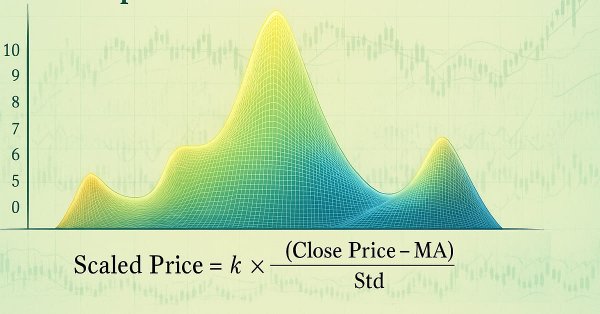

Filtering Signals Based on Statistical Data of Price Correlation

Is there any correlation between the past price behavior and its future trends? Why does the price repeat today the character of its previous day movement? Can the statistics be used to forecast the price dynamics? There is an answer, and it is positive. If you have any doubt, then this article is for you. I'll tell how to create a working filter for a trading system in MQL5, revealing an interesting pattern in price changes.

What Is a Martingale?

A short description of various illusions that come up when people trade using martingale betting strategies or misuse spiking and the like approaches.

Creating an EA that works automatically (Part 03): New functions

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. In the previous article, we started to develop an order system that we will use in our automated EA. However, we have created only one of the necessary functions.

Larry Williams Market Secrets (Part 4): Automating Short-Term Swing Highs and Lows in MQL5

Master the automation of Larry Williams’ short-term swing patterns using MQL5. In this guide, we develop a fully configurable Expert Advisor (EA) that leverages non-random market structures. We’ll cover how to integrate robust risk management and flexible exit logic, providing a solid foundation for systematic strategy development and backtesting.

MQL5 Trading Tools (Part 3): Building a Multi-Timeframe Scanner Dashboard for Strategic Trading

In this article, we build a multi-timeframe scanner dashboard in MQL5 to display real-time trading signals. We plan an interactive grid interface, implement signal calculations with multiple indicators, and add a close button. The article concludes with backtesting and strategic trading benefits

Gradient boosting in transductive and active machine learning

In this article, we will consider active machine learning methods utilizing real data, as well discuss their pros and cons. Perhaps you will find these methods useful and will include them in your arsenal of machine learning models. Transduction was introduced by Vladimir Vapnik, who is the co-inventor of the Support-Vector Machine (SVM).

Formulating Dynamic Multi-Pair EA (Part 5): Scalping vs Swing Trading Approaches

This part explores how to design a Dynamic Multi-Pair Expert Advisor capable of adapting between Scalping and Swing Trading modes. It covers the structural and algorithmic differences in signal generation, trade execution, and risk management, allowing the EA to intelligently switch strategies based on market behavior and user input.

Learn how to design a trading system by Chaikin Oscillator

Welcome to our new article from our series about learning how to design a trading system by the most popular technical indicator. Through this new article, we will learn how to design a trading system by the Chaikin Oscillator indicator.

Understanding functions in MQL5 with applications

Functions are critical things in any programming language, it helps developers apply the concept of (DRY) which means do not repeat yourself, and many other benefits. In this article, you will find much more information about functions and how we can create our own functions in MQL5 with simple applications that can be used or called in any system you have to enrich your trading system without complicating things.

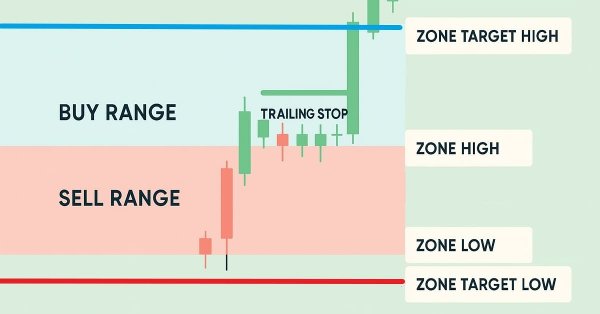

Automating Trading Strategies in MQL5 (Part 23): Zone Recovery with Trailing and Basket Logic

In this article, we enhance our Zone Recovery System by introducing trailing stops and multi-basket trading capabilities. We explore how the improved architecture uses dynamic trailing stops to lock in profits and a basket management system to handle multiple trade signals efficiently. Through implementation and backtesting, we demonstrate a more robust trading system tailored for adaptive market performance.

Trading with the MQL5 Economic Calendar (Part 1): Mastering the Functions of the MQL5 Economic Calendar

In this article, we explore how to use the MQL5 Economic Calendar for trading by first understanding its core functionalities. We then implement key functions of the Economic Calendar in MQL5 to extract relevant news data for trading decisions. Finally, we conclude by showcasing how to utilize this information to enhance trading strategies effectively.

Tips for Purchasing a Product on the Market. Step-By-Step Guide

This step-by-step guide provides tips and tricks for better understanding and searching for a required product. The article makes an attempt to puzzle out different methods of searching for an appropriate product, sorting out unwanted products, determining product efficiency and essentiality for you.

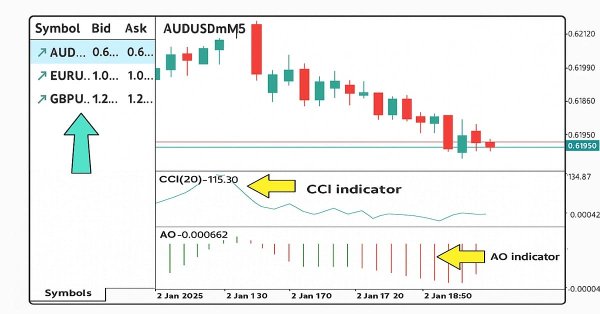

Automating Trading Strategies in MQL5 (Part 20): Multi-Symbol Strategy Using CCI and AO

In this article, we create a multi-symbol trading strategy using CCI and AO indicators to detect trend reversals. We cover its design, MQL5 implementation, and backtesting process. The article concludes with tips for performance improvement.

Automating Trading Strategies with Parabolic SAR Trend Strategy in MQL5: Crafting an Effective Expert Advisor

In this article, we will automate the trading strategies with Parabolic SAR Strategy in MQL5: Crafting an Effective Expert Advisor. The EA will make trades based on trends identified by the Parabolic SAR indicator.

Principles of Time Transformation in Intraday Trading

This article contains the concept of operation time that allows to receive more even price flow. It also contains the code of the changed moving average with an allowance for this time transformation.

Developing a Trading Strategy: The Triple Sine Mean Reversion Method

This article introduces the Triple Sine Mean Reversion Method, a trading strategy built upon a new mathematical indicator — the Triple Sine Oscillator (TSO). The TSO is derived from the sine cube function, which oscillates between –1 and +1, making it suitable for identifying overbought and oversold market conditions. Overall, the study demonstrates how mathematical functions can be transformed into practical trading tools.

Creating an EA that works automatically (Part 15): Automation (VII)

To complete this series of articles on automation, we will continue discussing the topic of the previous article. We will see how everything will fit together, making the EA run like clockwork.

From Novice to Expert: Support and Resistance Strength Indicator (SRSI)

In this article, we will share insights on how to leverage MQL5 programming to pinpoint market levels—differentiating between weaker and strongest price levels. We will fully develop a working, Support and Resistance Strength Indicator (SRSI).

Introduction to MQL5 (Part 17): Building Expert Advisors for Trend Reversals

This article teaches beginners how to build an Expert Advisor (EA) in MQL5 that trades based on chart pattern recognition using trend line breakouts and reversals. By learning how to retrieve trend line values dynamically and compare them with price action, readers will be able to develop EAs capable of identifying and trading chart patterns such as ascending and descending trend lines, channels, wedges, triangles, and more.

Rebuy algorithm: Math model for increasing efficiency

In this article, we will use the rebuy algorithm for a deeper understanding of the efficiency of trading systems and start working on the general principles of improving trading efficiency using mathematics and logic, as well as apply the most non-standard methods of increasing efficiency in terms of using absolutely any trading system.

MetaTrader 5 Machine Learning Blueprint (Part 2): Labeling Financial Data for Machine Learning

In this second installment of the MetaTrader 5 Machine Learning Blueprint series, you’ll discover why simple labels can lead your models astray—and how to apply advanced techniques like the Triple-Barrier and Trend-Scanning methods to define robust, risk-aware targets. Packed with practical Python examples that optimize these computationally intensive techniques, this hands-on guide shows you how to transform noisy market data into reliable labels that mirror real-world trading conditions.

Automating Trading Strategies in MQL5 (Part 26): Building a Pin Bar Averaging System for Multi-Position Trading

In this article, we develop a Pin Bar Averaging system in MQL5 that detects pin bar patterns to initiate trades and employs an averaging strategy for multi-position management, enhanced by trailing stops and breakeven adjustments. We incorporate customizable parameters with a dashboard for real-time monitoring of positions and profits.

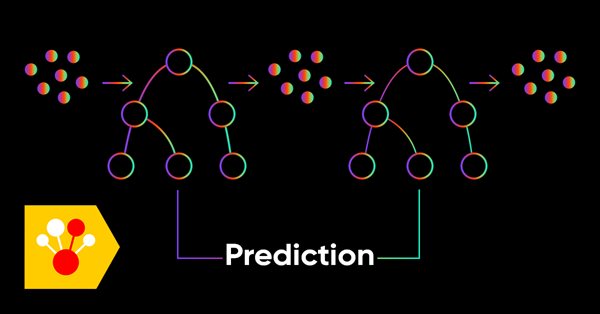

Data Science and Machine Learning (Part 05): Decision Trees

Decision trees imitate the way humans think to classify data. Let's see how to build trees and use them to classify and predict some data. The main goal of the decision trees algorithm is to separate the data with impurity and into pure or close to nodes.

Introduction to MQL5 (Part 26): Building an EA Using Support and Resistance Zones

This article teaches you how to build an MQL5 Expert Advisor that automatically detects support and resistance zones and executes trades based on them. You’ll learn how to program your EA to identify these key market levels, monitor price reactions, and make trading decisions without manual intervention.

Using cryptography with external applications

In this article, we consider encryption/decryption of objects in MetaTrader and in external applications. Our purpose is to determine the conditions under which the same results will be obtained with the same initial data.

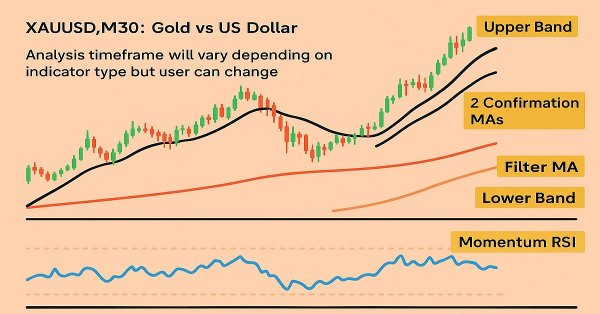

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 5): Bollinger Bands On Keltner Channel — Indicators Signal

The Multi-Currency Expert Advisor in this article is an Expert Advisor or Trading Robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than one symbol pair from only one symbol chart. In this article we will use signals from two indicators, in this case Bollinger Bands® on Keltner Channel.

Comparative Analysis of 30 Indicators and Oscillators

The article describes an Expert Advisor that allows conducting the comparative analysis of 30 indicators and oscillators aiming at the formation of an effective package of indexes for trading.

Analytical Volume Profile Trading (AVPT): Liquidity Architecture, Market Memory, and Algorithmic Execution

Analytical Volume Profile Trading (AVPT) explores how liquidity architecture and market memory shape price behavior, enabling more profound insight into institutional positioning and volume-driven structure. By mapping POC, HVNs, LVNs, and Value Areas, traders can identify acceptance, rejection, and imbalance zones with precision.

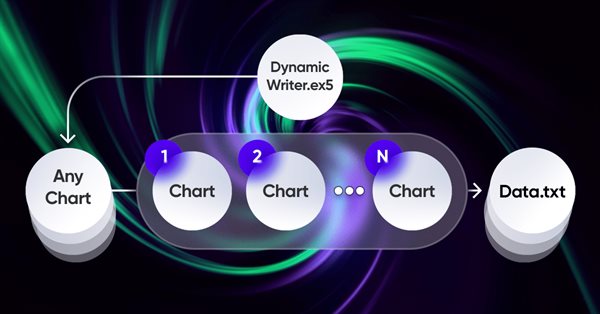

Brute force approach to patterns search (Part VI): Cyclic optimization

In this article I will show the first part of the improvements that allowed me not only to close the entire automation chain for MetaTrader 4 and 5 trading, but also to do something much more interesting. From now on, this solution allows me to fully automate both creating EAs and optimization, as well as to minimize labor costs for finding effective trading configurations.

Creating an EA that works automatically (Part 04): Manual triggers (I)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode.

Metamodels in machine learning and trading: Original timing of trading orders

Metamodels in machine learning: Auto creation of trading systems with little or no human intervention — The model decides when and how to trade on its own.

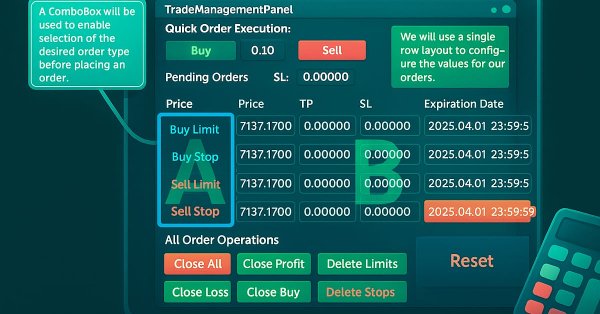

Creating a Trading Administrator Panel in MQL5 (Part XII): Integration of a Forex Values Calculator

Accurate calculation of key trading values is an indispensable part of every trader’s workflow. In this article, we will discuss, the integration of a powerful utility—the Forex Calculator—into the Trade Management Panel, further extending the functionality of our multi-panel Trading Administrator system. Efficiently determining risk, position size, and potential profit is essential when placing trades, and this new feature is designed to make that process faster and more intuitive within the panel. Join us as we explore the practical application of MQL5 in building advanced, trading panels.

Integrating AI model into already existing MQL5 trading strategy

This topic focuses on incorporating a trained AI model (such as a reinforcement learning model like LSTM or a machine learning-based predictive model) into an existing MQL5 trading strategy.

Creating a Daily Drawdown Limiter EA in MQL5

The article discusses, from a detailed perspective, how to implement the creation of an Expert Advisor (EA) based on the trading algorithm. This helps to automate the system in the MQL5 and take control of the Daily Drawdown.

Automating Trading Strategies in MQL5 (Part 18): Envelopes Trend Bounce Scalping - Core Infrastructure and Signal Generation (Part I)

In this article, we build the core infrastructure for the Envelopes Trend Bounce Scalping Expert Advisor in MQL5. We initialize envelopes and other indicators for signal generation. We set up backtesting to prepare for trade execution in the next part.

ALGLIB numerical analysis library in MQL5

The article takes a quick look at the ALGLIB 3.19 numerical analysis library, its applications and new algorithms that can improve the efficiency of financial data analysis.

Understanding MQL5 Object-Oriented Programming (OOP)

As developers, we need to learn how to create and develop software that can be reusable and flexible without duplicated code especially if we have different objects with different behaviors. This can be smoothly done by using object-oriented programming techniques and principles. In this article, we will present the basics of MQL5 Object-Oriented programming to understand how we can use principles and practices of this critical topic in our software.

Using PatchTST Machine Learning Algorithm for Predicting Next 24 Hours of Price Action

In this article, we apply a relatively complex neural network algorithm released in 2023 called PatchTST for predicting the price action for the next 24 hours. We will use the official repository, make slight modifications, train a model for EURUSD, and apply it to making future predictions both in Python and MQL5.

Automating Trading Strategies in MQL5 (Part 29): Creating a price action Gartley Harmonic Pattern system

In this article, we develop a Gartley Pattern system in MQL5 that identifies bullish and bearish Gartley harmonic patterns using pivot points and Fibonacci ratios, executing trades with precise entry, stop loss, and take-profit levels. We enhance trader insight with visual feedback through chart objects like triangles, trendlines, and labels to clearly display the XABCD pattern structure.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 4): Triangular moving average — Indicator Signals

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than one symbol pair only from one symbol chart. This time we will use only 1 indicator, namely Triangular moving average in multi-timeframes or single timeframe.