ATR Strategy Multiplier

- Indicators

- Wenly Pranata

- Version: 1.0

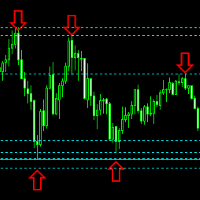

The ATR Strategy Multiplier is designed to help traders assess market volatility using the Average True Range (ATR) across multiple timeframes. It calculates and displays ATR values along with recommended Stop Loss (SL) and Take Profit (TP) levels based on the ATR. These levels are essential for setting risk management parameters and optimizing trading strategies.

Parameters:

-

Indicator Parameters:

- ATR Period: Determines the period over which the ATR is calculated.

- Timeframe: Select the timeframe for the ATR calculation.

-

Panel Display Parameters:

- Xoff and Yoff: Adjust the position of the control panel on the chart.

- Font Size: Customize the font size of the displayed text.

-

Calculation Parameters:

- Start Step: The initial multiplier for the Stop Loss calculation.

- Interval: The increment for the step size.

- Size: Specifies the number of rows for displaying SL/TP calculations.

- Reward: Defines the reward-to-risk ratio for take profit calculations (e.g., TP = SL * Reward).

How to Use:

- Apply the indicator to any chart with the desired timeframe.

- The panel will display the ATR value for the selected timeframe, along with recommended Stop Loss and Take Profit levels based on the user-defined parameters.

- Adjust the parameters to suit your trading strategy and risk tolerance.

User didn't leave any comment to the rating