Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs (II)-LoRA-Tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

MQL5 Wizard Techniques you should know (Part 28): GANs Revisited with a Primer on Learning Rates

The Learning Rate, is a step size towards a training target in many machine learning algorithms’ training processes. We examine the impact its many schedules and formats can have on the performance of a Generative Adversarial Network, a type of neural network that we had examined in an earlier article.

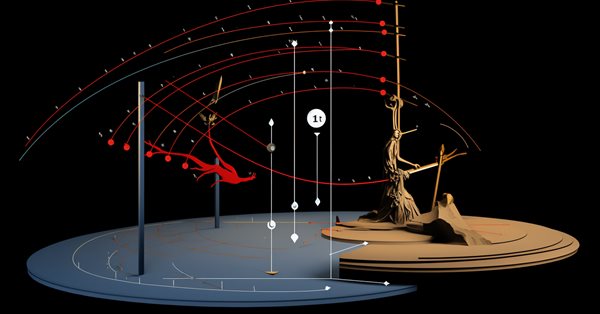

Developing a Replay System (Part 54): The Birth of the First Module

In this article, we will look at how to put together the first of a number of truly functional modules for use in the replay/simulator system that will also be of general purpose to serve other purposes. We are talking about the mouse module.

Neural Networks in Trading: A Complex Trajectory Prediction Method (Traj-LLM)

In this article, I would like to introduce you to an interesting trajectory prediction method developed to solve problems in the field of autonomous vehicle movements. The authors of the method combined the best elements of various architectural solutions.

Neural Networks in Trading: Controlled Segmentation

In this article. we will discuss a method of complex multimodal interaction analysis and feature understanding.

Neural networks made easy (Part 72): Trajectory prediction in noisy environments

The quality of future state predictions plays an important role in the Goal-Conditioned Predictive Coding method, which we discussed in the previous article. In this article I want to introduce you to an algorithm that can significantly improve the prediction quality in stochastic environments, such as financial markets.

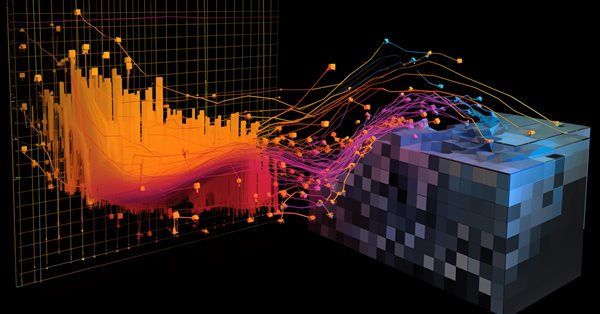

Time series clustering in causal inference

Clustering algorithms in machine learning are important unsupervised learning algorithms that can divide the original data into groups with similar observations. By using these groups, you can analyze the market for a specific cluster, search for the most stable clusters using new data, and make causal inferences. The article proposes an original method for time series clustering in Python.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs(I)-Fine-tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part II)

Today, we are discussing a working Telegram integration for MetaTrader 5 Indicator notifications using the power of MQL5, in partnership with Python and the Telegram Bot API. We will explain everything in detail so that no one misses any point. By the end of this project, you will have gained valuable insights to apply in your projects.

Category Theory in MQL5 (Part 23): A different look at the Double Exponential Moving Average

In this article we continue with our theme in the last of tackling everyday trading indicators viewed in a ‘new’ light. We are handling horizontal composition of natural transformations for this piece and the best indicator for this, that expands on what we just covered, is the double exponential moving average (DEMA).

Risk Management (Part 2): Implementing Lot Calculation in a Graphical Interface

In this article, we will look at how to improve and more effectively apply the concepts presented in the previous article using the powerful MQL5 graphical control libraries. We'll go step by step through the process of creating a fully functional GUI. I'll be explaining the ideas behind it, as well as the purpose and operation of each method used. Additionally, at the end of the article, we will test the panel we created to ensure it functions correctly and meets its stated goals.

MQL5 Wizard Techniques you should know (Part 26): Moving Averages and the Hurst Exponent

The Hurst Exponent is a measure of how much a time series auto-correlates over the long term. It is understood to be capturing the long-term properties of a time series and therefore carries some weight in time series analysis even outside of economic/ financial time series. We however, focus on its potential benefit to traders by examining how this metric could be paired with moving averages to build a potentially robust signal.

Developing a Replay System — Market simulation (Part 12): Birth of the SIMULATOR (II)

Developing a simulator can be much more interesting than it seems. Today we'll take a few more steps in this direction because things are getting more interesting.

Neural networks made easy (Part 65): Distance Weighted Supervised Learning (DWSL)

In this article, we will get acquainted with an interesting algorithm that is built at the intersection of supervised and reinforcement learning methods.

MQL5 Wizard Techniques you should know (Part 69): Using Patterns of SAR and the RVI

The Parabolic-SAR (SAR) and the Relative Vigour Index (RVI) are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered in the past, is also complementary since SAR defines the trend while RVI checks momentum. As usual, we use the MQL5 wizard to build and test any potential this indicator pairing may have.

Neural Networks in Trading: Directional Diffusion Models (DDM)

In this article, we discuss Directional Diffusion Models that exploit data-dependent anisotropic and directed noise in a forward diffusion process to capture meaningful graph representations.

Example of Stochastic Optimization and Optimal Control

This Expert Advisor, named SMOC (likely standing for Stochastic Model Optimal Control), is a simple example of an advanced algorithmic trading system for MetaTrader 5. It uses a combination of technical indicators, model predictive control, and dynamic risk management to make trading decisions. The EA incorporates adaptive parameters, volatility-based position sizing, and trend analysis to optimize its performance across varying market conditions.

Neural networks made easy (Part 62): Using Decision Transformer in hierarchical models

In recent articles, we have seen several options for using the Decision Transformer method. The method allows analyzing not only the current state, but also the trajectory of previous states and actions performed in them. In this article, we will focus on using this method in hierarchical models.

Neural networks made easy (Part 52): Research with optimism and distribution correction

As the model is trained based on the experience reproduction buffer, the current Actor policy moves further and further away from the stored examples, which reduces the efficiency of training the model as a whole. In this article, we will look at the algorithm of improving the efficiency of using samples in reinforcement learning algorithms.

Neural networks made easy (Part 64): ConserWeightive Behavioral Cloning (CWBC) method

As a result of tests performed in previous articles, we came to the conclusion that the optimality of the trained strategy largely depends on the training set used. In this article, we will get acquainted with a fairly simple yet effective method for selecting trajectories to train models.

Neural Networks in Trading: Spatio-Temporal Neural Network (STNN)

In this article we will talk about using space-time transformations to effectively predict upcoming price movement. To improve the numerical prediction accuracy in STNN, a continuous attention mechanism is proposed that allows the model to better consider important aspects of the data.

Trading with the MQL5 Economic Calendar (Part 10): Draggable Dashboard and Interactive Hover Effects for Seamless News Navigation

In this article, we enhance the MQL5 Economic Calendar by introducing a draggable dashboard that allows us to reposition the interface for better chart visibility. We implement hover effects for buttons to improve interactivity and ensure seamless navigation with a dynamically positioned scrollbar.

Statistical Arbitrage Through Cointegrated Stocks (Part 2): Expert Advisor, Backtests, and Optimization

This article presents a sample Expert Advisor implementation for trading a basket of four Nasdaq stocks. The stocks were initially filtered based on Pearson correlation tests. The filtered group was then tested for cointegration with Johansen tests. Finally, the cointegrated spread was tested for stationarity with the ADF and KPSS tests. Here we will see some notes about this process and the results of the backtests after a small optimization.

Developing a Replay System (Part 61): Playing the service (II)

In this article, we will look at changes that will allow the replay/simulation system to operate more efficiently and securely. I will also not leave without attention those who want to get the most out of using classes. In addition, we will consider a specific problem in MQL5 that reduces code performance when working with classes, and explain how to solve it.

MQL5 Wizard Techniques you should know (Part 51): Reinforcement Learning with SAC

Soft Actor Critic is a Reinforcement Learning algorithm that utilizes 3 neural networks. An actor network and 2 critic networks. These machine learning models are paired in a master slave partnership where the critics are modelled to improve the forecast accuracy of the actor network. While also introducing ONNX in these series, we explore how these ideas could be put to test as a custom signal of a wizard assembled Expert Advisor.

Developing a Replay System (Part 28): Expert Advisor project — C_Mouse class (II)

When people started creating the first systems capable of computing, everything required the participation of engineers, who had to know the project very well. We are talking about the dawn of computer technology, a time when there were not even terminals for programming. As it developed and more people got interested in being able to create something, new ideas and ways of programming emerged which replaced the previous-style changing of connector positions. This is when the first terminals appeared.

MQL5 Wizard Techniques you should know (Part 22): Conditional GANs

Generative Adversarial Networks are a pairing of Neural Networks that train off of each other for more accurate results. We adopt the conditional type of these networks as we look to possible application in forecasting Financial time series within an Expert Signal Class.

Implementing Practical Modules from Other Languages in MQL5 (Part 03): Schedule Module from Python, the OnTimer Event on Steroids

The schedule module in Python offers a simple way to schedule repeated tasks. While MQL5 lacks a built-in equivalent, in this article we’ll implement a similar library to make it easier to set up timed events in MetaTrader 5.

Data Science and ML (Part 46): Stock Markets Forecasting Using N-BEATS in Python

N-BEATS is a revolutionary deep learning model designed for time series forecasting. It was released to surpass classical models for time series forecasting such as ARIMA, PROPHET, VAR, etc. In this article, we are going to discuss this model and use it in predicting the stock market.

MQL5 Wizard Techniques you should know (Part 72): Using Patterns of MACD and the OBV with Supervised Learning

We follow up on our last article, where we introduced the indicator pair of the MACD and the OBV, by looking at how this pairing could be enhanced with Machine Learning. MACD and OBV are a trend and volume complimentary pairing. Our machine learning approach uses a convolution neural network that engages the Exponential kernel in sizing its kernels and channels, when fine-tuning the forecasts of this indicator pairing. As always, this is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

MetaTrader tick info access from MQL5 services to Python application using sockets

Sometimes everything is not programmable in the MQL5 language. And even if it is possible to convert existing advanced libraries in MQL5, it would be time-consuming. This article tries to show that we can bypass Windows OS dependency by transporting tick information such as bid, ask and time with MetaTrader services to a Python application using sockets.

Developing a Replay System — Market simulation (Part 25): Preparing for the next phase

In this article, we complete the first phase of developing our replay and simulation system. Dear reader, with this achievement I confirm that the system has reached an advanced level, paving the way for the introduction of new functionality. The goal is to enrich the system even further, turning it into a powerful tool for research and development of market analysis.

Developing a multi-currency Expert Advisor (Part 10): Creating objects from a string

The EA development plan includes several stages with intermediate results being saved in the database. They can only be retrieved from there again as strings or numbers, not objects. So we need a way to recreate the desired objects in the EA from the strings read from the database.

Market Simulation (Part 01): Cross Orders (I)

Today we will begin the second stage, where we will look at the market replay/simulation system. First, we will show a possible solution for cross orders. I will show you the solution, but it is not final yet. It will be a possible solution to a problem that we will need to solve in the near future.

MQL5 Wizard Techniques you should know (Part 67): Using Patterns of TRIX and the Williams Percent Range

The Triple Exponential Moving Average Oscillator (TRIX) and the Williams Percentage Range Oscillator are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered recently, is also complementary given that TRIX defines the trend while Williams Percent Range affirms support and Resistance levels. As always, we use the MQL5 wizard to prototype any potential these two may have.

Neural Networks in Trading: Superpoint Transformer (SPFormer)

In this article, we introduce a method for segmenting 3D objects based on Superpoint Transformer (SPFormer), which eliminates the need for intermediate data aggregation. This speeds up the segmentation process and improves the performance of the model.

Neural Networks Made Easy (Part 91): Frequency Domain Forecasting (FreDF)

We continue to explore the analysis and forecasting of time series in the frequency domain. In this article, we will get acquainted with a new method to forecast data in the frequency domain, which can be added to many of the algorithms we have studied previously.

Developing a multi-currency Expert Advisor (Part 18): Automating group selection considering forward period

Let's continue to automate the steps we previously performed manually. This time we will return to the automation of the second stage, that is, the selection of the optimal group of single instances of trading strategies, supplementing it with the ability to take into account the results of instances in the forward period.

Introduction to MQL5 (Part 22): Building an Expert Advisor for the 5-0 Harmonic Pattern

This article explains how to detect and trade the 5-0 harmonic pattern in MQL5, validate it using Fibonacci levels, and display it on the chart.

MQL5 Wizard Techniques you should know (Part 49): Reinforcement Learning with Proximal Policy Optimization

Proximal Policy Optimization is another algorithm in reinforcement learning that updates the policy, often in network form, in very small incremental steps to ensure the model stability. We examine how this could be of use, as we have with previous articles, in a wizard assembled Expert Advisor.