News Trading Made Easy (Part 5): Performing Trades (II)

This article will expand on the trade management class to include buy-stop and sell-stop orders to trade news events and implement an expiration constraint on these orders to prevent any overnight trading. A slippage function will be embedded into the expert to try and prevent or minimize possible slippage that may occur when using stop orders in trading, especially during news events.

MQL5 Wizard Techniques you should know (Part 64): Using Patterns of DeMarker and Envelope Channels with the White-Noise Kernel

The DeMarker Oscillator and the Envelopes' indicator are momentum and support/ resistance tools that can be paired when developing an Expert Advisor. We continue from our last article that introduced these pair of indicators by adding machine learning to the mix. We are using a recurrent neural network that uses the white-noise kernel to process vectorized signals from these two indicators. This is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Category Theory in MQL5 (Part 7): Multi, Relative and Indexed Domains

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Implementation of the Augmented Dickey Fuller test in MQL5

In this article we demonstrate the implementation of the Augmented Dickey-Fuller test, and apply it to conduct cointegration tests using the Engle-Granger method.

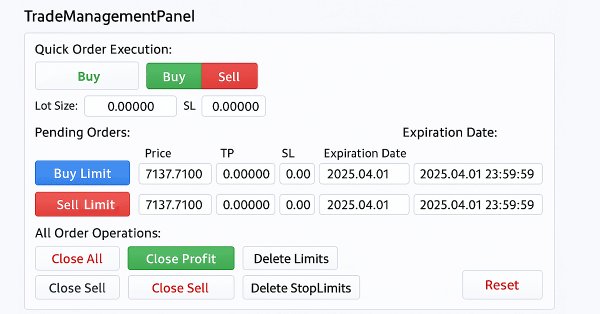

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (IV): Trade Management Panel class

This discussion covers the updated TradeManagementPanel in our New_Admin_Panel EA. The update enhances the panel by using built-in classes to offer a user-friendly trade management interface. It includes trading buttons for opening positions and controls for managing existing trades and pending orders. A key feature is the integrated risk management that allows setting stop loss and take profit values directly in the interface. This update improves code organization for large programs and simplifies access to order management tools, which are often complex in the terminal.

From Novice to Expert: Animated News Headline Using MQL5 (IX) — Multiple Symbol Management on a single chart for News Trading

News trading often requires managing multiple positions and symbols within a very short time due to heightened volatility. In today’s discussion, we address the challenges of multi-symbol trading by integrating this feature into our News Headline EA. Join us as we explore how algorithmic trading with MQL5 makes multi-symbol trading more efficient and powerful.

Market Reactions and Trading Strategies in Response to Dividend Announcements: Evaluating the Efficient Market Hypothesis in Stock Trading

In this article, we will analyse the impact of dividend announcements on stock market returns and see how investors can earn more returns than those offered by the market when they expect a company to announce dividends. In doing so, we will also check the validity of the Efficient Market Hypothesis in the context of the Indian Stock Market.

Category Theory in MQL5 (Part 5): Equalizers

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Population optimization algorithms: Binary Genetic Algorithm (BGA). Part II

In this article, we will look at the binary genetic algorithm (BGA), which models the natural processes that occur in the genetic material of living things in nature.

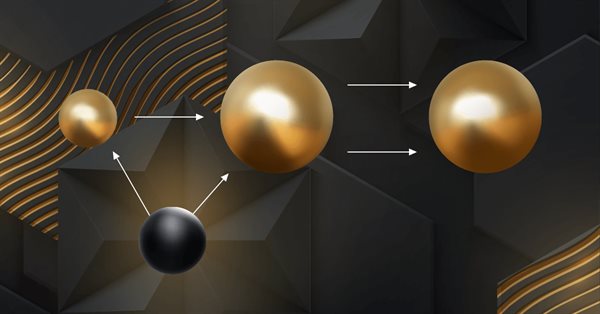

Black Hole Algorithm (BHA)

The Black Hole Algorithm (BHA) uses the principles of black hole gravity to optimize solutions. In this article, we will look at how BHA attracts the best solutions while avoiding local extremes, and why this algorithm has become a powerful tool for solving complex problems. Learn how simple ideas can lead to impressive results in the world of optimization.

Moving to MQL5 Algo Forge (Part 3): Using External Repositories in Your Own Projects

Let's explore how you can start integrating external code from any repository in the MQL5 Algo Forge storage into your own project. In this article, we finally turn to this promising, yet more complex, task: how to practically connect and use libraries from third-party repositories within MQL5 Algo Forge.

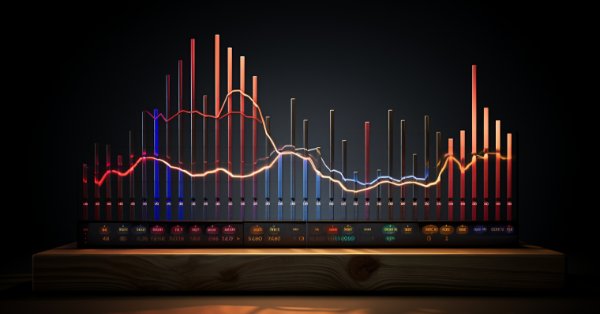

Price Action Analysis Toolkit Development (Part 8): Metrics Board

As one of the most powerful Price Action analysis toolkits, the Metrics Board is designed to streamline market analysis by instantly providing essential market metrics with just a click of a button. Each button serves a specific function, whether it’s analyzing high/low trends, volume, or other key indicators. This tool delivers accurate, real-time data when you need it most. Let’s dive deeper into its features in this article.

MQL5 Trading Toolkit (Part 4): Developing a History Management EX5 Library

Learn how to retrieve, process, classify, sort, analyze, and manage closed positions, orders, and deal histories using MQL5 by creating an expansive History Management EX5 Library in a detailed step-by-step approach.

Building A Candlestick Trend Constraint Model (Part 9): Multiple Strategies Expert Advisor (II)

The number of strategies that can be integrated into an Expert Advisor is virtually limitless. However, each additional strategy increases the complexity of the algorithm. By incorporating multiple strategies, an Expert Advisor can better adapt to varying market conditions, potentially enhancing its profitability. Today, we will explore how to implement MQL5 for one of the prominent strategies developed by Richard Donchian, as we continue to enhance the functionality of our Trend Constraint Expert.

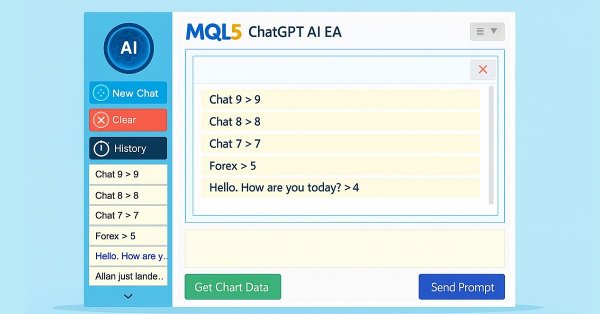

Building AI-Powered Trading Systems in MQL5 (Part 5): Adding a Collapsible Sidebar with Chat Popups

In Part 5 of our MQL5 AI trading system series, we enhance the ChatGPT-integrated Expert Advisor by introducing a collapsible sidebar, improving navigation with small and large history popups for seamless chat selection, while maintaining multiline input handling, persistent encrypted chat storage, and AI-driven trade signal generation from chart data.

MQL5 Wizard Techniques you should know (Part 61): Using Patterns of ADX and CCI with Supervised Learning

The ADX Oscillator and CCI oscillator are trend following and momentum indicators that can be paired when developing an Expert Advisor. We look at how this can be systemized by using all the 3 main training modes of Machine Learning. Wizard Assembled Expert Advisors allow us to evaluate the patterns presented by these two indicators, and we start by looking at how Supervised-Learning can be applied with these Patterns.

Developing an MQL5 Reinforcement Learning agent with RestAPI integration (Part 1): How to use RestAPIs in MQL5

In this article we will talk about the importance of APIs (Application Programming Interface) for interaction between different applications and software systems. We will see the role of APIs in simplifying interactions between applications, allowing them to efficiently share data and functionality.

Creating a Trading Administrator Panel in MQL5 (Part II): Enhancing Responsiveness and Quick Messaging

In this article, we will enhance the responsiveness of the Admin Panel that we previously created. Additionally, we will explore the significance of quick messaging in the context of trading signals.

Risk Management (Part 3): Building the Main Class for Risk Management

In this article, we will begin creating a core risk management class that will be key to controlling risks in the system. We will focus on building the foundations, defining the basic structures, variables and functions. In addition, we will implement the necessary methods for setting maximum profit and loss values, thereby laying the foundation for risk management.

Population ADAM (Adaptive Moment Estimation)

The article presents the transformation of the well-known and popular ADAM gradient optimization method into a population algorithm and its modification with the introduction of hybrid individuals. The new approach allows creating agents that combine elements of successful decisions using probability distribution. The key innovation is the formation of hybrid population individuals that adaptively accumulate information from the most promising solutions, increasing the efficiency of search in complex multidimensional spaces.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part III)

This part of the article series is dedicated to integrating WhatsApp with MetaTrader 5 for notifications. We have included a flow chart to simplify understanding and will discuss the importance of security measures in integration. The primary purpose of indicators is to simplify analysis through automation, and they should include notification methods for alerting users when specific conditions are met. Discover more in this article.

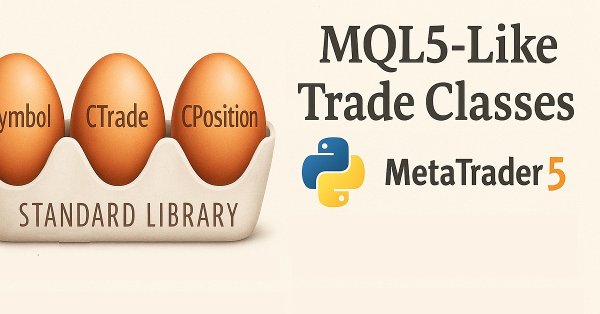

Building MQL5-Like Trade Classes in Python for MetaTrader 5

MetaTrader 5 python package provides an easy way to build trading applications for the MetaTrader 5 platform in the Python language, while being a powerful and useful tool, this module isn't as easy as MQL5 programming language when it comes to making an algorithmic trading solution. In this article, we are going to build trade classes similar to the one offered in MQL5 to create a similar syntax and make it easier to make trading robots in Python as in MQL5.

From Novice to Expert: Animated News Headline Using MQL5 (VI) — Pending Order Strategy for News Trading

In this article, we shift focus toward integrating news-driven order execution logic—enabling the EA to act, not just inform. Join us as we explore how to implement automated trade execution in MQL5 and extend the News Headline EA into a fully responsive trading system. Expert Advisors offer significant advantages for algorithmic developers thanks to the wide range of features they support. So far, we’ve focused on building a news and calendar events presentation tool, complete with integrated AI insights lanes and technical indicator insights.

Creating a Trading Administrator Panel in MQL5 (Part VI):Trade Management Panel (II)

In this article, we enhance the Trade Management Panel of our multi-functional Admin Panel. We introduce a powerful helper function that simplifies the code, improving readability, maintainability, and efficiency. We will also demonstrate how to seamlessly integrate additional buttons and enhance the interface to handle a wider range of trading tasks. Whether managing positions, adjusting orders, or simplifying user interactions, this guide will help you develop a robust, user-friendly Trade Management Panel.

Time series clustering in causal inference

Clustering algorithms in machine learning are important unsupervised learning algorithms that can divide the original data into groups with similar observations. By using these groups, you can analyze the market for a specific cluster, search for the most stable clusters using new data, and make causal inferences. The article proposes an original method for time series clustering in Python.

Market Simulation (Part 06): Transferring Information from MetaTrader 5 to Excel

Many people, especially non=programmers, find it very difficult to transfer information between MetaTrader 5 and other programs. One such program is Excel. Many use Excel as a way to manage and maintain their risk control. It is an excellent program and easy to learn, even for those who are not VBA programmers. Here we will look at how to establish a connection between MetaTrader 5 and Excel (a very simple method).

From Novice to Expert: Animated News Headline Using MQL5 (III) — Indicator Insights

In this article, we’ll advance the News Headline EA by introducing a dedicated indicator insights lane—a compact, on-chart display of key technical signals generated from popular indicators such as RSI, MACD, Stochastic, and CCI. This approach eliminates the need for multiple indicator subwindows on the MetaTrader 5 terminal, keeping your workspace clean and efficient. By leveraging the MQL5 API to access indicator data in the background, we can process and visualize market insights in real-time using custom logic. Join us as we explore how to manipulate indicator data in MQL5 to create an intelligent and space-saving scrolling insights system, all within a single horizontal lane on your trading chart.

Developing a multi-currency Expert Advisor (Part 8): Load testing and handling a new bar

As we progressed, we used more and more simultaneously running instances of trading strategies in one EA. Let's try to figure out how many instances we can get to before we hit resource limitations.

Implementing Practical Modules from Other Languages in MQL5 (Part 02): Building the REQUESTS Library, Inspired by Python

In this article, we implement a module similar to requests offered in Python to make it easier to send and receive web requests in MetaTrader 5 using MQL5.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 7): Command Analysis for Indicator Automation on Charts

In this article, we explore how to integrate Telegram commands with MQL5 to automate the addition of indicators on trading charts. We cover the process of parsing user commands, executing them in MQL5, and testing the system to ensure smooth indicator-based trading

Codex Pipelines: From Python to MQL5 for Indicator Selection — A Multi-Quarter Analysis of the FXI ETF

We continue our look at how MetaTrader can be used outside its forex trading ‘comfort-zone’ by looking at another tradable asset in the form of the FXI ETF. Unlike in the last article where we tried to do ‘too-much’ by delving into not just indicator selection, but also considering indicator pattern combinations, for this article we will swim slightly upstream by focusing more on indicator selection. Our end product for this is intended as a form of pipeline that can help recommend indicators for various assets, provided we have a reasonable amount of their price history.

MQL5 Wizard Techniques you should know (Part 57): Supervised Learning with Moving Average and Stochastic Oscillator

Moving Average and Stochastic Oscillator are very common indicators that some traders may not use a lot because of their lagging nature. In a 3-part ‘miniseries' that considers the 3 main forms of machine learning, we look to see if this bias against these indicators is justified, or they might be holding an edge. We do our examination in wizard assembled Expert Advisors.

Developing a multi-currency Expert Advisor (Part 20): Putting in order the conveyor of automatic project optimization stages (I)

We have already created quite a few components that help arrange auto optimization. During the creation, we followed the traditional cyclical structure: from creating minimal working code to refactoring and obtaining improved code. It is time to start clearing up our database, which is also a key component in the system we are creating.

Time Evolution Travel Algorithm (TETA)

This is my own algorithm. The article presents the Time Evolution Travel Algorithm (TETA) inspired by the concept of parallel universes and time streams. The basic idea of the algorithm is that, although time travel in the conventional sense is impossible, we can choose a sequence of events that lead to different realities.

Price Action Analysis Toolkit Development (Part 34): Turning Raw Market Data into Predictive Models Using an Advanced Ingestion Pipeline

Have you ever missed a sudden market spike or been caught off‑guard when one occurred? The best way to anticipate live events is to learn from historical patterns. Intending to train an ML model, this article begins by showing you how to create a script in MetaTrader 5 that ingests historical data and sends it to Python for storage—laying the foundation for your spike‑detection system. Read on to see each step in action.

Websockets for MetaTrader 5: Asynchronous client connections with the Windows API

This article details the development of a custom dynamically linked library designed to facilitate asynchronous websocket client connections for MetaTrader programs.

Cross-validation and basics of causal inference in CatBoost models, export to ONNX format

The article proposes the method of creating bots using machine learning.

Websockets for MetaTrader 5: Asynchronous client connections with the Windows API

This article details the development of a custom dynamically linked library designed to facilitate asynchronous websocket client connections for MetaTrader programs.

Quantitative approach to risk management: Applying VaR model to optimize multi-currency portfolio using Python and MetaTrader 5

This article explores the potential of the Value at Risk (VaR) model for multi-currency portfolio optimization. Using the power of Python and the functionality of MetaTrader 5, we demonstrate how to implement VaR analysis for efficient capital allocation and position management. From theoretical foundations to practical implementation, the article covers all aspects of applying one of the most robust risk calculation systems – VaR – in algorithmic trading.

From Novice to Expert: Mastering Detailed Trading Reports with Reporting EA

In this article, we delve into enhancing the details of trading reports and delivering the final document via email in PDF format. This marks a progression from our previous work, as we continue exploring how to harness the power of MQL5 and Python to generate and schedule trading reports in the most convenient and professional formats. Join us in this discussion to learn more about optimizing trading report generation within the MQL5 ecosystem.