An attempt at developing an EA constructor

In this article, I offer my set of trading functions in the form of a ready-made EA. This method allows getting multiple trading strategies by simply adding indicators and changing inputs.

Universal RSI indicator for working in two directions simultaneously

When developing trading algorithms, we often encounter a problem: how to determine where a trend/flat begins and ends? In this article, we try to create a universal indicator, in which we try to combine signals for different types of strategies. We will try to simplify the process of obtaining trade signals in an expert as much as possible. An example of combining several indicators in one will be given.

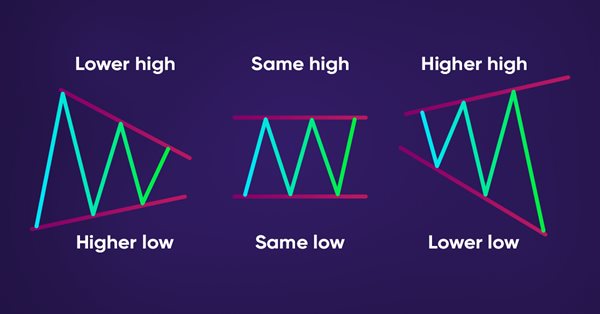

How to detect trends and chart patterns using MQL5

In this article, we will provide a method to detect price actions patterns automatically by MQL5, like trends (Uptrend, Downtrend, Sideways), Chart patterns (Double Tops, Double Bottoms).

Moving Mini-Max: a New Indicator for Technical Analysis and Its Implementation in MQL5

In the following article I am describing a process of implementing Moving Mini-Max indicator based on a paper by Z.G.Silagadze 'Moving Mini-max: a new indicator for technical analysis'. The idea of the indicator is based on simulation of quantum tunneling phenomena, proposed by G. Gamov in the theory of alpha decay.

Applying One Indicator to Another

When writing an indicator that uses the short form of the OnCalculate() function call, you might miss the fact that an indicator can be calculated not only by price data, but also by data of some other indicator (no matter whether it is a built-in or custom one). Do you want to improve an indicator for its correct application to the other indicator's data? In this article we'll review all the steps required for such modification.

Applying OLAP in trading (part 4): Quantitative and visual analysis of tester reports

The article offers basic tools for the OLAP analysis of tester reports relating to single passes and optimization results. The tool can work with standard format files (tst and opt), and it also provides a graphical interface. MQL source codes are attached below.

On Methods to Detect Overbought/Oversold Zones. Part I

Overbought/oversold zones characterize a certain state of the market, differentiating through weaker changes in the prices of securities. This adverse change in the synamics is pronounced most at the final stage in the development of trends of any scales. Since the profit value in trading depends directly on the capability of covering as large trend amplitude as possible, the accuracy of detecting such zones is a key task in trading with any securities whatsoever.

Deep Neural Networks (Part IV). Creating, training and testing a model of neural network

This article considers new capabilities of the darch package (v.0.12.0). It contains a description of training of a deep neural networks with different data types, different structure and training sequence. Training results are included.

Use of Resources in MQL5

MQL5 programs not only automate routine calculations, but also can create a full-featured graphical environment. The functions for creating truly interactive controls are now virtually the same rich, as those in classical programming languages. If you want to write a full-fledged stand-alone program in MQL5, use resources in them. Programs with resources are easier to maintain and distribute.

MQL5 Cookbook - Pivot trading signals

The article describes the development and implementation of a class for sending signals based on pivots — reversal levels. This class is used to form a strategy applying the Standard Library. Improving the pivot strategy by adding filters is considered.

Library for easy and quick development of MetaTrader programs (part V): Classes and collection of trading events, sending events to the program

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the fourth part, we tested tracking trading events on the account. In this article, we will develop trading event classes and place them to the event collections. From there, they will be sent to the base object of the Engine library and the control program chart.

Applying network functions, or MySQL without DLL: Part I - Connector

MetaTrader 5 has received network functions recently. This opened up great opportunities for programmers developing products for the Market. Now they can implement things that required dynamic libraries before. In this article, we will consider them using the implementation of the MySQL as an example.

Developing a trading Expert Advisor from scratch

In this article, we will discuss how to develop a trading robot with minimum programming. Of course, MetaTrader 5 provides a high level of control over trading positions. However, using only the manual ability to place orders can be quite difficult and risky for less experienced users.

Library for easy and quick development of MetaTrader programs (part XXVI): Working with pending trading requests - first implementation (opening positions)

In this article, we are going to store some data in the value of the orders and positions magic number and start the implementation of pending requests. To check the concept, let's create the first test pending request for opening market positions when receiving a server error requiring waiting and sending a repeated request.

Deep Neural Networks (Part VII). Ensemble of neural networks: stacking

We continue to build ensembles. This time, the bagging ensemble created earlier will be supplemented with a trainable combiner — a deep neural network. One neural network combines the 7 best ensemble outputs after pruning. The second one takes all 500 outputs of the ensemble as input, prunes and combines them. The neural networks will be built using the keras/TensorFlow package for Python. The features of the package will be briefly considered. Testing will be performed and the classification quality of bagging and stacking ensembles will be compared.

950 websites broadcast the Economic Calendar from MetaQuotes

The widget provides websites with a detailed release schedule of 500 indicators and indices, of the world's largest economies. Thus, traders quickly receive up-to-date information on all important events with explanations and graphs in addition to the main website content.

Automatic Selection of Promising Signals

The article is devoted to the analysis of trading signals for the MetaTrader 5 platform, which enable the automated execution of trading operations on subscribers' accounts. Also, the article considers the development of tools, which help search for potentially promising trading signals straight from the terminal.

MQL5 Cookbook - Trading signals of moving channels

The article describes the process of developing and implementing a class for sending signals based on the moving channels. Each of the signal version is followed by a trading strategy with testing results. Classes of the Standard Library are used for creating derived classes.

OpenCL: The Bridge to Parallel Worlds

In late January 2012, the software development company that stands behind the development of MetaTrader 5 announced native support for OpenCL in MQL5. Using an illustrative example, the article sets forth the programming basics in OpenCL in the MQL5 environment and provides a few examples of the naive optimization of the program for the increase of operating speed.

Cross-Platform Expert Advisor: Money Management

This article discusses the implementation of money management method for a cross-platform expert advisor. The money management classes are responsible for the calculation of the lot size to be used for the next trade to be entered by the expert advisor.

Order Strategies. Multi-Purpose Expert Advisor

This article centers around strategies that actively use pending orders, a metalanguage that can be created to formally describe such strategies and the use of a multi-purpose Expert Advisor whose operation is based on those descriptions

Optimizing a strategy using balance graph and comparing results with "Balance + max Sharpe Ratio" criterion

In this article, we consider yet another custom trading strategy optimization criterion based on the balance graph analysis. The linear regression is calculated using the function from the ALGLIB library.

Practical application of correlations in trading

In this article, we will analyze the concept of correlation between variables, as well as methods for the calculation of correlation coefficients and their practical use in trading. Correlation is a statistical relationship between two or more random variables (or quantities which can be considered random with some acceptable degree of accuracy). Changes in one ore more variables lead to systematic changes of other related variables.

MQL5 Cookbook: Multi-Currency Expert Advisor - Simple, Neat and Quick Approach

This article will describe an implementation of a simple approach suitable for a multi-currency Expert Advisor. This means that you will be able to set up the Expert Advisor for testing/trading under identical conditions but with different parameters for each symbol. As an example, we will create a pattern for two symbols but in such a way so as to be able to add additional symbols, if necessary, by making small changes to the code.

Understanding order placement in MQL5

When creating any trading system, there is a task we need to deal with effectively. This task is order placement or to let the created trading system deal with orders automatically because it is crucial in any trading system. So, you will find in this article most of the topics that you need to understand about this task to create your trading system in terms of order placement effectively.

Developing a self-adapting algorithm (Part I): Finding a basic pattern

In the upcoming series of articles, I will demonstrate the development of self-adapting algorithms considering most market factors, as well as show how to systematize these situations, describe them in logic and take them into account in your trading activity. I will start with a very simple algorithm that will gradually acquire theory and evolve into a very complex project.

Optimization management (Part II): Creating key objects and add-on logic

This article is a continuation of the previous publication related to the creation of a graphical interface for optimization management. The article considers the logic of the add-on. A wrapper for the MetaTrader 5 terminal will be created: it will enable the running of the add-on as a managed process via C#. In addition, operation with configuration files and setup files is considered in this article. The application logic is divided into two parts: the first one describes the methods called after pressing a particular key, while the second part covers optimization launch and management.

Testing currency pair patterns: Practical application and real trading perspectives. Part IV

This article concludes the series devoted to trading currency pair baskets. Here we test the remaining pattern and discuss applying the entire method in real trading. Market entries and exits, searching for patterns and analyzing them, complex use of combined indicators are considered.

Continuous Walk-Forward Optimization (Part 4): Optimization Manager (Auto Optimizer)

The main purpose of the article is to describe the mechanism of working with our application and its capabilities. Thus the article can be treated as an instruction on how to use the application. It covers all possible pitfalls and specifics of the application usage.

Scraping bond yield data from the web

Automate the collection of interest rate data to improve the performance of an Expert Advisor.

MQL5 Programming Basics: Lists

The new version of the programming language for trading strategy development, MQL [MQL5], provides more powerful and effective features as compared with the previous version [MQL4]. The advantage essentially lies in the object-oriented programming features. This article looks into the possibility of using complex custom data types, such as nodes and lists. It also provides an example of using lists in practical programming in MQL5.

Learn how to design a trading system by ATR

In this article, we will learn a new technical tool that can be used in trading, as a continuation within the series in which we learn how to design simple trading systems. This time we will work with another popular technical indicator: Average True Range (ATR).

Trading signals module using the system by Bill Williams

The article describes the rules of the trading system by Bill Williams, the procedure of application for a developed MQL5 module to search and mark patterns of this system on the chart, automated trading with found patterns, and also presents the results of testing on various trading instruments.

Developing a cross-platform grider EA

In this article, we will learn how to create Expert Advisors (EAs) working both in MetaTrader 4 and MetaTrader 5. To do this, we are going to develop an EA constructing order grids. Griders are EAs that place several limit orders above the current price and the same number of limit orders below it simultaneously.

Interview with Rogério Figurelli (ATC 2012)

Today we are going to talk with Rogério Figurelli (figurelli), a regular participant from Brazil that has not missed any Automated Trading Championship since 2007. This year, he also began to sell his Championship's Expert Advisor in the Market along with his other products. Rogério believes that MetaTrader 5 platform certification on the largest Brazilian exchange BM&FBOVESPA will reveal new professional developers and traders, who do not yet know the full potential of robot investors.

Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

In this article, we automate order block detection in MQL5 using pure price action analysis. We define order blocks, implement their detection, and integrate automated trade execution. Finally, we backtest the strategy to evaluate its performance.

Studying the CCanvas Class. How to Draw Transparent Objects

Do you need more than awkward graphics of moving averages? Do you want to draw something more beautiful than a simple filled rectangle in your terminal? Attractive graphics can be drawn in the terminal. This can be implemented through the CСanvas class, which is used for creating custom graphics. With this class you can implement transparency, blend colors and produce the illusion of transparency by means of overlapping and blending colors.

Visualize this! MQL5 graphics library similar to 'plot' of R language

When studying trading logic, visual representation in the form of graphs is of great importance. A number of programming languages popular among the scientific community (such as R and Python) feature the special 'plot' function used for visualization. It allows drawing lines, point distributions and histograms to visualize patterns. In MQL5, you can do the same using the CGraphics class.

Using spreadsheets to build trading strategies

The article describes the basic principles and methods that allow you to analyze any strategy using spreadsheets (Excel, Calc, Google). The obtained results are compared with MetaTrader 5 tester.

MQL5 vs QLUA - Why trading operations in MQL5 are up to 28 times faster?

Have you ever wondered how quickly your order is delivered to the exchange, how fast it is executed, and how much time your terminal needs in order to receive the operation result? We have prepared a comparison of trading operation execution speed, because no one has ever measured these values using applications in MQL5 and QLUA.