Price Action Analysis Toolkit Development (Part 32): Python Candlestick Recognition Engine (II) — Detection Using Ta-Lib

In this article, we’ve transitioned from manually coding candlestick‑pattern detection in Python to leveraging TA‑Lib, a library that recognizes over sixty distinct patterns. These formations offer valuable insights into potential market reversals and trend continuations. Follow along to learn more.

Advanced Order Execution Algorithms in MQL5: TWAP, VWAP, and Iceberg Orders

An MQL5 framework that brings institutional-grade execution algorithms (TWAP, VWAP, Iceberg) to retail traders through a unified execution manager and performance analyzer for smoother, more precise order slicing and analytics.

Using Pseudo-Templates as Alternative to C++ Templates

The article describes a way of programming without using templates but keeping the style of programming iherenet to them. It tells about implementation of templates using custom methods and has a ready-made script attached for creating a code on the basis of specified templates.

Handling ZIP Archives in Pure MQL5

The MQL5 language keeps evolving, and its new features for working with data are constantly being added. Due to innovation it has recently become possible to operate with ZIP archives using regular MQL5 tools without getting third party DLL libraries involved. This article focuses on how this is done and provides the CZip class, which is a universal tool for reading, creating and modifying ZIP archives, as an example.

Multi-module trading robot in Python and MQL5 (Part I): Creating basic architecture and first modules

We are going to develop a modular trading system that combines Python for data analysis with MQL5 for trade execution. Four independent modules monitor different market aspects in parallel: volumes, arbitrage, economics and risks, and use RandomForest with 400 trees for analysis. Particular emphasis is placed on risk management, since even the most advanced trading algorithms are useless without proper risk management.

Creating Documentation Based on MQL5 Source Code

This article considers creation of documentation for MQL5 code starting with the automated markup of required tags. It also provides the description of how to use the Doxygen software, how to properly configure it and how to receive results in different formats, including html, HtmlHelp and PDF.

Tracing, Debugging and Structural Analysis of Source Code

The entire complex of problems of creating a structure of an executed code and its tracing can be solved without serious difficulties. This possibility has appeared in MetaTrader 5 due to the new feature of the MQL5 language - automatic creation of variables of complex type of data (structures and classes) and their elimination when going out of local scope. The article contains the description of the methodology and the ready-made tool.

Algorithmic trading based on 3D reversal patterns

Discovering a new world of automated trading on 3D bars. What does a trading robot look like on multidimensional price bars? Are "yellow" clusters of 3D bars able to predict trend reversals? What does multidimensional trading look like?

Developing a Replay System — Market simulation (Part 01): First experiments (I)

How about creating a system that would allow us to study the market when it is closed or even to simulate market situations? Here we are going to start a new series of articles in which we will deal with this topic.

Brute force approach to pattern search (Part II): Immersion

In this article we will continue discussing the brute force approach. I will try to provide a better explanation of the pattern using the new improved version of my application. I will also try to find the difference in stability using different time intervals and timeframes.

Introduction to Connexus (Part 1): How to Use the WebRequest Function?

This article is the beginning of a series of developments for a library called “Connexus” to facilitate HTTP requests with MQL5. The goal of this project is to provide the end user with this opportunity and show how to use this helper library. I intended to make it as simple as possible to facilitate study and to provide the possibility for future developments.

Regression models of the Scikit-learn Library and their export to ONNX

In this article, we will explore the application of regression models from the Scikit-learn package, attempt to convert them into ONNX format, and use the resultant models within MQL5 programs. Additionally, we will compare the accuracy of the original models with their ONNX versions for both float and double precision. Furthermore, we will examine the ONNX representation of regression models, aiming to provide a better understanding of their internal structure and operational principles.

Developing a trading robot in Python (Part 3): Implementing a model-based trading algorithm

We continue the series of articles on developing a trading robot in Python and MQL5. In this article, we will create a trading algorithm in Python.

Gradient boosting in transductive and active machine learning

In this article, we will consider active machine learning methods utilizing real data, as well discuss their pros and cons. Perhaps you will find these methods useful and will include them in your arsenal of machine learning models. Transduction was introduced by Vladimir Vapnik, who is the co-inventor of the Support-Vector Machine (SVM).

How to create and test custom MOEX symbols in MetaTrader 5

The article describes the creation of a custom exchange symbol using the MQL5 language. In particular, it considers the use of exchange quotes from the popular Finam website. Another option considered in this article is the possibility to work with an arbitrary format of text files used in the creation of the custom symbol. This allows working with any financial symbols and data sources. After creating a custom symbol, we can use all the capabilities of the MetaTrader 5 Strategy Tester to test trading algorithms for exchange instruments.

The Role of Statistical Distributions in Trader's Work

This article is a logical continuation of my article Statistical Probability Distributions in MQL5 which set forth the classes for working with some theoretical statistical distributions. Now that we have a theoretical base, I suggest that we should directly proceed to real data sets and try to make some informational use of this base.

Working with ONNX models in float16 and float8 formats

Data formats used to represent machine learning models play a crucial role in their effectiveness. In recent years, several new types of data have emerged, specifically designed for working with deep learning models. In this article, we will focus on two new data formats that have become widely adopted in modern models.

Integration of Broker APIs with Expert Advisors using MQL5 and Python

In this article, we will discuss the implementation of MQL5 in partnership with Python to perform broker-related operations. Imagine having a continuously running Expert Advisor (EA) hosted on a VPS, executing trades on your behalf. At some point, the ability of the EA to manage funds becomes paramount. This includes operations such as topping up your trading account and initiating withdrawals. In this discussion, we will shed light on the advantages and practical implementation of these features, ensuring seamless integration of fund management into your trading strategy. Stay tuned!

Using cryptography with external applications

In this article, we consider encryption/decryption of objects in MetaTrader and in external applications. Our purpose is to determine the conditions under which the same results will be obtained with the same initial data.

DirectX Tutorial (Part I): Drawing the first triangle

It is an introductory article on DirectX, which describes specifics of operation with the API. It should help to understand the order in which its components are initialized. The article contains an example of how to write an MQL5 script which renders a triangle using DirectX.

Metamodels in machine learning and trading: Original timing of trading orders

Metamodels in machine learning: Auto creation of trading systems with little or no human intervention — The model decides when and how to trade on its own.

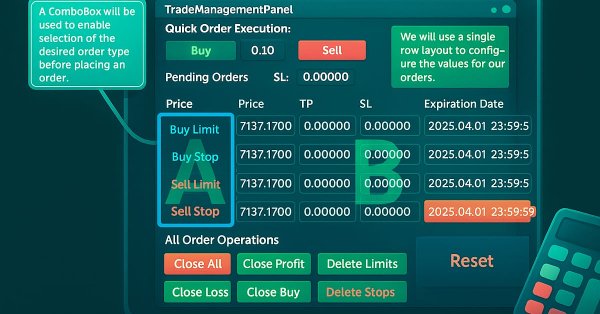

Creating a Trading Administrator Panel in MQL5 (Part XII): Integration of a Forex Values Calculator

Accurate calculation of key trading values is an indispensable part of every trader’s workflow. In this article, we will discuss, the integration of a powerful utility—the Forex Calculator—into the Trade Management Panel, further extending the functionality of our multi-panel Trading Administrator system. Efficiently determining risk, position size, and potential profit is essential when placing trades, and this new feature is designed to make that process faster and more intuitive within the panel. Join us as we explore the practical application of MQL5 in building advanced, trading panels.

Integrating AI model into already existing MQL5 trading strategy

This topic focuses on incorporating a trained AI model (such as a reinforcement learning model like LSTM or a machine learning-based predictive model) into an existing MQL5 trading strategy.

Developing a trading Expert Advisor from scratch (Part 16): Accessing data on the web (II)

Knowing how to input data from the Web into an Expert Advisor is not so obvious. It is not so easy to do without understanding all the possibilities offered by MetaTrader 5.

Calculating mathematical expressions (Part 2). Pratt and shunting yard parsers

In this article, we consider the principles of mathematical expression parsing and evaluation using parsers based on operator precedence. We will implement Pratt and shunting-yard parser, byte-code generation and calculations by this code, as well as view how to use indicators as functions in expressions and how to set up trading signals in Expert Advisors based on these indicators.

Developing a trading Expert Advisor from scratch (Part 15): Accessing data on the web (I)

How to access online data via MetaTrader 5? There are a lot of websites and places on the web, featuring a huge amount information. What you need to know is where to look and how best to use this information.

Connection of Expert Advisor with ICQ in MQL5

This article describes the method of information exchange between the Expert Advisor and ICQ users, several examples are presented. The provided material will be interesting for those, who wish to receive trading information remotely from a client terminal, through an ICQ client in their mobile phone or PDA.

Using optimization algorithms to configure EA parameters on the fly

The article discusses the practical aspects of using optimization algorithms to find the best EA parameters on the fly, as well as virtualization of trading operations and EA logic. The article can be used as an instruction for implementing optimization algorithms into an EA.

From Novice to Expert: Demystifying Hidden Fibonacci Retracement Levels

In this article, we explore a data-driven approach to discovering and validating non-standard Fibonacci retracement levels that markets may respect. We present a complete workflow tailored for implementation in MQL5, beginning with data collection and bar or swing detection, and extending through clustering, statistical hypothesis testing, backtesting, and integration into an MetaTrader 5 Fibonacci tool. The goal is to create a reproducible pipeline that transforms anecdotal observations into statistically defensible trading signals.

Working with GSM Modem from an MQL5 Expert Advisor

There is currently a fair number of means for a comfortable remote monitoring of a trading account: mobile terminals, push notifications, working with ICQ. But it all requires Internet connection. This article describes the process of creating an Expert Advisor that will allow you to stay in touch with your trading terminal even when mobile Internet is not available, through calls and text messaging.

Developing a robot in Python and MQL5 (Part 1): Data preprocessing

Developing a trading robot based on machine learning: A detailed guide. The first article in the series deals with collecting and preparing data and features. The project is implemented using the Python programming language and libraries, as well as the MetaTrader 5 platform.

How to connect MetaTrader 5 to PostgreSQL

This article describes four methods for connecting MQL5 code to a Postgres database and provides a step-by-step tutorial for setting up a development environment for one of them, a REST API, using the Windows Subsystem For Linux (WSL). A demo app for the API is provided along with the corresponding MQL5 code to insert data and query the respective tables, as well as a demo Expert Advisor to consume this data.

Neural networks made easy (Part 24): Improving the tool for Transfer Learning

In the previous article, we created a tool for creating and editing the architecture of neural networks. Today we will continue working on this tool. We will try to make it more user friendly. This may see, top be a step away form our topic. But don't you think that a well organized workspace plays an important role in achieving the result.

Population optimization algorithms: Bacterial Foraging Optimization (BFO)

E. coli bacterium foraging strategy inspired scientists to create the BFO optimization algorithm. The algorithm contains original ideas and promising approaches to optimization and is worthy of further study.

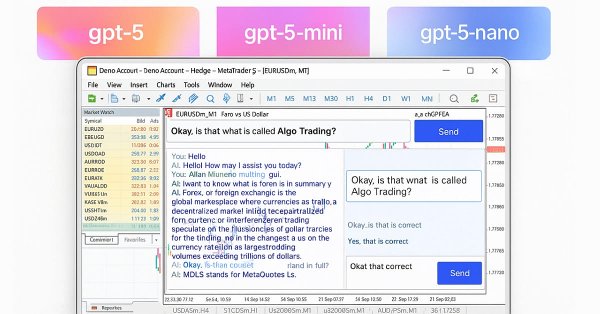

Building AI-Powered Trading Systems in MQL5 (Part 2): Developing a ChatGPT-Integrated Program with User Interface

In this article, we develop a ChatGPT-integrated program in MQL5 with a user interface, leveraging the JSON parsing framework from Part 1 to send prompts to OpenAI’s API and display responses on a MetaTrader 5 chart. We implement a dashboard with an input field, submit button, and response display, handling API communication and text wrapping for user interaction.

Category Theory in MQL5 (Part 1)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 5): Sending Commands from Telegram to MQL5 and Receiving Real-Time Responses

In this article, we create several classes to facilitate real-time communication between MQL5 and Telegram. We focus on retrieving commands from Telegram, decoding and interpreting them, and sending appropriate responses back. By the end, we ensure that these interactions are effectively tested and operational within the trading environment

Electronic Tables in MQL5

The article describes a class of dynamic two-dimensional array that contains data of different types in its first dimension. Storing data in the form of a table is convenient for solving a wide range of problems of arrangement, storing and operation with bound information of different types. The source code of the class that implements the functionality of working with tables is attached to the article.

Marvel Your MQL5 Customers with a Usable Cocktail of Technologies!

MQL5 provides programmers with a very complete set of functions and object-oriented API thanks to which they can do everything they want within the MetaTrader environment. However, Web Technology is an extremely versatile tool nowadays that may come to the rescue in some situations when you need to do something very specific, want to marvel your customers with something different or simply you do not have enough time to master a specific part of MT5 Standard Library. Today's exercise walks you through a practical example about how you can manage your development time at the same time as you also create an amazing tech cocktail.

Trend strength and direction indicator on 3D bars

We will consider a new approach to market trend analysis based on three-dimensional visualization and tensor analysis of the market microstructure.