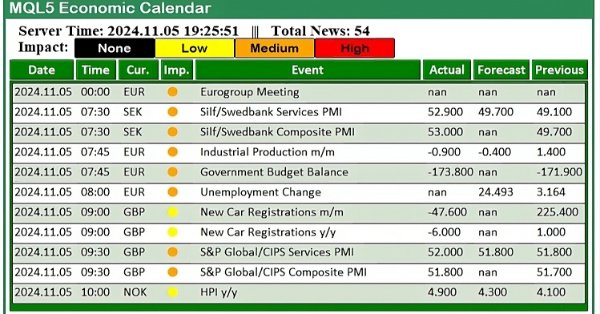

Trading with the MQL5 Economic Calendar (Part 2): Creating a News Dashboard Panel

In this article, we create a practical news dashboard panel using the MQL5 Economic Calendar to enhance our trading strategy. We begin by designing the layout, focusing on key elements like event names, importance, and timing, before moving into the setup within MQL5. Finally, we implement a filtering system to display only the most relevant news, giving traders quick access to impactful economic events.

Modified Grid-Hedge EA in MQL5 (Part IV): Optimizing Simple Grid Strategy (I)

In this fourth part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Grid EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

Formulating Dynamic Multi-Pair EA (Part 3): Mean Reversion and Momentum Strategies

In this article, we will explore the third part of our journey in formulating a Dynamic Multi-Pair Expert Advisor (EA), focusing specifically on integrating Mean Reversion and Momentum trading strategies. We will break down how to detect and act on price deviations from the mean (Z-score), and how to measure momentum across multiple forex pairs to determine trade direction.

High frequency arbitrage trading system in Python using MetaTrader 5

In this article, we will create an arbitration system that remains legal in the eyes of brokers, creates thousands of synthetic prices on the Forex market, analyzes them, and successfully trades for profit.

How to build and optimize a volume-based trading system (Chaikin Money Flow - CMF)

In this article, we will provide a volume-based indicator, Chaikin Money Flow (CMF) after identifying how it can be constructed, calculated, and used. We will understand how to build a custom indicator. We will share some simple strategies that can be used and then test them to understand which one is better.

Automating Trading Strategies in MQL5 (Part 27): Creating a Price Action Crab Harmonic Pattern with Visual Feedback

In this article, we develop a Crab Harmonic Pattern system in MQL5 that identifies bullish and bearish Crab harmonic patterns using pivot points and Fibonacci ratios, triggering trades with precise entry, stop loss, and take-profit levels. We incorporate visual feedback through chart objects like triangles and trendlines to display the XABCD pattern structure and trade levels.

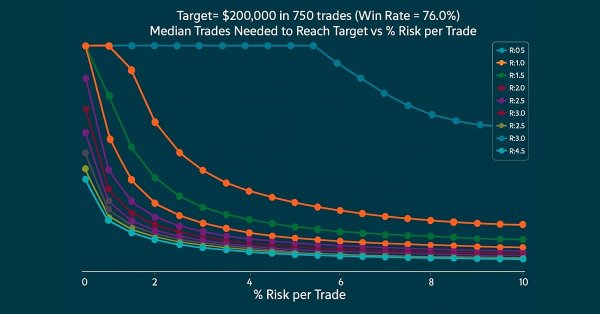

Building a Trading System (Part 3): Determining Minimum Risk Levels for Realistic Profit Targets

Every trader's ultimate goal is profitability, which is why many set specific profit targets to achieve within a defined trading period. In this article, we will use Monte Carlo simulations to determine the optimal risk percentage per trade needed to meet trading objectives. The results will help traders assess whether their profit targets are realistic or overly ambitious. Finally, we will discuss which parameters can be adjusted to establish a practical risk percentage per trade that aligns with trading goals.

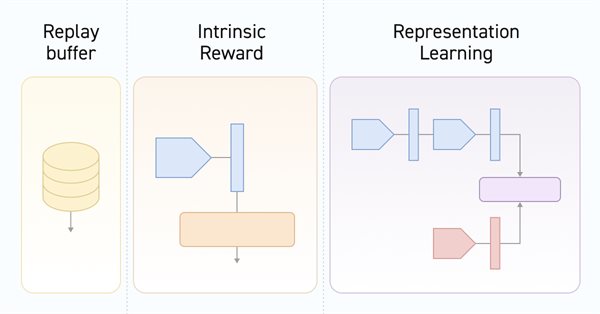

Neural networks made easy (Part 55): Contrastive intrinsic control (CIC)

Contrastive training is an unsupervised method of training representation. Its goal is to train a model to highlight similarities and differences in data sets. In this article, we will talk about using contrastive training approaches to explore different Actor skills.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part II): Movable GUI (II)

Unlock the potential of dynamic data representation in your trading strategies and utilities with our in-depth guide to creating movable GUIs in MQL5. Delve into the fundamental principles of object-oriented programming and discover how to design and implement single or multiple movable GUIs on the same chart with ease and efficiency.

Timeseries in DoEasy library (part 52): Cross-platform nature of multi-period multi-symbol single-buffer standard indicators

In the article, consider creation of multi-symbol multi-period standard indicator Accumulation/Distribution. Slightly improve library classes with respect to indicators so that, the programs developed for outdated platform MetaTrader 4 based on this library could work normally when switching over to MetaTrader 5.

Neural Networks in Trading: A Multi-Agent System with Conceptual Reinforcement (Final Part)

We continue to implement the approaches proposed by the authors of the FinCon framework. FinCon is a multi-agent system based on Large Language Models (LLMs). Today, we will implement the necessary modules and conduct comprehensive testing of the model on real historical data.

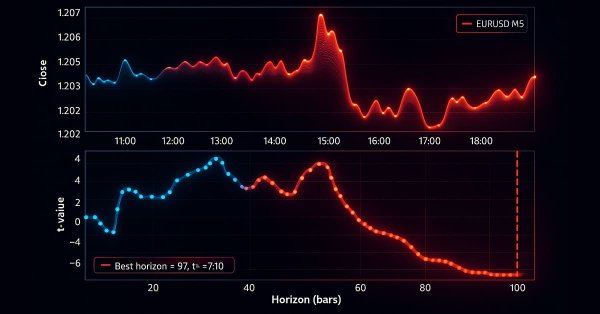

MetaTrader 5 Machine Learning Blueprint (Part 3): Trend-Scanning Labeling Method

We have built a robust feature engineering pipeline using proper tick-based bars to eliminate data leakage and solved the critical problem of labeling with meta-labeled triple-barrier signals. This installment covers the advanced labeling technique, trend-scanning, for adaptive horizons. After covering the theory, an example shows how trend-scanning labels can be used with meta-labeling to improve on the classic moving average crossover strategy.

Price Action Analysis Toolkit Development (Part 41): Building a Statistical Price-Level EA in MQL5

Statistics has always been at the heart of financial analysis. By definition, statistics is the discipline that collects, analyzes, interprets, and presents data in meaningful ways. Now imagine applying that same framework to candlesticks—compressing raw price action into measurable insights. How helpful would it be to know, for a specific period of time, the central tendency, spread, and distribution of market behavior? In this article, we introduce exactly that approach, showing how statistical methods can transform candlestick data into clear, actionable signals.

Data Science and Machine Learning (Part 15): SVM, A Must-Have Tool in Every Trader's Toolbox

Discover the indispensable role of Support Vector Machines (SVM) in shaping the future of trading. This comprehensive guide explores how SVM can elevate your trading strategies, enhance decision-making, and unlock new opportunities in the financial markets. Dive into the world of SVM with real-world applications, step-by-step tutorials, and expert insights. Equip yourself with the essential tool that can help you navigate the complexities of modern trading. Elevate your trading game with SVM—a must-have for every trader's toolbox.

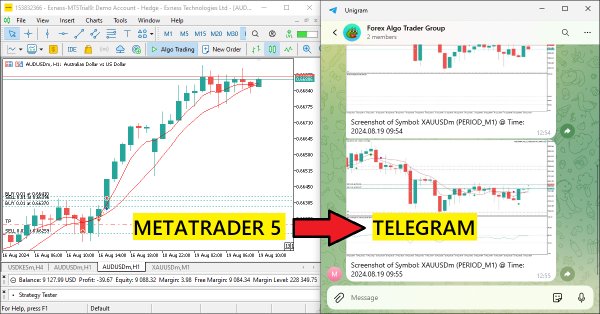

Creating an MQL5-Telegram Integrated Expert Advisor (Part 3): Sending Chart Screenshots with Captions from MQL5 to Telegram

In this article, we create an MQL5 Expert Advisor that encodes chart screenshots as image data and sends them to a Telegram chat via HTTP requests. By integrating photo encoding and transmission, we enhance the existing MQL5-Telegram system with visual trading insights directly within Telegram.

Price Action Analysis Toolkit Development (Part 41): Building a Statistical Price-Level EA in MQL5

Statistics has always been at the heart of financial analysis. By definition, statistics is the discipline that collects, analyzes, interprets, and presents data in meaningful ways. Now imagine applying that same framework to candlesticks—compressing raw price action into measurable insights. How helpful would it be to know, for a specific period of time, the central tendency, spread, and distribution of market behavior? In this article, we introduce exactly that approach, showing how statistical methods can transform candlestick data into clear, actionable signals.

News Trading Made Easy (Part 2): Risk Management

In this article, inheritance will be introduced into our previous and new code. A new database design will be implemented to provide efficiency. Additionally, a risk management class will be created to tackle volume calculations.

Neural networks made easy (Part 33): Quantile regression in distributed Q-learning

We continue studying distributed Q-learning. Today we will look at this approach from the other side. We will consider the possibility of using quantile regression to solve price prediction tasks.

The MQL5 Standard Library Explorer (Part 1): Introduction with CTrade, CiMA, and CiATR

The MQL5 Standard Library plays a vital role in developing trading algorithms for MetaTrader 5. In this discussion series, our goal is to master its application to simplify the creation of efficient trading tools for MetaTrader 5. These tools include custom Expert Advisors, indicators, and other utilities. We begin today by developing a trend-following Expert Advisor using the CTrade, CiMA, and CiATR classes. This is an especially important topic for everyone—whether you are a beginner or an experienced developer. Join this discussion to discover more.

Developing a Replay System — Market simulation (Part 20): FOREX (I)

The initial goal of this article is not to cover all the possibilities of Forex trading, but rather to adapt the system so that you can perform at least one market replay. We'll leave simulation for another moment. However, if we don't have ticks and only bars, with a little effort we can simulate possible trades that could happen in the Forex market. This will be the case until we look at how to adapt the simulator. An attempt to work with Forex data inside the system without modifying it leads to a range of errors.

Developing a trading Expert Advisor from scratch (Part 20): New order system (III)

We continue to implement the new order system. The creation of such a system requires a good command of MQL5, as well as an understanding of how the MetaTrader 5 platform actually works and what resources it provides.

Risk manager for manual trading

In this article we will discuss in detail how to write a risk manager class for manual trading from scratch. This class can also be used as a base class for inheritance by algorithmic traders who use automated programs.

Day Trading Larry Connors RSI2 Mean-Reversion Strategies

Larry Connors is a renowned trader and author, best known for his work in quantitative trading and strategies like the 2-period RSI (RSI2), which helps identify short-term overbought and oversold market conditions. In this article, we’ll first explain the motivation behind our research, then recreate three of Connors’ most famous strategies in MQL5 and apply them to intraday trading of the S&P 500 index CFD.

Building AI-Powered Trading Systems in MQL5 (Part 1): Implementing JSON Handling for AI APIs

In this article, we develop a JSON parsing framework in MQL5 to handle data exchange for AI API integration, focusing on a JSON class for processing JSON structures. We implement methods to serialize and deserialize JSON data, supporting various data types like strings, numbers, and objects, essential for communicating with AI services like ChatGPT, enabling future AI-driven trading systems by ensuring accurate data handling and manipulation.

Introduction to MQL5 (Part 25): Building an EA that Trades with Chart Objects (II)

This article explains how to build an Expert Advisor (EA) that interacts with chart objects, particularly trend lines, to identify and trade breakout and reversal opportunities. You will learn how the EA confirms valid signals, manages trade frequency, and maintains consistency with user-selected strategies.

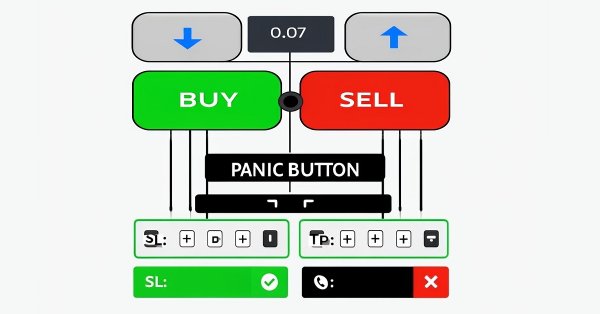

Manual Backtesting Made Easy: Building a Custom Toolkit for Strategy Tester in MQL5

In this article, we design a custom MQL5 toolkit for easy manual backtesting in the Strategy Tester. We explain its design and implementation, focusing on interactive trade controls. We then show how to use it to test strategies effectively

Developing a Replay System (Part 38): Paving the Path (II)

Many people who consider themselves MQL5 programmers do not have the basic knowledge that I will outline in this article. Many people consider MQL5 to be a limited tool, but the actual reason is that they do not have the required knowledge. So, if you don't know something, don't be ashamed of it. It's better to feel ashamed for not asking. Simply forcing MetaTrader 5 to disable indicator duplication in no way ensures two-way communication between the indicator and the Expert Advisor. We are still very far from this, but the fact that the indicator is not duplicated on the chart gives us some confidence.

Introduction to MQL5 (Part 8): Beginner's Guide to Building Expert Advisors (II)

This article addresses common beginner questions from MQL5 forums and demonstrates practical solutions. Learn to perform essential tasks like buying and selling, obtaining candlestick prices, and managing automated trading aspects such as trade limits, trading periods, and profit/loss thresholds. Get step-by-step guidance to enhance your understanding and implementation of these concepts in MQL5.

Price Action Analysis Toolkit Development (Part 39): Automating BOS and ChoCH Detection in MQL5

This article presents Fractal Reaction System, a compact MQL5 system that converts fractal pivots into actionable market-structure signals. Using closed-bar logic to avoid repainting, the EA detects Change-of-Character (ChoCH) warnings and confirms Breaks-of-Structure (BOS), draws persistent chart objects, and logs/alerts every confirmed event (desktop, mobile and sound). Read on for the algorithm design, implementation notes, testing results and the full EA code so you can compile, test and deploy the detector yourself.

Sentiment Analysis and Deep Learning for Trading with EA and Backtesting with Python

In this article, we will introduce Sentiment Analysis and ONNX Models with Python to be used in an EA. One script runs a trained ONNX model from TensorFlow for deep learning predictions, while another fetches news headlines and quantifies sentiment using AI.

Volumetric neural network analysis as a key to future trends

The article explores the possibility of improving price forecasting based on trading volume analysis by integrating technical analysis principles with LSTM neural network architecture. Particular attention is paid to the detection and interpretation of anomalous volumes, the use of clustering and the creation of features based on volumes and their definition in the context of machine learning.

Price Action Analysis Toolkit Development (Part 46): Designing an Interactive Fibonacci Retracement EA with Smart Visualization in MQL5

Fibonacci tools are among the most popular instruments used by technical analysts. In this article, we’ll build an Interactive Fibonacci EA that draws retracement and extension levels that react dynamically to price movement, delivering real‑time alerts, stylish lines, and a scrolling news‑style headline. Another key advantage of this EA is flexibility; you can manually type the high (A) and low (B) swing values directly on the chart, giving you exact control over the market range you want to analyze.

Testing and optimization of binary options strategies in MetaTrader 5

In this article, I will check and optimize binary options strategies in MetaTrader 5.

Design Patterns in software development and MQL5 (Part 3): Behavioral Patterns 1

A new article from Design Patterns articles and we will take a look at one of its types which is behavioral patterns to understand how we can build communication methods between created objects effectively. By completing these Behavior patterns we will be able to understand how we can create and build a reusable, extendable, tested software.

Neural Networks in Trading: Enhancing Transformer Efficiency by Reducing Sharpness (SAMformer)

Training Transformer models requires large amounts of data and is often difficult since the models are not good at generalizing to small datasets. The SAMformer framework helps solve this problem by avoiding poor local minima. This improves the efficiency of models even on limited training datasets.

Data Science and ML (Part 28): Predicting Multiple Futures for EURUSD, Using AI

It is a common practice for many Artificial Intelligence models to predict a single future value. However, in this article, we will delve into the powerful technique of using machine learning models to predict multiple future values. This approach, known as multistep forecasting, allows us to predict not only tomorrow's closing price but also the day after tomorrow's and beyond. By mastering multistep forecasting, traders and data scientists can gain deeper insights and make more informed decisions, significantly enhancing their predictive capabilities and strategic planning.

Reimagining Classic Strategies (Part XI): Moving Average Cross Over (II)

The moving averages and the stochastic oscillator could be used to generate trend following trading signals. However, these signals will only be observed after the price action has occurred. We can effectively overcome this inherent lag in technical indicators using AI. This article will teach you how to create a fully autonomous AI-powered Expert Advisor in a manner that can improve any of your existing trading strategies. Even the oldest trading strategy possible can be improved.

Neural networks made easy (Part 18): Association rules

As a continuation of this series of articles, let's consider another type of problems within unsupervised learning methods: mining association rules. This problem type was first used in retail, namely supermarkets, to analyze market baskets. In this article, we will talk about the applicability of such algorithms in trading.

Introduction to MQL5 (Part 24): Building an EA that Trades with Chart Objects

This article teaches you how to create an Expert Advisor that detects support and resistance zones drawn on the chart and executes trades automatically based on them.

William Gann methods (Part I): Creating Gann Angles indicator

What is the essence of Gann Theory? How are Gann angles constructed? We will create Gann Angles indicator for MetaTrader 5.