Atmosphere Clouds Model Optimization (ACMO): Theory

The article is devoted to the metaheuristic Atmosphere Clouds Model Optimization (ACMO) algorithm, which simulates the behavior of clouds to solve optimization problems. The algorithm uses the principles of cloud generation, movement and propagation, adapting to the "weather conditions" in the solution space. The article reveals how the algorithm's meteorological simulation finds optimal solutions in a complex possibility space and describes in detail the stages of ACMO operation, including "sky" preparation, cloud birth, cloud movement, and rain concentration.

A feature selection algorithm using energy based learning in pure MQL5

In this article we present the implementation of a feature selection algorithm described in an academic paper titled,"FREL: A stable feature selection algorithm", called Feature weighting as regularized energy based learning.

MQL5 Trading Toolkit (Part 6): Expanding the History Management EX5 Library with the Last Filled Pending Order Functions

Learn how to create an EX5 module of exportable functions that seamlessly query and save data for the most recently filled pending order. In this comprehensive step-by-step guide, we will enhance the History Management EX5 library by developing dedicated and compartmentalized functions to retrieve essential properties of the last filled pending order. These properties include the order type, setup time, execution time, filling type, and other critical details necessary for effective pending orders trade history management and analysis.

Reimagining Classic Strategies in MQL5 (Part II): FTSE100 and UK Gilts

In this series of articles, we explore popular trading strategies and try to improve them using AI. In today's article, we revisit the classical trading strategy built on the relationship between the stock market and the bond market.

Neural Networks in Trading: Two-Dimensional Connection Space Models (Chimera)

In this article, we will explore the innovative Chimera framework: a two-dimensional state-space model that uses neural networks to analyze multivariate time series. This method offers high accuracy with low computational cost, outperforming traditional approaches and Transformer architectures.

From Basic to Intermediate: Indicator (IV)

In this article, we will explore how to easily create and implement an operational approach for coloring candles. This concept is highly valued by traders. When implementing such things, care must be taken to ensure that the bars or candles retain their original appearance and do not hinder reading candle by candle.

All about Automated Trading Championship: Reporting the Championship 2006

This article contains Weekly Reports of the ATC 2006. These materials are like snapshots, they are interesting-to-read not only during the Championship, but years later as well.

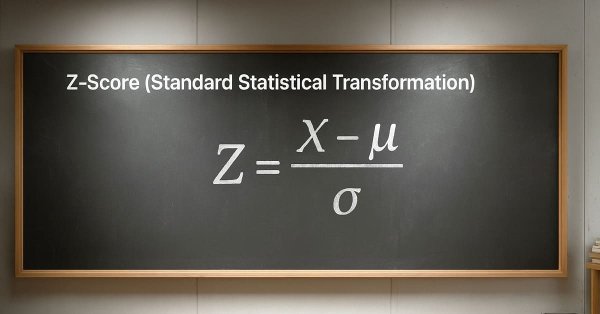

Self Optimizing Expert Advisors in MQL5 (Part 14): Viewing Data Transformations as Tuning Parameters of Our Feedback Controller

Preprocessing is a powerful yet quickly overlooked tuning parameter. It lives in the shadows of its bigger brothers: optimizers and shiny model architectures. Small percentage improvements here can have disproportionately large, compounding effects on profitability and risk. Too often, this largely unexplored science is boiled down to a simple routine, seen only as a means to an end, when in reality it is where signal can be directly amplified, or just as easily destroyed.

The case for using Hospital-Performance Data with Perceptrons, this Q4, in weighing SPDR XLV's next Performance

XLV is SPDR healthcare ETF and in an age where it is common to be bombarded by a wide array of traditional news items plus social media feeds, it can be pressing to select a data set for use with a model. We try to tackle this problem for this ETF by sizing up some of its critical data sets in MQL5.

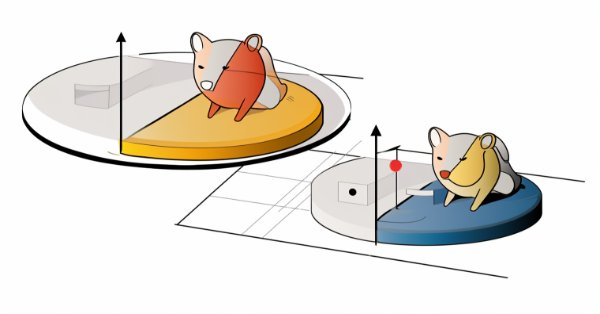

Adaptive Social Behavior Optimization (ASBO): Two-phase evolution

We continue dwelling on the topic of social behavior of living organisms and its impact on the development of a new mathematical model - ASBO (Adaptive Social Behavior Optimization). We will dive into the two-phase evolution, test the algorithm and draw conclusions. Just as in nature a group of living organisms join their efforts to survive, ASBO uses principles of collective behavior to solve complex optimization problems.

Developing a Replay System (Part 45): Chart Trade Project (IV)

The main purpose of this article is to introduce and explain the C_ChartFloatingRAD class. We have a Chart Trade indicator that works in a rather interesting way. As you may have noticed, we still have a fairly small number of objects on the chart, and yet we get the expected functionality. The values present in the indicator can be edited. The question is, how is this possible? This article will start to make things clearer.

Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT)

In offline learning, we use a fixed dataset, which limits the coverage of environmental diversity. During the learning process, our Agent can generate actions beyond this dataset. If there is no feedback from the environment, how can we be sure that the assessments of such actions are correct? Maintaining the Agent's policy within the training dataset becomes an important aspect to ensure the reliability of training. This is what we will talk about in this article.

Building Volatility models in MQL5 (Part I): The Initial Implementation

In this article, we present an MQL5 library for modeling volatility, designed to function similarly to Python's arch package. The library currently supports the specification of common conditional mean (HAR, AR, Constant Mean, Zero Mean) and conditional volatility (Constant Variance, ARCH, GARCH) models.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (HypDiff)

The article considers methods of encoding initial data in hyperbolic latent space through anisotropic diffusion processes. This helps to more accurately preserve the topological characteristics of the current market situation and improves the quality of its analysis.

Developing a Replay System (Part 55): Control Module

In this article, we will implement a control indicator so that it can be integrated into the message system we are developing. Although it is not very difficult, there are some details that need to be understood about the initialization of this module. The material presented here is for educational purposes only. In no way should it be considered as an application for any purpose other than learning and mastering the concepts shown.

Developing a Replay System (Part 35): Making Adjustments (I)

Before we can move forward, we need to fix a few things. These are not actually the necessary fixes but rather improvements to the way the class is managed and used. The reason is that failures occurred due to some interaction within the system. Despite attempts to find out the cause of such failures in order to eliminate them, all these attempts were unsuccessful. Some of these cases make no sense, for example, when we use pointers or recursion in C/C++, the program crashes.

Atmosphere Clouds Model Optimization (ACMO): Practice

In this article, we will continue diving into the implementation of the ACMO (Atmospheric Cloud Model Optimization) algorithm. In particular, we will discuss two key aspects: the movement of clouds into low-pressure regions and the rain simulation, including the initialization of droplets and their distribution among clouds. We will also look at other methods that play an important role in managing the state of clouds and ensuring their interaction with the environment.

Population optimization algorithms: Bacterial Foraging Optimization - Genetic Algorithm (BFO-GA)

The article presents a new approach to solving optimization problems by combining ideas from bacterial foraging optimization (BFO) algorithms and techniques used in the genetic algorithm (GA) into a hybrid BFO-GA algorithm. It uses bacterial swarming to globally search for an optimal solution and genetic operators to refine local optima. Unlike the original BFO, bacteria can now mutate and inherit genes.

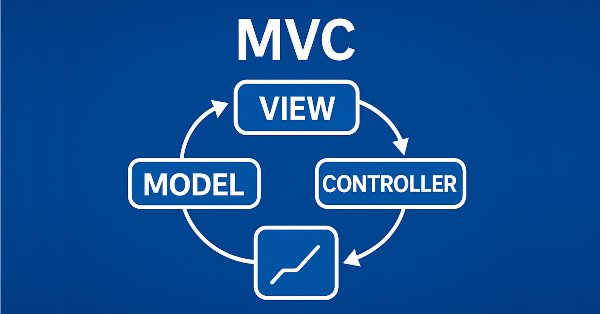

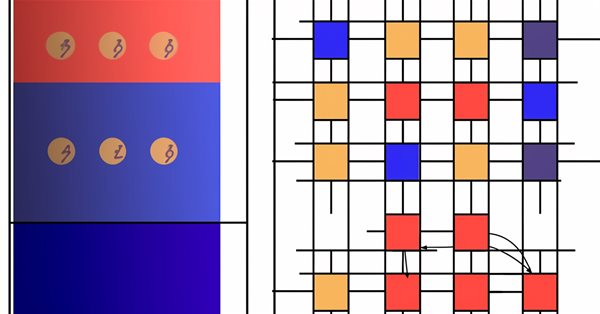

Table and Header Classes based on a table model in MQL5: Applying the MVC concept

This is the second part of the article devoted to the implementation of the table model in MQL5 using the MVC (Model-View-Controller) architectural paradigm. The article discusses the development of table classes and the table header based on a previously created table model. The developed classes will form the basis for further implementation of View and Controller components, which will be discussed in the following articles.

Reimagining Classic Strategies (Part VII) : Forex Markets And Sovereign Debt Analysis on the USDJPY

In today's article, we will analyze the relationship between future exchange rates and government bonds. Bonds are among the most popular forms of fixed income securities and will be the focus of our discussion.Join us as we explore whether we can improve a classic strategy using AI.

Implementing Practical Modules from Other Languages in MQL5 (Part 06): Python-Like File IO operations in MQL5

This article shows how to simplify complex MQL5 file operations by building a Python-style interface for effortless reading and writing. It explains how to recreate Python’s intuitive file-handling patterns through custom functions and classes. The result is a cleaner, more reliable approach to MQL5 file I/O.

Developing an MQTT client for Metatrader 5: a TDD approach — Part 5

This article is the fifth part of a series describing our development steps of a native MQL5 client for the MQTT 5.0 protocol. In this part we describe the structure of PUBLISH packets, how we are setting their Publish Flags, encoding Topic Name(s) strings, and setting Packet Identifier(s) when required.

Feature selection and dimensionality reduction using principal components

The article delves into the implementation of a modified Forward Selection Component Analysis algorithm, drawing inspiration from the research presented in “Forward Selection Component Analysis: Algorithms and Applications” by Luca Puggini and Sean McLoone.

MQL5 Trading Tools (Part 14): Pixel-Perfect Scrollable Text Canvas with Antialiasing and Rounded Scrollbar

In this article, we enhance the canvas-based price dashboard in MQL5 by adding a pixel-perfect scrollable text panel for usage guides, overcoming native scrolling limitations through custom antialiasing and a rounded scrollbar design with hover-expand functionality. The text panel supports themed backgrounds with opacity, dynamic line wrapping for content like instructions and contacts, and interactive navigation via up/down buttons, slider dragging, and mouse wheel scrolling within the body area.

Integrating External Applications with MQL5 Community OAuth

Learn how to add “Sign in with MQL5” to your Android app using the OAuth 2.0 authorization code flow. The guide covers app registration, endpoints, redirect URI, Custom Tabs, deep-link handling, and a PHP backend that exchanges the code for an access token over HTTPS. You will authenticate real MQL5 users and access profile data such as rank and reputation.

Database Is Easy (Part 1): A Lightweight ORM Framework for MQL5 Using SQLite

This article presents a structured way to manage SQLite data in MQL5 through an ORM layer for MetaTrader 5. It introduces core classes for entity modeling and database access, a fluent CRUD API, reflection hooks for OnGet/OnSet, and macros to define models quickly. Practical code shows creating tables, binding fields, inserting, updating, querying, and deleting records. Developers gain reusable, type-safe components that minimize repetitive SQL.

Overcoming The Limitation of Machine Learning (Part 8): Nonparametric Strategy Selection

This article shows how to configure a black-box model to automatically uncover strong trading strategies using a data-driven approach. By using Mutual Information to prioritize the most learnable signals, we can build smarter and more adaptive models that outperform conventional methods. Readers will also learn to avoid common pitfalls like overreliance on surface-level metrics, and instead develop strategies rooted in meaningful statistical insight.

Larry Williams Market Secrets (Part 8): Combining Volatility, Structure and Time Filters

An in-depth walkthrough of building a Larry Williams inspired volatility breakout Expert Advisor in MQL5, combining swing structure, volatility-based entries, trade day of the week filtering, time filters, and flexible risk management, with a complete implementation and reproducible test setup.

Mastering Log Records (Part 10): Avoiding Log Replay by Implementing a Suppression

We created a log suppression system in the Logify library. It details how the CLogifySuppression class reduces console noise by applying configurable rules to avoid repetitive or irrelevant messages. We also cover the external configuration framework, validation mechanisms, and comprehensive testing to ensure robustness and flexibility in log capture during bot or indicator development.

Developing a Replay System (Part 41): Starting the second phase (II)

If everything seemed right to you up to this point, it means you're not really thinking about the long term, when you start developing applications. Over time you will no longer need to program new applications, you will just have to make them work together. So let's see how to finish assembling the mouse indicator.

Developing a Replay System (Part 39): Paving the Path (III)

Before we proceed to the second stage of development, we need to revise some ideas. Do you know how to make MQL5 do what you need? Have you ever tried to go beyond what is contained in the documentation? If not, then get ready. Because we will be doing something that most people don't normally do.

From Basic to Intermediate: Union (I)

In this article we will look at what a union is. Here, through experiments, we will analyze the first constructions in which union can be used. However, what will be shown here is only a core part of a set of concepts and information that will be covered in subsequent articles. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a Replay System (Part 34): Order System (III)

In this article, we will complete the first phase of construction. Although this part is fairly quick to complete, I will cover details that were not discussed previously. I will explain some points that many do not understand. Do you know why you have to press the Shift or Ctrl key?

Mastering Log Records (Part 9): Implementing the builder pattern and adding default configurations

This article shows how to drastically simplify the use of the Logify library with the Builder pattern and automatic default configurations. It explains the structure of the specialized builders, how to use them with smart auto-completion, and how to ensure a functional log even without manual configuration. It also covers tweaks for MetaTrader 5 build 5100.

From Novice to Expert: Animated News Headline Using MQL5 (V)—Event Reminder System

In this discussion, we’ll explore additional advancements as we integrate refined event‑alerting logic for the economic calendar events displayed by the News Headline EA. This enhancement is critical—it ensures users receive timely notifications a short time before key upcoming events. Join this discussion to discover more.

Introduction to MQL5 (Part 33): Mastering API and WebRequest Function in MQL5 (VII)

This article demonstrates how to integrate the Google Generative AI API with MetaTrader 5 using MQL5. You will learn how to structure API requests, handle server responses, extract AI-generated content, manage rate limits, and save the results to a text file for easy access.

Python-MetaTrader 5 Strategy Tester (Part 02): Dealing with Bars, Ticks, and Overloading Built-in Functions in a Simulator

In this article, we introduce functions similar to those provided by the Python-MetaTrader 5 module, providing a simulator with a familiar interface and a custom way of handling bars and ticks internally.

Stepwise feature selection in MQL5

In this article, we introduce a modified version of stepwise feature selection, implemented in MQL5. This approach is based on the techniques outlined in Modern Data Mining Algorithms in C++ and CUDA C by Timothy Masters.

Mastering Log Records (Part 2): Formatting Logs

In this article, we will explore how to create and apply log formatters in the library. We will see everything from the basic structure of a formatter to practical implementation examples. By the end, you will have the necessary knowledge to format logs within the library, and understand how everything works behind the scenes.

Price-Driven CGI Model: Advanced Data Post-Processing and Implementation

In this article, we will explore the development of a fully customizable Price Data export script using MQL5, marking new advancements in the simulation of the Price Man CGI Model. We have implemented advanced refinement techniques to ensure that the data is user-friendly and optimized for animation purposes. Additionally, we will uncover the capabilities of Blender 3D in effectively working with and visualizing price data, demonstrating its potential for creating dynamic and engaging animations.