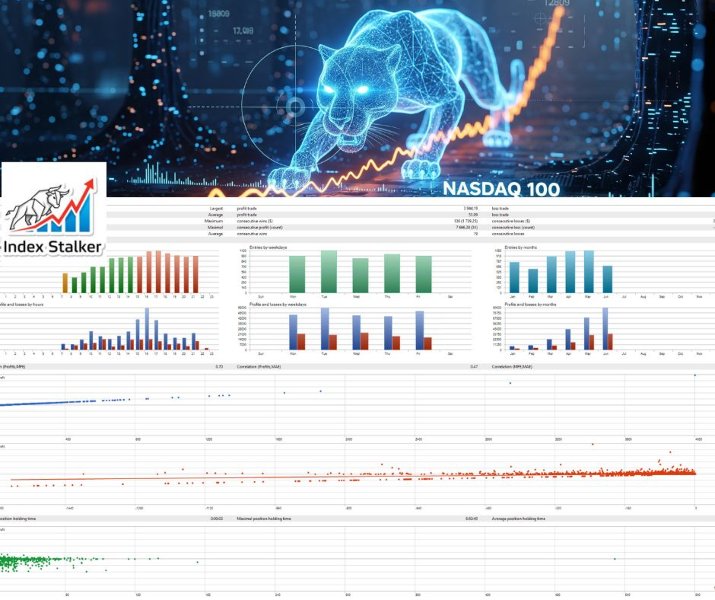

Index Stalker

- Experts

- Jayaweera Arachchige D Ranasinghe

- Version: 1.17

Index Stalker EA (v1.x Series) Prop Firm Ready

Stay on the Rules

1% Risk Margin.

3% Daily Drawdown.

$10000 account.

Please Don't Hesitate to Contact me for any info you need.

1. High-Impact Product Description

In the volatile currents of the NASDAQ 100, the greatest opportunities are found not through brute force, but through precision and patience. Introducing Index Stalker EA, the sophisticated trading tool engineered to silently track and execute high-probability setups with surgical accuracy.

At its core, a sophisticated dual-strategy engine intelligently identifies market states. The Momentum Rider strategy aligns your trades with the powerful intraday trends of the NAS100, while the Reversal Specialist pinpoints moments of trend exhaustion at critical supply and demand zones, positioning you for sharp, profitable turnarounds.

This intelligent core is protected by an unbreakable stealth framework—a professional-grade risk management system. With a dynamic ATR-based stop loss, a hard-coded daily drawdown limit, and filters for spread and trading sessions, your capital is rigorously protected from market noise and unpredictable conditions.

The Index Stalker isn't just an EA; it's a disciplined, institutional-grade trading assistant built for the modern index trader. Stop chasing the market and start stalking your profits.

2. Official Specifications

-

Expert Adviser Name: Index Stalker EA

-

Primary Trading Instrument: NASDAQ 100 (Common Symbols: NAS100, US100, USTEC)

-

Secondary Trading Instrument: Dow Jones (Common Symbols: US30, WS30)

-

Recommended Account Type: ECN or Raw Spread account with low spreads and fast execution. A hedging account type is required for MetaTrader 5.

-

Expert Adviser Type: Hybrid Trend & Reversal System.

-

Explanation: The Index Stalker does not use dangerous strategies like Martingale, Grid, or high-risk Arbitrage. It is a precision tool that enters a single position at a time per instrument, based on a strict set of rules. It either follows a confirmed trend or trades a confirmed reversal, making it a pure rules-based system suitable for prop firm evaluations and serious retail traders.

-

3. In-Depth User Documentation

The Philosophy

The NASDAQ 100 is one of the most volatile and potentially rewarding instruments to trade. The Index Stalker EA was built from the ground up to exploit this specific market character. It operates on the principle that the NAS100 market exists in two primary states: strong, clear trends, and sharp, aggressive reversals. Our EA is designed to identify and trade both with precision.

The Core Engine: Dual-Strategy Logic

-

Strategy A: The Momentum Rider

-

Objective: To identify the dominant intraday trend and enter on low-risk pullbacks.

-

Methodology: The EA uses a Triple EMA (Exponential Moving Average) cascade across multiple timeframes (4H, 1H, 15M) to confirm a unified market direction. An entry is only considered when the price pulls back to the 15-minute EMA and the RSI confirms that momentum is still strong, ensuring you're not buying the top or selling the bottom.

-

-

Strategy B: The Reversal Specialist

-

Objective: To pinpoint moments of trend exhaustion at key institutional levels and trade the subsequent reversal.

-

Methodology: This strategy ignores simple support/resistance lines. Instead, it identifies true 4-Hour Supply and Demand zones—areas where a massive imbalance of orders previously occurred. When the price returns to these potent zones, the EA waits for a confirmed Market Structure Shift on the 15-minute chart before executing a trade, ensuring the reversal is genuine.

-

The Unbreakable Armor: Integrated Safety Features

The Index Stalker EA is built with capital preservation as its first priority.

-

Precise Risk Management: Every trade is sized based on a fixed percentage of your account equity (e.g., 1%). You define the risk, and the EA handles the complex calculations.

-

Volatility-Adaptive Stops: Stop losses are not static. They are dynamically calculated using the Average True Range (ATR), automatically placing them outside of the current market noise and reducing the chance of being stopped out prematurely.

-

Account Guardian: A non-negotiable daily drawdown limit is hard-coded into the EA's logic. If this percentage is hit, the EA ceases all trading for the day, protecting your account from catastrophic loss.

-

Market Condition Filters: The EA automatically halts trading during unfavorable conditions, including excessively high spreads or periods outside of your defined trading session hours.