Category Theory in MQL5 (Part 3)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that provides insight while hopefully furthering the use of this remarkable field in Traders' strategy development.

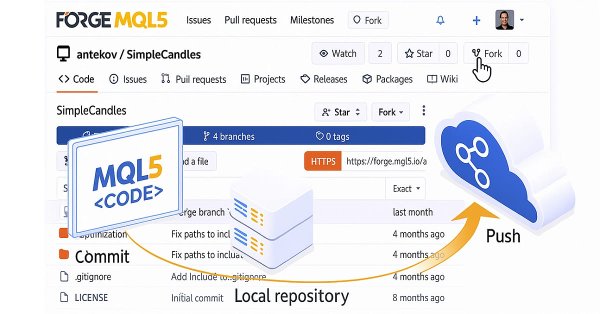

Moving to MQL5 Algo Forge (Part 1): Creating the Main Repository

When working on projects in MetaEditor, developers often face the need to manage code versions. MetaQuotes recently announced migration to GIT and the launch of MQL5 Algo Forge with code versioning and collaboration capabilities. In this article, we will discuss how to use the new and previously existing tools more efficiently.

Moving to MQL5 Algo Forge (Part 4): Working with Versions and Releases

We'll continue developing the Simple Candles and Adwizard projects, while also describing the finer aspects of using the MQL5 Algo Forge version control system and repository.

How to Use Crashlogs to Debug Your Own DLLs

25 to 30% of all crashlogs received from users appear due to errors occurring when functions imported from custom dlls are executed.

Non-linear regression models on the stock exchange

Non-linear regression models on the stock exchange: Is it possible to predict financial markets? Let's consider creating a model for forecasting prices for EURUSD, and make two robots based on it - in Python and MQL5.

Understand and efficiently use OpenCL API by recreating built-in support as DLL on Linux (Part 1): Motivation and validation

Bulit-in OpenCL support in MetaTrader 5 still has a major problem especially the one about device selection error 5114 resulting from unable to create an OpenCL context using CL_USE_GPU_ONLY, or CL_USE_GPU_DOUBLE_ONLY although it properly detects GPU. It works fine with directly using of ordinal number of GPU device we found in Journal tab, but that's still considered a bug, and users should not hard-code a device. We will solve it by recreating an OpenCL support as DLL with C++ on Linux. Along the journey, we will get to know OpenCL from concept to best practices in its API usage just enough for us to put into great use later when we deal with DLL implementation in C++ and consume it with MQL5.

Population optimization algorithms: Firefly Algorithm (FA)

In this article, I will consider the Firefly Algorithm (FA) optimization method. Thanks to the modification, the algorithm has turned from an outsider into a real rating table leader.

Implementing the SHA-256 Cryptographic Algorithm from Scratch in MQL5

Building DLL-free cryptocurrency exchange integrations has long been a challenge, but this solution provides a complete framework for direct market connectivity.

Mastering JSON: Create Your Own JSON Reader from Scratch in MQL5

Experience a step-by-step guide on creating a custom JSON parser in MQL5, complete with object and array handling, error checking, and serialization. Gain practical insights into bridging your trading logic and structured data with this flexible solution for handling JSON in MetaTrader 5.

MetaTrader Meets Google Sheets with Pythonanywhere: A Guide to Secure Data Flow

This article demonstrates a secure way to export MetaTrader data to Google Sheets. Google Sheet is the most valuable solution as it is cloud based and the data saved in there can be accessed anytime and from anywhere. So traders can access trading and related data exported to google sheet and do further analysis for future trading anytime and wherever they are at the moment.

Portfolio Risk Model using Kelly Criterion and Monte Carlo Simulation

For decades, traders have been using the Kelly Criterion formula to determine the optimal proportion of capital to allocate to an investment or bet to maximize long-term growth while minimizing the risk of ruin. However, blindly following Kelly Criterion using the result of a single backtest is often dangerous for individual traders, as in live trading, trading edge diminishes over time, and past performance is no predictor of future result. In this article, I will present a realistic approach to applying the Kelly Criterion for one or more EA's risk allocation in MetaTrader 5, incorporating Monte Carlo simulation results from Python.

Understand and Efficiently use OpenCL API by Recreating built-in support as DLL on Linux (Part 2): OpenCL Simple DLL implementation

Continued from the part 1 in the series, now we proceed to implement as a simple DLL then test with MetaTrader 5. This will prepare us well before developing a full-fledge OpenCL as DLL support in the following part to come.

News Trading Made Easy (Part 3): Performing Trades

In this article, our news trading expert will begin opening trades based on the economic calendar stored in our database. In addition, we will improve the expert's graphics to display more relevant information about upcoming economic calendar events.

Pipelines in MQL5

In this piece, we look at a key data preparation step for machine learning that is gaining rapid significance. Data Preprocessing Pipelines. These in essence are a streamlined sequence of data transformation steps that prepare raw data before it is fed to a model. As uninteresting as this may initially seem to the uninducted, this ‘data standardization’ not only saves on training time and execution costs, but it goes a long way in ensuring better generalization. In this article we are focusing on some SCIKIT-LEARN preprocessing functions, and while we are not exploiting the MQL5 Wizard, we will return to it in coming articles.

Building A Candlestick Trend Constraint Model (Part 7): Refining our model for EA development

In this article, we will delve into the detailed preparation of our indicator for Expert Advisor (EA) development. Our discussion will encompass further refinements to the current version of the indicator to enhance its accuracy and functionality. Additionally, we will introduce new features that mark exit points, addressing a limitation of the previous version, which only identified entry points.

Creating 3D bars based on time, price and volume

The article dwells on multivariate 3D price charts and their creation. We will also consider how 3D bars predict price reversals, and how Python and MetaTrader 5 allow us to plot these volume bars in real time.

Finding custom currency pair patterns in Python using MetaTrader 5

Are there any repeating patterns and regularities in the Forex market? I decided to create my own pattern analysis system using Python and MetaTrader 5. A kind of symbiosis of math and programming for conquering Forex.

Moving to MQL5 Algo Forge (Part 2): Working with Multiple Repositories

In this article, we are considering one of the possible approaches to organizing the storage of the project's source code in a public repository. We will distribute the code across different branches to establish clear and convenient rules for the project development.

News Trading Made Easy (Part 6): Performing Trades (III)

In this article news filtration for individual news events based on their IDs will be implemented. In addition, previous SQL queries will be improved to provide additional information or reduce the query's runtime. Furthermore, the code built in the previous articles will be made functional.

Developing a multi-currency Expert Advisor (Part 12): Developing prop trading level risk manager

In the EA being developed, we already have a certain mechanism for controlling drawdown. But it is probabilistic in nature, as it is based on the results of testing on historical price data. Therefore, the drawdown can sometimes exceed the maximum expected values (although with a small probability). Let's try to add a mechanism that ensures guaranteed compliance with the specified drawdown level.

MQL5 Wizard Techniques you should know (Part 17): Multicurrency Trading

Trading across multiple currencies is not available by default when an expert advisor is assembled via the wizard. We examine 2 possible hacks traders can make when looking to test their ideas off more than one symbol at a time.

From Novice to Expert: Reporting EA — Setting up the work flow

Brokerages often provide trading account reports at regular intervals, based on a predefined schedule. These firms, through their API technologies, have access to your account activity and trading history, allowing them to generate performance reports on your behalf. Similarly, the MetaTrader 5 terminal stores detailed records of your trading activity, which can be leveraged using MQL5 to create fully customized reports and define personalized delivery methods.

Developing a multi-currency Expert Advisor (Part 4): Pending virtual orders and saving status

Having started developing a multi-currency EA, we have already achieved some results and managed to carry out several code improvement iterations. However, our EA was unable to work with pending orders and resume operation after the terminal restart. Let's add these features.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part I)

We will breakdown the main MQL5 code into specified code snippets to illustrate the integration of Telegram and WhatsApp for receiving signal notifications from the Trend Constraint indicator we are creating in this article series. This will help traders, both novices and experienced developers, grasp the concept easily. First, we will cover the setup of MetaTrader 5 for notifications and its significance to the user. This will help developers in advance to take notes to further apply in their systems.

Category Theory in MQL5 (Part 2)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

Integrating MQL5 with data processing packages (Part 2): Machine Learning and Predictive Analytics

In our series on integrating MQL5 with data processing packages, we delve in to the powerful combination of machine learning and predictive analysis. We will explore how to seamlessly connect MQL5 with popular machine learning libraries, to enable sophisticated predictive models for financial markets.

Developing an MQTT client for MetaTrader 5: a TDD approach — Part 3

This article is the third part of a series describing our development steps of a native MQL5 client for the MQTT protocol. In this part, we describe in detail how we are using Test-Driven Development to implement the Operational Behavior part of the CONNECT/CONNACK packet exchange. At the end of this step, our client MUST be able to behave appropriately when dealing with any of the possible server outcomes from a connection attempt.

Mastering Quick Trades: Overcoming Execution Paralysis

The UT BOT ATR Trailing Indicator is a personal and customizable indicator that is very effective for traders who like to make quick decisions and make money from differences in price referred to as short-term trading (scalpers) and also proves to be vital and very effective for long-term traders (positional traders).

From Novice to Expert: Forex Market Periods

Every market period has a beginning and an end, each closing with a price that defines its sentiment—much like any candlestick session. Understanding these reference points allows us to gauge the prevailing market mood, revealing whether bullish or bearish forces are in control. In this discussion, we take an important step forward by developing a new feature within the Market Periods Synchronizer—one that visualizes Forex market sessions to support more informed trading decisions. This tool can be especially powerful for identifying, in real time, which side—bulls or bears—dominates the session. Let’s explore this concept and uncover the insights it offers.

Using association rules in Forex data analysis

How to apply predictive rules of supermarket retail analytics to the real Forex market? How are purchases of cookies, milk and bread related to stock exchange transactions? The article discusses an innovative approach to algorithmic trading based on the use of association rules.

From Novice to Expert: Forex Market Periods

Every market period has a beginning and an end, each closing with a price that defines its sentiment—much like any candlestick session. Understanding these reference points allows us to gauge the prevailing market mood, revealing whether bullish or bearish forces are in control. In this discussion, we take an important step forward by developing a new feature within the Market Periods Synchronizer—one that visualizes Forex market sessions to support more informed trading decisions. This tool can be especially powerful for identifying, in real time, which side—bulls or bears—dominates the session. Let’s explore this concept and uncover the insights it offers.

Creating a Trading Administrator Panel in MQL5 (Part VIII): Analytics Panel

Today, we delve into incorporating useful trading metrics within a specialized window integrated into the Admin Panel EA. This discussion focuses on the implementation of MQL5 to develop an Analytics Panel and highlights the value of the data it provides to trading administrators. The impact is largely educational, as valuable lessons are drawn from the development process, benefiting both upcoming and experienced developers. This feature demonstrates the limitless opportunities this development series offers in equipping trade managers with advanced software tools. Additionally, we'll explore the implementation of the PieChart and ChartCanvas classes as part of the continued expansion of the Trading Administrator panel’s capabilities.

Building a Keltner Channel Indicator with Custom Canvas Graphics in MQL5

In this article, we build a Keltner Channel indicator with custom canvas graphics in MQL5. We detail the integration of moving averages, ATR calculations, and enhanced chart visualization. We also cover backtesting to evaluate the indicator’s performance for practical trading insights.

Brain Storm Optimization algorithm (Part II): Multimodality

In the second part of the article, we will move on to the practical implementation of the BSO algorithm, conduct tests on test functions and compare the efficiency of BSO with other optimization methods.

Population optimization algorithms: Bat algorithm (BA)

In this article, I will consider the Bat Algorithm (BA), which shows good convergence on smooth functions.

Pure implementation of RSA encryption in MQL5

MQL5 lacks built-in asymmetric cryptography, making secure data exchange over insecure channels like HTTP difficult. This article presents a pure MQL5 implementation of RSA using PKCS#1 v1.5 padding, enabling safe transmission of AES session keys and small data blocks without external libraries. This approach provides HTTPS-like security over standard HTTP and even more, it fills an important gap in secure communication for MQL5 applications.

Portfolio optimization in Forex: Synthesis of VaR and Markowitz theory

How does portfolio trading work on Forex? How can Markowitz portfolio theory for portfolio proportion optimization and VaR model for portfolio risk optimization be synthesized? We create a code based on portfolio theory, where, on the one hand, we will get low risk, and on the other, acceptable long-term profitability.

Utilizing CatBoost Machine Learning model as a Filter for Trend-Following Strategies

CatBoost is a powerful tree-based machine learning model that specializes in decision-making based on stationary features. Other tree-based models like XGBoost and Random Forest share similar traits in terms of their robustness, ability to handle complex patterns, and interpretability. These models have a wide range of uses, from feature analysis to risk management. In this article, we're going to walk through the procedure of utilizing a trained CatBoost model as a filter for a classic moving average cross trend-following strategy.

Atomic Orbital Search (AOS) algorithm: Modification

In the second part of the article, we will continue developing a modified version of the AOS (Atomic Orbital Search) algorithm focusing on specific operators to improve its efficiency and adaptability. After analyzing the fundamentals and mechanics of the algorithm, we will discuss ideas for improving its performance and the ability to analyze complex solution spaces, proposing new approaches to extend its functionality as an optimization tool.

Developing a multi-currency Expert Advisor (Part 21): Preparing for an important experiment and optimizing the code

For further progress it would be good to see if we can improve the results by periodically re-running the automatic optimization and generating a new EA. The stumbling block in many debates about the use of parameter optimization is the question of how long the obtained parameters can be used for trading in the future period while maintaining the profitability and drawdown at the specified levels. And is it even possible to do this?