Developing a trading Expert Advisor from scratch (Part 11): Cross order system

In this article we will create a system of cross orders. There is one type of assets that makes traders' life very difficult for traders — futures contracts. But why do they make life difficult?

Creating an MQL5-Telegram Integrated Expert Advisor (Part 5): Sending Commands from Telegram to MQL5 and Receiving Real-Time Responses

In this article, we create several classes to facilitate real-time communication between MQL5 and Telegram. We focus on retrieving commands from Telegram, decoding and interpreting them, and sending appropriate responses back. By the end, we ensure that these interactions are effectively tested and operational within the trading environment

Introduction to MQL5 (Part 10): A Beginner's Guide to Working with Built-in Indicators in MQL5

This article introduces working with built-in indicators in MQL5, focusing on creating an RSI-based Expert Advisor (EA) using a project-based approach. You'll learn to retrieve and utilize RSI values, handle liquidity sweeps, and enhance trade visualization using chart objects. Additionally, the article emphasizes effective risk management, including setting percentage-based risk, implementing risk-reward ratios, and applying risk modifications to secure profits.

Timeseries in DoEasy library (part 53): Abstract base indicator class

The article considers creation of an abstract indicator which further will be used as the base class to create objects of library’s standard and custom indicators.

Introduction to MQL5 (Part 10): A Beginner's Guide to Working with Built-in Indicators in MQL5

This article introduces working with built-in indicators in MQL5, focusing on creating an RSI-based Expert Advisor (EA) using a project-based approach. You'll learn to retrieve and utilize RSI values, handle liquidity sweeps, and enhance trade visualization using chart objects. Additionally, the article emphasizes effective risk management, including setting percentage-based risk, implementing risk-reward ratios, and applying risk modifications to secure profits.

MQL5 Market Results for Q1 2013

Since its founding, the store of trading robots and technical indicators MQL5 Market has already attracted more than 250 developers who have published 580 products. The first quarter of 2013 has turned out to be quite successful for some MQL5 Market sellers who have managed to make handsome profit by selling their products.

MQL5 Wizard Techniques you should know (Part 09): Pairing K-Means Clustering with Fractal Waves

K-Means clustering takes the approach to grouping data points as a process that’s initially focused on the macro view of a data set that uses random generated cluster centroids before zooming in and adjusting these centroids to accurately represent the data set. We will look at this and exploit a few of its use cases.

MQL5 Market Turns One Year Old

One year has passed since the launch of sales in MQL5 Market. It was a year of hard work, which turned the new service into the largest store of trading robots and technical indicators for MetaTrader 5 platform.

Developing a trading Expert Advisor from scratch (Part 14): Adding Volume At Price (II)

Today we will add some more resources to our EA. This interesting article can provide some new ideas and methods of presenting information. At the same time, it can assist in fixing minor flaws in your projects.

Build Self Optimizing Expert Advisors With MQL5 And Python

In this article, we will discuss how we can build Expert Advisors capable of autonomously selecting and changing trading strategies based on prevailing market conditions. We will learn about Markov Chains and how they can be helpful to us as algorithmic traders.

How to Create an Interactive MQL5 Dashboard/Panel Using the Controls Class (Part 2): Adding Button Responsiveness

In this article, we focus on transforming our static MQL5 dashboard panel into an interactive tool by enabling button responsiveness. We explore how to automate the functionality of the GUI components, ensuring they react appropriately to user clicks. By the end of the article, we establish a dynamic interface that enhances user engagement and trading experience.

Automating Trading Strategies in MQL5 (Part 21): Enhancing Neural Network Trading with Adaptive Learning Rates

In this article, we enhance a neural network trading strategy in MQL5 with an adaptive learning rate to boost accuracy. We design and implement this mechanism, then test its performance. The article concludes with optimization insights for algorithmic trading.

Automating Trading Strategies in MQL5 (Part 26): Building a Pin Bar Averaging System for Multi-Position Trading

In this article, we develop a Pin Bar Averaging system in MQL5 that detects pin bar patterns to initiate trades and employs an averaging strategy for multi-position management, enhanced by trailing stops and breakeven adjustments. We incorporate customizable parameters with a dashboard for real-time monitoring of positions and profits.

Creating a Daily Drawdown Limiter EA in MQL5

The article discusses, from a detailed perspective, how to implement the creation of an Expert Advisor (EA) based on the trading algorithm. This helps to automate the system in the MQL5 and take control of the Daily Drawdown.

Timeseries in DoEasy library (part 52): Cross-platform nature of multi-period multi-symbol single-buffer standard indicators

In the article, consider creation of multi-symbol multi-period standard indicator Accumulation/Distribution. Slightly improve library classes with respect to indicators so that, the programs developed for outdated platform MetaTrader 4 based on this library could work normally when switching over to MetaTrader 5.

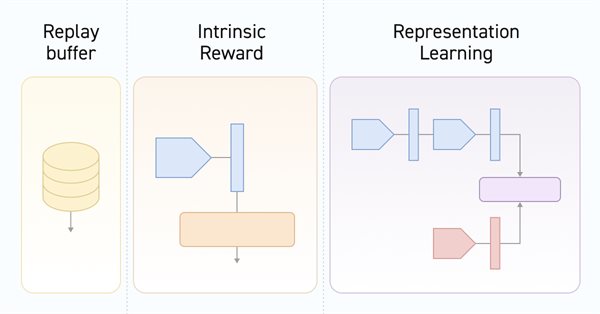

Neural networks made easy (Part 55): Contrastive intrinsic control (CIC)

Contrastive training is an unsupervised method of training representation. Its goal is to train a model to highlight similarities and differences in data sets. In this article, we will talk about using contrastive training approaches to explore different Actor skills.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 7): ZigZag with Awesome Oscillator Indicators Signal

The multi-currency expert advisor in this article is an expert advisor or automated trading that uses ZigZag indicator which are filtered with the Awesome Oscillator or filter each other's signals.

Automating Trading Strategies in MQL5 (Part 15): Price Action Harmonic Cypher Pattern with Visualization

In this article, we explore the automation of the Cypher harmonic pattern in MQL5, detailing its detection and visualization on MetaTrader 5 charts. We implement an Expert Advisor that identifies swing points, validates Fibonacci-based patterns, and executes trades with clear graphical annotations. The article concludes with guidance on backtesting and optimizing the program for effective trading.

Building Your First Glass-box Model Using Python And MQL5

Machine learning models are difficult to interpret and understanding why our models deviate from our expectations is critical if we want to gain any value from using such advanced techniques. Without comprehensive insight into the inner workings of our model, we might fail to spot bugs that are corrupting our model's performance, we may waste time over engineering features that aren't predictive and in the long run we risk underutilizing the power of these models. Fortunately, there is a sophisticated and well maintained all in one solution that allows us to see exactly what our model is doing underneath the hood.

Introduction to MQL5 (Part 17): Building Expert Advisors for Trend Reversals

This article teaches beginners how to build an Expert Advisor (EA) in MQL5 that trades based on chart pattern recognition using trend line breakouts and reversals. By learning how to retrieve trend line values dynamically and compare them with price action, readers will be able to develop EAs capable of identifying and trading chart patterns such as ascending and descending trend lines, channels, wedges, triangles, and more.

Cycles and trading

This article is about using cycles in trading. We will consider building a trading strategy based on cyclical models.

Developing a Replay System — Market simulation (Part 20): FOREX (I)

The initial goal of this article is not to cover all the possibilities of Forex trading, but rather to adapt the system so that you can perform at least one market replay. We'll leave simulation for another moment. However, if we don't have ticks and only bars, with a little effort we can simulate possible trades that could happen in the Forex market. This will be the case until we look at how to adapt the simulator. An attempt to work with Forex data inside the system without modifying it leads to a range of errors.

Developing a trading Expert Advisor from scratch (Part 20): New order system (III)

We continue to implement the new order system. The creation of such a system requires a good command of MQL5, as well as an understanding of how the MetaTrader 5 platform actually works and what resources it provides.

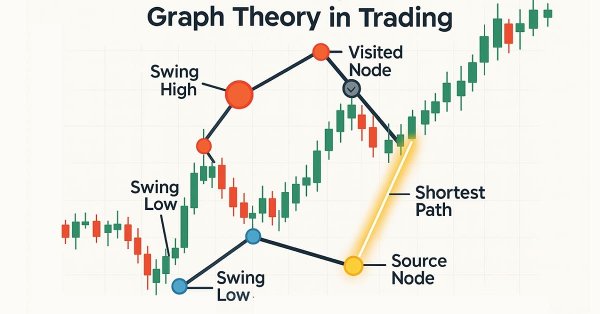

Graph Theory: Dijkstra's Algorithm Applied in Trading

Dijkstra's algorithm, a classic shortest-path solution in graph theory, can optimize trading strategies by modeling market networks. Traders can use it to find the most efficient routes in the candlestick chart data.

Developing a Replay System (Part 38): Paving the Path (II)

Many people who consider themselves MQL5 programmers do not have the basic knowledge that I will outline in this article. Many people consider MQL5 to be a limited tool, but the actual reason is that they do not have the required knowledge. So, if you don't know something, don't be ashamed of it. It's better to feel ashamed for not asking. Simply forcing MetaTrader 5 to disable indicator duplication in no way ensures two-way communication between the indicator and the Expert Advisor. We are still very far from this, but the fact that the indicator is not duplicated on the chart gives us some confidence.

Neural networks made easy (Part 33): Quantile regression in distributed Q-learning

We continue studying distributed Q-learning. Today we will look at this approach from the other side. We will consider the possibility of using quantile regression to solve price prediction tasks.

Implementing the Deus EA: Automated Trading with RSI and Moving Averages in MQL5

This article outlines the steps to implement the Deus EA based on the RSI and Moving Average indicators for guiding automated trading.

Reimagining Classic Strategies (Part 15): Daily Breakout Trading Strategy

Human traders had long participated in financial markets before the rise of computers, developing rules of thumb that guided their decisions. In this article, we revisit a well-known breakout strategy to test whether such market logic, learned through experience, can hold its own against systematic methods. Our findings show that while the original strategy produced high accuracy, it suffered from instability and poor risk control. By refining the approach, we demonstrate how discretionary insights can be adapted into more robust, algorithmic trading strategies.

Price Action Analysis Toolkit Development (Part 13): RSI Sentinel Tool

Price action can be effectively analyzed by identifying divergences, with technical indicators such as the RSI providing crucial confirmation signals. In the article below, we explain how automated RSI divergence analysis can identify trend continuations and reversals, thereby offering valuable insights into market sentiment.

Build Self Optimizing Expert Advisors in MQL5 (Part 6): Stop Out Prevention

Join us in our discussion today as we look for an algorithmic procedure to minimize the total number of times we get stopped out of winning trades. The problem we faced is significantly challenging, and most solutions given in community discussions lack set and fixed rules. Our algorithmic approach to solving the problem increased the profitability of our trades and reduced our average loss per trade. However, there are further advancements to be made to completely filter out all trades that will be stopped out, our solution is a good first step for anyone to try.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part II): Movable GUI (II)

Unlock the potential of dynamic data representation in your trading strategies and utilities with our in-depth guide to creating movable GUIs in MQL5. Delve into the fundamental principles of object-oriented programming and discover how to design and implement single or multiple movable GUIs on the same chart with ease and efficiency.

Automating Trading Strategies in MQL5 (Part 29): Creating a price action Gartley Harmonic Pattern system

In this article, we develop a Gartley Pattern system in MQL5 that identifies bullish and bearish Gartley harmonic patterns using pivot points and Fibonacci ratios, executing trades with precise entry, stop loss, and take-profit levels. We enhance trader insight with visual feedback through chart objects like triangles, trendlines, and labels to clearly display the XABCD pattern structure.

Build Self Optimizing Expert Advisors in MQL5 (Part 3): Dynamic Trend Following and Mean Reversion Strategies

Financial markets are typically classified as either in a range mode or a trending mode. This static view of the market may make it easier for us to trade in the short run. However, it is disconnected from the reality of the market. In this article, we look to better understand how exactly financial markets move between these 2 possible modes and how we can use our new understanding of market behavior to gain confidence in our algorithmic trading strategies.

Risk manager for algorithmic trading

The objectives of this article are to prove the necessity of using a risk manager and to implement the principles of controlled risk in algorithmic trading in a separate class, so that everyone can verify the effectiveness of the risk standardization approach in intraday trading and investing in financial markets. In this article, we will create a risk manager class for algorithmic trading. This is a logical continuation of the previous article in which we discussed the creation of a risk manager for manual trading.

Data Science and Machine Learning (Part 15): SVM, A Must-Have Tool in Every Trader's Toolbox

Discover the indispensable role of Support Vector Machines (SVM) in shaping the future of trading. This comprehensive guide explores how SVM can elevate your trading strategies, enhance decision-making, and unlock new opportunities in the financial markets. Dive into the world of SVM with real-world applications, step-by-step tutorials, and expert insights. Equip yourself with the essential tool that can help you navigate the complexities of modern trading. Elevate your trading game with SVM—a must-have for every trader's toolbox.

Implementing the Generalized Hurst Exponent and the Variance Ratio test in MQL5

In this article, we investigate how the Generalized Hurst Exponent and the Variance Ratio test can be utilized to analyze the behaviour of price series in MQL5.

Neural networks made easy (Part 18): Association rules

As a continuation of this series of articles, let's consider another type of problems within unsupervised learning methods: mining association rules. This problem type was first used in retail, namely supermarkets, to analyze market baskets. In this article, we will talk about the applicability of such algorithms in trading.

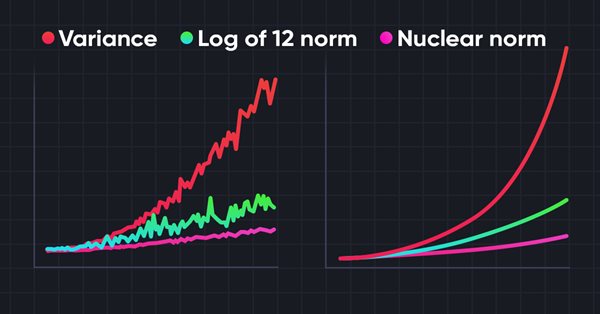

Neural networks made easy (Part 56): Using nuclear norm to drive research

The study of the environment in reinforcement learning is a pressing problem. We have already looked at some approaches previously. In this article, we will have a look at yet another method based on maximizing the nuclear norm. It allows agents to identify environmental states with a high degree of novelty and diversity.

Developing a Replay System — Market simulation (Part 04): adjusting the settings (II)

Let's continue creating the system and controls. Without the ability to control the service, it is difficult to move forward and improve the system.

Trading with the MQL5 Economic Calendar (Part 1): Mastering the Functions of the MQL5 Economic Calendar

In this article, we explore how to use the MQL5 Economic Calendar for trading by first understanding its core functionalities. We then implement key functions of the Economic Calendar in MQL5 to extract relevant news data for trading decisions. Finally, we conclude by showcasing how to utilize this information to enhance trading strategies effectively.