes for encoding the initial data in a hyperbolic latent space, as proposed in the HypDIff framework, assists in preserving the topological features of the current market situation and improves the quality of its analysis. In the previous article, we started implementing the proposed approaches using MQL5. Today we will continue the work we started and will bring it to its logical conclusion.

Advanced Memory Management and Optimization Techniques in MQL5

Discover practical techniques to optimize memory usage in MQL5 trading systems. Learn to build efficient, stable, and fast-performing Expert Advisors and indicators. We’ll explore how memory really works in MQL5, the common traps that slow your systems down or cause them to fail, and — most importantly — how to fix them.

News Trading Made Easy (Part 6): Performing Trades (III)

In this article news filtration for individual news events based on their IDs will be implemented. In addition, previous SQL queries will be improved to provide additional information or reduce the query's runtime. Furthermore, the code built in the previous articles will be made functional.

Building A Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (II)

Think about an independent Expert Advisor. Previously, we discussed an indicator-based Expert Advisor that also partnered with an independent script for drawing risk and reward geometry. Today, we will discuss the architecture of an MQL5 Expert Advisor, that integrates, all the features in one program.

Creating a market making algorithm in MQL5

How do market makers work? Let's consider this issue and create a primitive market-making algorithm.

Developing a Trading Strategy: The Flower Volatility Index Trend-Following Approach

The relentless quest to decode market rhythms has led traders and quantitative analysts to develop countless mathematical models. This article has introduced the Flower Volatility Index (FVI), a novel approach that transforms the mathematical elegance of Rose Curves into a functional trading tool. Through this work, we have shown how mathematical models can be adapted into practical trading mechanisms capable of supporting both analysis and decision-making in real market conditions.

Category Theory in MQL5 (Part 20): A detour to Self-Attention and the Transformer

We digress in our series by pondering at part of the algorithm to chatGPT. Are there any similarities or concepts borrowed from natural transformations? We attempt to answer these and other questions in a fun piece, with our code in a signal class format.

Neural networks made easy (Part 47): Continuous action space

In this article, we expand the range of tasks of our agent. The training process will include some aspects of money and risk management, which are an integral part of any trading strategy.

Developing a trading Expert Advisor from scratch (Part 26): Towards the future (I)

Today we will take our order system to the next level. But before that, we need to solve a few problems. Now we have some questions that are related to how we want to work and what things we do during the trading day.

MQL5 Wizard Techniques you should know (Part 08): Perceptrons

Perceptrons, single hidden layer networks, can be a good segue for anyone familiar with basic automated trading and is looking to dip into neural networks. We take a step by step look at how this could be realized in a signal class assembly that is part of the MQL5 Wizard classes for expert advisors.

Finding custom currency pair patterns in Python using MetaTrader 5

Are there any repeating patterns and regularities in the Forex market? I decided to create my own pattern analysis system using Python and MetaTrader 5. A kind of symbiosis of math and programming for conquering Forex.

Multiple Symbol Analysis With Python And MQL5 (Part 3): Triangular Exchange Rates

Traders often face drawdowns from false signals, while waiting for confirmation can lead to missed opportunities. This article introduces a triangular trading strategy using Silver’s pricing in Dollars (XAGUSD) and Euros (XAGEUR), along with the EURUSD exchange rate, to filter out noise. By leveraging cross-market relationships, traders can uncover hidden sentiment and refine their entries in real time.

Neural Networks in Trading: Using Language Models for Time Series Forecasting

We continue to study time series forecasting models. In this article, we get acquainted with a complex algorithm built on the use of a pre-trained language model.

Reimagining Classic Strategies (Part II): Bollinger Bands Breakouts

This article explores a trading strategy that integrates Linear Discriminant Analysis (LDA) with Bollinger Bands, leveraging categorical zone predictions for strategic market entry signals.

MQL5 Wizard Techniques you should know (Part 25): Multi-Timeframe Testing and Trading

Strategies that are based on multiple time frames cannot be tested in wizard assembled Expert Advisors by default because of the MQL5 code architecture used in the assembly classes. We explore a possible work around this limitation for strategies that look to use multiple time frames in a case study with the quadratic moving average.

Portfolio Risk Model using Kelly Criterion and Monte Carlo Simulation

For decades, traders have been using the Kelly Criterion formula to determine the optimal proportion of capital to allocate to an investment or bet to maximize long-term growth while minimizing the risk of ruin. However, blindly following Kelly Criterion using the result of a single backtest is often dangerous for individual traders, as in live trading, trading edge diminishes over time, and past performance is no predictor of future result. In this article, I will present a realistic approach to applying the Kelly Criterion for one or more EA's risk allocation in MetaTrader 5, incorporating Monte Carlo simulation results from Python.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part I)

We will breakdown the main MQL5 code into specified code snippets to illustrate the integration of Telegram and WhatsApp for receiving signal notifications from the Trend Constraint indicator we are creating in this article series. This will help traders, both novices and experienced developers, grasp the concept easily. First, we will cover the setup of MetaTrader 5 for notifications and its significance to the user. This will help developers in advance to take notes to further apply in their systems.

Neural Networks Made Easy (Part 93): Adaptive Forecasting in Frequency and Time Domains (Final Part)

In this article, we continue the implementation of the approaches of the ATFNet model, which adaptively combines the results of 2 blocks (frequency and time) within time series forecasting.

Developing a Replay System (Part 27): Expert Advisor project — C_Mouse class (I)

In this article we will implement the C_Mouse class. It provides the ability to program at the highest level. However, talking about high-level or low-level programming languages is not about including obscene words or jargon in the code. It's the other way around. When we talk about high-level or low-level programming, we mean how easy or difficult the code is for other programmers to understand.

Neural Networks Made Easy (Part 92): Adaptive Forecasting in Frequency and Time Domains

The authors of the FreDF method experimentally confirmed the advantage of combined forecasting in the frequency and time domains. However, the use of the weight hyperparameter is not optimal for non-stationary time series. In this article, we will get acquainted with the method of adaptive combination of forecasts in frequency and time domains.

MQL5 Wizard Techniques you should know (Part 19): Bayesian Inference

Bayesian inference is the adoption of Bayes Theorem to update probability hypothesis as new information is made available. This intuitively leans to adaptation in time series analysis, and so we have a look at how we could use this in building custom classes not just for the signal but also money-management and trailing-stops.

Price Action Analysis Toolkit Development (Part 29): Boom and Crash Interceptor EA

Discover how the Boom & Crash Interceptor EA transforms your charts into a proactive alert system-spotting explosive moves with lightning-fast velocity scans, volatility surge checks, trend confirmation, and pivot-zone filters. With crisp green “Boom” and red “Crash” arrows guiding your every decision, this tool cuts through the noise and lets you capitalize on market spikes like never before. Dive in to see how it works and why it can become your next essential edge.

Neural networks made easy (Part 80): Graph Transformer Generative Adversarial Model (GTGAN)

In this article, I will get acquainted with the GTGAN algorithm, which was introduced in January 2024 to solve complex problems of generation architectural layouts with graph constraints.

Developing a multi-currency Expert Advisor (Part 12): Developing prop trading level risk manager

In the EA being developed, we already have a certain mechanism for controlling drawdown. But it is probabilistic in nature, as it is based on the results of testing on historical price data. Therefore, the drawdown can sometimes exceed the maximum expected values (although with a small probability). Let's try to add a mechanism that ensures guaranteed compliance with the specified drawdown level.

Data Science and Machine Learning (Part 17): Money in the Trees? The Art and Science of Random Forests in Forex Trading

Discover the secrets of algorithmic alchemy as we guide you through the blend of artistry and precision in decoding financial landscapes. Unearth how Random Forests transform data into predictive prowess, offering a unique perspective on navigating the complex terrain of stock markets. Join us on this journey into the heart of financial wizardry, where we demystify the role of Random Forests in shaping market destiny and unlocking the doors to lucrative opportunities

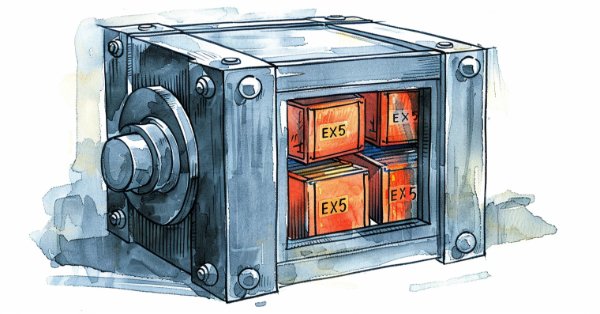

MQL5 Trading Toolkit (Part 1): Developing A Positions Management EX5 Library

Learn how to create a developer's toolkit for managing various position operations with MQL5. In this article, I will demonstrate how to create a library of functions (ex5) that will perform simple to advanced position management operations, including automatic handling and reporting of the different errors that arise when dealing with position management tasks with MQL5.

Neural Networks in Trading: A Multi-Agent Self-Adaptive Model (Final Part)

In the previous article, we introduced the multi-agent self-adaptive framework MASA, which combines reinforcement learning approaches and self-adaptive strategies, providing a harmonious balance between profitability and risk in turbulent market conditions. We have built the functionality of individual agents within this framework. In this article, we will continue the work we started, bringing it to its logical conclusion.

Practicing the development of trading strategies

In this article, we will make an attempt to develop our own trading strategy. Any trading strategy must be based on some kind of statistical advantage. Moreover, this advantage should exist for a long time.

Neural Networks in Trading: Transformer with Relative Encoding

Self-supervised learning can be an effective way to analyze large amounts of unlabeled data. The efficiency is provided by the adaptation of models to the specific features of financial markets, which helps improve the effectiveness of traditional methods. This article introduces an alternative attention mechanism that takes into account the relative dependencies and relationships between inputs.

MQL5 Trading Toolkit (Part 8): How to Implement and Use the History Manager EX5 Library in Your Codebase

Discover how to effortlessly import and utilize the History Manager EX5 library in your MQL5 source code to process trade histories in your MetaTrader 5 account in this series' final article. With simple one-line function calls in MQL5, you can efficiently manage and analyze your trading data. Additionally, you will learn how to create different trade history analytics scripts and develop a price-based Expert Advisor as practical use-case examples. The example EA leverages price data and the History Manager EX5 library to make informed trading decisions, adjust trade volumes, and implement recovery strategies based on previously closed trades.

Neural Networks in Trading: An Agent with Layered Memory (Final Part)

We continue our work on creating the FinMem framework, which uses layered memory approaches that mimic human cognitive processes. This allows the model not only to effectively process complex financial data but also to adapt to new signals, significantly improving the accuracy and effectiveness of investment decisions in dynamically changing markets.