MQL5 Wizard: New Version

The article contains descriptions of the new features available in the updated MQL5 Wizard. The modified architecture of signals allow creating trading robots based on the combination of various market patterns. The example contained in the article explains the procedure of interactive creation of an Expert Advisor.

Strategy builder based on Merrill patterns

In the previous article, we considered application of Merrill patterns to various data, such as to a price value on a currency symbol chart and values of standard MetaTrader 5 indicators: ATR, WPR, CCI, RSI, among others. Now, let us try to create a strategy construction set based on Merrill patterns.

Martingale as the basis for a long-term trading strategy

In this article we will consider in detail the martingale system. We will review whether this system can be applied in trading and how to use it in order to minimize risks. The main disadvantage of this simple system is the probability of losing the entire deposit. This fact must be taken into account, if you decide to trade using the martingale technique.

How to Become a Successful Signal Provider on MQL5.com

My main goal in this article is to provide you with a simple and accurate account of the steps that will help you become a top signal provider on MQL5.com. Drawing upon my knowledge and experience, I will explain what it takes to become a successful signal provider, including how to find, test, and optimize a good strategy. Additionally, I will provide tips on publishing your signal, writing a compelling description and effectively promoting and managing it.

Bid/Ask spread analysis in MetaTrader 5

An indicator to report your brokers Bid/Ask spread levels. Now we can use MT5s tick data to analyze what the historic true average Bid/Ask spread actually have recently been. You shouldn't need to look at the current spread because that is available if you show both bid and ask price lines.

The Indicators of the Micro, Middle and Main Trends

The aim of this article is to investigate the possibilities of trade automation and the analysis, on the basis of some ideas from a book by James Hyerczyk "Pattern, Price & Time: Using Gann Theory in Trading Systems" in the form of indicators and Expert Advisor. Without claiming to be exhaustive, here we investigate only the Model - the first part of the Gann theory.

Better Programmer (Part 07): Notes on becoming a successful freelance developer

Do you wish to become a successful Freelance developer on MQL5? If the answer is yes, this article is right for you.

Deep Neural Networks (Part VIII). Increasing the classification quality of bagging ensembles

The article considers three methods which can be used to increase the classification quality of bagging ensembles, and their efficiency is estimated. The effects of optimization of the ELM neural network hyperparameters and postprocessing parameters are evaluated.

Indicator for Point and Figure Charting

There are lots of chart types that provide information on the current market situation. Many of them, such as Point and Figure chart, are the legacy of the remote past. The article describes an example of Point and Figure charting using a real time indicator.

Building an Automatic News Trader

This is the continuation of Another MQL5 OOP class article which showed you how to build a simple OO EA from scratch and gave you some tips on object-oriented programming. Today I am showing you the technical basics needed to develop an EA able to trade the news. My goal is to keep on giving you ideas about OOP and also cover a new topic in this series of articles, working with the file system.

My First "Grail"

Examined are the most frequent mistakes that lead the first-time programmers to creation of a "super-moneymaking" (when tested) trading systems. Exemplary experts that show fantastic results in tester, but result in losses during real trading are presented.

Fuzzy logic to create manual trading strategies

This article suggests the ways of improving manual trading strategy by applying fuzzy set theory. As an example we have provided a step-by-step description of the strategy search and the selection of its parameters, followed by fuzzy logic application to blur overly formal criteria for the market entry. This way, after strategy modification we obtain flexible conditions for opening a position that has a reasonable reaction to a market situation.

Applying OLAP in trading (part 4): Quantitative and visual analysis of tester reports

The article offers basic tools for the OLAP analysis of tester reports relating to single passes and optimization results. The tool can work with standard format files (tst and opt), and it also provides a graphical interface. MQL source codes are attached below.

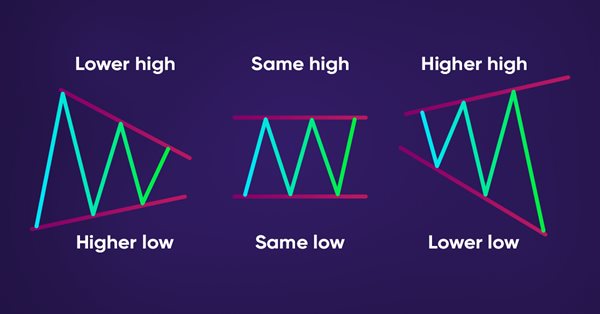

How to detect trends and chart patterns using MQL5

In this article, we will provide a method to detect price actions patterns automatically by MQL5, like trends (Uptrend, Downtrend, Sideways), Chart patterns (Double Tops, Double Bottoms).

Deep Neural Networks (Part IV). Creating, training and testing a model of neural network

This article considers new capabilities of the darch package (v.0.12.0). It contains a description of training of a deep neural networks with different data types, different structure and training sequence. Training results are included.

Developing a trading Expert Advisor from scratch

In this article, we will discuss how to develop a trading robot with minimum programming. Of course, MetaTrader 5 provides a high level of control over trading positions. However, using only the manual ability to place orders can be quite difficult and risky for less experienced users.

950 websites broadcast the Economic Calendar from MetaQuotes

The widget provides websites with a detailed release schedule of 500 indicators and indices, of the world's largest economies. Thus, traders quickly receive up-to-date information on all important events with explanations and graphs in addition to the main website content.

Deep Neural Networks (Part VII). Ensemble of neural networks: stacking

We continue to build ensembles. This time, the bagging ensemble created earlier will be supplemented with a trainable combiner — a deep neural network. One neural network combines the 7 best ensemble outputs after pruning. The second one takes all 500 outputs of the ensemble as input, prunes and combines them. The neural networks will be built using the keras/TensorFlow package for Python. The features of the package will be briefly considered. Testing will be performed and the classification quality of bagging and stacking ensembles will be compared.

Order Strategies. Multi-Purpose Expert Advisor

This article centers around strategies that actively use pending orders, a metalanguage that can be created to formally describe such strategies and the use of a multi-purpose Expert Advisor whose operation is based on those descriptions

Testing currency pair patterns: Practical application and real trading perspectives. Part IV

This article concludes the series devoted to trading currency pair baskets. Here we test the remaining pattern and discuss applying the entire method in real trading. Market entries and exits, searching for patterns and analyzing them, complex use of combined indicators are considered.

Developing a self-adapting algorithm (Part I): Finding a basic pattern

In the upcoming series of articles, I will demonstrate the development of self-adapting algorithms considering most market factors, as well as show how to systematize these situations, describe them in logic and take them into account in your trading activity. I will start with a very simple algorithm that will gradually acquire theory and evolve into a very complex project.

Understanding order placement in MQL5

When creating any trading system, there is a task we need to deal with effectively. This task is order placement or to let the created trading system deal with orders automatically because it is crucial in any trading system. So, you will find in this article most of the topics that you need to understand about this task to create your trading system in terms of order placement effectively.

Using spreadsheets to build trading strategies

The article describes the basic principles and methods that allow you to analyze any strategy using spreadsheets (Excel, Calc, Google). The obtained results are compared with MetaTrader 5 tester.

Learn how to design a trading system by ATR

In this article, we will learn a new technical tool that can be used in trading, as a continuation within the series in which we learn how to design simple trading systems. This time we will work with another popular technical indicator: Average True Range (ATR).

Simple Methods of Forecasting Directions of the Japanese Candlesticks

Knowing the direction of the price movement is sufficient for getting positive results from trading operations. Some information on the possible direction of the price can be obtained from the Japanese candlesticks. This article deals with a few simple approaches to forecasting the direction of the Japanese candlesticks.

Mathematics in trading: Sharpe and Sortino ratios

Return on investments is the most obvious indicator which investors and novice traders use for the analysis of trading efficiency. Professional traders use more reliable tools to analyze strategies, such as Sharpe and Sortino ratios, among others.

A Virtual Order Manager to track orders within the position-centric MetaTrader 5 environment

This class library can be added to an MetaTrader 5 Expert Advisor to enable it to be written with an order-centric approach broadly similar to MetaTrader 4, in comparison to the position-based approach of MetaTrader 5. It does this by keeping track of virtual orders at the MetaTrader 5 client terminal, while maintaining a protective broker stop for each position for disaster protection.

Dealing with Time (Part 1): The Basics

Functions and code snippets that simplify and clarify the handling of time, broker offset, and the changes to summer or winter time. Accurate timing may be a crucial element in trading. At the current hour, is the stock exchange in London or New York already open or not yet open, when does the trading time for Forex trading start and end? For a trader who trades manually and live, this is not a big problem.

Combinatorics and probability theory for trading (Part I): The basics

In this series of article, we will try to find a practical application of probability theory to describe trading and pricing processes. In the first article, we will look into the basics of combinatorics and probability, and will analyze the first example of how to apply fractals in the framework of the probability theory.

Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

In this article, we automate order block detection in MQL5 using pure price action analysis. We define order blocks, implement their detection, and integrate automated trade execution. Finally, we backtest the strategy to evaluate its performance.

Thomas DeMark's contribution to technical analysis

The article details TD points and TD lines discovered by Thomas DeMark. Their practical implementation is revealed. In addition to that, a process of writing three indicators and two Expert Advisors using the concepts of Thomas DeMark is demonstrated.

Patterns available when trading currency baskets

Following up our previous article on the currency baskets trading principles, here we are going to analyze the patterns traders can detect. We will also consider the advantages and the drawbacks of each pattern and provide some recommendations on their use. The indicators based on Williams' oscillator will be used as analysis tools.

Practical application of neural networks in trading. Python (Part I)

In this article, we will analyze the step-by-step implementation of a trading system based on the programming of deep neural networks in Python. This will be performed using the TensorFlow machine learning library developed by Google. We will also use the Keras library for describing neural networks.

Developing a cross-platform Expert Advisor to set StopLoss and TakeProfit based on risk settings

In this article, we will create an Expert Advisor for automated entry lot calculation based on risk values. Also the Expert Advisor will be able to automatically place Take Profit with the select ratio to Stop Loss. That is, it can calculate Take Profit based on any selected ratio, such as 3 to 1, 4 to 1 or any other selected value.

Advanced EA constructor for MetaTrader - botbrains.app

In this article, we demonstrate features of botbrains.app - a no-code platform for trading robots development. To create a trading robot you don't need to write any code - just drag and drop the necessary blocks onto the scheme, set their parameters, and establish connections between them.

Developing Pivot Mean Oscillator: a novel Indicator for the Cumulative Moving Average

This article presents Pivot Mean Oscillator (PMO), an implementation of the cumulative moving average (CMA) as a trading indicator for the MetaTrader platforms. In particular, we first introduce Pivot Mean (PM) as a normalization index for timeseries that computes the fraction between any data point and the CMA. We then build PMO as the difference between the moving averages applied to two PM signals. Some preliminary experiments carried out on the EURUSD symbol to test the efficacy of the proposed indicator are also reported, leaving ample space for further considerations and improvements.

Learn how to design a trading system by ADX

In this article, we will continue our series about designing a trading system using the most popular indicators and we will talk about the average directional index (ADX) indicator. We will learn this indicator in detail to understand it well and we will learn how we to use it through a simple strategy. By learning something deeply we can get more insights and we can use it better.

Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1

This article describes a new approach to hedging of positions and draws the line in the debates between users of MetaTrader 4 and MetaTrader 5 about this matter. The algorithms making such hedging reliable are described in layman's terms and illustrated with simple charts and diagrams. This article is dedicated to the new panel HedgeTerminal, which is essentially a fully featured trading terminal within MetaTrader 5. Using HedgeTerminal and the virtualization of the trade it offers, positions can be managed in the way similar to MetaTrader 4.

Learn how to trade the Fair Value Gap (FVG)/Imbalances step-by-step: A Smart Money concept approach

A step-by-step guide to creating and implementing an automated trading algorithm in MQL5 based on the Fair Value Gap (FVG) trading strategy. A detailed tutorial on creating an expert advisor that can be useful for both beginners and experienced traders.

Machine learning in Grid and Martingale trading systems. Would you bet on it?

This article describes the machine learning technique applied to grid and martingale trading. Surprisingly, this approach has little to no coverage in the global network. After reading the article, you will be able to create your own trading bots.