From Python to MQL5: A Journey into Quantum-Inspired Trading Systems

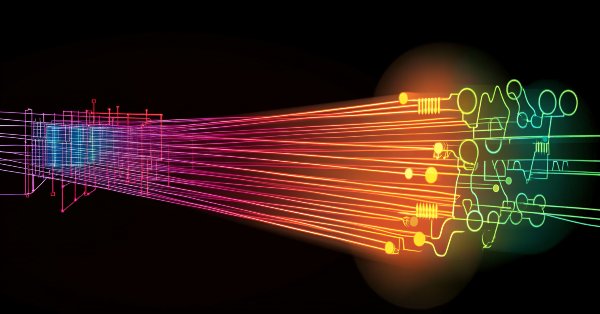

The article explores the development of a quantum-inspired trading system, transitioning from a Python prototype to an MQL5 implementation for real-world trading. The system uses quantum computing principles like superposition and entanglement to analyze market states, though it runs on classical computers using quantum simulators. Key features include a three-qubit system for analyzing eight market states simultaneously, 24-hour lookback periods, and seven technical indicators for market analysis. While the accuracy rates might seem modest, they provide a significant edge when combined with proper risk management strategies.

Price Action Analysis Toolkit Development (Part 35): Training and Deploying Predictive Models

Historical data is far from “trash”—it’s the foundation of any robust market analysis. In this article, we’ll take you step‑by‑step from collecting that history to using it to train a predictive model, and finally deploying that model for live price forecasts. Read on to learn how!

ALGLIB library optimization methods (Part II)

In this article, we will continue to study the remaining optimization methods from the ALGLIB library, paying special attention to their testing on complex multidimensional functions. This will allow us not only to evaluate the efficiency of each algorithm, but also to identify their strengths and weaknesses in different conditions.

Building A Candlestick Trend Constraint Model (Part 9): Multiple Strategies Expert Advisor (I)

Today, we will explore the possibilities of incorporating multiple strategies into an Expert Advisor (EA) using MQL5. Expert Advisors provide broader capabilities than just indicators and scripts, allowing for more sophisticated trading approaches that can adapt to changing market conditions. Find, more in this article discussion.

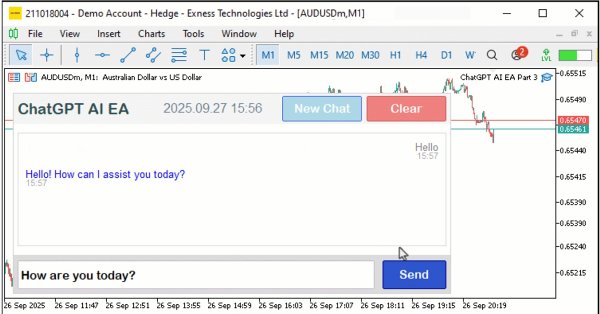

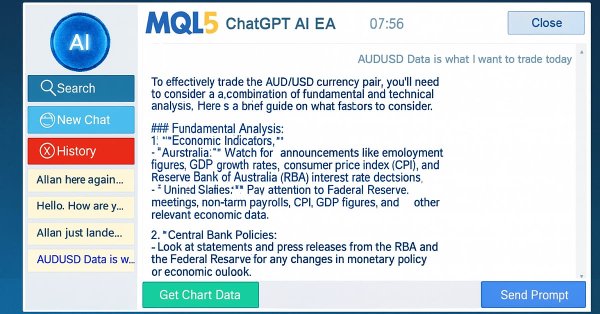

Building AI-Powered Trading Systems in MQL5 (Part 3): Upgrading to a Scrollable Single Chat-Oriented UI

In this article, we upgrade the ChatGPT-integrated program in MQL5 to a scrollable single chat-oriented UI, enhancing conversation history display with timestamps and dynamic scrolling. The system builds on JSON parsing to manage multi-turn messages, supporting customizable scrollbar modes and hover effects for improved user interaction.

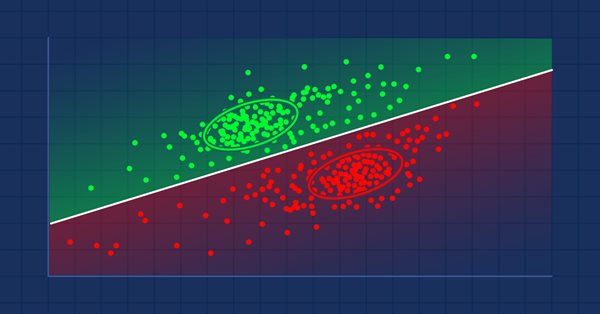

Developing Trend Trading Strategies Using Machine Learning

This study introduces a novel methodology for the development of trend-following trading strategies. This section describes the process of annotating training data and using it to train classifiers. This process yields fully operational trading systems designed to run on MetaTrader 5.

Building AI-Powered Trading Systems in MQL5 (Part 4): Overcoming Multiline Input, Ensuring Chat Persistence, and Generating Signals

In this article, we enhance the ChatGPT-integrated program in MQL5 overcoming multiline input limitations with improved text rendering, introducing a sidebar for navigating persistent chat storage using AES256 encryption and ZIP compression, and generating initial trade signals through chart data integration.

MQL5 Wizard techniques you should know (Part 04): Linear Discriminant Analysis

Todays trader is a philomath who is almost always looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders in this effort.

Neural networks made easy (Part 22): Unsupervised learning of recurrent models

We continue to study unsupervised learning algorithms. This time I suggest that we discuss the features of autoencoders when applied to recurrent model training.

Population optimization algorithms: Monkey algorithm (MA)

In this article, I will consider the Monkey Algorithm (MA) optimization algorithm. The ability of these animals to overcome difficult obstacles and get to the most inaccessible tree tops formed the basis of the idea of the MA algorithm.

Developing an MQL5 RL agent with RestAPI integration (Part 2): MQL5 functions for HTTP interaction with the tic-tac-toe game REST API

In this article we will talk about how MQL5 can interact with Python and FastAPI, using HTTP calls in MQL5 to interact with the tic-tac-toe game in Python. The article discusses the creation of an API using FastAPI for this integration and provides a test script in MQL5, highlighting the versatility of MQL5, the simplicity of Python, and the effectiveness of FastAPI in connecting different technologies to create innovative solutions.

Multilayer perceptron and backpropagation algorithm (Part 3): Integration with the Strategy Tester - Overview (I).

The multilayer perceptron is an evolution of the simple perceptron which can solve non-linear separable problems. Together with the backpropagation algorithm, this neural network can be effectively trained. In Part 3 of the Multilayer Perceptron and Backpropagation series, we'll see how to integrate this technique into the Strategy Tester. This integration will allow the use of complex data analysis aimed at making better decisions to optimize your trading strategies. In this article, we will discuss the advantages and problems of this technique.

Circle Search Algorithm (CSA)

The article presents a new metaheuristic optimization Circle Search Algorithm (CSA) based on the geometric properties of a circle. The algorithm uses the principle of moving points along tangents to find the optimal solution, combining the phases of global exploration and local exploitation.

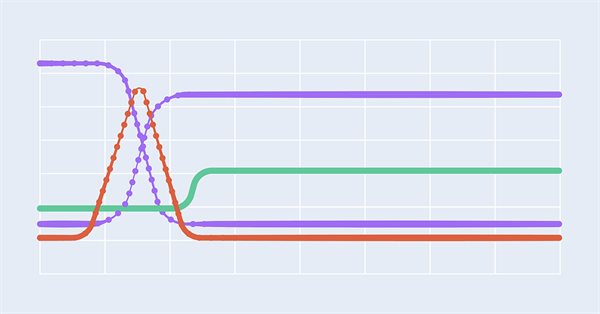

Hidden Markov Models for Trend-Following Volatility Prediction

Hidden Markov Models (HMMs) are powerful statistical tools that identify underlying market states by analyzing observable price movements. In trading, HMMs enhance volatility prediction and inform trend-following strategies by modeling and anticipating shifts in market regimes. In this article, we will present the complete procedure for developing a trend-following strategy that utilizes HMMs to predict volatility as a filter.

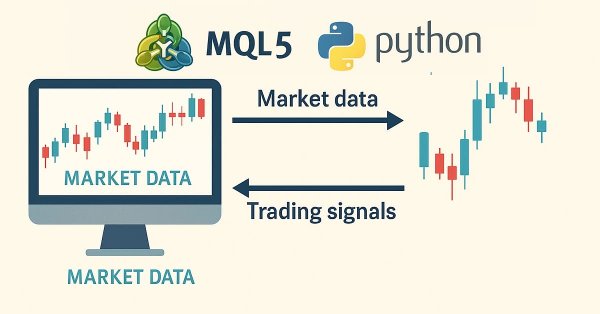

Developing a robot in Python and MQL5 (Part 2): Model selection, creation and training, Python custom tester

We continue the series of articles on developing a trading robot in Python and MQL5. Today we will solve the problem of selecting and training a model, testing it, implementing cross-validation, grid search, as well as the problem of model ensemble.

Modified Grid-Hedge EA in MQL5 (Part III): Optimizing Simple Hedge Strategy (I)

In this third part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Hedge EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

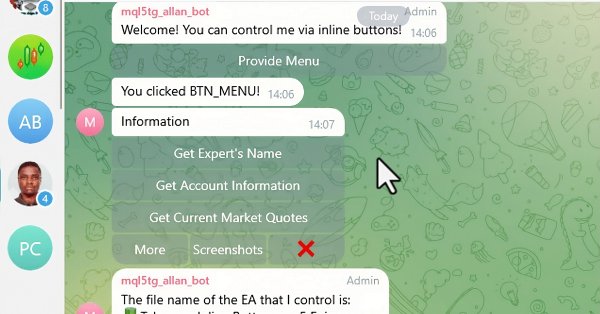

Creating an MQL5-Telegram Integrated Expert Advisor (Part 6): Adding Responsive Inline Buttons

In this article, we integrate interactive inline buttons into an MQL5 Expert Advisor, allowing real-time control via Telegram. Each button press triggers specific actions and sends responses back to the user. We also modularize functions for handling Telegram messages and callback queries efficiently.

Creating a Trading Administrator Panel in MQL5 (Part III): Enhancing the GUI with Visual Styling (I)

In this article, we will focus on visually styling the graphical user interface (GUI) of our Trading Administrator Panel using MQL5. We’ll explore various techniques and features available in MQL5 that allow for customization and optimization of the interface, ensuring it meets the needs of traders while maintaining an attractive aesthetic.

Integrating Hidden Markov Models in MetaTrader 5

In this article we demonstrate how Hidden Markov Models trained using Python can be integrated into MetaTrader 5 applications. Hidden Markov Models are a powerful statistical tool used for modeling time series data, where the system being modeled is characterized by unobservable (hidden) states. A fundamental premise of HMMs is that the probability of being in a given state at a particular time depends on the process's state at the previous time slot.

Neural networks made easy (Part 23): Building a tool for Transfer Learning

In this series of articles, we have already mentioned Transfer Learning more than once. However, this was only mentioning. in this article, I suggest filling this gap and taking a closer look at Transfer Learning.

Price Action Analysis Toolkit Development (Part 12): External Flow (III) TrendMap

The flow of the market is determined by the forces between bulls and bears. There are specific levels that the market respects due to the forces acting on them. Fibonacci and VWAP levels are especially powerful in influencing market behavior. Join me in this article as we explore a strategy based on VWAP and Fibonacci levels for signal generation.

Integrating MQL5 with data processing packages (Part 5): Adaptive Learning and Flexibility

This part focuses on building a flexible, adaptive trading model trained on historical XAUUSD data, preparing it for ONNX export and potential integration into live trading systems.

From Novice to Expert: Predictive Price Pathways

Fibonacci levels provide a practical framework that markets often respect, highlighting price zones where reactions are more likely. In this article, we build an expert advisor that applies Fibonacci retracement logic to anticipate likely future moves and trade retracements with pending orders. Explore the full workflow—from swing detection to level plotting, risk controls, and execution.

Developing an MQTT client for MetaTrader 5: a TDD approach

This article reports the first attempts in the development of a native MQTT client for MQL5. MQTT is a Client Server publish/subscribe messaging transport protocol. It is lightweight, open, simple, and designed to be easy to implement. These characteristics make it ideal for use in many situations.

Building AI-Powered Trading Systems in MQL5 (Part 6): Introducing Chat Deletion and Search Functionality

In Part 6 of our MQL5 AI trading system series, we advance the ChatGPT-integrated Expert Advisor by introducing chat deletion functionality through interactive delete buttons in the sidebar, small/large history popups, and a new search popup, allowing traders to manage and organize persistent conversations efficiently while maintaining encrypted storage and AI-driven signals from chart data.

MQL5 Wizard Techniques you should know (Part 80): Using Patterns of Ichimoku and the ADX-Wilder with TD3 Reinforcement Learning

This article follows up ‘Part-74’, where we examined the pairing of Ichimoku and the ADX under a Supervised Learning framework, by moving our focus to Reinforcement Learning. Ichimoku and ADX form a complementary combination of support/resistance mapping and trend strength spotting. In this installment, we indulge in how the Twin Delayed Deep Deterministic Policy Gradient (TD3) algorithm can be used with this indicator set. As with earlier parts of the series, the implementation is carried out in a custom signal class designed for integration with the MQL5 Wizard, which facilitates seamless Expert Advisor assembly.

Developing a multi-currency Expert Advisor (Part 13): Automating the second stage — selection into groups

We have already implemented the first stage of the automated optimization. We perform optimization for different symbols and timeframes according to several criteria and store information about the results of each pass in the database. Now we are going to select the best groups of parameter sets from those found at the first stage.

Price Action Analysis Toolkit Development Part (4): Analytics Forecaster EA

We are moving beyond simply viewing analyzed metrics on charts to a broader perspective that includes Telegram integration. This enhancement allows important results to be delivered directly to your mobile device via the Telegram app. Join us as we explore this journey together in this article.

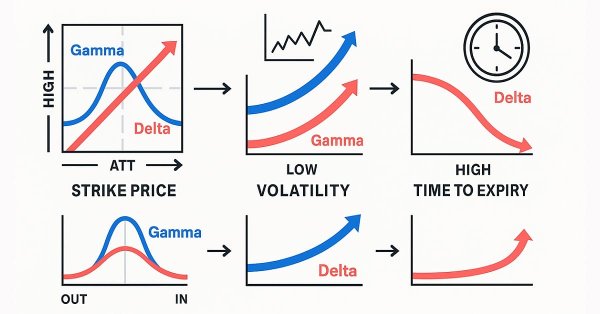

Black-Scholes Greeks: Gamma and Delta

Gamma and Delta measure how an option’s value reacts to changes in the underlying asset’s price. Delta represents the rate of change of the option’s price relative to the underlying, while Gamma measures how Delta itself changes as price moves. Together, they describe an option’s directional sensitivity and convexity—critical for dynamic hedging and volatility-based trading strategies.

Price Action Analysis Toolkit Development (Part 20): External Flow (IV) — Correlation Pathfinder

Correlation Pathfinder offers a fresh approach to understanding currency pair dynamics as part of the Price Action Analysis Toolkit Development Series. This tool automates data collection and analysis, providing insight into how pairs like EUR/USD and GBP/USD interact. Enhance your trading strategy with practical, real-time information that helps you manage risk and spot opportunities more effectively.

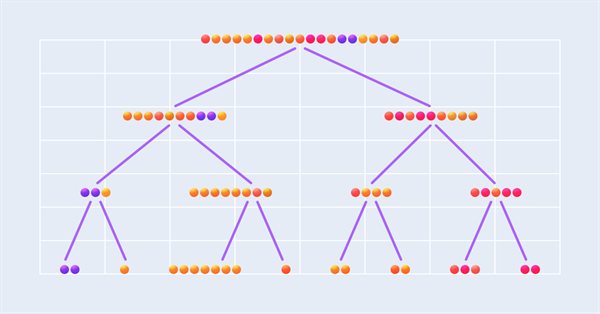

Integrating ML models with the Strategy Tester (Conclusion): Implementing a regression model for price prediction

This article describes the implementation of a regression model based on a decision tree. The model should predict prices of financial assets. We have already prepared the data, trained and evaluated the model, as well as adjusted and optimized it. However, it is important to note that this model is intended for study purposes only and should not be used in real trading.

Price Action Analysis Toolkit Development (Part 20): External Flow (IV) — Correlation Pathfinder

Correlation Pathfinder offers a fresh approach to understanding currency pair dynamics as part of the Price Action Analysis Toolkit Development Series. This tool automates data collection and analysis, providing insight into how pairs like EUR/USD and GBP/USD interact. Enhance your trading strategy with practical, real-time information that helps you manage risk and spot opportunities more effectively.

Simplifying Databases in MQL5 (Part 1): Introduction to Databases and SQL

We explore how to manipulate databases in MQL5 using the language's native functions. We cover everything from table creation, insertion, updating, and deletion to data import and export, all with sample code. The content serves as a solid foundation for understanding the internal mechanics of data access, paving the way for the discussion of ORM, where we'll build one in MQL5.

Advanced Memory Management and Optimization Techniques in MQL5

Discover practical techniques to optimize memory usage in MQL5 trading systems. Learn to build efficient, stable, and fast-performing Expert Advisors and indicators. We’ll explore how memory really works in MQL5, the common traps that slow your systems down or cause them to fail, and — most importantly — how to fix them.

Price Action Analysis Toolkit Development (Part 31): Python Candlestick Recognition Engine (I) — Manual Detection

Candlestick patterns are fundamental to price-action trading, offering valuable insights into potential market reversals or continuations. Envision a reliable tool that continuously monitors each new price bar, identifies key formations such as engulfing patterns, hammers, dojis, and stars, and promptly notifies you when a significant trading setup is detected. This is precisely the functionality we have developed. Whether you are new to trading or an experienced professional, this system provides real-time alerts for candlestick patterns, enabling you to focus on executing trades with greater confidence and efficiency. Continue reading to learn how it operates and how it can enhance your trading strategy.

MQL5 Wizard Techniques you should know (Part 38): Bollinger Bands

Bollinger Bands are a very common Envelope Indicator used by a lot of traders to manually place and close trades. We examine this indicator by considering as many of the different possible signals it does generate, and see how they could be put to use in a wizard assembled Expert Advisor.

Analyzing all price movement options on the IBM quantum computer

We will use a quantum computer from IBM to discover all price movement options. Sounds like science fiction? Welcome to the world of quantum computing for trading!

Creating an MQL5-Telegram Integrated Expert Advisor (Part 4): Modularizing Code Functions for Enhanced Reusability

In this article, we refactor the existing code used for sending messages and screenshots from MQL5 to Telegram by organizing it into reusable, modular functions. This will streamline the process, allowing for more efficient execution and easier code management across multiple instances.

From Novice to Expert: Animated News Headline Using MQL5 (II)

Today, we take another step forward by integrating an external news API as the source of headlines for our News Headline EA. In this phase, we’ll explore various news sources—both established and emerging—and learn how to access their APIs effectively. We'll also cover methods for parsing the retrieved data into a format optimized for display within our Expert Advisor. Join the discussion as we explore the benefits of accessing news headlines and the economic calendar directly on the chart, all within a compact, non-intrusive interface.

Developing a multi-currency Expert Advisor (Part 19): Creating stages implemented in Python

So far we have considered the automation of launching sequential procedures for optimizing EAs exclusively in the standard strategy tester. But what if we would like to perform some handling of the obtained data using other means between such launches? We will attempt to add the ability to create new optimization stages performed by programs written in Python.