News Trading Made Easy (Part 5): Performing Trades (II)

This article will expand on the trade management class to include buy-stop and sell-stop orders to trade news events and implement an expiration constraint on these orders to prevent any overnight trading. A slippage function will be embedded into the expert to try and prevent or minimize possible slippage that may occur when using stop orders in trading, especially during news events.

Market Reactions and Trading Strategies in Response to Dividend Announcements: Evaluating the Efficient Market Hypothesis in Stock Trading

In this article, we will analyse the impact of dividend announcements on stock market returns and see how investors can earn more returns than those offered by the market when they expect a company to announce dividends. In doing so, we will also check the validity of the Efficient Market Hypothesis in the context of the Indian Stock Market.

MQL5 Wizard Techniques you should know (Part 75): Using Awesome Oscillator and the Envelopes

The Awesome Oscillator by Bill Williams and the Envelopes Channel are a pairing that could be used complimentarily within an MQL5 Expert Advisor. We use the Awesome Oscillator for its ability to spot trends, while the envelopes channel is incorporated to define our support/resistance levels. In exploring this indicator pairing, we use the MQL5 wizard to build and test any potential these two may possess.

Developing a multi-currency Expert Advisor (Part 3): Architecture revision

We have already made some progress in developing a multi-currency EA with several strategies working in parallel. Considering the accumulated experience, let's review the architecture of our solution and try to improve it before we go too far ahead.

Developing a Replay System — Market simulation (Part 11): Birth of the SIMULATOR (I)

In order to use the data that forms the bars, we must abandon replay and start developing a simulator. We will use 1 minute bars because they offer the least amount of difficulty.

Archery Algorithm (AA)

The article takes a detailed look at the archery-inspired optimization algorithm, with an emphasis on using the roulette method as a mechanism for selecting promising areas for "arrows". The method allows evaluating the quality of solutions and selecting the most promising positions for further study.

Overcoming ONNX Integration Challenges

ONNX is a great tool for integrating complex AI code between different platforms, it is a great tool that comes with some challenges that one must address to get the most out of it, In this article we discuss the common issues you might face and how to mitigate them.

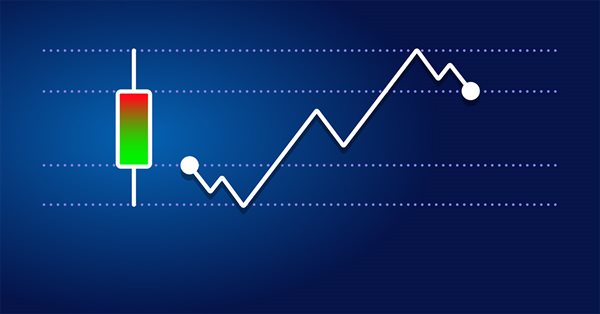

Visualizing deals on a chart (Part 2): Data graphical display

Here we are going to develop a script from scratch that simplifies unloading print screens of deals for analyzing trading entries. All the necessary information on a single deal is to be conveniently displayed on one chart with the ability to draw different timeframes.

Developing a Replay System — Market simulation (Part 14): Birth of the SIMULATOR (IV)

In this article we will continue the simulator development stage. this time we will see how to effectively create a RANDOM WALK type movement. This type of movement is very intriguing because it forms the basis of everything that happens in the capital market. In addition, we will begin to understand some concepts that are fundamental to those conducting market analysis.

Category Theory in MQL5 (Part 22): A different look at Moving Averages

In this article we attempt to simplify our illustration of concepts covered in these series by dwelling on just one indicator, the most common and probably the easiest to understand. The moving average. In doing so we consider significance and possible applications of vertical natural transformations.

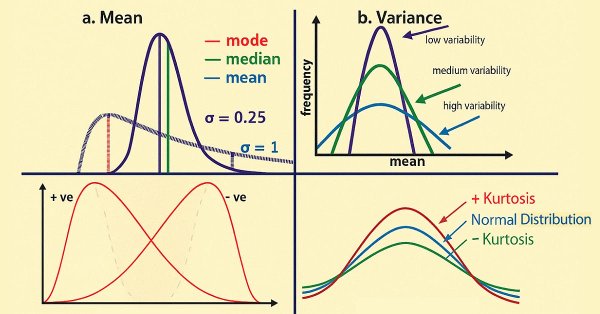

Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds

Neural networks made easy (Part 45): Training state exploration skills

Training useful skills without an explicit reward function is one of the main challenges in hierarchical reinforcement learning. Previously, we already got acquainted with two algorithms for solving this problem. But the question of the completeness of environmental research remains open. This article demonstrates a different approach to skill training, the use of which directly depends on the current state of the system.

Neural networks made easy (Part 51): Behavior-Guided Actor-Critic (BAC)

The last two articles considered the Soft Actor-Critic algorithm, which incorporates entropy regularization into the reward function. This approach balances environmental exploration and model exploitation, but it is only applicable to stochastic models. The current article proposes an alternative approach that is applicable to both stochastic and deterministic models.

MQL5 Wizard Techniques you should know (Part 37): Gaussian Process Regression with Linear and Matérn Kernels

Linear Kernels are the simplest matrix of its kind used in machine learning for linear regression and support vector machines. The Matérn kernel on the other hand is a more versatile version of the Radial Basis Function we looked at in an earlier article, and it is adept at mapping functions that are not as smooth as the RBF would assume. We build a custom signal class that utilizes both kernels in forecasting long and short conditions.

Price Action Analysis Toolkit Development (Part 40): Market DNA Passport

This article explores the unique identity of each currency pair through the lens of its historical price action. Inspired by the concept of genetic DNA, which encodes the distinct blueprint of every living being, we apply a similar framework to the markets, treating price action as the “DNA” of each pair. By breaking down structural behaviors such as volatility, swings, retracements, spikes, and session characteristics, the tool reveals the underlying profile that distinguishes one pair from another. This approach provides more profound insight into market behavior and equips traders with a structured way to align strategies with the natural tendencies of each instrument.

MQL5 Trading Tools (Part 7): Informational Dashboard for Multi-Symbol Position and Account Monitoring

In this article, we develop an informational dashboard in MQL5 for monitoring multi-symbol positions and account metrics like balance, equity, and free margin. We implement a sortable grid with real-time updates, CSV export, and a glowing header effect to enhance usability and visual appeal.

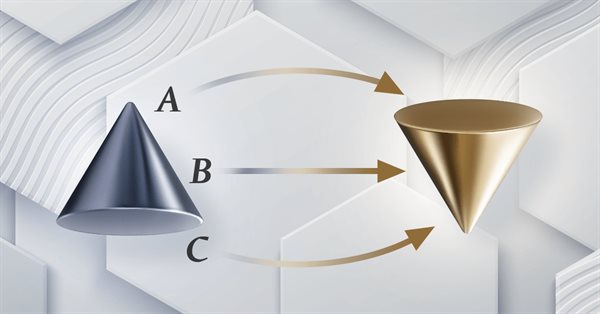

Design Patterns in software development and MQL5 (Part 2): Structural Patterns

In this article, we will continue our articles about Design Patterns after learning how much this topic is more important for us as developers to develop extendable, reliable applications not only by the MQL5 programming language but others as well. We will learn about another type of Design Patterns which is the structural one to learn how to design systems by using what we have as classes to form larger structures.

Developing a multi-currency Expert Advisor (Part 6): Automating the selection of an instance group

After optimizing the trading strategy, we receive sets of parameters. We can use them to create several instances of trading strategies combined in one EA. Previously, we did this manually. Here we will try to automate this process.

Chaos theory in trading (Part 1): Introduction, application in financial markets and Lyapunov exponent

Can chaos theory be applied to financial markets? In this article, we will consider how conventional Chaos theory and chaotic systems are different from the concept proposed by Bill Williams.

Trading with the MQL5 Economic Calendar (Part 5): Enhancing the Dashboard with Responsive Controls and Filter Buttons

In this article, we create buttons for currency pair filters, importance levels, time filters, and a cancel option to improve dashboard control. These buttons are programmed to respond dynamically to user actions, allowing seamless interaction. We also automate their behavior to reflect real-time changes on the dashboard. This enhances the overall functionality, mobility, and responsiveness of the panel.

Self Optimizing Expert Advisors in MQL5 (Part 10): Matrix Factorization

Factorization is a mathematical process used to gain insights into the attributes of data. When we apply factorization to large sets of market data — organized in rows and columns — we can uncover patterns and characteristics of the market. Factorization is a powerful tool, and this article will show how you can use it within the MetaTrader 5 terminal, through the MQL5 API, to gain more profound insights into your market data.

From Novice to Expert: Animated News Headline Using MQL5 (IX) — Multiple Symbol Management on a single chart for News Trading

News trading often requires managing multiple positions and symbols within a very short time due to heightened volatility. In today’s discussion, we address the challenges of multi-symbol trading by integrating this feature into our News Headline EA. Join us as we explore how algorithmic trading with MQL5 makes multi-symbol trading more efficient and powerful.

Reimagining Classic Strategies in Python: MA Crossovers

In this article, we revisit the classic moving average crossover strategy to assess its current effectiveness. Given the amount of time since its inception, we explore the potential enhancements that AI can bring to this traditional trading strategy. By incorporating AI techniques, we aim to leverage advanced predictive capabilities to potentially optimize trade entry and exit points, adapt to varying market conditions, and enhance overall performance compared to conventional approaches.

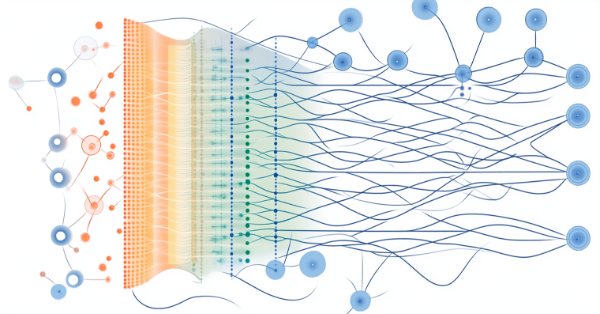

Neural Networks in Trading: Lightweight Models for Time Series Forecasting

Lightweight time series forecasting models achieve high performance using a minimum number of parameters. This, in turn, reduces the consumption of computing resources and speeds up decision-making. Despite being lightweight, such models achieve forecast quality comparable to more complex ones.

Creating a Trading Administrator Panel in MQL5 (Part II): Enhancing Responsiveness and Quick Messaging

In this article, we will enhance the responsiveness of the Admin Panel that we previously created. Additionally, we will explore the significance of quick messaging in the context of trading signals.

Trading with the MQL5 Economic Calendar (Part 4): Implementing Real-Time News Updates in the Dashboard

This article enhances our Economic Calendar dashboard by implementing real-time news updates to keep market information current and actionable. We integrate live data fetching techniques in MQL5 to update events on the dashboard continuously, improving the responsiveness of the interface. This update ensures that we can access the latest economic news directly from the dashboard, optimizing trading decisions based on the freshest data.

Neural Networks in Trading: Contrastive Pattern Transformer

The Contrastive Transformer is designed to analyze markets both at the level of individual candlesticks and based on entire patterns. This helps improve the quality of market trend modeling. Moreover, the use of contrastive learning to align representations of candlesticks and patterns fosters self-regulation and improves the accuracy of forecasts.

Developing a Replay System — Market simulation (Part 09): Custom events

Here we'll see how custom events are triggered and how the indicator reports the state of the replay/simulation service.

Developing a Replay System — Market simulation (Part 08): Locking the indicator

In this article, we will look at how to lock the indicator while simply using the MQL5 language, and we will do it in a very interesting and amazing way.

Formulating Dynamic Multi-Pair EA (Part 2): Portfolio Diversification and Optimization

Portfolio Diversification and Optimization strategically spreads investments across multiple assets to minimize risk while selecting the ideal asset mix to maximize returns based on risk-adjusted performance metrics.

Developing a Replay System (Part 76): New Chart Trade (III)

In this article, we'll look at how the code of DispatchMessage, missing from the previous article, works. We will laso introduce the topic of the next article. For this reason, it is important to understand how this code works before moving on to the next topic. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Neural Networks in Trading: Controlled Segmentation (Final Part)

We continue the work started in the previous article on building the RefMask3D framework using MQL5. This framework is designed to comprehensively study multimodal interaction and feature analysis in a point cloud, followed by target object identification based on a description provided in natural language.

Neural Networks Made Easy (Part 85): Multivariate Time Series Forecasting

In this article, I would like to introduce you to a new complex timeseries forecasting method, which harmoniously combines the advantages of linear models and transformers.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part III)

This part of the article series is dedicated to integrating WhatsApp with MetaTrader 5 for notifications. We have included a flow chart to simplify understanding and will discuss the importance of security measures in integration. The primary purpose of indicators is to simplify analysis through automation, and they should include notification methods for alerting users when specific conditions are met. Discover more in this article.

MQL5 Wizard Techniques you should know (Part 61): Using Patterns of ADX and CCI with Supervised Learning

The ADX Oscillator and CCI oscillator are trend following and momentum indicators that can be paired when developing an Expert Advisor. We look at how this can be systemized by using all the 3 main training modes of Machine Learning. Wizard Assembled Expert Advisors allow us to evaluate the patterns presented by these two indicators, and we start by looking at how Supervised-Learning can be applied with these Patterns.

Developing a multi-currency Expert Advisor (Part 15): Preparing EA for real trading

As we gradually approach to obtaining a ready-made EA, we need to pay attention to issues that seem secondary at the stage of testing a trading strategy, but become important when moving on to real trading.

Neural networks made easy (Part 74): Trajectory prediction with adaptation

This article introduces a fairly effective method of multi-agent trajectory forecasting, which is able to adapt to various environmental conditions.

Developing Trading Strategy: Pseudo Pearson Correlation Approach

Generating new indicators from existing ones offers a powerful way to enhance trading analysis. By defining a mathematical function that integrates the outputs of existing indicators, traders can create hybrid indicators that consolidate multiple signals into a single, efficient tool. This article introduces a new indicator built from three oscillators using a modified version of the Pearson correlation function, which we call the Pseudo Pearson Correlation (PPC). The PPC indicator aims to quantify the dynamic relationship between oscillators and apply it within a practical trading strategy.

Developing a multi-currency Expert Advisor (Part 16): Impact of different quote histories on test results

The EA under development is expected to show good results when trading with different brokers. But for now we have been using quotes from a MetaQuotes demo account to perform tests. Let's see if our EA is ready to work on a trading account with different quotes compared to those used during testing and optimization.

Neural networks made easy (Part 71): Goal-Conditioned Predictive Coding (GCPC)

In previous articles, we discussed the Decision Transformer method and several algorithms derived from it. We experimented with different goal setting methods. During the experiments, we worked with various ways of setting goals. However, the model's study of the earlier passed trajectory always remained outside our attention. In this article. I want to introduce you to a method that fills this gap.