MetaTrader AppStore Results for Q3 2013

Another quarter of the year has passed and we have decided to sum up its results for MetaTrader AppStore - the largest store of trading robots and technical indicators for MetaTrader platforms. More than 500 developers have placed over 1 200 products in the Market by the end of the reported quarter.

Indicators with on-chart interactive controls

The article offers a new perspective on indicator interfaces. I am going to focus on convenience. Having tried dozens of different trading strategies over the years, as well as having tested hundreds of different indicators, I have come to some conclusions I want to share with you in this article.

Trademinator 3: Rise of the Trading Machines

In the article "Dr. Tradelove..." we created an Expert Advisor, which independently optimizes parameters of a pre-selected trading system. Moreover, we decided to create an Expert Advisor that can not only optimize parameters of one trading system underlying the EA, but also select the best one of several trading systems. Let's see what can come of it...

Price Action Analysis Toolkit Development (Part 1): Chart Projector

This project aims to leverage the MQL5 algorithm to develop a comprehensive set of analysis tools for MetaTrader 5. These tools—ranging from scripts and indicators to AI models and expert advisors—will automate the market analysis process. At times, this development will yield tools capable of performing advanced analyses with no human involvement and forecasting outcomes to appropriate platforms. No opportunity will ever be missed. Join me as we explore the process of building a robust market analysis custom tools' chest. We will begin by developing a simple MQL5 program that I have named, Chart Projector.

Alert and Comment for External Indicators (Part Two)

Since I published the article "Alert and Comment for External Indicators", I have been receiving requests and questions regarding the possibility of developing an external informer operating based on indicator lines. Having analyzed the questions, I have decided to continue with the subject. Getting data stored in indicator buffers turned out to be another area of interest to users.

Price Action Analysis Toolkit Development (Part 3): Analytics Master — EA

Moving from a simple trading script to a fully functioning Expert Advisor (EA) can significantly enhance your trading experience. Imagine having a system that automatically monitors your charts, performs essential calculations in the background, and provides regular updates every two hours. This EA would be equipped to analyze key metrics that are crucial for making informed trading decisions, ensuring that you have access to the most current information to adjust your strategies effectively.

Other classes in DoEasy library (Part 72): Tracking and recording chart object parameters in the collection

In this article, I will complete working with chart object classes and their collection. I will also implement auto tracking of changes in chart properties and their windows, as well as saving new parameters to the object properties. Such a revision allows the future implementation of an event functionality for the entire chart collection.

How to Implement Auto Optimization in MQL5 Expert Advisors

Step by step guide for auto optimization in MQL5 for Expert Advisors. We will cover robust optimization logic, best practices for parameter selection, and how to reconstruct strategies with back-testing. Additionally, higher-level methods like walk-forward optimization will be discussed to enhance your trading approach.

Graphics in DoEasy library (Part 81): Integrating graphics into library objects

It is time to start the integration of the already created objects into the previously created library objects. This will ultimately endow each library object with its own graphical object allowing users to interact with the program.

Magic of time trading intervals with Frames Analyzer tool

What is Frames Analyzer? This is a plug-in module for any Expert Advisor for analyzing optimization frames during parameter optimization in the strategy tester, as well as outside the tester, by reading an MQD file or a database that is created immediately after parameter optimization. You will be able to share these optimization results with other users who have the Frames Analyzer tool to discuss the results together.

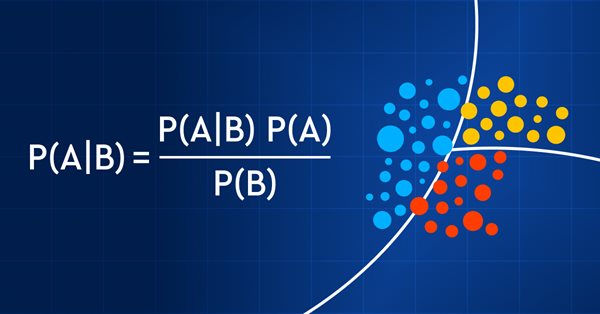

Data Science and Machine Learning (Part 11): Naïve Bayes, Probability theory in Trading

Trading with probability is like walking on a tightrope - it requires precision, balance, and a keen understanding of risk. In the world of trading, the probability is everything. It's the difference between success and failure, profit and loss. By leveraging the power of probability, traders can make informed decisions, manage risk effectively, and achieve their financial goals. So, whether you're a seasoned investor or a novice trader, understanding probability is the key to unlocking your trading potential. In this article, we'll explore the exciting world of trading with probability and show you how to take your trading game to the next level.

Indicator for Spindles Charting

The article regards spindle chart plotting and its usage in trading strategies and experts. First let's discuss the chart's appearance, plotting and connection with japanese candlestick chart. Next we analyze the indicator's implementation in the source code in the MQL5 language. Let's test the expert based on indicator and formulate the trading strategy.

How to Write Fast Non-Redrawing ZigZags

A rather universal approach to writing indicators of the ZigZag type is proposed. The method includes a significant part of ZigZags already described and allows you to create new ones relatively easily.

Multi-module trading robot in Python and MQL5 (Part I): Creating basic architecture and first modules

We are going to develop a modular trading system that combines Python for data analysis with MQL5 for trade execution. Four independent modules monitor different market aspects in parallel: volumes, arbitrage, economics and risks, and use RandomForest with 400 trees for analysis. Particular emphasis is placed on risk management, since even the most advanced trading algorithms are useless without proper risk management.

Price series discretization, random component and noise

We usually analyze the market using candlesticks or bars that slice the price series into regular intervals. Doesn't such discretization method distort the real structure of market movements? Discretization of an audio signal at regular intervals is an acceptable solution because an audio signal is a function that changes over time. The signal itself is an amplitude which depends on time. This signal property is fundamental.

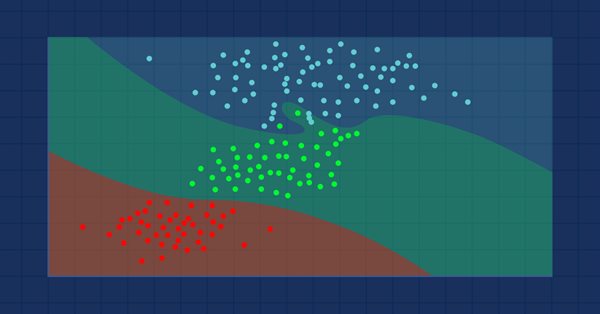

Data Science and Machine Learning (Part 09): The K-Nearest Neighbors Algorithm (KNN)

This is a lazy algorithm that doesn't learn from the training dataset, it stores the dataset instead and acts immediately when it's given a new sample. As simple as it is, it is used in a variety of real-world applications.

Creating Documentation Based on MQL5 Source Code

This article considers creation of documentation for MQL5 code starting with the automated markup of required tags. It also provides the description of how to use the Doxygen software, how to properly configure it and how to receive results in different formats, including html, HtmlHelp and PDF.

Tracing, Debugging and Structural Analysis of Source Code

The entire complex of problems of creating a structure of an executed code and its tracing can be solved without serious difficulties. This possibility has appeared in MetaTrader 5 due to the new feature of the MQL5 language - automatic creation of variables of complex type of data (structures and classes) and their elimination when going out of local scope. The article contains the description of the methodology and the ready-made tool.

Learn how to design a trading system by Bill Williams' MFI

This is a new article in the series in which we learn how to design a trading system based on popular technical indicators. This time we will cover Bill Williams' Market Facilitation Index (BW MFI).

Building and testing Aroon Trading Systems

In this article, we will learn how we can build an Aroon trading system after learning the basics of the indicators and the needed steps to build a trading system based on the Aroon indicator. After building this trading system, we will test it to see if it can be profitable or needs more optimization.

Developing Advanced ICT Trading Systems: Implementing Signals in the Order Blocks Indicator

In this article, you will learn how to develop an Order Blocks indicator based on order book volume (market depth) and optimize it using buffers to improve accuracy. This concludes the current stage of the project and prepares for the next phase, which will include the implementation of a risk management class and a trading bot that uses signals generated by the indicator.

Timeseries in DoEasy library (part 45): Multi-period indicator buffers

In this article, I will start the improvement of the indicator buffer objects and collection class for working in multi-period and multi-symbol modes. I am going to consider the operation of buffer objects for receiving and displaying data from any timeframe on the current symbol chart.

Learn how to design a trading system by Gator Oscillator

A new article in our series about learning how to design a trading system based on popular technical indicators will be about the Gator Oscillator technical indicator and how to create a trading system through simple strategies.

MetaTrader 4 Working under Antiviruses and Firewalls

The most of traders use special programs to protect their PCs. Unfortunately, these programs don't only protect computers against intrusions, viruses and Trojans, but also consume a significant amount of resources. This relates to network traffic, first of all, which is wholly controlled by various intelligent antiviruses and firewalls.

The reason for writing this article was that traders complained of slowed MetaTrader 4 Client Terminal when working with Outpost Firewall. We decided to make our own research using Kaspersky Antivirus 6.0 and Outpost Firewall Pro 4.0.

Graphical Interfaces XI: Refactoring the Library code (build 14.1)

As the library grows, its code must be optimized again in order to reduce its size. The version of the library described in this article has become even more object-oriented. This made the code easier to learn. A detailed description of the latest changes will allow the readers to develop the library independently based on their own needs.

Price Action Analysis Toolkit Development (Part 25): Dual EMA Fractal Breaker

Price action is a fundamental approach for identifying profitable trading setups. However, manually monitoring price movements and patterns can be challenging and time-consuming. To address this, we are developing tools that analyze price action automatically, providing timely signals whenever potential opportunities are detected. This article introduces a robust tool that leverages fractal breakouts alongside EMA 14 and EMA 200 to generate reliable trading signals, helping traders make informed decisions with greater confidence.

Building a Spectrum Analyzer

This article is intended to get its readers acquainted with a possible variant of using graphical objects of the MQL5 language. It analyses an indicator, which implements a panel of managing a simple spectrum analyzer using the graphical objects. The article is meant for readers acquianted with basics of MQL5.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 6): Two RSI indicators cross each other's lines

The multi-currency expert advisor in this article is an expert advisor or trading robot that uses two RSI indicators with crossing lines, the Fast RSI which crosses with the Slow RSI.

Creating an EA that works automatically (Part 12): Automation (IV)

If you think automated systems are simple, then you probably don't fully understand what it takes to create them. In this article, we will talk about the problem that kills a lot of Expert Advisors. The indiscriminate triggering of orders is a possible solution to this problem.

MQL5 — You too can become a master of this language

This article will be a kind of interview with myself, in which I will tell you how I took my first steps in the MQL5 language. I will show you how you can become a great MQL5 programmer. I will explain the necessary bases for you to achieve this feat. The only prerequisite is a willingness to learn.

EA Status SMS Notifications

Developing a system of SMS notifications that informs you of the status of your EA so that you are always aware of any critical situation, wherever you may be.

How to create a custom Donchian Channel indicator using MQL5

There are many technical tools that can be used to visualize a channel surrounding prices, One of these tools is the Donchian Channel indicator. In this article, we will learn how to create the Donchian Channel indicator and how we can trade it as a custom indicator using EA.

MetaEditor:Templates as a Spot to Stand On

It may be news to many our readers that all preparations for writing an EA can be performed once and then used continuously.

Transferring an Indicator Code into an Expert Advisor Code. Conclusion

This is the final article, devoted to transferring an indicator code into an Expert Advisor code. Here the author transforms on a certain example a code of an Expert Advisor so, that this EA is presented in a single file without calling custom indicators.

Statistical Estimations

Estimation of statistical parameters of a sequence is very important, since most of mathematical models and methods are based on different assumptions. For example, normality of distribution law or dispersion value, or other parameters. Thus, when analyzing and forecasting of time series we need a simple and convenient tool that allows quickly and clearly estimating the main statistical parameters. The article shortly describes the simplest statistical parameters of a random sequence and several methods of its visual analysis. It offers the implementation of these methods in MQL5 and the methods of visualization of the result of calculations using the Gnuplot application.

Graphical Interfaces VIII: The Tree View Control (Chapter 2)

The previous chapter of part VIII on graphical interfaces has focused on the elements of static and drop-down calendar. The second chapter will be dedicated to an equally complex element — a tree view, that is included in every complete library used for creating graphical interfaces. A tree view implemented in this article contains multiple flexible settings and modes, thus allowing to adjust this element of control to your needs.

Graphics in DoEasy library (Part 89): Programming standard graphical objects. Basic functionality

Currently, the library is able to track standard graphical objects on the client terminal chart, including their removal and modification of some of their parameters. At the moment, it lacks the ability to create standard graphical objects from custom programs.

Complex indicators made easy using objects

This article provides a method to create complex indicators while also avoiding the problems that arise when dealing with multiple plots, buffers and/or combining data from multiple sources.

Library for easy and quick development of MetaTrader programs (part VI): Netting account events

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the fifth part of the article series, we created trading event classes and the event collection, from which the events are sent to the base object of the Engine library and the control program chart. In this part, we will let the library to work on netting accounts.

Developing a trading Expert Advisor from scratch (Part 31): Towards the future (IV)

We continue to remove separate parts from our EA. This is the last article within this series. And the last thing to be removed is the sound system. This can be a bit confusing if you haven't followed these article series.