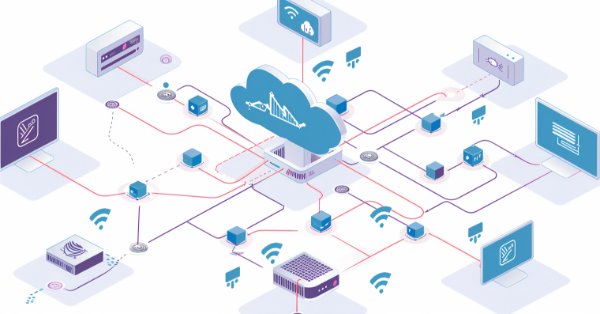

MetaTrader tick info access from MQL5 services to Python application using sockets

Sometimes everything is not programmable in the MQL5 language. And even if it is possible to convert existing advanced libraries in MQL5, it would be time-consuming. This article tries to show that we can bypass Windows OS dependency by transporting tick information such as bid, ask and time with MetaTrader services to a Python application using sockets.

Building AI-Powered Trading Systems in MQL5 (Part 8): UI Polish with Animations, Timing Metrics, and Response Management Tools

In this article, we enhance the AI-powered trading system in MQL5 with user interface improvements, including loading animations for request preparation and thinking phases, as well as timing metrics displayed in responses for better feedback. We add response management tools like regenerate buttons to re-query the AI and export options to save the last response to a file, streamlining interaction.

Category Theory in MQL5 (Part 10): Monoid Groups

This article continues the series on category theory implementation in MQL5. Here we look at monoid-groups as a means normalising monoid sets making them more comparable across a wider span of monoid sets and data types..

Connexus Helper (Part 5): HTTP Methods and Status Codes

In this article, we will understand HTTP methods and status codes, two very important pieces of communication between client and server on the web. Understanding what each method does gives you the control to make requests more precisely, informing the server what action you want to perform and making it more efficient.

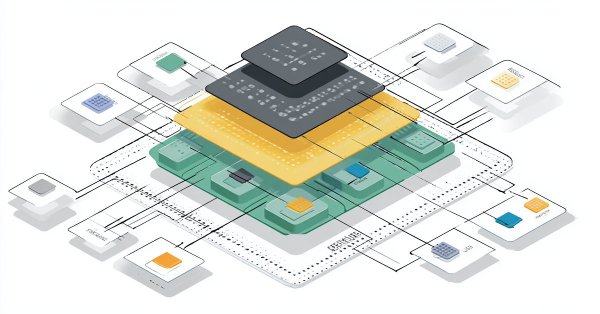

MetaTrader 5 Machine Learning Blueprint (Part 6): Engineering a Production-Grade Caching System

Tired of watching progress bars instead of testing trading strategies? Traditional caching fails financial ML, leaving you with lost computations and frustrating restarts. We've engineered a sophisticated caching architecture that understands the unique challenges of financial data—temporal dependencies, complex data structures, and the constant threat of look-ahead bias. Our three-layer system delivers dramatic speed improvements while automatically invalidating stale results and preventing costly data leaks. Stop waiting for computations and start iterating at the pace the markets demand.

Propensity score in causal inference

The article examines the topic of matching in causal inference. Matching is used to compare similar observations in a data set. This is necessary to correctly determine causal effects and get rid of bias. The author explains how this helps in building trading systems based on machine learning, which become more stable on new data they were not trained on. The propensity score plays a central role and is widely used in causal inference.

Evolutionary trading algorithm with reinforcement learning and extinction of feeble individuals (ETARE)

In this article, I introduce an innovative trading algorithm that combines evolutionary algorithms with deep reinforcement learning for Forex trading. The algorithm uses the mechanism of extinction of inefficient individuals to optimize the trading strategy.

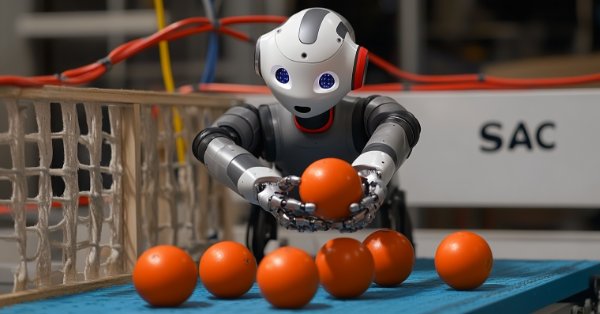

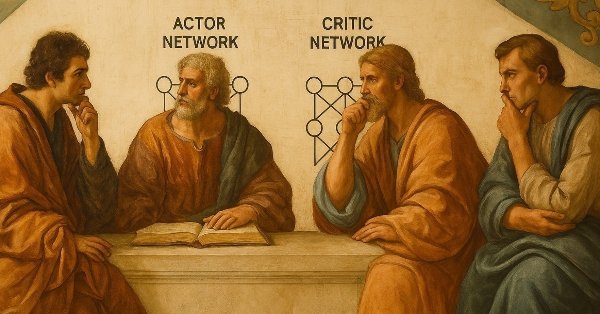

MQL5 Wizard Techniques you should know (Part 51): Reinforcement Learning with SAC

Soft Actor Critic is a Reinforcement Learning algorithm that utilizes 3 neural networks. An actor network and 2 critic networks. These machine learning models are paired in a master slave partnership where the critics are modelled to improve the forecast accuracy of the actor network. While also introducing ONNX in these series, we explore how these ideas could be put to test as a custom signal of a wizard assembled Expert Advisor.

MQL5 Wizard Techniques you should know (Part 72): Using Patterns of MACD and the OBV with Supervised Learning

We follow up on our last article, where we introduced the indicator pair of the MACD and the OBV, by looking at how this pairing could be enhanced with Machine Learning. MACD and OBV are a trend and volume complimentary pairing. Our machine learning approach uses a convolution neural network that engages the Exponential kernel in sizing its kernels and channels, when fine-tuning the forecasts of this indicator pairing. As always, this is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

From Novice to Expert: Animated News Headline Using MQL5 (VIII) — Quick Trade Buttons for News Trading

While algorithmic trading systems manage automated operations, many news traders and scalpers prefer active control during high-impact news events and fast-paced market conditions, requiring rapid order execution and management. This underscores the need for intuitive front-end tools that integrate real-time news feeds, economic calendar data, indicator insights, AI-driven analytics, and responsive trading controls.

From Novice to Expert: Backend Operations Monitor using MQL5

Using a ready-made solution in trading without concerning yourself with the internal workings of the system may sound comforting, but this is not always the case for developers. Eventually, an upgrade, misperformance, or unexpected error will arise, and it becomes essential to trace exactly where the issue originates to diagnose and resolve it quickly. Today’s discussion focuses on uncovering what normally happens behind the scenes of a trading Expert Advisor, and on developing a custom dedicated class for displaying and logging backend processes using MQL5. This gives both developers and traders the ability to quickly locate errors, monitor behavior, and access diagnostic information specific to each EA.

Population optimization algorithms: Changing shape, shifting probability distributions and testing on Smart Cephalopod (SC)

The article examines the impact of changing the shape of probability distributions on the performance of optimization algorithms. We will conduct experiments using the Smart Cephalopod (SC) test algorithm to evaluate the efficiency of various probability distributions in the context of optimization problems.

MQL5 Wizard Techniques you should know (Part 22): Conditional GANs

Generative Adversarial Networks are a pairing of Neural Networks that train off of each other for more accurate results. We adopt the conditional type of these networks as we look to possible application in forecasting Financial time series within an Expert Signal Class.

From Novice to Expert: Animated News Headline Using MQL5 (IV) — Locally hosted AI model market insights

In today's discussion, we explore how to self-host open-source AI models and use them to generate market insights. This forms part of our ongoing effort to expand the News Headline EA, introducing an AI Insights Lane that transforms it into a multi-integration assistive tool. The upgraded EA aims to keep traders informed through calendar events, financial breaking news, technical indicators, and now AI-generated market perspectives—offering timely, diverse, and intelligent support to trading decisions. Join the conversation as we explore practical integration strategies and how MQL5 can collaborate with external resources to build a powerful and intelligent trading work terminal.

Developing a multi-currency Expert Advisor (Part 10): Creating objects from a string

The EA development plan includes several stages with intermediate results being saved in the database. They can only be retrieved from there again as strings or numbers, not objects. So we need a way to recreate the desired objects in the EA from the strings read from the database.

Codex Pipelines, from Python to MQL5, for Indicator Selection: A Multi-Quarter Analysis of the XLF ETF with Machine Learning

We continue our look at how the selection of indicators can be pipelined when facing a ‘none-typical’ MetaTrader asset. MetaTrader 5 is primarily used to trade forex, and that is good given the liquidity on offer, however the case for trading outside of this ‘comfort-zone’, is growing bolder with not just the overnight rise of platforms like Robinhood, but also the relentless pursuit of an edge for most traders. We consider the XLF ETF for this article and also cap our revamped pipeline with a simple MLP.

Price Driven CGI Model: Theoretical Foundation

Let's discuss the data manipulation algorithm, as we dive deeper into conceptualizing the idea of using price data to drive CGI objects. Think about transferring the effects of events, human emotions and actions on financial asset prices to a real-life model. This study delves into leveraging price data to influence the scale of a CGI object, controlling growth and emotions. These visible effects can establish a fresh analytical foundation for traders. Further insights are shared in the article.

Comet Tail Algorithm (CTA)

In this article, we will look at the Comet Tail Optimization Algorithm (CTA), which draws inspiration from unique space objects - comets and their impressive tails that form when approaching the Sun. The algorithm is based on the concept of the motion of comets and their tails, and is designed to find optimal solutions in optimization problems.

From Novice to Expert: Animated News Headline Using MQL5 (X)—Multiple Symbol Chart View for News Trading

Today we will develop a multi-chart view system using chart objects. The goal is to enhance news trading by applying MQL5 algorithms that help reduce trader reaction time during periods of high volatility, such as major news releases. In this case, we provide traders with an integrated way to monitor multiple major symbols within a single all-in-one news trading tool. Our work is continuously advancing with the News Headline EA, which now features a growing set of functions that add real value both for traders using fully automated systems and for those who prefer manual trading assisted by algorithms. Explore more knowledge, insights, and practical ideas by clicking through and joining this discussion.

Blood inheritance optimization (BIO)

I present to you my new population optimization algorithm - Blood Inheritance Optimization (BIO), inspired by the human blood group inheritance system. In this algorithm, each solution has its own "blood type" that determines the way it evolves. Just as in nature where a child's blood type is inherited according to specific rules, in BIO new solutions acquire their characteristics through a system of inheritance and mutations.

Developing a multi-currency Expert Advisor (Part 11): Automating the optimization (first steps)

To get a good EA, we need to select multiple good sets of parameters of trading strategy instances for it. This can be done manually by running optimization on different symbols and then selecting the best results. But it is better to delegate this work to the program and engage in more productive activities.

Across Neighbourhood Search (ANS)

The article reveals the potential of the ANS algorithm as an important step in the development of flexible and intelligent optimization methods that can take into account the specifics of the problem and the dynamics of the environment in the search space.

Creating a Trading Administrator Panel in MQL5 (Part VI): Multiple Functions Interface (I)

The Trading Administrator's role goes beyond just Telegram communications; they can also engage in various control activities, including order management, position tracking, and interface customization. In this article, we’ll share practical insights on expanding our program to support multiple functionalities in MQL5. This update aims to overcome the current Admin Panel's limitation of focusing primarily on communication, enabling it to handle a broader range of tasks.

Building A Candlestick Trend Constraint Model (Part 6): All in one integration

One major challenge is managing multiple chart windows of the same pair running the same program with different features. Let's discuss how to consolidate several integrations into one main program. Additionally, we will share insights on configuring the program to print to a journal and commenting on the successful signal broadcast on the chart interface. Find more information in this article as we progress the article series.

Developing an MQTT client for MetaTrader 5: a TDD approach — Final

This article is the last part of a series describing our development steps of a native MQL5 client for the MQTT 5.0 protocol. Although the library is not production-ready yet, in this part, we will use our client to update a custom symbol with ticks (or rates) sourced from another broker. Please, see the bottom of this article for more information about the library's current status, what is missing for it to be fully compliant with the MQTT 5.0 protocol, a possible roadmap, and how to follow and contribute to its development.

Dialectic Search (DA)

The article introduces the dialectical algorithm (DA), a new global optimization method inspired by the philosophical concept of dialectics. The algorithm exploits a unique division of the population into speculative and practical thinkers. Testing shows impressive performance of up to 98% on low-dimensional problems and overall efficiency of 57.95%. The article explains these metrics and presents a detailed description of the algorithm and the results of experiments on different types of functions.

MQL5 Wizard Techniques you should know (Part 58): Reinforcement Learning (DDPG) with Moving Average and Stochastic Oscillator Patterns

Moving Average and Stochastic Oscillator are very common indicators whose collective patterns we explored in the prior article, via a supervised learning network, to see which “patterns-would-stick”. We take our analyses from that article, a step further by considering the effects' reinforcement learning, when used with this trained network, would have on performance. Readers should note our testing is over a very limited time window. Nonetheless, we continue to harness the minimal coding requirements afforded by the MQL5 wizard in showcasing this.

MQL5 Wizard Techniques you should know (Part 21): Testing with Economic Calendar Data

Economic Calendar Data is not available for testing with Expert Advisors within Strategy Tester, by default. We look at how Databases could help in providing a work around this limitation. So, for this article we explore how SQLite databases can be used to archive Economic Calendar news such that wizard assembled Expert Advisors can use this to generate trade signals.

Developing a multi-currency Expert Advisor (Part 9): Collecting optimization results for single trading strategy instances

Let's outline the main stages of the EA development. One of the first things to be done will be to optimize a single instance of the developed trading strategy. Let's try to collect all the necessary information about the tester passes during the optimization in one place.

Developing a multi-currency Expert Advisor (Part 24): Adding a new strategy (I)

In this article, we will look at how to connect a new strategy to the auto optimization system we have created. Let's see what kind of EAs we need to create and whether it will be possible to do without changing the EA library files or minimize the necessary changes.

Developing an MQTT client for Metatrader 5: a TDD approach — Part 4

This article is the fourth part of a series describing our development steps of a native MQL5 client for the MQTT protocol. In this part, we describe what MQTT v5.0 Properties are, their semantics, how we are reading some of them, and provide a brief example of how Properties can be used to extend the protocol.

From Novice to Expert: Animated News Headline Using MQL5 (I)

News accessibility is a critical factor when trading on the MetaTrader 5 terminal. While numerous news APIs are available, many traders face challenges in accessing and integrating them effectively into their trading environment. In this discussion, we aim to develop a streamlined solution that brings news directly onto the chart—where it’s most needed. We'll accomplish this by building a News Headline Expert Advisor that monitors and displays real-time news updates from API sources.

The base class of population algorithms as the backbone of efficient optimization

The article represents a unique research attempt to combine a variety of population algorithms into a single class to simplify the application of optimization methods. This approach not only opens up opportunities for the development of new algorithms, including hybrid variants, but also creates a universal basic test stand. This stand becomes a key tool for choosing the optimal algorithm depending on a specific task.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (V): AnalyticsPanel Class

In this discussion, we explore how to retrieve real-time market data and trading account information, perform various calculations, and display the results on a custom panel. To achieve this, we will dive deeper into developing an AnalyticsPanel class that encapsulates all these features, including panel creation. This effort is part of our ongoing expansion of the New Admin Panel EA, introducing advanced functionalities using modular design principles and best practices for code organization.

MQL5 Wizard Techniques you should know (Part 79): Using Gator Oscillator and Accumulation/Distribution Oscillator with Supervised Learning

In the last piece, we concluded our look at the pairing of the gator oscillator and the accumulation/distribution oscillator when used in their typical setting of the raw signals they generate. These two indicators are complimentary as trend and volume indicators, respectively. We now follow up that piece, by examining the effect that supervised learning can have on enhancing some of the feature patterns we had reviewed. Our supervised learning approach is a CNN that engages with kernel regression and dot product similarity to size its kernels and channels. As always, we do this in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Price Action Analysis Toolkit Development (Part 9): External Flow

This article explores a new dimension of analysis using external libraries specifically designed for advanced analytics. These libraries, like pandas, provide powerful tools for processing and interpreting complex data, enabling traders to gain more profound insights into market dynamics. By integrating such technologies, we can bridge the gap between raw data and actionable strategies. Join us as we lay the foundation for this innovative approach and unlock the potential of combining technology with trading expertise.

Combinatorially Symmetric Cross Validation In MQL5

In this article we present the implementation of Combinatorially Symmetric Cross Validation in pure MQL5, to measure the degree to which a overfitting may occure after optimizing a strategy using the slow complete algorithm of the Strategy Tester.

Custom Debugging and Profiling Tools for MQL5 Development (Part I): Advanced Logging

Learn how to implement a powerful custom logging framework for MQL5 that goes beyond simple Print() statements by supporting severity levels, multiple output handlers, and automated file rotation—all configurable on‐the‐fly. Integrate the singleton CLogger with ConsoleLogHandler and FileLogHandler to capture contextual, timestamped logs in both the Experts tab and persistent files. Streamline debugging and performance tracing in your Expert Advisors with clear, customizable log formats and centralized control.

The MQL5 Standard Library Explorer (Part 3): Expert Standard Deviation Channel

In this discussion, we will develop an Expert Advisor using the CTrade and CStdDevChannel classes, while applying several filters to enhance profitability. This stage puts our previous discussion into practical application. Additionally, I’ll introduce another simple approach to help you better understand the MQL5 Standard Library and its underlying codebase. Join the discussion to explore these concepts in action.

Fibonacci in Forex (Part I): Examining the Price-Time Relationship

How does the market observe Fibonacci-based relationships? This sequence, where each subsequent number is equal to the sum of the two previous ones (1, 1, 2, 3, 5, 8, 13, 21...), not only describes the growth of the rabbit population. We will consider the Pythagorean hypothesis that everything in the world is subject to certain relationships of numbers...